Evaluation of the Impact of Hainan Free Trade Port's Full Island Customs Closure on the Performance of Duty-Free Retail Leaders

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I will now provide you with a

The Hainan Free Trade Port

| Policy Item | Specific Content |

|---|---|

| Zero Tariff | Approximately 74% of over 6,600 commodity tariff lines are subject to “zero tariff” [1] |

| Low Tax Rate | Both corporate income tax and personal income tax are set at 15% |

| Simplified Tax System | Optimized adjustments to tax policies such as consumption tax and value-added tax |

| Duty-Free Shopping | Offshore duty-free goods expanded from 45 categories to 47 categories [1] |

According to the latest statistical data, duty-free consumption has shown significant growth after the launch of customs closure operation:

| Indicator | Data | Year-on-Year Change |

|---|---|---|

| Offshore Duty-Free Shopping Amount in Over 20 Days After Customs Closure | RMB 3.89 Billion |

+49.6% [0] |

| Average Daily Number of Shoppers | 24,000 | Significant Growth |

| Shopping Amount on the First Day of Customs Closure (December 18) | RMB 161 Million | +61% [1] |

| Shopping Amount in the First Week (December 18-24) | RMB 1.1 Billion | +54.9% [1] |

| Tourism Consumption During New Year’s Day Holiday (January 1-3) | - | +28.9% [1] |

These data indicate that the consumption stimulation effect of Hainan Free Trade Port’s customs closure policy has initially emerged, with significant growth in duty-free consumption after the customs closure.

- Sanya International Duty-Free City (the world’s largest single duty-free store)

- Haikou Riyue Plaza Duty-Free Store

- Haikou Meilan Airport Duty-Free Store

- Sanya Phoenix Airport Duty-Free Store

- Shanghai Pudong/Hongqiao Airport Duty-Free Store (newly obtained operation rights in December 2025) [4]

According to financial analysis data [0], China Duty Free Group has faced significant performance pressure in recent years:

| Indicator | 2024 | Year-on-Year Change | Remarks |

|---|---|---|---|

| Operating Revenue | RMB 56.5 Billion | -16% | Largest decline in recent years [4] |

| Net Profit | RMB 4.32 Billion | -36% | Largest decline in recent years [4] |

| Gross Profit Margin | Approximately 33% | Decreased | Intensified competition |

| ROE | 6.10% | Significant Decline | Weakened profitability |

| Quarter | Operating Revenue (RMB 100 Million) | Net Profit (RMB 100 Million) | Revenue Year-on-Year | Net Profit Year-on-Year |

|---|---|---|---|---|

| 2024Q1 | 157 | 14.0 | +6.8% | -13.6% |

| 2024Q2 | 135 | 12.5 | -14.0% | -10.7% |

| 2024Q3 | 138 | 11.5 | +2.2% | -8.0% |

| 2024Q4 | 134 | 10.5 | -2.9% | -8.7% |

| 2025Q1 | 167 | 15.8 | +24.6% | +50.5% |

| 2025Q2 | 114 | 8.4 | -31.7% | -46.8% |

| 2025Q3 | 117 | 3.7 | +2.6% | -56.0% [0] |

From the quarterly data, it can be seen that the net profit in Q3 2025 plummeted, with EPS standing at only $0.22, falling short of the market expectation of $0.37, representing a shortfall of

According to professional financial analysis [0], the assessment results of China Duty Free Group in five dimensions are as follows:

| Assessment Dimension | Rating | Explanation |

|---|---|---|

Financial Stance |

Neutral | Accounting policies remain balanced, with no extreme operations |

Revenue Status |

Under Pressure | Revenue continues to decline, with a 16% drop in 2024 |

Cash Flow |

Stable | Latest free cash flow reaches RMB 6.82 Billion |

Debt Risk |

Low Risk | Current ratio of 5.82, quick ratio of 4.03, sufficient liquidity |

Profitability |

Declining | ROE of 6.10%, net profit margin of 6.38%, at a historical low |

The customs closure of Hainan Free Trade Port brings multiple benefits to China Duty Free Group:

- The zero-tariff policy covers approximately 74% of commodity tariff lines, which is expected to reduce procurement costs by more than 30%[3]

- Combined with the 15% corporate income tax preference, the annual tax savings are expected to reach RMB 300-500 Million[3]

- The age limit for offshore duty-free shopping has been lowered from 16 to 18 years old, expanding consumer groups

- The scope of duty-free goods has been expanded, with new categories including pet supplies, portable musical instruments, micro-drones, and small home appliances added

- Domestic brands are allowed to sell in duty-free stores, with value-added tax and consumption tax refunded (exempted)

- The “buy now, take now” policy for island residents has been upgraded, allowing unlimited purchases within a year

- The 85-country visa-free policy combined with increased international flight frequencies is expected to push international passenger volume to exceed 2.4 million [3]

- Hainan’s industrial transformation is shifting from pure tourism to “cultural and tourism integration”, with events such as concerts driving passenger flow

- Travel costs are reduced (compared to going abroad), highlighting price competitiveness

According to forecasts from market research institutions [3]:

| Time Node | Hainan Revenue Forecast | Expected Net Profit Growth |

|---|---|---|

| 2026 | RMB 60-65 Billion | 40-55% Growth |

| Medium-Term | Sustained Growth | Benefiting from policy dividend release |

The duty-free consumption data in the over 20 days after customs closure has verified the policy effect:

- Average daily shopping amount is approximately RMB 162 Million, a significant increase compared to before customs closure

- Year-on-year growth rate of 49.6%, far exceeding market expectations

- Average daily number of shoppers is 24,000, with a significant increase in consumption activity

These high-frequency data indicate that the customs closure of Hainan Free Trade Port has directly driven China Duty Free Group’s core business.

According to professional DCF valuation analysis [0], the valuation status of China Duty Free Group’s current share price of $92.47 is as follows:

| Valuation Scenario | Valuation Price | Comparison with Current Share Price | Assumptions |

|---|---|---|---|

Conservative Valuation |

$67.00 | -27.5% |

Zero revenue growth, EBITDA Margin 14.1% |

Neutral Valuation |

$78.70 | -14.9% |

1.8% revenue growth, EBITDA Margin 14.9% |

Optimistic Valuation |

$269.52 | +191.5% |

40% revenue growth, EBITDA Margin 15.6% |

Weighted Valuation |

$138.41 | +49.7% |

Probability-weighted comprehensive scenarios |

- WACC (Weighted Average Cost of Capital): 9.6%

- Beta Coefficient: 0.75 (lower than market volatility)

- Terminal Growth Rate Assumption: 2.0%-3.0%

The current share price of $92.47 has an approximate 15% premium over the

- Hainan Business Contribution: China Duty Free Group holds over 85% market share in Hainan [3], and the incremental benefits from the customs closure policy are the most direct

- Continuous Release of Policy Dividends: Short-term data has verified the policy effect, and it is expected to continue to benefit in the medium and long term

- Valuation Repair Space: If Hainan’s business grows as expected, the share price is expected to return to the weighted valuation ($138.41)

| Indicator | China Duty Free Group | Industry Average | Evaluation |

|---|---|---|---|

| P/E (TTM) | 56.27x |

Approximately 39x | Relatively high, reflecting market growth expectations |

| P/B | 3.44x | - | Within a reasonable range |

| P/S | 3.39x | - | - |

It should be noted that the company’s current P/E ratio is higher than the industry average [3], indicating that the market has already priced in the Hainan Free Trade Port policy to some extent.

