In-Depth Analysis of Zhixiang Jintai's GR1803 Bispecific Antibody Conditional Marketing Authorization: Reshaping the Valuation Logic of Innovative Drugs

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest data and market information I have collected, I will provide an in-depth analysis of Zhixiang Jintai’s GR1803 bispecific antibody conditional marketing authorization, as well as a study on the changes in the valuation logic of innovative drugs.

On January 8, 2026, Chongqing Zhixiang Jintai Biopharmaceutical Co., Ltd. (Stock Code: 688443.SS) announced that the marketing authorization application for the domestic production of its self-developed bispecific antibody drug GR1803 Injection has been accepted by the National Medical Products Administration (NMPA) (Acceptance No.: CXSS2600003). Notably, this application was subsequently included in the priority review list, marking a critical stage in the commercialization process of this innovative bispecific antibody drug[1][2].

As a BCMA×CD3 dual-target bispecific antibody, GR1803 has the following core technical advantages:

Since its R&D initiation, GR1803 has continuously received high recognition from regulatory authorities, forming a clear timeline of milestone events:

| Time Node | Milestone Event | Significance |

|---|---|---|

| August 2024 | Included in Breakthrough Therapy Designation list | Gained priority review access |

| June 2025 | Reached BD transaction with Cullinan | Major breakthrough in globalization strategy |

| January 2026 | Conditional marketing authorization application accepted | Critical step on the eve of commercialization |

In June 2025, Zhixiang Jintai reached a business development (BD) transaction with Cullinan Therapeutics, Inc., granting Cullinan the rights to develop, produce, and commercialize GR1803 in regions outside the Greater China. According to the agreement, the total potential amount of upfront and milestone payments for this transaction is up to USD 712 million, including a USD 20 million upfront payment, cumulative development and registration milestone payments of no more than USD 292 million, cumulative net sales-based milestone payments of no more than USD 400 million, and tiered royalties of up to mid-double digits based on net sales[1][3].

China’s innovative drug industry is undergoing a fundamental restructuring of its valuation logic. Traditionally, the valuation of innovative drugs mainly relied on domestic medical insurance negotiation pricing and domestic market size estimation. However, a series of BD transaction data in 2025 indicates that this valuation framework has undergone a fundamental shift.

