In-Depth Analysis Report on Insider Buying at Alumis Inc.

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I will now prepare a detailed professional analysis report for you.

Alumis Inc. (NASDAQ: ALMS) is a clinical-stage biopharmaceutical company focused on immune-mediated diseases. In November 2025, the company’s director James B. Tananbaum (also founder of Foresite Capital and beneficial owner of more than 10% of the company’s shares) executed a significant insider purchase, investing approximately

This report will conduct a systematic assessment from multiple dimensions including insider transaction motives, valuation analysis, clinical trial progress, technical analysis, and the reference value for investment decision-making.

According to SEC Form 4 filings and public market transaction records, Tananbaum’s insider purchase featured phased position building [1][2]:

| Transaction Date | Purchase Price Range | Estimated Number of Shares Purchased | Investment Amount |

|---|---|---|---|

| November 17-19, 2025 | $5.59 - $6.56 | Approximately 471,000 - 553,000 shares | Approximately $3.09 million |

| November 21, 2025 | $7.38 | 72,212 shares | Approximately $533,000 |

Total |

$5.59 - $7.38 |

Approximately 543,000 - 625,000 shares |

Approximately $3.62 million |

- As a founding partner of Foresite Capital, Tananbaum increased his holdings through an affiliated fund, indicating confidence in the company from a specialized biopharmaceutical investment institution

- The purchase spanned approximately one week, using a phased position-building strategy, which is typically regarded as a price-sensitive professional investment behavior

- The purchase price range was $5.59-$7.38, while the closing price as of January 12, 2026, was $21.09, meaning the unrealized gain on the insider’s holdings has reached 186%-277%[0]

According to insider shareholding data disclosed by Yahoo Finance [2], other insiders of the company have also shown a net buying trend besides Tananbaum:

| Insider | Position | Transaction Type | Date |

|---|---|---|---|

| Srinivas Akkaraju | Director | Buy | December 5, 2025 |

| Foresite Capital (Affiliated Entity) | Holder of >10% of Shares | Buy | November 21, 2025 |

The signal strength of coordinated buying by multiple insiders is significantly higher than that of a single insider purchase, reflecting strong confidence in the company’s prospects among the company’s management and major shareholders [1][2].

Envudeucitinib (formerly ESK-001) is a

- Achieves comprehensive disease control by maximizing TYK2 inhibition while blocking the IL-23 and IL-17 pathways

- Compared to Bristol Myers Squibb (BMS)'s marketed Sotyktu (deucravacitinib, the first marketed oral TYK2 drug), envudeucitinib demonstrates higher selectivity

- Sotyktu generated $206 million in revenue in the first nine months of 2025, representing a 26% year-over-year increase, validating the market potential of TYK2 inhibitors [4]

On January 6, 2026, Alumis announced topline results from the

| Efficacy Metric | Result | Comparison |

|---|---|---|

| PASI 75 (Week 16) | Average 74% | vs Placebo, p<0.0001 |

| sPGA 0/1 (Week 16) | Average 59% | vs Placebo, p<0.0001 |

PASI 90 (Week 24) |

Approx. 65% |

Outperforms Sotyktu’s approx. 40% |

PASI 100 (Week 24) |

Over 40% |

Outperforms Sotyktu’s approx. 15% |

- On the high-threshold skin clearance metrics at Week 24, envudeucitinib achieved a “leading level among next-generation oral psoriasis therapies”

- Compared to placebo, PASI 90 showed a significant separation as early as Week 4, indicating rapid onset of action

- Safety profile is consistent with the Phase II program, with good tolerability and no new safety signals identified

- Plans to submit a New Drug Application (NDA) to the FDA in the second half of 2026[3][4]

