Report on AI Transformation Strategy for European Fashion E-Commerce and Zalando Valuation Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The European fashion e-commerce industry is undergoing profound transformation driven by AI technology. According to industry data, the global AI fashion market size is projected to grow from $1.26 billion in 2024 to $60.57 billion in 2034, with a compound annual growth rate (CAGR) of 40.4%, and 83% of fashion industry executives believe AI will deliver significant business value [1][2].

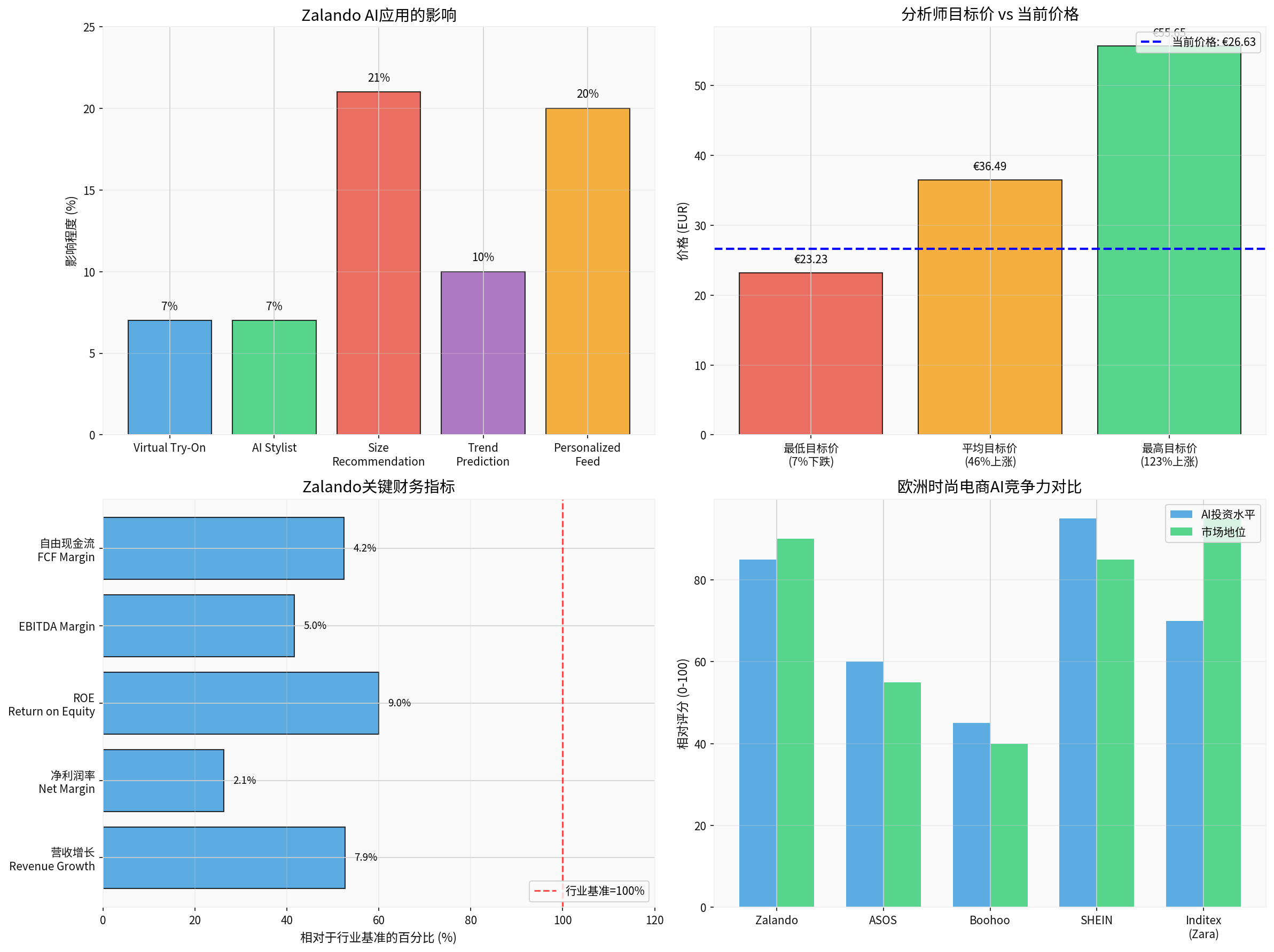

| Application Field | Function Description | Business Impact |

|---|---|---|

Virtual Try-On |

Generative computer vision technology that allows consumers to visualize outfit effects online | Reduce return rates by 5-10% [3] |

