Analysis of Expion360's Financial Improvement, Management Enhancement, and Sustainability

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

In-Depth Analysis of Expion360 Inc. (NASDAQ: XPON)'s Financial Improvement, Management Enhancement, and Sustainability

Expion360 Inc. is a company focused on the design, assembly, manufacturing, and sales of lithium iron phosphate (LiFePO4) batteries, with products primarily used in recreational vehicles (RVs), marine vessels, and the residential energy storage sector. The company underwent a significant transformation in 2025, with major changes in both financial performance and management structure [0][1].

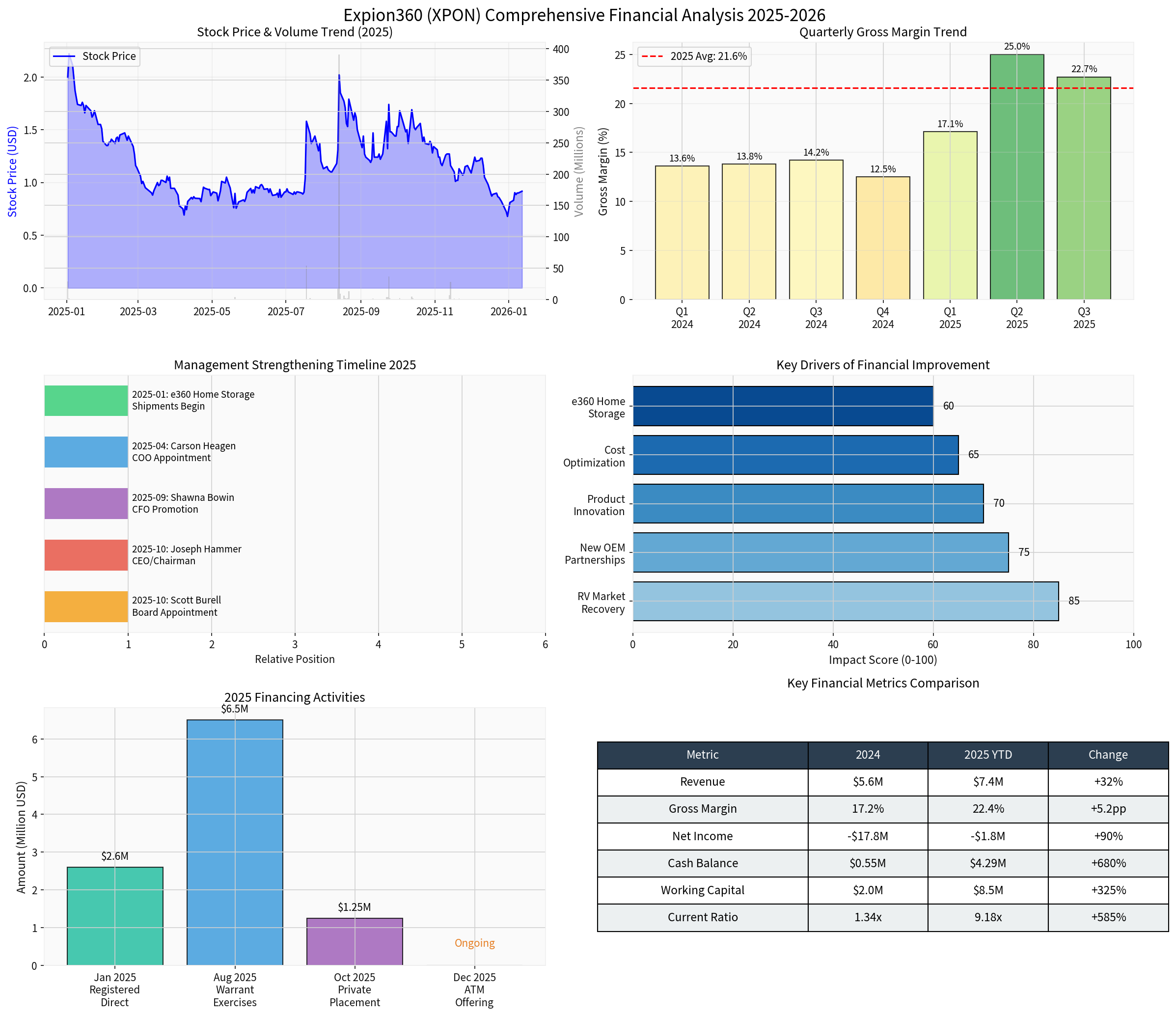

As of January 13, 2026, Expion360’s stock price was $0.92, with a market capitalization of $3.3 million, placing it in the typical micro-cap company category. The company’s 52-week trading range is $0.60-$5.50, and the current price is near the lower end of the range, reflecting the market’s cautious attitude toward the company’s prospects [0].