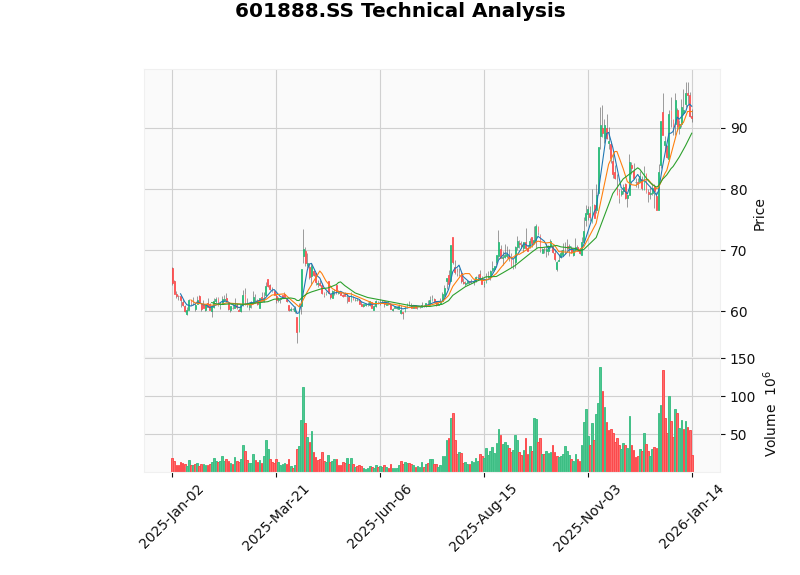

According to technical analysis data [0]:

| Technical Indicator | Value | Signal Interpretation |

|---|---|---|

| Latest Closing Price | $91.67 | - |

| Support Level | $89.14 | Important short-term support |

| Resistance Level | $93.66 | Important short-term pressure |

| Trend Judgment | Sideways Consolidation |

No clear direction |

| MACD | No Crossover | Bullish-leaning |

| KDJ | K:52.3, D:63.7, J:29.5 | Death cross signal, bearish-leaning |

| RSI | Normal Range | - |

| Beta | 0.75 | Lower than market volatility |

- The share price is in sideways consolidation within the range of $89.14-$93.66

- The MACD indicator shows a bullish lean, but KDJ has a death cross signal

- Short-term direction is unclear, waiting for further clarity in fundamentals

- Low Beta value (0.75), share price volatility is lower than the market

| Factor | Impact Analysis |

|---|---|

Continuous Release of Policy Dividends |

The customs closure policy has just been implemented for one month, and institutional dividends will gradually emerge |

Category Structure Optimization |

Focus on expanding high unit-price categories such as mobile phones and gold jewelry [5]; although gross profit margin is low, revenue grows rapidly |

Consumption Upgrade Trend |

Domestic brands enter duty-free channels, improving the supply side |

Improved Infrastructure |

Expansion of infrastructure such as airports and ferries provides support |

Seasonal Factors |

Consumption peaks during holidays such as New Year’s Day and Spring Festival will continue |

| Risk | Impact Analysis |

|---|---|

Macroeconomic Fluctuations |

Weak consumer demand may affect purchasing power |

Intensified Competition |

Foreign duty-free operators are allowed to enter, intensifying industry competition [4] |

Policy Implementation Risk |

The detailed rules for “managing the second line” may be tightened, affecting circulation |

Shift in Consumption Habits |

The rise of domestic brands leads to reduced demand for high-priced foreign goods [4] |

Sustainability of Promotional Activities |

Data may decline after the end of promotional activities such as government consumption vouchers [5] |

- The positive data trend is expected to continue

- The consumption peak during the Spring Festival holiday (late January to February 2026) will provide support

- Combined promotional activities and government consumption vouchers enhance price attractiveness

- Need to pay attention to data performance after the withdrawal of promotional policies

- The effect of Hainan’s cultural and tourism integration remains to be seen

- The consumption voucher activity lasts until January 4, 2026 [5], and sustainability needs to be tracked thereafter

- Policy dividends continue to be released, and the construction of Hainan Free Trade Port is progressing steadily

- Market scale is expected to continue to expand

- Leading position is stable, benefiting from industry growth

| Assessment Dimension | Score | Explanation |

|---|---|---|

| Policy Benefit Degree | ★★★★★ | Directly benefited leading enterprise from Hainan’s customs closure |

| Expected Performance Improvement | ★★★★☆ | Short-term data verified, medium and long-term performance remains to be seen |

| Valuation Rationality | ★★★☆☆ | Current share price is slightly higher than neutral valuation |

| Technical Aspects | ★★★☆☆ | Sideways consolidation, no clear direction |

| Risk Level | ★★★☆☆ | Macroeconomic and competition risks exist |

| Investment Cycle | Recommended Targets | Operation Strategy |

|---|---|---|

Short-Term (1-3 Months) |

China Duty Free Group | Follow the implementation of detailed policies, pay attention to data verification, and take profits promptly after news catalysis |

