Assessment Report on the Impact of Perovskite Tandem Cell Technological Breakthroughs on the Investment Landscape of the Photovoltaic Industry Chain

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on in-depth research and data analysis, I will conduct a systematic assessment of the impact of perovskite tandem cell technological breakthroughs on the investment landscape of the photovoltaic industry chain.

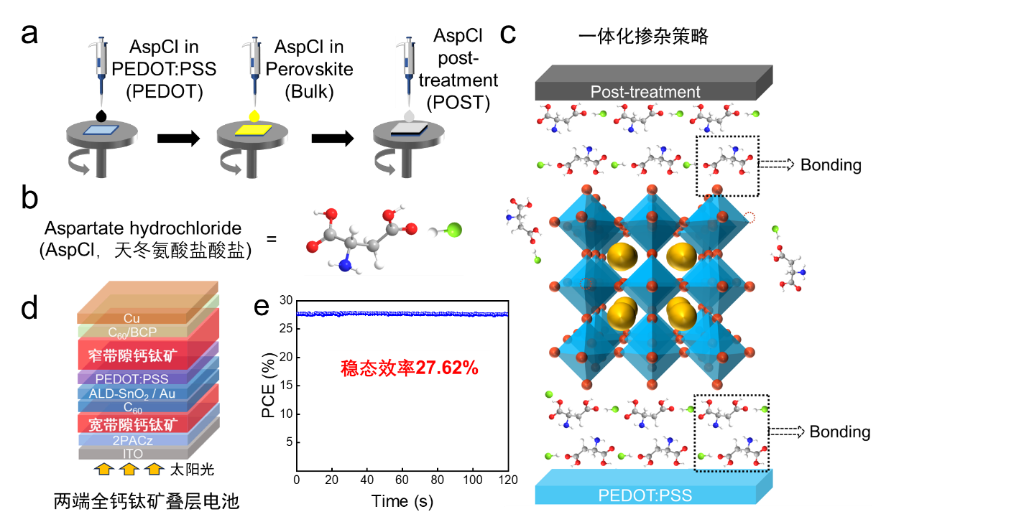

The research results on flexible crystalline silicon-perovskite tandem solar cells published by the team led by Professor Zhang Xiaohong from Soochow University in the journal Nature represent a major technological breakthrough in this field. Through an innovative double buffer layer design, this technology effectively solves the core problem of traditional perovskite cells being unable to balance efficiency and stability, laying a foundation for the application of perovskite technology in high-value scenarios such as spacecraft and space data centers [1].

| Indicator Category | Traditional Crystalline Silicon Cell | Perovskite Tandem Cell | Advantage Multiple |

|---|---|---|---|

| Maximum Theoretical Efficiency | 29.4% | 43% | 1.46x |

| Power-to-Mass Ratio | 0.38 W/g | 50 W/g | 131x |

| Flexibility | Rigid | Bendable | Fundamental Difference |

| Space Applicability | Fast Attenuation | Radiation Resistant | Significant Advantage |

2025 marks a critical transition period for perovskite tandem cells from laboratory research to industrialization verification:

- Capacity Construction Breakthrough:Extreme Optoelectronics has built the world’s first GW-scale perovskite photovoltaic module production line, and GCL Photovoltaic has put its GW-scale production line into operation [2]

- Continuous Efficiency Improvements:LONGi Green Energy’s crystalline silicon-perovskite tandem cell has reached an efficiency of 34.85%, and GCL Photovoltaic’s tandem module efficiency has exceeded 27% [3]

- Process Verification:Tongwei Co., Ltd.'s Global Innovation R&D Center has fully commissioned the first fully automated MW-scale perovskite-crystalline silicon tandem cell pilot line [4]

- Commercial Verification:2025 is defined by the industry as the “First Year of GW-Scale Perovskite Production”

- 2025-2026:GW-scale production lines put into operation; technology verification period

- 2027-2028:Quasi-GW-scale production lines deployed; commercialization in niche scenarios

- 2028-2030:Mass production launched; breakthroughs in space applications

- After 2030:Penetration into mainstream markets; substitution effects emerge

The breakthrough in perovskite tandem technology is reshaping the value distribution pattern of the photovoltaic industry chain:

Industrial Chain Segment │ Proportion in Traditional Crystalline Silicon │ Proportion in Perovskite Tandem │ Trend

────────────┼─────────────┼──────────────┼──────────

Silicon Raw Material/Wafer │ 45% │ 25% │ ↓ Significant Decrease

Cell │ 35% │ 30% │ → Stable

Perovskite Layer │ 0% │ 20% │ ↑ New Value Added

Equipment/Process │ 10% │ 15% │ ↑ Equipment Upgrade

Auxiliary Materials/Packaging │ 10% │ 10% │ → Basically Stable

- Jinjing Technology:TCO glass supplier with product light transmittance reaching 94%, already applied in leading perovskite production lines

- Wanrun New Materials:Full-range material supplier covering hole transport layers, perovskite layers and electron transport layer materials; began mass sales to GCL Photovoltaic in the first half of 2025 [5]

- Jingshan Light Machinery:RPD equipment supplier with coating equipment capacity reaching 15GW

