Analysis of U.S. Chip Sales Restrictions to China and the Reshaping of the Global Semiconductor Competitive Landscape

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest collected data and market information, I will provide you with a systematic in-depth analysis report.

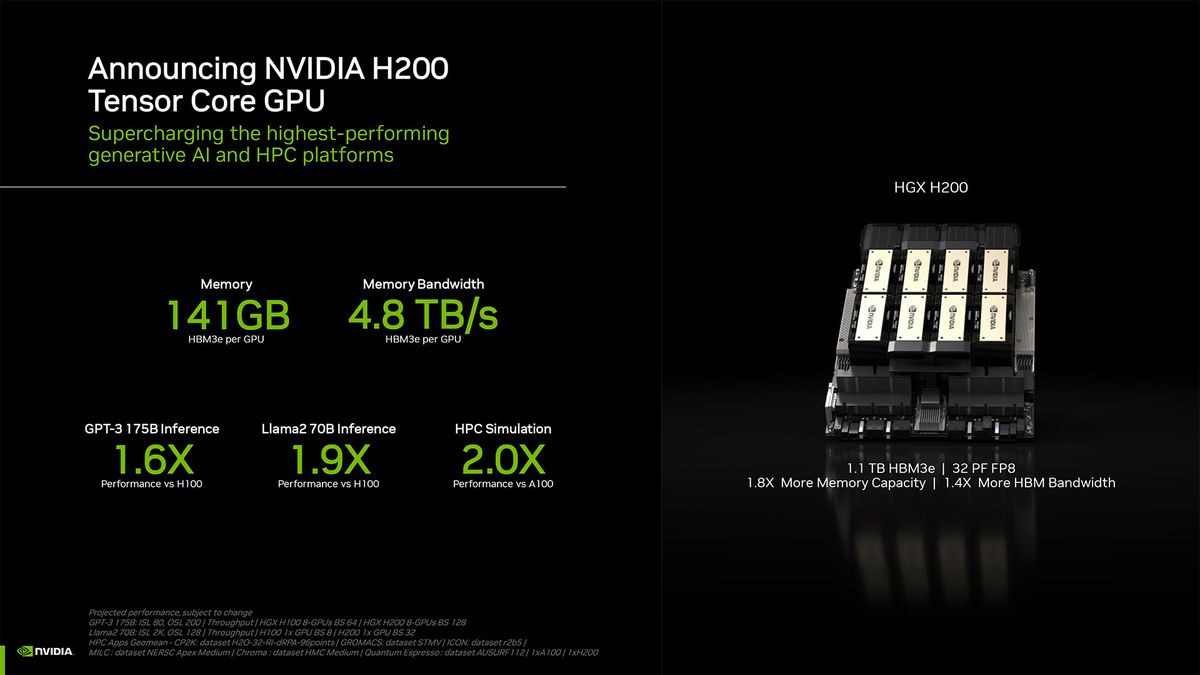

According to a January 14, 2026 report from Cailian News, the Trump administration further relaxed restrictions on Nvidia Corporation’s sales of H200 artificial intelligence chips to China. The U.S. Department of Commerce introduced new review standards, shifting from the previous “presumption of denial” to “case-by-case review” [1]. This policy shift marks a major adjustment to U.S. chip export controls to China, with the H200 becoming the first advanced AI chip that can be legally exported to Chinese customers [1].

The attached conditions for export licenses are quite strict, mainly including the following core requirements: The semiconductor products to be exported must be commercially available in the U.S.; The exporter must prove that the U.S. has sufficient supply of such products; The production of such products for export to China will not occupy the global foundry capacity that the U.S. uses to produce similar or more advanced products for U.S. end users; The recipient must prove that it has sufficient security procedures; The item must undergo independent third-party testing in the U.S. to verify its performance specifications; The number of chips sold to China shall not exceed 50% of the total amount Nvidia sells to U.S. customers; The U.S. will charge a fee of approximately 25% from related transactions [2][3].

This policy shift reflects the delicate balance within the U.S. government regarding its technology containment strategy against China. According to analysis from Internet Law Review, the camp represented by David Sacks, the White House’s “AI Director”, advocates that exporting advanced AI chips to China can curb the pace at which Chinese competitors including Huawei catch up with the most advanced chip designs of Nvidia and AMD [3]. The core logic of this strategy is: By allowing China to access relatively backward chip technology, it can both maintain the market revenue of U.S. enterprises and delay the iterative upgrade of China’s local technology.

