Analysis of the Impact of Space Nuclear Reactor Technology Development on Investment in the Nuclear Energy and Aerospace Sectors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I will now provide you with a systematic and comprehensive investment analysis report.

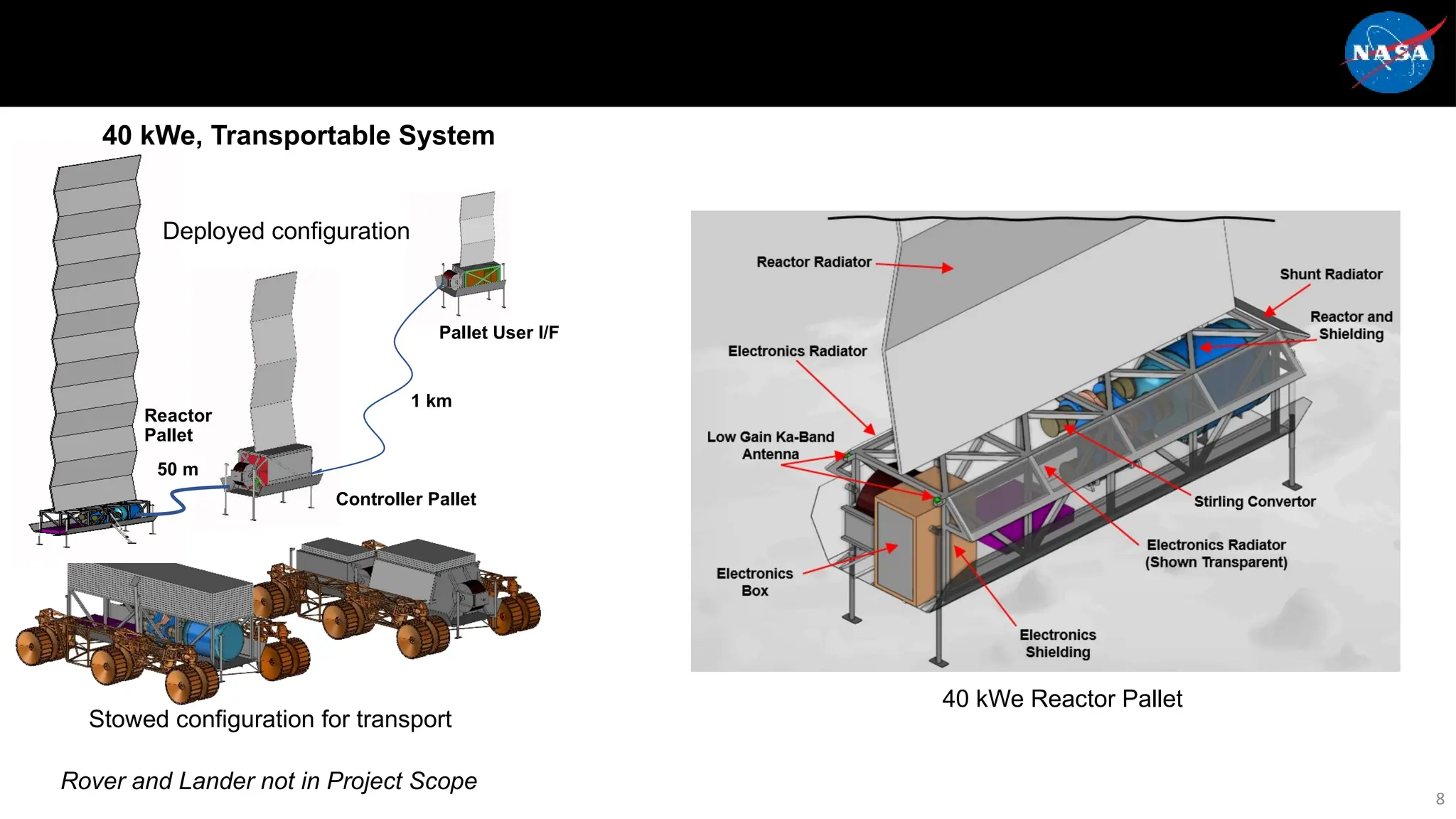

The National Aeronautics and Space Administration (NASA) is collaborating with the Department of Energy (DOE) to develop a lunar surface nuclear reactor system, with plans to complete deployment by 2030 [1]. The project aims to provide continuous, reliable energy supply for sustainable lunar missions, eliminating reliance on solar power. This nuclear reactor system will provide at least 10 kilowatts of power to lunar bases, supporting the operation of infrastructure for deep space exploration missions.

