In-Depth Analysis of Wuzhou Xinchun's Humanoid Robot Lead Screw Business

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I will now present a systematic and comprehensive analysis report on Wuzhou Xinchun’s humanoid robot lead screw business.

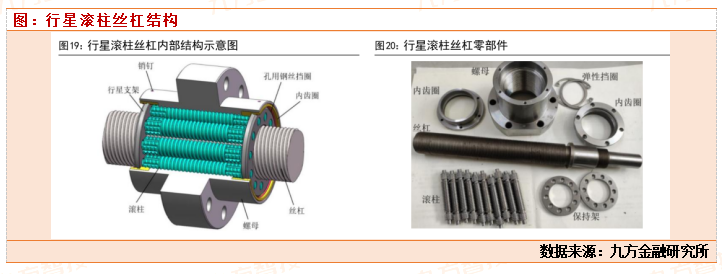

Wuzhou Xinchun (Stock Code: 603667.SS) is an industrial enterprise focusing on the precision manufacturing field, with main businesses including bearings, auto parts, and lead screw products. In recent years, the company has actively deployed in the emerging track of humanoid robot lead screws, relying on more than 20 years of precision manufacturing technology, and has prioritized the lead screw business as a strategic emerging direction [0][1].

In terms of capital market performance, the company’s stock price has performed strongly since 2024, with a gain of over 163% in the past year and an impressive 489.51% gain in the past three years, reflecting the market’s optimistic expectations for the company’s lead screw business [0]. However, the company’s current price-to-earnings ratio (PE) is as high as 330.35x, and price-to-book ratio (PB) is 10.15x, indicating that the valuation has fully reflected the market’s high growth expectations for the future [0].

In December 2025, Wuzhou Xinchun’s RMB 1 billion private placement plan was approved by the Shanghai Stock Exchange, which is an important milestone for the development of the company’s lead screw business [1][2]. The raised funds will be mainly invested in the “R&D and Industrialization Project of Core Components for Embodied Intelligent Robots and Automotive Intelligent Driving”, with a total project investment of RMB 1.055 billion [1].

| Product Type | Capacity Plan | Unit Consumption | Number of Supportable Humanoid Robots |

|---|---|---|---|

| Planetary Roller Screw | 980,000 units | 14 units/unit (Optimus Gen2) | Approximately 70,000 units |

| Miniature Ball Screw | 2.1 million units | 28 units/unit (Dexterous Hand) | Approximately 75,000 units |

| Bearings for General-Purpose Robots | 70,000 sets | - | Approximately 70,000 units |

From the perspective of capacity design, the company’s planetary roller screw capacity (980,000 units), calculated based on the 14 units per Optimus Gen2, can meet the demand for load-bearing transmission joints such as the large arms of approximately 70,000 humanoid robots; the miniature ball screw (2.1 million units), calculated based on 28 units per unit, can meet the demand for finger joints of the dexterous hands of approximately 75,000 humanoid robots [1].

According to the announcement, the project has a construction period of 3 years. Combined with the previously raised investment capacity, the company will have the lead screw capacity to support approximately 80,000 humanoid robots and 1.35 million intelligent vehicles, corresponding to an annual output value of over RMB 2 billion [2]. This means that large-scale production capacity release is expected to be realized only after 2027.

2026 is regarded as a key year for the mass production of humanoid robots, and major players have all given capacity targets of over 10,000 units:

| Enterprise | 2026 Planned Capacity | Planetary Roller Screw Demand |

|---|---|---|

| Tesla | 50,000-100,000 units | 700,000-1.4 million units |

| Unitree Robotics | Approximately 100,000 units | Approximately 1.4 million units |

| Agibot | Approximately 10,000 units | Approximately 140,000 units |

| UBTECH | Approximately 10,000 units | Approximately 140,000 units |

| Figure AI | 20,000-50,000 units | Approximately 280,000-700,000 units |

Total |

Approximately 190,000-270,000 units |

Approximately 2.66-3.82 million units |

As the industry leader, Tesla plans to produce “1,000 to several thousand units” of its Optimus robots in 2025, and raise the target to 50,000-100,000 units in 2026, expanding at a tenfold annual growth rate [1]. Elon Musk has also proposed a long-term plan to deliver a total of 1 million units by 2035 [2].

According to Huaxin Securities’ research, the market value of planetary roller screws applied in humanoid robots will reach RMB 22.96 billion by 2030, with a compound annual growth rate (CAGR) of as high as 154.1% from 2024 to 2030 [2]. Zheshang Securities estimates that the value of linear actuators, including planetary roller screws and T-type lead screws, accounts for 19.4% of the whole machine, making it the largest value segment of the whole machine [2].

The unit price of planetary roller screws applied in Tesla’s Optimus is approximately RMB 2,000 per unit, and the price of ball screws ranges from RMB 200 to 600 [2]. Taking Optimus Gen2 as an example, the total value of lead screws for the whole machine is approximately:

- Planetary roller screws: 14 × RMB 2,000 = RMB 28,000

- Miniature ball screws: 28 × RMB 400 = RMB 11,200

- Total approximately RMB 39,200

| Indicator | Value |

|---|---|

| Wuzhou Xinchun’s Planetary Roller Screw Capacity | 980,000 units |

| Minimum Industry Demand for Planetary Roller Screws in 2026 | 2.66 million units |

| Maximum Industry Demand for Planetary Roller Screws in 2026 | 3.82 million units |

Supply-Demand Gap (Conservative Estimate) |

1.68 million units |

Supply-Demand Gap (Optimistic Estimate) |

2.84 million units |

It can be seen from the data that the industry’s demand for planetary roller screws in 2026 will be approximately 2.66-3.82 million units, while Wuzhou Xinchun’s capacity (980,000 units) can only meet 25.7%-36.8% of the industry demand, resulting in a significant supply-demand gap.