AI Stylist |

Personalized recommendation conversational system based on large language models | Increases conversion rate, reduces return rate by 7% [4] |

Size Recommendation System |

Machine learning algorithm predicts optimal size | Reduces return rate due to incorrect sizing by 21% [3] |

Trend Prediction |

AI-driven fashion trend identification and inventory optimization | Reduces overstock and improves inventory turnover rate |

Personalized Discovery Engine |

AI-driven product discovery and content recommendation | Increases user engagement by over 20% [4] |

┌─────────────────────────────────────────────────────────────────────┐

│ AI Competitive Landscape of European Fashion E-Commerce │

├─────────────────────────────────────────────────────────────────────┤

│ │

│ SHEIN ████████████████████████████████████████████████ 95 points │

│ (Chinese Cross-Border) Extremely high AI investment level, algorithm-driven supply chain and personalized recommendation │

│ │

│ Zalando ████████████████████████████████████████░░░░░ 85 points │

│ (Germany) Comprehensive AI strategy: Virtual Try-On + AI Assistant + ZEOS Platform Ecosystem │

│ │

│ Inditex ███████████████████████████████████████████░░░ 70 points │

│ (Zara) AR Fitting Room + RFID Inventory Tracking + AI Design Assistance │

│ │

│ ASOS █████████████████████████████████████████░░░░░ 60 points │

│ (UK) AI Styling Recommendation + AR Try-On + Data Science-Driven Operations │

│ │

│ Boohoo ███████████████████████████████░░░░░░░░░░░░░░ 45 points │

│ (UK) Relatively limited AI applications, focusing on basic recommendation systems │

│ │

└─────────────────────────────────────────────────────────────────────┘

-

Reducing Return Costs: The average return rate of European fashion e-commerce is as high as 25-30%, generating approximately €15 billion in logistics costs annually. AI try-on and size recommendation can reduce return rates by 5-21%, directly improving profit margins [3]

-

Increasing Conversion Rates: Personalized recommendation engines make it easier for customers to find desired products; Zalando reports that approximately 20% of incremental revenue growth comes from AI-driven personalization improvements [4]

-

Enhancing Customer Stickiness: AI assistants provide 24-hour “VIP-level” shopping experiences, increasing brand loyalty and repurchase rates

-

Optimizing Supply Chain: AI trend prediction helps brands reduce overproduction and overstock, enabling “on-demand manufacturing”

Zalando SE (ZAL.DE) is one of Europe’s largest online fashion and lifestyle retail platforms, headquartered in Berlin, Germany. As of Q3 2025, the company has approximately 52 million active customers and annual revenue exceeding €10 billion [5][6].

- Active customers: 52.4 million (Q1 2025, +5.2% YoY)

- Average order value: €61.1 (after returns)

- Active markets: 25+ European countries

- Logistics network: 50+ distribution centers

- Technical Implementation: Generative computer vision + diffusion models to realize outfit simulation

- Development History: Internal trials in 2020-2021, enhanced generative capabilities in 2022, launched online version in selected markets by end of 2022

- Commercial Results: Attracted over 30,000 users for trials within weeks of launch; expected to reduce return rates for participating categories by 5-10% [3]

- Technical Foundation: GPT-powered conversational AI

- Functional Features: Outfit suggestions, trend recommendations, and scenario-based matching based on natural language understanding

- Effect Verification: Reduces user return rates by 7%, contributing approximately 20% to incremental revenue growth in some quarters [4]