In addition to psoriasis, Alumis’ pipeline in development includes [3][5]:

| Drug Candidate | Indication | Clinical Phase | Expected Data Release Time |

|---|---|---|---|

| Envudeucitinib | Systemic Lupus Erythematosus (SLE) | Phase IIb (LUMUS) | Q3 2026 |

| A-005 | Neuroinflammatory Diseases including Multiple Sclerosis | Phase I | Initiate Phase II in H2 2026 |

| Lonigutamab | Thyroid Eye Disease (TED) | Phase I/II | Ongoing Development |

The “pipeline-in-a-pill” strategy reduces the risk of reliance on a single indication and enhances the company’s long-term value [3][5].

| Financial Metric | Q3 2025 | Year-over-Year Change |

|---|---|---|

| Cash and Cash Equivalents | $378 million | Sufficient |

| R&D Expenses | $97.8 million | +11.4% |

| Net Loss | $111 million | +18.9% |

| Operating Cash Burn | Supports Operations Through 2027 | Ample Capital |

In January 2026, the company completed an

An intrinsic value assessment of Alumis using a Discounted Cash Flow (DCF) model shows a significant divergence between the current stock price and the model’s valuation [0]:

| Valuation Scenario | Intrinsic Value | vs Current Price ($21.09) |

|---|---|---|

| Conservative Scenario | $4.60 | -78.2% |

| Base Case Scenario | $4.59 | -78.2% |

| Optimistic Scenario | $4.60 | -78.2% |

-

Special Nature of Biopharmaceutical Valuation:The DCF model relies on cash flow projections, but clinical-stage biopharmaceutical companies struggle to generate stable cash flows before product approval. Traditional valuation methods have inherent limitations for such companies.

-

Option Value Consideration:The DCF model fails to fully reflect the option value of clinical trial success. After the success of the Phase III trial, the value brought by envudeucitinib’s commercial potential far exceeds current R&D investment.

-

Comparable Transaction Valuation:Referencing Sotyktu’s $206 million in quarterly sales and BMS’s acquisition logic, if envudeucitinib is successfully launched, its peak annual sales could reach the billion-dollar level.

-

Market Expectations Already Priced In:The current stock price ($21.09) may have partially priced in the expectation of Phase III success, but analysts’ target price ($36.00) indicates the market believes there is further upside potential [0].

| Metric | Value |

|---|---|

| Analyst Consensus Target Price | $36.00 |

| Target Price Range | $32.00 - $50.00 |

| Upside from Current Price | +70.7% |

| Share of Buy Ratings | 100% (All 7 analysts recommend Buy) |

| Date | Institution | Action |

|---|---|---|

| 2026-01-09 | HC Wainwright & Co. | Maintain Buy Rating |

| 2026-01-07 | Morgan Stanley | Maintain Overweight |

| 2026-01-07 | Leerink Partners | Maintain Outperform |

| 2026-01-07 | Guggenheim | Maintain Buy |

| 2026-01-06 | Wells Fargo | Maintain Overweight |

Wall Street holds a uniformly bullish stance on Alumis, and the target price distribution shows that professional institutions are optimistic about the company’s medium- to long-term development [0].

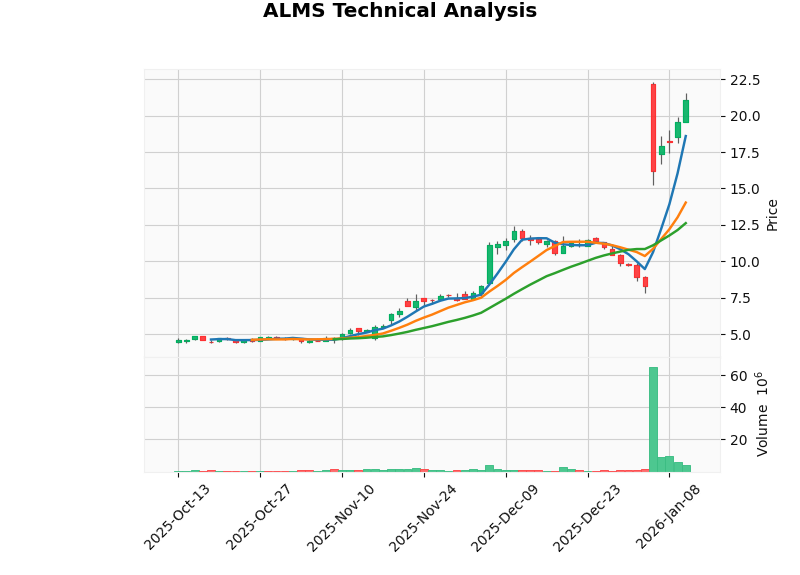

Based on technical analysis data [0]:

| Analysis Dimension | Assessment |

|---|---|

| Trend Type | Sideways |

| Support Level | $12.62 (20-Day Moving Average) |

| Resistance Level | $21.96 |

| Beta Coefficient | -2.08 (vs. SPY) |

| Daily Volatility | 13.26% |

| Indicator | Value | Signal Interpretation |

|---|---|---|

| MACD | No Crossover | Neutral Bullish |

| KDJ | K:71.8, D:54.6, J:106.0 | Buy Signal |

| RSI (14) | Overbought Zone | Short-Term Risk Warning |

- The KDJ indicator shows short-term bullish momentum, but the RSI has entered the overbought zone, suggesting a potential short-term pullback

- The stock price is above the 20-day and 50-day moving averages, with an upward medium-term trend

- A beta of -2.08 indicates the stock is negatively correlated with the broader market and may perform independently during market volatility [0]

- Current Reference Price Range: $12.62 - $21.96

-

Information Advantage:Insiders (directors, executives, major shareholders) have access to non-public information such as company operations, clinical trial progress, and regulatory communications. As a founding partner of Foresite Capital, Tananbaum’s investment decision is based on a deep understanding of the biopharmaceutical industry and a comprehensive judgment of Alumis’ internal information.

-

Interest Alignment:The investment of approximately $3.62 million in real capital shows that insiders’ interests are highly aligned with those of external shareholders. As a holder of more than 10% of shares, Tananbaum’s Foresite Capital’s holding cost is directly related to the fund’s reputation and subsequent exit returns.

-

Timing:The purchase timing (November 17-21, 2025), approximately 6 weeks before the release of Phase III data, demonstrates insiders’ confidence in the upcoming positive catalyst. In hindsight, this timing was extremely precise.

-

Professional Endorsement:Foresite Capital is a well-known venture capital institution focused on the healthcare sector. Its continued investment in Alumis provides professional institutional endorsement for the company’s scientific foundation and commercial prospects.

-

Excessive Post-Purchase Rally:The current stock price ($21.09) has risen by over 250% compared to the insider’s average purchase price (around $6.00), meaning the “value” of the insider buying signal has been largely priced in by the market.

-

DCF Valuation Divergence:Traditional valuation models indicate the current stock price may have fully or even excessively priced in expectations.

-

Catalyst Partially Realized:The major positive news of Phase III trial success has already been reflected in the stock price; subsequent progress in NDA submission and FDA approval should be monitored.

For the biopharmaceutical industry, the reference value of insider buying must be comprehensively judged in conjunction with the following industry characteristics:

| Consideration Factor | Impact on ALMS |

|---|---|

| Clinical Trial Results | Phase III success is a key catalyst, already realized |

| Regulatory Approval Path | Plans to submit NDA in H2 2026 |

| Competitive Landscape | Demonstrates efficacy advantage over Sotyktu |

| Commercialization Capability | As a late-stage company, building a commercialization team will be critical |

| Pipeline Diversification | Expansion into indications such as SLE and MS reduces single-indication risk |

| Investor Type | Recommended Strategy |

|---|---|

| Risk-Tolerant Investors | May consider small-position participation on pullbacks, with stop-loss levels set |

| Value Investors | Wait for a better buying opportunity, focus on opportunities below $15 |

| Short-Term Traders | Given current overbought RSI, recommend waiting on the sidelines or quick in-and-out trades |

| Long-Term Investors | May consider phased position building, with a target hold until NDA approval |

-

Regulatory Risk:There is uncertainty in NDA submission and FDA approval, which may lead to approval delays or rejection.

