Bear Market Experience and Investor Psychology: MarketWatch Analysis on Risk Awareness

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

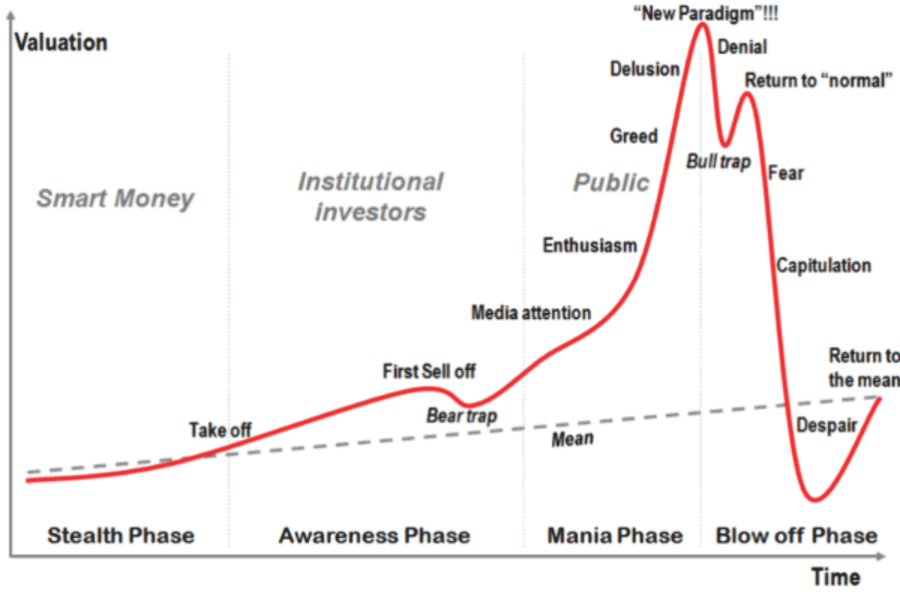

The MarketWatch article published on January 14, 2026, addresses one of the most persistent challenges facing investors: the psychological conviction that one can successfully time market exits before significant corrections occur [1]. The article’s central premise—that investors who have never experienced a bear market often underestimate both the emotional and financial severity of market crashes—represents a fundamental lesson in behavioral finance. While intellectually, market participants understand that bull markets eventually end, the article argues that extended periods of rising prices create a dangerous complacency that leads to poor decision-making during actual market stress events [1].

The article’s thesis gains particular relevance when examining current market conditions. As of early 2026, major indices have shown modest gains, with the S&P 500 advancing approximately 2.22%, the NASDAQ rising around 2.32%, and the Dow Jones Industrial Average gaining approximately 3.39% [0]. The Russell 2000 has demonstrated stronger performance at approximately 6.08% [0]. However, beneath these positive headline numbers, sector rotation patterns reveal a noteworthy shift: defensive sectors such as Real Estate and Consumer Defensive have outperformed cyclical sectors including Consumer Cyclical and Healthcare [0]. This divergence often serves as an early indicator of shifting market sentiment toward risk aversion.

The MarketWatch article’s emphasis on learning from experienced investors aligns with extensive behavioral finance research documenting systematic psychological biases that affect investment decision-making. Research consistently demonstrates that investors believe they can exit markets before crashes, yet historical data shows this ability is rarely achieved in practice [2]. The psychological phenomenon operates through several interconnected mechanisms that compound during extended bull markets.

Recency bias causes investors to project recent market conditions into the future, systematically underestimating downside risks after prolonged periods of gains [2]. Survey data from multiple market cycles reveals that during bull markets, a majority of investors rate themselves as “above average” in skill—a statistical impossibility that nonetheless persists across market cycles [2]. This overconfidence becomes particularly dangerous when combined with loss aversion, where investors who claim long-term horizons frequently panic-sell during initial drawdowns, crystallizing losses rather than waiting for recovery [2].

The concept of “sleep at night” risk tolerance represents another critical dimension highlighted in related analyses. Investors often discover their true risk tolerance only after experiencing a significant market drop, when the theoretical ability to withstand losses meets the emotional reality of watching portfolio values decline [2]. The MarketWatch article’s advice to consult experienced investors who have lived through bear markets serves as a practical mechanism for bridging this experiential gap, allowing newer investors to understand through others’ experiences what they have not yet personally encountered.