Jensen Huang, CEO of Nvidia, clearly stated in a previous public statement that China is a very large artificial intelligence market, and in another two to three years, the scale of China’s artificial intelligence market may reach 50 billion U.S. dollars. Missing this market would be a huge loss [1]. He also emphasized that the U.S. must recognize that it is not the only country in the AI race. This statement reflects the strategic dependence of U.S. chip enterprises on the huge Chinese market.

China’s semiconductor industry showed a strong recovery momentum in 2025. According to data from Galaxy Securities’ research report, in the first three quarters of 2025, China’s semiconductor industry achieved double growth in revenue and profit: the overall revenue of the semiconductor sector reached 479.378 billion yuan, a year-on-year increase of 11.49%, and the net attributable profit reached 41.353 billion yuan, a year-on-year increase of 52.98% [4]. Looking at the third quarter alone, the sector’s revenue was 161.01 billion yuan, a year-on-year increase of 2.8%, and the net attributable profit was 17.931 billion yuan, a year-on-year increase of 60.6%. The profit growth rate was significantly higher than the revenue growth rate, reflecting a substantial improvement in the overall profitability of the industry [4].

From the perspective of sub-sectors: The chip design sector maintained a high degree of prosperity; The memory sector, driven by AI computing power demand, saw strong demand for high-end products such as HBM and DDR5; Analog chips ushered in new opportunities around low-power technology and domestic substitution in fields such as automotive electronics and industry [4]. The capital market’s enthusiasm for semiconductor domestic substitution continues to rise: On August 27, 2025, Cambricon’s intraday stock price hit 1,464.98 yuan per share, surpassing Kweichow Moutai for the first time to briefly become the highest-priced stock on the A-share market. Then on October 24, its stock price surged 9%, closing at 1,525 yuan per share to regain the “stock king” title, with its total market value once exceeding 643 billion yuan [4].

The latest forecast from international investment bank Bernstein paints a possible future scenario: By 2026, China’s AI chip market may usher in a major change — Nvidia’s share is expected to plummet from the current 60-70% to about 8%; Huawei is expected to rise to a dominant position of about 50%; AMD is expected to account for 12%; and Cambricon is expected to stand out in the third echelon and become the leader in this tier [5]. Although this prediction has uncertainties, it reflects the recognition of the domestic substitution process by the international capital market.

From Nvidia’s financial data, the proportion of the Chinese market in its revenue structure is about 5.9% (latest quarterly revenue of 277 million U.S. dollars) [6]. Although this ratio seems small, considering the huge potential of China’s artificial intelligence market, Jensen Huang estimates that the market size may reach about 50 billion U.S. dollars, making the Chinese market of undeniable strategic value to Nvidia [7]. Currently, Nvidia’s market value reaches 4.52 trillion U.S. dollars, with a price-earnings ratio of 45.57 times. The market remains optimistic about its future growth, with an analyst consensus rating of “Buy” and a target price of 268.50 U.S. dollars, representing a 44.5% upside from the current price [6].

The U.S.'s economic fortress strategy is reshaping the global semiconductor supply chain pattern. Yu Xiang, a special expert at the Center for International Security and Strategy, Tsinghua University, pointed out that the core of the 2025 National Security Strategy is the systematic weaponization of economic and financial tools. Supply chains, technical standards, critical minerals, data flows, the U.S. dollar clearing network, and related investment decisions all serve the supreme goal of countering strategic rivals [8].

The cost of this transformation is high. In highly concentrated and scale-intensive industries such as semiconductors, rare earths, and battery materials, forced “de-risking” and friendshoring will lead to short-term cost surges, insufficient production capacity, and inflationary pressures, while in the medium and long term, it will erode the depth of global division of labor and overall efficiency [8]. However, as analyzed in Internet Law Review, even against the background of long-term structural competition and rising geopolitical factors, major economies still retain a certain degree of policy flexibility and risk buffer mechanisms in the implementation of rules, which helps prevent local frictions from rapidly escalating into systemic confrontation [9].