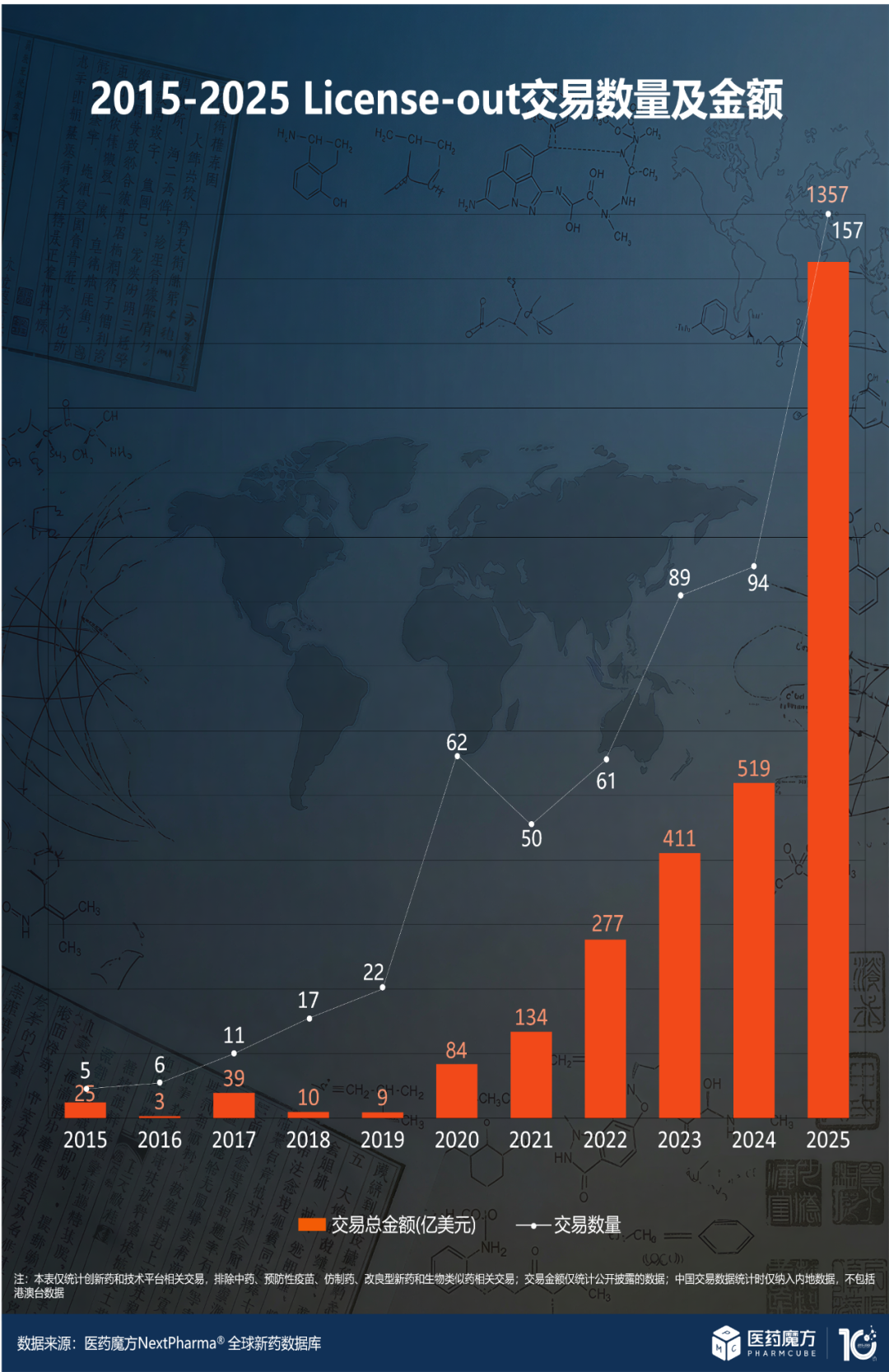

According to the Pharmcube NextPharma database, as of December 31, 2025, the total annual transaction value of China’s innovative drug overseas licensing BD transactions reached

| Indicator | 2024 | 2025 | YoY Growth |

|---|---|---|---|

| Transaction Value | USD 51.9 billion | USD 135.7 billion | +161% |

| Number of Transactions | 94 | 157 | +67% |

| Upfront Payment | - | USD 7 billion | - |

More importantly, in December 2025 alone, 15 overseas licensing transactions with a potential total value exceeding USD 16 billion were completed, reflecting the sustained enthusiasm for China’s innovative drugs to expand overseas[4].

Through Pharmcube data, Zhongtai Securities systematically sorted out 2025 transactions where the TOP 20 multinational pharmaceutical corporations (MNCs) acquired innovative drugs from China and overseas, and found significant pricing differences[3]:

| Acquisition Source | Average Total Deal Value | Average Upfront Payment | Average Milestone Payment |

|---|---|---|---|

| Acquired from China | USD 2.756 billion | USD 236 million | USD 2.978 billion |

| Acquired from Overseas | USD 1.289 billion | USD 153 million | USD 1.174 billion |

This data clearly shows that multinational pharmaceutical corporations are willing to pay a higher premium for Chinese innovative assets, with the average total deal value being approximately

2025 marks the entry of China’s innovative drug BD transactions into the era of “both upfront and milestone payments”. According to incomplete statistics from Pharmcube, in 2025, milestone payments for 4 overseas licensing transactions were received one after another, involving pharmaceutical companies such as BioLander Therapeutics, China Biopharmaceuticals, Hutchison China MediTech, and ImmuneOnco Biopharma[4].

- Value Validation:The triggering of milestone payments proves the clinical progress and development value of the product, eliminating market concerns that “BD transactions are only one-time monetization”

- Cash Flow Supplement:Milestone payments effectively supplement the cash flow of pharmaceutical companies, alleviating the financial pressure of R&D investment

- Proof of Innovation Efficiency:Most of these milestone payments are triggered within one to two years after the transaction is reached, reflecting the R&D efficiency of China’s innovative drugs

For example, after receiving an USD 800 million upfront payment in March 2024 for the collaboration between BioLander Therapeutics and Bristol Myers Squibb (BMS) on BL-B01D1 (EGFR×HER3 bispecific antibody ADC), milestone payments were successively triggered in 2025, fully verifying the continuous value creation capability of China’s innovative drugs[4].