According to the company’s Q3 2025 financial report, Expion360 achieved

| Metric | Q3 2025 | Q3 2024 | Year-over-Year Change |

|---|---|---|---|

| Net Sales | $2.4 million | $1.39 million | +72.2% |

| Gross Profit | $542,000 | $169,000 | +221.6% |

| Gross Margin | 22.7% | 12.1% | +10.6 percentage points |

- Net sales reached $7.4 million, representing a 104.2% increasecompared to $3.6 million in the same period of 2024

- Gross margin improved from 19.7% in 2024 to 22.4%, a 2.7 percentage point increase [2]

The significant improvement in gross profit is mainly attributed to

The company has adopted multiple cost optimization measures, reflected in the following aspects:

-

Optimization of operating expense structure: Despite expanded sales scale, operating leverage is gradually emerging. The ratio of selling, general and administrative (SG&A) expenses to revenue dropped significantly from 172.8% in 2024 to 96.4% in the first three quarters of 2025, indicating a notable improvement in operational efficiency [2].

-

Improved inventory management: The company successfully reduced inventory and prepaid inventory levels, releasing approximately $2.2 million in operating capital. Inventory decreased by $1.2 million in the first nine months of 2025, while prepaid in-transit inventory decreased by $1.03 million [2].

-

Supply chain cost control: Through long-term partnerships with third-party manufacturers in Asia, the company has obtained volume discounts, effectively alleviating pressure from rising raw material costs and tariff adjustments [2].

| Period | Financing Method | Funds Raised |

|---|---|---|

| January 2025 | Registered Direct Offering | Approximately $2.6 million |

| August 2025 | Warrant Exercises | $6.5 million |

| October 2025 | Private Placement | $1.25 million |

| December 2025 | At-the-Market (ATM) Offering | Ongoing [1][2] |

- Cash and cash equivalents: Increased from $550,000 at the end of 2024 to $4.29 millionat the end of September 2025 (+680%)

- Working capital: Improved from $2 million at the end of 2024 to $8.5 million(+325%)

- Current ratio: Significantly improved from 1.34x to 9.18x[0][2]

These financing activities not only addressed the company’s short-term liquidity needs but also provided necessary capital support for its subsequent business expansion.

Expion360 carried out a

| Appointment Date | New Executive | Background and Responsibilities |

|---|---|---|

| April 2025 | Carson Heagen | Chief Operating Officer (COO), responsible for daily operations management |

| September 2025 | Shawna Bowin | Chief Financial Officer (CFO), promoted from Controller, with experience in financial reporting for public companies |

| October 2025 | Joseph Hammer | Chief Executive Officer (CEO) and Chairman, with over 20 years of senior financial leadership experience |

| October 2025 | Scott Burell | Board Member, senior financial executive [1][2] |

-

Enhanced Professional Capabilities: The new CEO Joseph Hammer’s financial leadership background brings stronger professional capabilities to the company in capital market communication, financing strategy, and financial planning [1].

-

Strengthened Internal Controls: The promotion of CFO Shawna Bowin ensures the continuity and professionalism of the company’s financial reporting process, which is crucial for a public company [2].

-

Improved Governance Structure: The addition of new board members enhances the independence and oversight capabilities of corporate governance [2].

Management openly stated in the announcement that

Based on an in-depth analysis of the company’s business model, the following factors will determine the sustainability of financial improvement:

- Structural Market Shift: The transition from lead-acid batteries to lithium batteries is a long-term trend. The company’s lithium iron phosphate batteries have a 12-year service life (3-4 times that of lead-acid batteries) and 10 times the charge-discharge cycles of lead-acid batteries, representing obvious technological advantages [2].

