Wolfspeed's 300mm SiC Wafer Breakthrough: Strategic Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on comprehensive research and data analysis, I can now provide a detailed assessment of Wolfspeed’s 300mm SiC wafer breakthrough and its potential to reverse the company’s stock decline and competitive position.

Wolfspeed, Inc. (NYSE: WOLF) announced on January 13, 2026, a significant industry milestone: the successful production of a single crystal 300mm (12-inch) silicon carbide wafer [1]. This technological advancement positions the company at the forefront of SiC manufacturing, but faces substantial headwinds from its recent bankruptcy restructuring, competitive pressures, and financial challenges. While the breakthrough represents a genuine technological achievement with long-term strategic value, its ability to immediately reverse Wolfspeed’s stock decline remains uncertain and depends on several critical execution factors.

Wolfspeed has successfully produced a single crystal 300mm silicon carbide wafer, representing a fundamental manufacturing advancement from the current 200mm (8-inch) standard [1][2]. The key technical highlights include:

- Unified Manufacturing Platform: The 300mm technology enables a converged platform combining high-volume SiC power electronics manufacturing with advanced high-purity semi-insulating substrates for optical and RF systems [1]

- Wafer-Scale Integration: Enables integration across optical, photonic, thermal, and power domains at wafer scale [1]

- IP Leadership: Backed by over 2,300 issued and pending patents worldwide, one of the industry’s largest foundational SiC IP portfolios [1]

The breakthrough enables Wolfspeed to address several high-growth markets [1][3]:

| Market Application | Value Proposition |

|---|---|

AI Infrastructure |

Addresses data center power limits by enabling integration of high-voltage power delivery, advanced thermal solutions, and active interconnects at wafer scale |

AR/VR Systems |

Supports compact, lightweight systems with high-brightness displays and effective thermal management |

Advanced Power Devices |

Enables cost-effective scaling for high-voltage grid transmission, next-generation industrial systems, and electrification |