In August 2025, NASA officially announced the launch of the Fission Surface Power project, and selected Steve Sinacore to lead the project [2]. NASA also announced that it will launch a pair of Mars probes named ESCAPADE in 2026 to study the mechanism by which Mars’ magnetic field is affected by the sun. This is crucial for understanding the deep space radiation environment and also provides important environmental data support for future nuclear-powered spacecraft [2].

The project is being jointly advanced by two defense and nuclear energy giants:

- Lockheed Martin Corporation (Lockheed Martin): Responsible for overall system integration and spacecraft development

- BWX Technologies (BWXT): Responsible for core design and manufacturing of the nuclear reactor

In addition, companies such as Aerojet Rocketdyne are also participating in the research and development of key technologies for this project [3]. This government-industry cooperation model opens up a new path for commercial nuclear energy companies to enter the space market.

| Ticker Symbol | Company Name | Initial Price | Final Price | Cumulative Return | Volatility |

|---|---|---|---|---|---|

BWXT |

BWX Technologies | $102.50 | $210.54 | +105.40% |

2.48% |

NNE |

NANO Nuclear Energy | $10.12 | $32.42 | +220.36% |

8.27% |

OKLO |

Oklo Inc. | $5.83 | $97.09 | +1565.35% |

8.29% |

Data shows that

2025 was a record year for advanced nuclear energy investment. According to data from Net Zero Insights, as of Q3 2025, nuclear fission companies had raised

Among them, small modular reactors (SMRs) and microreactors accounted for approximately 75% of nuclear fission financing [6].

The energy sector as a whole rose

- Cameco (CCJ): Stock price $109.79, market capitalization $47.8 billion, one of the world’s largest uranium miners

- Energy Fuels (UUUU): Stock price $19.26, uranium producer

- Centrus Energy (LEU): Stock price $309.68, high-assay low-enriched uranium (HALEU) supplier

These companies provide fuel and raw material support for space nuclear reactors and benefit from overall industry growth.

| Segment | Key Companies | Investment Rationale |

|---|---|---|

| Reactor Design and Manufacturing | BWXT, NNE, OKLO, NuScale | NASA project orders, technology verification, accelerated commercialization |

| Nuclear Fuel Supply | CCJ, UEC, UUUU, LEU | Increased demand for high-assay low-enriched uranium (HALEU) for space missions |

| Nuclear Material Processing | BWXT, LTBR | Advanced nuclear fuel manufacturing technology |

| Engineering and Consulting Services | CurtissWright (CW) | Provides key components such as nuclear reactor cooling pumps [8] |

- Certainty of Government Orders: The NASA project provides a stable source of government revenue, reducing commercialization risks

- Technology Verification Endorsement: Government projects verify the feasibility of relevant technical routes, enhancing investor confidence

- Diversified Application Scenarios: Space nuclear reactor technology can be extended to power supply in remote areas, offshore platforms, military bases, etc.

- Driven by Carbon Neutrality Policies: As a clean energy source, nuclear energy is supported by policies, creating a dual positive with space exploration

| Company | Ticker | Business Relevance |

|---|---|---|

| Lockheed Martin | LMT | Prime contractor for Fission Surface Power |

| RTX Corporation | RTX | Participates in advanced propulsion system R&D |

| General Atomics | Unlisted | Nuclear engineering and space systems |

| Firefly Aerospace | Unlisted | Commercial lunar lander developer |

- Advancement of the Artemis Program: NASA’s Artemis Program continues to progress, with the first crewed lunar mission launch potentially taking place in February 2026 [9]

- Commercial Lunar Payload Services (CLPS): NASA has awarded lunar lander contracts to multiple companies, forming a commercial space ecosystem [1]