The timing of the MarketWatch article, published in January 2026, places it within the context of a midterm election year, a period historically characterized by elevated market volatility and elevated drawdown risk. Historical data reveals that the 12 months preceding midterm elections have delivered average S&P 500 returns of negative 1.1%, compared to positive 11.2% during non-midterm periods [3]. More significantly, average peak-to-trough declines during pre-midterm periods have reached approximately 18%, including a 22% drop before the 2022 midterms [3].

These patterns carry important context for understanding the article’s message about investor overconfidence. The historical record suggests that even sophisticated investors frequently underestimate the magnitude of corrections that can occur during election cycles, despite extensive documentation of these patterns [3]. However, the data also reveals a consistent post-election recovery pattern, with S&P 500 average returns reaching positive 16.3% in the 12 months following elections [3]. This pattern suggests that the fundamental risk lies not in the eventual recovery—which has been remarkably consistent—but in investor behavior during the correction period, where panic selling often converts temporary drawdowns into permanent losses.

The market environment at the time of the article’s publication presents several factors that amplify its relevance. Market valuations remain elevated, with the S&P 500 trading at a forward price-to-earnings ratio of approximately 22.4, above long-term historical averages [4]. This valuation level reduces future expected returns while simultaneously increasing the magnitude of potential corrections when sentiment shifts.

Corporate debt dynamics represent another significant risk factor highlighted in related analyses. The concentration of Treasury, commercial real estate, and corporate debt maturities creates what analysts describe as a potential “debt maturity wall” for 2026 [5]. Some analyses suggest this could trigger a 20-30% correction in the S&P 500, with a base case probability of approximately 60% [5]. While such projections carry inherent uncertainty, the concentration of refinancing risk across multiple sectors provides a concrete foundation for the MarketWatch article’s emphasis on risk awareness.

The AI and technology sector’s valuation patterns have drawn comparisons to the 1999 dot-com era, with consensus earnings per share projections for 2026 reaching approximately 14.1% [4]. Historical parallels are notable—the consensus EPS projection of 19% for 2000 ultimately missed by 15.2 percentage points, suggesting that current optimistic projections may similarly underestimate the gap between expectations and reality [4]. This comparison reinforces the article’s core message about the dangers of extrapolating current conditions indefinitely.

Additional market indicators suggest elevated complacency risk. Nearly 50% of investors characterized themselves as bullish entering 2026, indicating elevated positioning for potential downside [6]. High-yield credit spreads have compressed below 300 basis points, a level reached only approximately 5% of the time since 2000, suggesting limited cushion for credit deterioration [6]. These indicators collectively point toward market conditions where the article’s message about bear market preparation carries particular urgency.

The MarketWatch article provides several interconnected insights that extend beyond simple market timing advice. First, the distinction between volatility and risk represents a crucial conceptual framework that experienced investors consistently emphasize. Volatility represents temporary price movement, while true risk constitutes permanent capital loss [2]. The practical implication is that investors who can maintain conviction during market weakness often benefit from subsequent recoveries, while those who exit during volatility lock in losses that permanent market appreciation cannot recover.

Second, the article implicitly addresses the limitations of prediction-based investment strategies. Rather than attempting to time markets—a strategy with a poor historical track record even among professional investors—the emphasis on learning from experienced investors points toward discipline-based approaches [2]. Dollar-cost averaging, maintaining appropriate cash reserves, and avoiding leverage represent systematic strategies that reduce the need for accurate market predictions while providing participation in long-term market appreciation.

Third, the quality versus hype investment framework emerges as a consistent theme in related analyses. Low price-to-earnings stocks have historically outperformed high P/E stocks by approximately 5 annualized percentage points since 1951 [4]. This pattern suggests that the MarketWatch article’s message about consulting experienced investors may implicitly include guidance toward investment approaches that prioritize quality, earnings, and solid cash flow over momentum-driven speculation.