In the wave of semiconductor domestic substitution, technological breakthroughs are the core confidence for enterprises to gain a firm foothold. SMIC, the leading wafer foundry in mainland China with the most advanced technology, has completed mass production of 14nm FinFET processes, becoming one of the few wafer foundries in the world that master this technology [4]. In the face of external technical restrictions, SMIC has adopted a “dual catch-up” strategy: while consolidating the yield and production capacity of 14nm processes, it actively promotes independent R&D of advanced nodes such as N+1. As of June 2025, SMIC has accumulated more than 14,000 authorized patents, of which invention patents account for 86.8%, and the deep patent barrier provides a guarantee for continuous technological iteration [4].

What is even more noteworthy is that the verification progress of China’s domestic equipment has exceeded market expectations. According to a report from South China Morning Post, by the end of 2025, the proportion of the amount of domestic equipment used in new production lines of wafer factories across China has risen to 55% [10]. Among them, the localization rate of etching equipment has increased to 65%, thin film deposition equipment and cleaning equipment have reached 61% and 63% respectively, and ion implantation equipment has also risen to 35% [10]. The 7nm pilot line of SMIC South, which was originally scheduled to complete process verification in the second quarter of 2026, has now been advanced to the end of 2025 for tape-out. The core etching, thin film, and cleaning equipment have all been switched to domestic models, and the yield of the first batch of 256 Mb SRAM has exceeded 42% [10].

The development path of domestic manufacturers has always been full of strategic choices. Entering 2025, a series of moves by Nvidia have brought huge pressure to local competitors. Xu Zhijun, Rotating Chairman of Huawei, once publicly emphasized: Investing a lot of resources to imitate the old CUDA ecosystem will only lead to greater passivity once a full blockade is encountered in the future. Only by building an independent and controllable technological foundation can we achieve sustainable development [5].

Huawei has established a relatively complete independent chain: Ascend series chips are paired with the CANN toolchain, and a collaborative network has been formed with telecom operators, server manufacturers, and ISV software providers, initially completing a closed-loop ecosystem [5]. In contrast, Moore Threads launched the MUSA unified system architecture, committed to enabling developers to migrate to its platform with zero or minimal code changes; Muxi built the MXMACA software stack, focusing on achieving high compatibility with CUDA at the API interface layer to reduce the user switching threshold [5]. The pros and cons of these two routes will become a key variable in the evolution of the industry pattern in the future.

After the implementation of the STAR Market’s “1+6” policy, the capital market has opened up a smoother financing channel for hard technology enterprises, and semiconductor industry chain enterprises have become direct beneficiaries of this policy dividend [4]. At the end of 2025, Moore Threads and Muxi Technology successively submitted IPO applications to the STAR Market; Biren Technology and Tianshu Zhixin have also launched their HKEX IPO processes, pushing the heat of the entire industry chain to a historical high [5].

Brokerage research reports point out that based on the current bidding rhythm of wafer factories, the market size of China’s domestic semiconductor equipment is expected to exceed 50 billion yuan in 2026, with a compound annual growth rate (CAGR) expected to remain at about 30% [10]. The dual support of capital and market has materialized the long-termism in the chip field, and has also become the confidence of enterprises in the wave of domestic substitution. The trillion-level market space has attracted giants to enter, and China’s chip industry is ushering in the resonance of the price cycle and product iteration cycle, with capital expenditure expected to accelerate growth [4].

Despite the significant overall progress, metrology and lithography equipment are still regarded as the biggest shortcomings of China’s semiconductor equipment. Although SMEE’s 28nm DUV lithography machine has completed process verification, there is still an obvious gap with ASML in terms of overlay accuracy and equipment uptime; Zhongke Feice’s metrology equipment is still in the 14nm verification stage [10]. In addition, the localization rate of advanced processes (<14nm) is less than 10%, mainly relying on SMIC’s 14nm process and 5nm-class MJ3 process (without EUV) [11].

From a commercial perspective, although Cambricon has made breakthroughs in financial performance, it still has obvious shortcomings in the breadth of ecosystem coverage and the activity of developer communities. Improving profit quality and optimizing customer structure are also thresholds that all domestic manufacturers must cross — only by getting rid of reliance on government subsidies and non-recurring gains to achieve normalized profitability of core businesses; and at the same time breaking the over-reliance on a few large customers and expanding the customer base of small and medium-sized enterprises in fields such as finance, medical care, and manufacturing, can we build a truly solid commercial foundation [5].