- Liyuanheng:Laser scribing machines and laser edge cleaning equipment have completed laboratory verification

- Tongwei Co., Ltd.:Its advanced cell laboratory has achieved a perovskite/silicon tandem cell efficiency of 34.69%

- LONGi Green Energy:Holder of the world record for crystalline silicon-perovskite tandem cell efficiency

- Junda Co., Ltd.:Signed a strategic cooperation agreement with Shangyi Optoelectronics to lay out space energy applications [6]

Perovskite tandem cells demonstrate unique advantages in space application scenarios, opening up a brand-new market space:

- 2035 global in-orbit data center market size: USD 39.09 billion [7]

- Low-Earth orbit satellite solar array market space: Annual launch of 10,000 satellites corresponds to a market demand of approximately RMB 200 billion

- As the “ultimate application scenario”, space photovoltaic power has a theoretical market space of up to trillion RMB level

| Comparison Dimension | Gallium Arsenide Cell | Crystalline Silicon Cell | Perovskite Tandem Cell |

|---|---|---|---|

| Cost (Yuan/Watt) | 1000-2000 | 1-2 | 5-10 |

| Efficiency | 30-35% | 24-26% | 30-35% |

| Weight | Heavy | Heavy | Ultra-light (90% weight reduction) |

| Launch Cost | High | High | Low |

- Technological Iteration Dividend:The breakthrough in perovskite tandem technology breaks through the theoretical efficiency ceiling of crystalline silicon (29.4% → 43%), driving demand for product upgrades fueled by efficiency improvements

- Scenario Expansion Value:New scenarios such as space photovoltaic power, lightweight applications, and Building-Integrated Photovoltaics (BIPV) open up incremental markets

- Industrial Chain Restructuring Opportunities:Demand for new materials and new equipment spurs the emergence of specialized leading suppliers

- Clear Policy Support:The Ministry of Industry and Information Technology has included perovskite photovoltaic cells and tandem photovoltaic cells in the key directions of manufacturing pilot test platforms [8]

- Stability Bottleneck:The intrinsic stability issue of perovskite materials has not been fully resolved; long-term operation attenuation remains a major obstacle to commercialization

- Cost Disadvantage:The current per-watt price of perovskite modules is approximately RMB 1.4, while TOPCon modules are only RMB 0.62-0.72, showing a significant gap [9]

- Industrialization Verification Period:Large-scale commercial breakthroughs are not expected until 2028-2030, resulting in a long investment payback period

- Uncertain Technological Routes:The technical routes of three-terminal and four-terminal tandem structures have not been unified, and the standard system remains to be improved

Focus on enterprises with

- Leading enterprises with GW-scale mass production capacity: Extreme Optoelectronics, GCL Photovoltaic

- Equipment suppliers: Jingshan Light Machinery, Liyuanheng (equipment-first logic)

Layout the

- Space Trek and Wuxi Zhongneng Optoelectronics & Energy Storage jointly established Space Super Energy Aerospace Energy Technology Co., Ltd. [10]

- Strategic positioning of Junda Co., Ltd., JinkoSolar, and Trina Solar

- Testing and certification service providers: Xice Testing

Focus on

- Technological transformation of traditional photovoltaic leaders such as LONGi Green Energy and Tongwei Co., Ltd.

- Enterprises with integrated layouts in materials, equipment, and modules

The technological breakthrough by the team led by Professor Zhang Xiaohong from Soochow University marks an important milestone for perovskite tandem cells from laboratory research to industrialization. This technological breakthrough will have far-reaching impacts on the photovoltaic industry chain:

- Efficiency Boundary Breakthrough:Tandem technology breaks through the efficiency ceiling of crystalline silicon, with a theoretical efficiency of up to 43%

- Scenario Restructuring:Space photovoltaic power transitions from science fiction to reality, with a trillion-level new blue ocean taking shape

- Investment Landscape Restructuring:New material and new equipment enterprises face development opportunities, while traditional silicon raw material and wafer segments come under pressure

- Clear Time Nodes:Large-scale commercial breakthroughs are expected between 2028 and 2030

[1] Research team led by Professor Zhang Xiaohong, Soochow University - Research results on flexible crystalline silicon-perovskite tandem solar cells, Nature

[2] Extreme Optoelectronics, GCL Photovoltaic GW-scale production lines put into operation - The first year of GW-scale perovskite production kicks off

[3] LONGi Green Energy, GCL Photovoltaic efficiency breakthroughs - 2025 perovskite tandem cell efficiency progress

[4] Tongwei Co., Ltd. Global Innovation R&D Center - Fully automated MW-scale tandem cell pilot line commissioned

[5] Wanrun New Materials - Announcement on mass sales of perovskite-related materials

[6] Junda Co., Ltd. - Signed strategic cooperation agreement with Shangyi Optoelectronics

[7] Research and Markets - 2035 global in-orbit data center market size forecast

[8] Ministry of Industry and Information Technology, Notice on Further Accelerating the Systematic Layout and High-Level Construction of Manufacturing Pilot Test Platforms

[9] China Business Journal - Cost and market analysis of perovskite cells

[10] Space Trek - Established Beijing Space Super Energy Aerospace Energy Technology Co., Ltd.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.