Medium-Term (3-6 Months) |

China Duty Free Group, Haiqi Group | Pay attention to performance realization, track core duty-free sales data |

Long-Term (1-3 Years) |

China Duty Free Group | Build positions on dips, and enjoy the continuous release of industrial upgrading and policy dividends [3] |

- Policy Risk: The detailed rules of the customs closure policy may be adjusted, and there is uncertainty in the implementation intensity of “managing the second line”

- Performance Risk: Net profit plummeted in Q3 2025, and the recovery of profitability remains to be seen

- Competition Risk: Foreign duty-free operators are allowed to enter, and market competition may intensify

- Valuation Risk: The current P/E ratio (56.27x) is higher than the industry average, and there is a risk of valuation correction

- Macroeconomic Risk: Weak consumer demand may affect duty-free sales

The customs closure operation of Hainan Free Trade Port has brought significant policy dividends to duty-free retail leaders such as China Duty Free Group. The data showing that the offshore duty-free shopping amount reached RMB 3.89 billion in the over 20 days after customs closure, with a year-on-year growth of 49.6%, indicates that the policy effect has initially emerged.

- Positive Impact on Performance: The customs closure policy directly reduces procurement costs (expected to be over 30%), expands consumer groups, and optimizes product structure, providing support for China Duty Free Group’s performance

- Sustainable Short-Term Growth: Combined with the Spring Festival holiday consumption peak and government promotional activities, the positive short-term data trend is expected to continue

- Medium and Long-Term Performance Remains to Be Seen: Factors such as data performance after the withdrawal of promotional policies, the effect of Hainan’s cultural and tourism integration, and macroeconomic trends will determine the sustainability of growth

- Valuation Partially Priced In: The current share price has an approximate 15% premium over the neutral DCF valuation, indicating that the market has already priced in policy expectations to some extent

- Stable Leading Position: The 78.7% market share ensures that the company fully benefits from the construction of Hainan Free Trade Port, but attention needs to be paid to the risk of intensified foreign competition

[0] Jinling AI Financial Analysis Database - Real-time Data, Technical Analysis, Financial Analysis and DCF Valuation of China Duty Free Group (601888.SS)

[1] Consumer Daily - “How Does the Consumption Momentum Flow After Over Half a Month of Hainan’s Customs Closure?” (https://m.sohu.com/a/975422735_118081)

[2] Economic Information Daily - “In-depth Implementation of the Hainan Free Trade Port Law to Escort Policy Implementation” (http://jjckb.xinhuanet.com/20260114/0e119a4bf2d240d8a8a522b6987624ed/c.html)

[3] Caifuhao (East Money) - “Comprehensive Analysis of Core Beneficial Stocks from Hainan’s Customs Closure” (https://caifuhao.eastmoney.com/news/20251220075358085192630)

[4] Yahoo Finance - “China Duty Free Group Wins Shanghai Airport Duty-Free Store Operation Rights After Bidding Battle With Sunris Duty-Free” (https://hk.finance.yahoo.com/news/竞投內鬥擊退日上免稅行中免拿下上海機場免稅店-035337451.html)

[5] Haoyanbao - “Consumer Services Industry Data and Summary of Institutional Research on China Duty Free Group” (https://www.appletree.fund/focus/)

Figure 1: Comparative Analysis of Duty-Free Consumption Data and DCF Valuation After Hainan Free Trade Port’s Customs Closure

Figure 2: Quarterly Operating Revenue and Net Profit Trend of China Duty Free Group (2023Q4-2025Q3)

Figure 3: K-Line Chart for Technical Analysis of China Duty Free Group (601888.SS)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.