Electric Vehicles |

Powers the expanding EV market requiring high-efficiency power electronics |

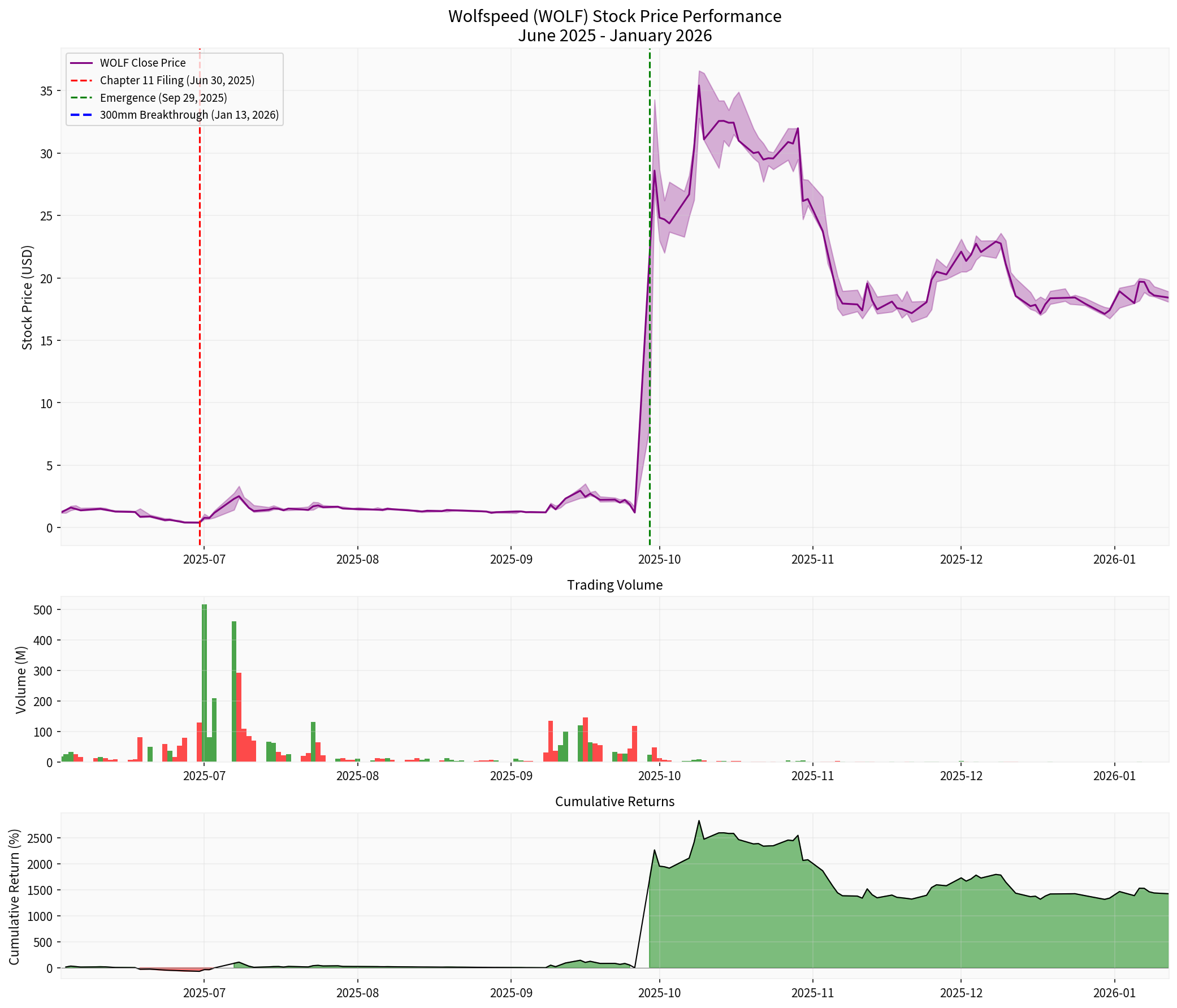

Wolfspeed’s stock has experienced extreme volatility, particularly following its Chapter 11 filing [4]:

| Metric | Value |

|---|---|

| Current Price | $18.42 |

| 52-Week Range | $8.05 - $36.60 |

| Market Cap | $476.94M |

| Average Daily Volume | 29.18M shares |

| Beta (vs S&P 500) | 4.48 [5] |

- Pre-Bankruptcy (June 27, 2025): $0.40 per share

- Chapter 11 Filing (June 30, 2025): Marked the beginning of restructuring

- Post-Emergence (September 30, 2025): $22.10 per share

- Peak (November 2025): $36.60 per share

- Current: $18.42 per share (down 43.44% from 3 months prior) [4]

Wolfspeed filed for Chapter 11 bankruptcy protection on June 30, 2025, and emerged on September 29, 2025, after completing a 91-day prepackaged restructuring [6]:

| Restructuring Metric | Value |

|---|---|

| Pre-Petition Debt | ~$6.7 billion |

| Debt Eliminated | ~$4.6 billion (70% reduction) |

| Post-Emergence Debt | ~$2.0 billion |

| Annual Interest Reduction | ~$240 million (60% reduction) |

| Enterprise Value (Post-Restructuring) | $2.35B - $2.85B |

| Existing Equity Recovery | 3-5% [6] |

The restructuring transferred significant ownership to creditors, resulting in substantial dilution for pre-bankruptcy shareholders [7].

The global silicon carbide market is highly competitive, with Wolfspeed facing pressure from established semiconductor giants [8]:

| Company | Estimated SiC Market Share (2025) |

|---|---|

| STMicroelectronics | ~40% |

| Infineon Technologies | ~22% |

| Wolfspeed | ~14% |

| ROHM | ~10% |

| onsemi | ~7% |

| Others | ~7% |

Wolfspeed has historically maintained leadership in SiC wafer technology, but competitors have been rapidly catching up [8].

The competitive dynamics reveal a race toward larger wafer sizes:

| Company | 200mm Status | 300mm Plans |

|---|---|---|

Wolfspeed |

Only company manufacturing SiC devices on 8-inch platform in high volume | Lab breakthrough achieved; volume commercialization path established |

Infineon |

Products on 200mm SiC from Villach, Austria facility since February 2025 | Actively developing 300mm capability [9] |

STMicroelectronics |

Strong 200mm production | Investment focus on automotive SiC |

onsemi |

Targeting 8-inch transition after 2025 technical verification | Achieved 50%+ self-sufficiency in SiC substrates via GTAT acquisition [8] |

Chinese Players (SICC, TanKeBlue) |

Controlling ~40% of SiC wafer market as of 2025 | Aggressive pricing creating 30% price decrease in 2024 [8] |

- Only company with high-volume 8-inch SiC manufacturing capability [3]

- Largest SiC IP portfolio with 2,300+ patents [1]

- First-mover advantage in 300mm SiC wafer production

- Integrated manufacturing capabilities

- Significant debt burden despite restructuring

- Chinese competitors with aggressive pricing strategies

- Established players (Infineon, STMicroelectronics) with greater financial resources

- Need for $1B+ investment to build 300mm production fab [3]

The 300mm breakthrough demonstrates that Wolfspeed retains its technological edge despite financial difficulties. According to Poshun Chiu, Principal Analyst at Compound Semiconductor, Yole Group: “This 300mm breakthrough is more than a technical milestone — it unlocks new opportunities for silicon carbide as a strategic material. It clearly demonstrates that silicon carbide is advancing to the next level of manufacturing maturity required for the coming decade of electrification, digitalization, and AI.” [1]

The transition to 300mm wafers offers significant cost advantages [3]:

- 300mm wafers provide 2.25x the surface area of 200mm wafers

- Higher chips per wafer spreads fixed costs over greater volume

- Critical for reducing per-device costs in an inherently expensive material system

The SiC market is projected to reach $1.3 trillion by 2035, growing at an 11.3% CAGR [9], with the automotive segment expected to capture 70.6% market share [9]. Wolfspeed’s technological position positions it to capture share in high-growth applications.