- Technical Principle: Machine learning algorithm analyzes user body data and matches it with product size charts

- Historical Results: Has reduced return rates due to incorrect sizing by 21% [3]

- Strategic Significance: Directly reduces logistics costs; every 1% reduction in return rates can save millions of euros

- Deployment Expansion: Expanded to 16 new markets in October 2025 [7]

- Functional Value: Transforms shopping experience from “transaction-oriented” to “inspirational and entertaining”

- Platform Strategy: Supports the vision of “E-mo(tional) Commerce”

After acquiring German fashion e-commerce platform ABOUT YOU in 2024, Zalando is building a more open platform ecosystem:

| Strategic Initiative | Content | Strategic Significance |

|---|---|---|

ZEOS Platform |

Brands can directly settle on the Zalando platform | Light asset model to expand product categories |

ABOUT YOU Integration |

Integrate logistics networks to optimize pan-European delivery | Improve operational efficiency by 5-10% |

Zalando Plus |

Paid membership system with benefits such as free returns and early access | Covered 13+ countries in 2025, with penetration rate exceeding 15% |

Public User Profiles |

Users can share outfits, follow brands and creators | Social e-commerce features enhance user stickiness |

Recently, Zalando announced the closure of its Erfurt, Germany distribution center (affecting approximately 2,700 positions), which is a logistics network optimization measure following the integration of ABOUT YOU [8]. Through AI demand forecasting and warehouse automation, it is expected to:

- Improve warehouse efficiency by 15-20%

- Reduce unit logistics costs by 8-12%

- Support the medium-term revenue growth target of 5-10%

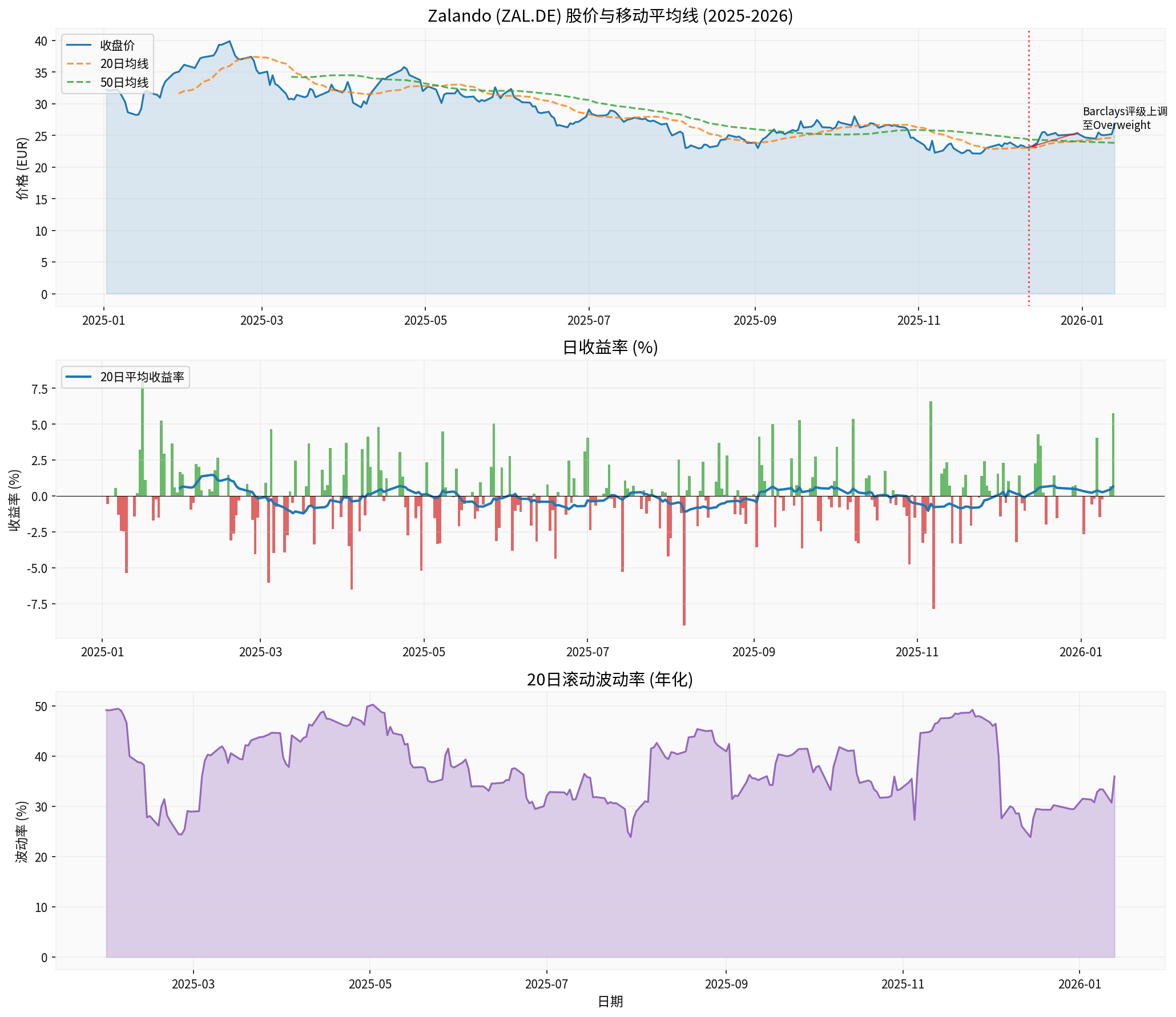

- Current Price: €26.63 (as of January 13, 2026)

- 52-Week Range: €22.11 - €39.86

- Year-to-Date: -17.35% (down from approximately €32.2)

- Average Daily Trading Volume: 1.13 million shares

- 20-Day Moving Average: €24.77 | 50-Day Moving Average: €23.81

- The current trading price is slightly above major moving averages, indicating signs of short-term stabilization

Based on market consensus data [9][10]:

| Valuation Indicator | Price/Multiple | Remarks |

|---|---|---|

| Current Price | €26.63 | - |

| Lowest Target Price | €23.23 | 7% decline from current price |

Average Target Price |

€36.49 |

37% upside from current price |

| Highest Target Price | €55.65 | 123% upside from current price |

| Price-to-Earnings (P/E) Ratio | 27.2x | Based on 2024 EPS of €0.928 |

| Market Capitalization | €6.41 billion | - |

Based on the DCF valuation model [11]:

┌──────────────────────────────────────────────────────────────┐

│ Zalando DCF Valuation Scenario Analysis │

├──────────────────────────────────────────────────────────────┤

│ │

│ Conservative Scenario: $8.45 (€7.75) -42% vs Current Price │

│ Base Case Scenario: $9.48 (€8.70) -35% vs Current Price │

│ Optimistic Scenario: $12.40 (€11.39) -15% vs Current Price │

│ Weighted Average: $10.11 (€9.28) -31% vs Current Price │

│ │

│ WACC: 15.0% | Beta: 1.86 | Terminal Growth Rate: 2.5% │

│ │

└──────────────────────────────────────────────────────────────┘

- The current share price of €26.63 is significantly higher than the upper limit of the DCF valuation range

- The high valuation reflects market expectations of profit improvement from AI strategy

- AI-driven growth exceeding expectations is required to support the current valuation

Although direct evidence indicates that Barclays may upgrade Zalando’s rating to “Overweight” in December 2025 [12], from a fundamental perspective:

| Positive Factors | Analysis |

|---|---|

AI Business Resilience |

Compared with traditional retailers, Zalando’s AI investment demonstrates stronger customer acquisition and retention capabilities during periods of weak consumption |

Profitability Improvement |

Adjusted EBIT in Q1 2025 increased 65.2% YoY to €46.7 million [13] |

Accelerated Revenue Growth |

Q1 2025 revenue reached €2.42 billion, representing 7.9% YoY growth, with growth rate rebounding from previous periods |