From the market reaction perspective, the domestic AI Chip Index rose 7.8% this week, with Cambricon, Montage Technology, ASR Microelectronics, GigaDevice, JCET, and TFME all rising by more than 10%, while Hygon Information, Rockchip, and Actions Microelectronics rose by 9.9%, 5.1%, and 3.8% respectively [12]. The Memory Chip Index rose 12.1% this week, with Puran Micro and Hengshuo Micro rising by 39.7% and 28.3% respectively [12]. These data reflect the market’s optimistic sentiment towards the expectations of domestic substitution.

However, as industry analysis points out, the news that Nvidia’s H200 is approved for export to China has once again challenged the already short window of opportunity for domestic substitution [5]. The sales terms of the H200 chip launched by Jensen Huang for Chinese customers are harsh, requiring full prepayment with no returns or refunds, which is regarded as a hedge against geopolitical risks [13]. Behind this move is Nvidia’s fear of losing the Chinese market — its fear lies in the rise of China’s computing power, not policy restrictions, and its anxiety stems from the maturity of China’s independent computing power system, which may no longer need Nvidia’s chips in the future [13].

From a long-term investment perspective, semiconductor domestic substitution has become an irreversible core development direction of the industry. From the acceleration of advanced production capacity breakthroughs in the wafer manufacturing link, to the continuous rise in order volumes in the semiconductor equipment and materials fields, and then to the accelerated localization of computing power infrastructure and memory products, the entire semiconductor industry chain is working collaboratively through various links to gradually get rid of external dependence and build a more independent industrial ecosystem [4].

For investors, several key areas need to be focused on: First, wafer foundry enterprises with mature process breakthrough capabilities; Second, opportunities for equipment leaders brought by the increase in equipment localization rate; Third, technological leaders in the field of AI inference chips; Fourth, platform enterprises building independent ecosystem systems. At the same time, it is also necessary to be alert to short-term volatility risks brought by external policy changes, as well as possible bottlenecks in the process of technological iteration.

U.S. chip sales restrictions to China are profoundly reshaping the global semiconductor competitive landscape. In the short term, policy uncertainty has increased market volatility, and the relaxation of H200 export restrictions is not only a reflection of internal divisions in the U.S. government but also a compromise to market forces. In the long term, this external pressure has instead accelerated the independent innovation process of China’s semiconductor industry: the overall market share of domestic chips has increased from about 15-20% in 2024 to 25-30% in 2025, and the policy target of equipment localization rate exceeding 50% has also been achieved ahead of schedule [10][11].

Bernstein’s prediction shows that by 2026, Nvidia’s market share in China’s AI chip market may plummet from the current 60-70% to about 8% [5]. Although this prediction may be overly aggressive, it reflects an irreversible trend: Under the strategic goal of technological self-reliance and self-control, China’s semiconductor industry is undergoing a historic transformation from “passive response” to “active breakthrough”.

Xu Zhijun, Rotating Chairman of Huawei, made a strategically insightful statement: Only by building an independent and controllable technological foundation can we achieve sustainable development [5]. From technological breakthroughs to ecosystem construction, from capital support to industrial collaboration, China’s semiconductor industry is writing an epic of domestic substitution. In the future, whether Cambricon can maintain its leading advantage, or players such as Huawei, Moore Threads, Muxi, and Biren overtake on the curve, as long as continuous technological innovation and commercial breakthroughs emerge in this track, the process of self-reliance of China’s AI chips will not stop [5].

[2] EET China - U.S. Officially Approves Nvidia’s H200 Chip Exports to China

[3] EET China - Export Conditions Clarified, Restrictive Measures Strict

[4] Tencent News - 2025 Technology and Capital Report | Domestic Chip Substitution

[5] NetEase - China’s AI Chips: Hit the Accelerator, Launch a Collective Charge

[6] Gilin API Data - Nvidia Company Profile and Financial Data

[7] Investing.com - Bloomberg: China May Approve Procurement of Nvidia H200 Chips in This Quarter

[9] Lexology - 2025 International Trade Compliance Annual Review and 2026 Outlook

[12] Eastmoney - Guoyuan Securities Industry Research - Electronic Industry Weekly Report

[13] NetEase - Manufacturing Industry Daily (01.11): Fierce Competition in AI Chips

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.