The consensus price target stands at $30.00, representing +62.9% upside from current levels, with 6 analysts rating it a Buy [4].

Wolfspeed faces significant challenges in funding the $1B+ 300mm fab investment [3]:

- Still carrying ~$2.0 billion in debt post-emergence

- Reported $864 million net loss for fiscal year 2024

- Limited access to capital markets given recent bankruptcy

The company has only established a “clear path to future volume commercialization” [1] — not immediate production. Competitors like Infineon already have products shipping on 200mm technology [9].

A securities class action lawsuit was recently transferred to North Carolina federal court, alleging misrepresentations about financial projections [7]. This creates ongoing legal and reputational risk.

Short interest has risen to 64.22% of float, indicating significant bearish sentiment [7]. It would take 4.25 days to cover short positions on average volume.

Commercial success hinges on:

- Post-reorganization cost efficiency

- Securing design wins to validate 300mm SiC advantages

- Competing against entrenched 200mm ecosystems [3]

Based on technical indicators as of January 13, 2026 [5]:

| Indicator | Signal | Interpretation |

|---|---|---|

MACD |

No cross (bullish bias) | No clear momentum shift |

KDJ |

Bullish (K:60.6, D:60.6, J:60.7) | Near overbought territory |

RSI |

Normal range | No extreme overbought/oversold conditions |

Trend |

Sideways/No clear trend | Trading range: $17.78 - $19.06 |

- Technological leadership in 300mm SiC positions Wolfspeed for next-generation semiconductor applications

- Massive market growth (11.3% CAGR through 2035) provides long-term tailwinds

- Debt reduction from bankruptcy improves financial flexibility

- Integration opportunities in AI infrastructure and EV supply chains

- 300mm commercialization timeline remains uncertain

- Significant competition from better-capitalized rivals

- Ongoing legal risks from securities litigation

- High short interest and bearish sentiment may limit upside

- Need for $1B+ capital investment in a constrained financial position

The current analyst consensus reflects uncertainty [4]:

- Buy: 6 analysts (31.6%)

- Hold: 9 analysts (47.4%)

- Sell: 4 analysts (21.1%)

Wolfspeed’s 300mm SiC wafer breakthrough represents a genuine technological achievement that validates the company’s innovation capabilities and positions it for long-term success in the expanding SiC market. However,

- Timing Gap: The breakthrough establishes a path to volume commercialization, not immediate revenue

- Financial Constraints: Post-bankruptcy capital structure limits investment capacity

- Competitive Pressure: Rivals like Infineon and STMicroelectronics maintain strong market positions

- Execution Requirements: Success depends on securing design wins and achieving cost targets

The breakthrough is a

- Successfully commercialize 300mm production

- Secure strategic design wins with major customers

- Navigate ongoing legal challenges

- Demonstrate improved financial performance

For investors, the 300mm breakthrough is a

[1] Business Wire - Wolfspeed Achieves 300mm Silicon Carbide (SiC) Technology Breakthrough (https://www.businesswire.com/news/home/20260113487095/en/Wolfspeed-Achieves-300mm-Silicon-Carbide-SiC-Technology-Breakthrough)

[2] StockTitan - Wolfspeed produces 300mm silicon carbide wafer (https://www.stocktitan.net/news/WOLF/wolfspeed-achieves-300mm-silicon-carbide-si-c-technology-w8qq5r5dfrup.html)

[3] AInvest - Wolfspeed’s 300mm SiC Breakthrough: Building the Rails for the Next Power Paradigm (https://www.ainvest.com/news/wolfspeed-300mm-sic-breakthrough-building-rails-power-paradigm-2601/)

[4]金灵API数据 - Company Overview, Real-Time Quote, and Stock Price Data

[5]金灵API数据 - Technical Analysis

[6] ElevenFlo - Wolfspeed: 91-Day Prepack Cuts $4.6B Debt (https://elevenflo.com/blog/wolfspeed-bankruptcy-46b-debt-restructuring)

[7] Benzinga - Looking Into Wolfspeed Inc’s Recent Short Interest (https://www.benzinga.com/insights/short-sellers/26/01/49752862/looking-into-wolfspeed-incs-recent-short-interest)

[8] Pestel Analysis - Competitive Landscape of Wolfspeed Company (https://pestel-analysis.com/blogs/competitors/wolfspeed)

[9] Research Nester - Silicon Carbide (SiC) Wafer Market Size, Growth Report 2035 (https://www.researchnester.com/reports/silicon-carbide-wafer-market/8302)

[10] Wolfspeed Investor Relations - Plan of Reorganization Confirmed (https://investor.wolfspeed.com/news/news-details/2025/Wolfspeeds-Plan-of-Reorganization-Confirmed-Clearing-Path-to-Emerge-from-Restructuring-Process-as-a-Financially-Stronger-Company/default.aspx)

Analysis completed: January 13, 2026

Data sources: 金灵API (market data, financial data, technical analysis), Business Wire, Wolfspeed Investor Relations, Research Nester, ElevenFlo, and other financial news sources

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.