Wuzhou Xinchun has the following competitive advantages in the lead screw field:

The domestic humanoid robot lead screw market presents a “tripartite” competitive landscape, with main players including Hengli Hydraulics, Wuzhou Xinchun, and Beite Technology [2]:

| Company | Capacity Layout and Progress | Corresponding Annual Output Value |

|---|---|---|

Hengli Hydraulics |

Put into production in 2024: annual output of 104,000 standard ball screw electric cylinders and 4,500 heavy-duty ball screw electric cylinders; the annual output 660,000 meters standard ball screw project was put into production in November 2025 | Over RMB 3 billion |

Wuzhou Xinchun |

Private placement approved in December 2025, 3-year construction period, large-scale production after 2027 | Over RMB 2 billion |

Beite Technology |

Invested RMB 1.85 billion in 2024 to build a Kunshan base, completed by the end of 2025, mass production in 2026, with a capacity of 2.6 million planetary roller screws | Not disclosed |

From the perspective of the rhythm of capacity release,

It is worth noting that in 2022, the top four overseas suppliers accounted for approximately 78% of the global planetary roller screw market, while domestic players Nanjing Gongyi and Jining Bote each accounted for approximately 8% [2]. This means that there is huge space for domestic substitution, and domestic enterprises such as Wuzhou Xinchun are expected to seize market share by virtue of cost advantages and localized services.

According to the latest financial data, Wuzhou Xinchun’s current financial status has the following characteristics [0]:

- ROE (Return on Equity): 3.10%, which is at a relatively low level

- Net Profit Margin: 2.66%, profitability needs to be improved

- Current Ratio: 1.40, with good liquidity

- Financial Risk: Low risk

The company’s net profit growth rate was weak in the first three quarters of 2025, falling into negative growth [2]. In terms of the absolute value of profitability, the net profit margins of Hengli Hydraulics, Wuzhou Xinchun, and Beite Technology are 26.85%, 4.1%, and 5.67% respectively, with obvious gaps [2].

- Capacity Planning Matching Degree: Wuzhou Xinchun’s 980,000-unit planetary roller screw capacity can meet 25.7%-36.8% of industry demand, which cannot fully cover the industry’s demand of approximately 2.66-3.82 million units in 2026, resulting in a supply-demand gap of 1.68-2.84 million units.

- Capacity Release Timing: The company’s capacity release time (after 2027) lags behind the industry’s volume inflection point (2026), and it may miss the market share in the early stage of the industry’s outbreak.

- Competitive Advantages: The company has technical cost advantages (C5-level precision, cost is 1/3 of Japan’s THK) and supply chain advantages (entered Tesla’s supply chain through Xinjian Transmission).

- Industry Prospects: The humanoid robot lead screw market has broad space, with a projected compound annual growth rate of 154.1% from 2024 to 2030, and huge space for domestic substitution.

As a core target in the humanoid robot lead screw field, Wuzhou Xinchun has a clear long-term growth logic, but faces short-term risks of delayed capacity release and high valuation. It is recommended that investors focus on the following:

- Private Placement Progress: Pay attention to the final implementation time and actual investment progress of the RMB 1 billion private placement;

- Customer Designation: Track whether the company obtains official designations from leading customers such as Tesla;

- Capacity Ramping: Pay attention to the small-batch capacity release situation after 2026;

- Performance Delivery: Whether the performance can achieve high-speed growth after 2026 to support the current high valuation.

[0] Jinling API - Company Overview and Financial Data of Wuzhou Xinchun (603667.SS)

[1] Soochow Securities - In-Depth Research Report “Wuzhou Xinchun (603667): Leader in Precision Manufacturing, Promising Future with Advanced Lead screw Layout” (https://pdf.dfcfw.com/pdf/H3_AP202503041644047989_1.PDF)

[2] 36Kr - “Which Segment is Most Likely to Break Out in the Trillion-Yuan Humanoid Robot Track?” (https://www.36kr.com/p/3636380217885702)

[3] 21st Century Business Herald - “Wuzhou Xinchun Raises RMB 1 Billion, Targeting Mass Production of 70,000 Humanoid Robots” (https://www.21jingji.com/article/20250617/herald/05cf32584a26e6fdfc4a7e696cbf7333.html)

[4] Sina Finance - “Wuzhou Xinchun: RMB 1 Billion Private Placement Approved, Positioning in Two Core Tracks of Humanoid Robots and Intelligent Vehicles” (https://finance.sina.com.cn/tech/roll/2025-12-08/doc-inhaaexm2539423.shtml)

[5] The Paper - “Xinjian Transmission Sprints for IPO, Targeting Annual Production of 1 Million Units of Planetary Roller Screws for Humanoid Robots” (https://www.thepaper.cn/newsDetail_forward_32359343)

[6] Guancha.cn - “Xinjian Transmission Challenges IPO, Core Component Supplier for Tesla’s Humanoid Robots” (https://user.guancha.cn/main/content?id=1582316&s=fwtjgzwz)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.