B2B Business Growth |

ZEOS platform and brand cooperation business are expanding rapidly |

Stable Market Share |

Reinforced leading position in European fashion e-commerce |

| Risk Factors | Potential Impact |

|---|---|

Macroeconomic Pressure |

Slowdown in European consumer spending may impact revenue growth |

High Valuation |

Current P/E ratio of 27.2x is higher than historical average, DCF indicates overvaluation |

Intensified Competition |

Competitors such as SHEIN and ASOS are also increasing AI investments |

Integration Risks |

Integration of ABOUT YOU may cause short-term frictions |

Logistics Restructuring |

Closure of Erfurt facility may bring one-time costs and public opinion pressure |

- AI-driven return rate reduction can directly improve profit margins by approximately 1-2 percentage points

- Incremental revenue growth from personalized recommendations is approximately 10-15%

- Current valuation already partially reflects AI expectations; earnings exceeding expectations are required to break through

- If AI investments continue to translate into sustainable competitive advantages (customer growth, average order value increase, profit margin improvement), there is room for further valuation expansion

- The 37% upside corresponding to the average analyst target price of €36.49 requires 8-10% revenue growth and profit margin improvement to 5-6% for support

- The 40% CAGR of the AI fashion market provides structural opportunities

- If Zalando’s platformization strategy (integration of ZEOS and ABOUT YOU) is successful, it can achieve a valuation re-rating from retailer to technology platform

- However, caution is warranted: the flip side of 83% of fashion executives recognizing AI’s value is that AI will become an industry standard, and competitive advantages may diminish over time

-

AI transformation is a must for European fashion e-commerce: As the AI fashion market grows from $1.26 billion to $60.5 billion, enterprises that do not invest in AI will be eliminated

-

Zalando’s AI strategy is in a leading position in the industry: Virtual try-on, AI stylist, and personalized recommendation form a complete application matrix, with the effect of reducing return rates by 5-21% already verified

-

Rationality of valuation is questionable: The current share price of €26.63 is significantly higher than the DCF valuation range; the 37% average upside predicted by analysts requires AI-driven earnings to exceed expectations to be achieved

-

Barclays’ rating upgrade has certain basis: The resilience of AI business and profitability improvement provide fundamental support, but the valuation has already fully reflected optimistic expectations

| Indicator | Monitoring Timing | Target Range |

|---|---|---|

| Quarterly Revenue Growth Rate | Quarterly financial reports | 8-12% YoY growth |

| Adjusted EBIT Margin | Quarterly financial reports | Improve to 5-6% |

| Active Customer Growth | Quarterly financial reports | +5% YoY growth |

| AI Function Penetration Rate | Product launches | Target 50%+ of users using AI functions |

| Change in Return Rate | Quarterly updates | 2-5% YoY decline |

- Macroeconomic Risk: European economic recession may lead to a sharp decline in consumer spending

- Competition Risk: Rapidly expanding competitors such as SHEIN may erode market share

- Technological Risk: AI technology iteration may lead to depreciation of existing investments

- Integration Risk: Integration of ABOUT YOU may generate unexpected costs

- Regulatory Risk: EU AI regulatory policies may increase compliance costs

[1] Kleep.ai - Fashion E-commerce AI Revolution

[2] LinkedIn - How AI Is Reshaping Fashion Retail in Spain and Europe

[3] Reruption - Zalando’s AI Virtual Try-On: Slashing Returns

[4] Tacticone - How Zalando Uses AI to Inspire, Engage, and Reduce Returns

[5] FashionBI - Zalando Inside the €15 Billion Platform’s Innovation

[6] Simply Wall St - Zalando Future Growth

[7] Zalando Corporate - AI Powered Discovery Feed Expansion

[8] Bloomberg - Zalando Shutting German Logistics Center

[9] Investing.com - Zalando SE Stock Price

[10] AlphaSpread - ZAL Intrinsic Valuation

[11] Jinling AI DCF Valuation Analysis Module

[12] Seeking Alpha - Zalando B2B Business Scaling Fast Rating Upgrade

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.