Fourth, the sector rotation patterns visible in current market data—defensive sectors outperforming cyclical sectors—represent a potentially significant signal [0]. While sector leadership can shift rapidly and such patterns do not guarantee future market direction, the consistent outperformance of Real Estate and Consumer Defensive sectors during a period of overall market gains suggests that sophisticated investors may already be positioning for increased volatility.

The analysis reveals several risk categories that warrant investor attention in the current environment. Market valuation risk remains elevated, with the S&P 500’s forward P/E of 22.4 above historical averages, suggesting reduced future expected returns and increased vulnerability to multiple compression during corrections [4]. Investors who have not experienced significant drawdowns may underestimate the psychological difficulty of maintaining positions during periods when valuation compression and earnings disappointment compound.

Midterm election year volatility represents a historically documented pattern that introduces uncertainty into 2026 market expectations [3]. The average 18% peak-to-trough decline during pre-midterm periods significantly exceeds typical daily波动幅度, creating potential for investor panic if recent market experience has not prepared participants for such moves [3]. The MarketWatch article’s emphasis on consulting experienced investors becomes particularly relevant in this context, as those who have navigated previous election cycles may provide perspective that tempers emotional reactions to短期 volatility.

Corporate debt refinancing risk concentrates across Treasury, commercial real estate, and corporate sectors, creating potential systemic vulnerabilities [5]. The scale of maturities coming due in 2026 means that market conditions could deteriorate rapidly if refinancing becomes difficult, regardless of individual company fundamentals. This concentration risk represents a form of systematic exposure that cannot be eliminated through diversification alone.

Technical and sentiment indicators suggest elevated complacency risk. Tight credit spreads, high bullish sentiment readings, and weakening market internals despite new highs all point toward conditions where unexpected negative information could trigger disproportionate market reactions [6]. Investors who have not experienced bear markets may underestimate both the speed and magnitude of such moves.

Despite the risk factors identified, the current environment also presents potential opportunities for prepared investors. The historical pattern of post-midterm election recoveries—with average S&P 500 returns of 16.3% in the 12 months following elections—suggests that disciplined investors who maintain positions through volatility may benefit from subsequent appreciation [3]. This pattern reinforces the MarketWatch article’s implicit message about the value of long-term discipline over short-term timing.

Quality investments remain available at valuations significantly below market averages. Single-digit P/E stocks currently trade at less than half the S&P 500’s 22.4 forward multiple, offering potential downside protection while maintaining participation in eventual market recoveries [4]. For investors with appropriate time horizons and risk tolerance, these valuations may represent attractive entry points if current risk factors materialize in the form of broader market corrections.

Cash reserves maintained during bull market periods provide both downside protection and opportunity capital for acquisitions during market weakness. The MarketWatch article’s emphasis on consulting experienced investors likely includes guidance about maintaining dry powder for opportunities that corrections create [2]. Investors who have experienced previous bear markets understand that market weakness often presents the most attractive entry opportunities for long-term positions.

The MarketWatch article published on January 14, 2026, delivers a timely reminder about the psychological challenges of investing through market cycles. Its core message—that investors who have never experienced bear markets often underestimate both the emotional toll and financial severity of significant corrections—aligns with extensive behavioral finance research documenting systematic biases that affect investment decision-making [1][2].

Current market data reveals modest gains across major indices with notable sector rotation toward defensive areas, potentially signaling early risk aversion among sophisticated investors [0]. Elevated valuations, historical midterm election patterns, and concentrated corporate debt maturities provide concrete context for the article’s emphasis on risk awareness [3][4][5]. Technical and sentiment indicators suggest elevated complacency levels, with nearly 50% of investors characterizing themselves as bullish entering 2026 and credit spreads near historical compressions [6].

The practical implications of this analysis center on self-assessment of true risk tolerance, maintenance of appropriate liquidity, emphasis on quality investments with reasonable valuations, and avoidance of leverage that amplifies losses during corrections. Historical data consistently shows that investor behavior during volatility—rather than the volatility itself—often determines long-term investment outcomes [2][3]. The MarketWatch article’s advice to consult experienced investors who have navigated previous bear markets provides a mechanism for newer investors to develop the perspective and discipline that extended market declines test.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.