-

Commercialization Risk:Even if approved, factors such as market acceptance, pricing, and competitor strategies for envudeucitinib will affect actual sales revenue.

-

Stock Price Volatility Risk:Biopharmaceutical company stock prices are highly sensitive to clinical trial and regulatory news, and may experience significant volatility.

-

Valuation Risk:The current P/S ratio is approximately 99.5x; if commercialization progress falls short of expectations, the company may face valuation pullback pressure.

-

Competitive Risk:BMS’s Sotyktu and other TYK2 inhibitors in development may compete for market share.

-

Reference Value of Insider Buying:Director Tananbaum’s large-scale share increase (approximately $3.62 million) is a positive signal with reference value. Combined with the purchase timing (ahead of Phase III data release) and the buyer (a specialized biopharmaceutical investment institution), the credibility of the signal is enhanced. However, the current stock price has risen significantly from the purchase cost, and part of the signal’s value has been priced in by the market.

-

Whether the Stock Price is Undervalued:From a DCF model perspective, the current stock price ($21.09) is significantly higher than the intrinsic value ($4.59), possibly indicating overvaluation. However, considering the option value characteristics of biopharmaceutical companies and analysts’ target price ($36.00), the current price may be within a reasonable range, depending on the investor’s time horizon and risk appetite.

-

Decision-Making Reference Value of Director’s Share Increase:For medium- to long-term investors, insider buying at Alumis should be regarded asone of the important reference factorsfor investment decisions, but not the sole basis. It is recommended to make a comprehensive judgment combining the company’s fundamentals, clinical progress, valuation level, and personal risk tolerance.

- Short-Term (1-3 Months):Given the technical overbought condition and partial realization of positive news, caution is advised against chasing highs

- Medium-Term (3-6 Months):Monitor catalysts from NDA submission progress and the release of SLE Phase IIb data

- Long-Term (6-12 Months):If the commercialization prospect gradually becomes clear, consider phased position building on pullbacks

[1] Investing.com - “Alumis Inc: director Tananbaum buys $3.09 million in ALMS stock” (https://www.investing.com/news/insider-trading-news/alumis-inc-director-tananbaum-buys-309-million-in-alms-stock-93CH-4369220)

[2] Yahoo Finance - “Alumis Inc. (ALMS) Insider Ownership & Holdings” (https://finance.yahoo.com/quote/ALMS/insider-roster/)

[3] GlobeNewswire - “Alumis’ Envudeucitinib Delivers Leading Skin Clearance Among Next-Generation Oral Plaque Psoriasis Therapies in Phase 3 Program” (https://investors.alumis.com/news-releases/news-release-details/alumis-envudeucitinib-delivers-leading-skin-clearance-among-next)

[4] Pharmaphorum - “Alumis shoots up as its Sotyktu rival aces psoriasis trials” (https://pharmaphorum.com/news/alumis-shoots-its-sotyktu-rival-aces-psoriasis-trials)

[5] GlobeNewswire - “Alumis Announces Closing of Upsized Public Offering” (https://investors.alumis.com/news-releases/news-release-details/alumis-announces-closing-upsized-public-offering-and-full)

[6] StockTitan.net - “Form 4 Alumis Inc Insider Trading Activity” (https://www.stocktitan.net/sec-filings/ALMS/form-4-alumis-inc-insider-trading-activity-d943ff068e30.html)

[7] SEC EDGAR - Alumis Inc. 8-K Filings (https://www.sec.gov/Archives/edgar/data/1847367)

Report Generation Date: January 13, 2026

Data Sources: Jinling API, SEC EDGAR, Yahoo Finance, Investing.com, GlobeNewswire

Disclaimer: This report is for reference only and does not constitute investment advice. Investing involves risks; please exercise caution when entering the market.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.