- New Market Expansion: The company is actively entering the residential energy storage market, which is expected to grow at a compound annual growth rate of 26.4% to reach a market size of $17.5 billion by 2028 [2]. The e360 Home Energy Storage Solutions, which began shipping in January 2025, will become a new growth engine.

- Expanded Customer Base: The company’s dealer network in the RV and marine markets continues to expand, with multiple new OEM partnerships added, which are expected to translate into sustained revenue sources [2].

- Optimized Cost Structure: As sales scale grows, the effect of spreading fixed costs per unit will continue to emerge, leaving room for further improvement in gross margin.

- Sustained Losses: Despite significant performance improvement, the company still recorded a net loss of $1.8 million in the first three quarters of 2025, and there is still a gap to achieve sustainable profitability [2].

- Market Concentration Risk: The company is highly dependent on the RV and marine markets; if these end markets experience a cyclical downturn, it will directly impact the company’s revenue.

- Fluctuations in Raw Material Prices: Price fluctuations in key raw materials such as lithium may affect the company’s cost structure and profitability.

- Uncertainty in Tariff Policies: Evolving Sino-US trade relations and tariff policy adjustments may increase the company’s import costs [2].

Cash outflow from operating activities was $3.73 million in the first three quarters of 2025, a 44% decrease compared to $6.65 million in the same period of 2024, but

Management clearly stated in the 10-Q filing that there is

- Continuous investment is required for product R&D and market expansion

- Working capital support is needed to expand OEM partnerships and distribution networks

- Investment in marketing and channel development is required to enter the residential energy storage market

According to technical analysis indicators [0]:

| Indicator | Status | Interpretation |

|---|---|---|

| Trend Judgment | Sideways Trading | No clear upward or downward trend |

| MACD | Slightly Bullish | No crossover signal |

| KDJ | Overbought Warning | K-value 84.3, D-value 69.9 |

| Support Level | $0.87 | Current price is close to support level |

| Resistance Level | $0.95 | Technical resistance exists above |

| Beta Coefficient | 0.25 | Low correlation with the market |

Technical indicators show that the stock price is in a bottom consolidation phase, and shrinking trading volume indicates limited market attention.

- Positive Factors: Consecutive revenue growth, improved gross margin, significantly enhanced liquidity, and enhanced professional capabilities of the management team — all of which lay a foundation for the company’s future development.

- Risk Factors: Going concern uncertainty, loss-making status, liquidity risks associated with micro-cap size, and dependence on a single market — these factors limit the company’s ability to achieve stable profitability in the short term.

- Key Observation Points: Whether the company can achieve break-even in 2026, market acceptance of residential energy storage products, the execution effect of the new management’s strategy, and whether financing activities can continue to support business expansion.

| Risk Type | Risk Level | Explanation |

|---|---|---|

| Operational Risk | Medium-High | Sustained losses, high market dependence |

| Financial Risk | Medium | Improved liquidity, but continuous capital needs |

| Management Risk | Medium | New team’s execution ability needs time to be verified |

| Market Risk | Medium-High | Fierce competition in the lithium battery industry |

| Stock Price Risk | High | Micro-cap size, high volatility |

For investors focusing on Expion360, it is recommended to focus on the following indicators:

- Whether quarterly revenue growth can be sustained

- Whether gross margin can stabilize above 20%

- Trends in the ratio of operating expenses to revenue

- Sales performance of residential energy storage products

- Contributions from new OEM partners

- Progress of financing activities and cash burn rate

[0] Jinling API Market Data - Expion360 Real-Time Quotes, Technical Analysis, and Company Overview (2026-01-13)

[1] Street Insider - “Expion360 reports sequential revenue growth in 2025 operations” (2026-01-13) (https://www.streetinsider.com/Corporate+News/Expion360+reports+sequential+revenue+growth+in+2025+operations/25841127.html)

[2] SEC EDGAR - Expion360 10-Q Filing (Period ended 2025-09-30, Filed 2025-11-13) (https://www.sec.gov/Archives/edgar/data/1894954/000190359625000532/xpon_10q.htm)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.