- Gateway Lunar Space Station: International partners continue to develop the lunar orbiting station, providing relay support for deep space exploration [2]

According to industry analysis, the space nuclear reactor market will show a high-growth trend:

2024: $2.5 billion → 2030: $55 billion

CAGR: Approximately 55% (2024-2030)

Growth drivers include:

- Continuous investment from NASA and space agencies of various countries

- Demand from commercial space companies (such as SpaceX, Blue Origin)

- Energy demand for space resource development (such as lunar mining)

- Demand for the advancement of deep space exploration missions

- Already a core supplier for NASA’s nuclear reactor project

- Low stock price volatility (2.48%), favorable risk-return ratio

- Secured multiple government contracts in 2025, high business stability

- Its subsidiary NANO Nuclear Space Inc. focuses on space nuclear applications

- High stock price elasticity, suitable for investors with higher risk appetite

- Signed a memorandum of understanding with Ameresco to expand commercialization paths [5]

- Delivered the largest increase, but with extremely high volatility

- Signed PPA agreements with tech giants (Meta, Vistra, TerraPower)

- Commercialization progress requires continuous tracking

| Allocation Ratio | Target Type | Specific Recommendations |

|---|---|---|

| 40-50% | Mature Nuclear Energy Companies | CCJ, BWXT |

| 30-40% | Growth-Oriented Nuclear Energy Companies | NNE, OKLO |

| 10-20% | Aerospace & Defense | LMT, RTX |

| 5-10% | Uranium Mining ETFs | URNM, URA |

- Technical Risk: Space nuclear reactor technology is not yet fully mature, and technical failure is possible

- Policy Risk: Changes in government budgets may affect project progress

- Geopolitical Risk: Nuclear technology export restrictions and uncertainties in international cooperation

- Market Risk: Highly valued stocks may experience a pullback

- Safety and Regulatory Risk: Safety approval and regulatory requirements for nuclear facilities are strict

The development of space nuclear reactor technology is creating new investment opportunities for the nuclear energy and aerospace sectors. NASA’s Fission Surface Power project not only brings definite government orders to relevant companies, but more importantly, verifies the feasibility of advanced nuclear technology in space applications, laying the foundation for commercialization.

From an investment perspective,

In the long term, the explosive growth of the space nuclear reactor market will provide investors with a significant source of alpha returns. As technological maturity improves and commercialization accelerates, more investment opportunities are expected to emerge. It is recommended that investors maintain continuous attention to this field and make strategic allocations based on their risk appetite.

[1] Payload Space - “The Moon: 2025 Wrapped” (https://payloadspace.com/the-moon-2025-wrapped/)

[2] NASA - “NASA Ignites New Golden Age of Exploration, Innovation in 2025” (https://www.nasa.gov/news-release/nasa-ignites-new-golden-age-of-exploration-innovation-in-2025/)

[3] SlideShare - “2023 Overview of NASA Fission Surface Power” (https://www.slideshare.net/)

[4] Power Mag - “Meta Locks In Up to 6.6 GW of Nuclear Power” (https://www.powermag.com/meta-locks-in-up-to-6-6-gw-of-nuclear-power-through-deals-with-vistra-oklo-and-terrapower/)

[5] Green Stock News - “Nuclear Energy Stocks List” (https://greenstocknews.com/stocks/nuclear-energy-stocks)

[6] Power Mag - “Advanced Nuclear Developers Raise New Capital” (https://www.powermag.com/advanced-nuclear-developers-raise-new-capital-as-2025-investment-hits-record-levels-and-demonstrations-near/)

[7] Jinling AI - Market Sector Performance Data (January 14, 2026)

[8] Nasdaq - “3 Aerospace-Defense Equipment Stocks to Buy” (https://www.nasdaq.com/articles/3-aerospace-defense-equipment-stocks-buy-ma-momentum)

[9] Brazilian Space - “Artemis 2 Mission Updates” (https://brazilianspace.blogspot.com/)

[10] Mordor Intelligence - “Nuclear Power Market Analysis” (https://www.mordorintelligence.com/industry-reports/nuclear-power-market)

Report Generation Date: January 14, 2026

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.