The

| Product | Developer | Target | ORR |

|---|---|---|---|

| GR1803 | Zhixiang Jintai | BCMA×CD3 | 89.5% |

| Teclistamab | Johnson & Johnson | BCMA×CD3 | 63% |

| Talquetamab | Johnson & Johnson | GPRC5D×CD3 | 73% |

| Elranatamab | Pfizer | BCMA×CD3 | 61% |

This comparative data shows that GR1803 has significant efficacy advantages, which lays a solid foundation for its domestic marketing pricing and overseas commercial value.

The BD transaction between Zhixiang Jintai and Cullinan not only brings potential revenue of USD 712 million, but more importantly, it proves that Zhixiang Jintai has the ability to bring innovative achievements to the global market. This

- Global Clinical Development Capability:Collaborating with MNCs means that the product will be reviewed by major global regulatory authorities such as the FDA and EMA

- Global Commercialization Network:The global commercialization network of MNCs provides broad market coverage for the product

- Recognition of Technology Platform Value:The success of the BD transaction indicates that Zhixiang Jintai’s technology platform has gained international recognition

Mao Dingding, Fund Manager of Invesco Great Wall Global Medical and Biological Fund, pointed out that when evaluating the commercial value of a new drug, the most important factor to focus on is the

- Relatively moderate competition in domestic bispecific antibody market, with large room for differentiation

- Limited treatment options for relapsed or refractory multiple myeloma, with unmet clinical needs

- First-mover advantage (leading R&D progress) is expected to be converted into market advantage

- Three BCMA×CD3 bispecific antibodies have been marketed globally

- Price competition and medical insurance negotiation pressure continue to exist

Zhixiang Jintai is transitioning from a pure R&D-oriented enterprise to a commercialization stage, with multiple product lines advancing simultaneously:

| Product | Indication | Progress | Commercial Value |

|---|---|---|---|

| Saiqilimab | Psoriasis and other indications | Launched + Included in National Medical Insurance Catalog | Cash Flow Contribution |

| GR1803 | Relapsed or Refractory Multiple Myeloma | Conditional Marketing Authorization Application Accepted | Short-Term Growth Driver |

| Sileweimab | - | Registration Application Stage | Pipeline Reserve |

| Weikangdutamab | - | Registration Application Stage | Pipeline Reserve |

| Tailiqibaimab | - | Registration Application Stage | Pipeline Reserve |

Notably, Saiqilimab has recently been included in the National Medical Insurance Catalog, and the new version of the catalog will take effect on January 1, 2026, which is expected to accelerate product sales volume and contribute stable cash flow to the company[1].

The case of Zhixiang Jintai shows that innovative drug valuation is shifting from single-pipeline valuation to

- Evaluate each product individually, calculate the rNPV (risk-adjusted net present value) of each pipeline

- Valuation mainly depends on peak sales forecast of individual products

- The continuous innovation capability of the technology platform becomes the core of valuation

- BD transaction capability proves the convertibility of platform value

- Commercialization capability verifies the integrated value of the platform

Zhixiang Jintai’s technical accumulation in the field of bispecific antibodies, BD cooperation with Cullinan, and successful commercialization of Saiqilimab together form a complete value closed-loop, providing support for platform-based valuation.

Pacific Securities pointed out that the main investment themes for innovative drugs in 2026 will focus on three directions[3]:

- Cutting-Edge Technology Breakthroughs:Focus on PD-(L)1 bispecific antibodies, ADCs, and small nucleic acid drugs

- Key Catalyst Fulfillment:Focus on key data readouts of core pipelines, clinical advancement efficiency, and regulatory approval decisions

- Commercial Value Realization:Focus on sales volume growth of marketed major products and continuous fulfillment of BD milestones

Galaxy Securities believes that after a long period of valuation adjustment, the pharmaceutical sector has shown a significant structural recovery trend, but the heavy holding level of public funds is still lower than the historical average. In 2026, against the background of policies supporting and guiding the development of commercial health insurance, the payment side is expected to improve marginally, and innovative drugs and devices are expected to continue to benefit[6].

- The acceptance of GR1803’s conditional marketing authorization is a key milestone for Zhixiang Jintai’s transition from R&D to commercialization, with the 89.5% ORR data providing strong support for its commercial value.

- China’s innovative drug valuation logic is undergoing a fundamental transformation, shifting from single domestic pricing to a “domestic + overseas” dual-track pricing system, with overseas BD transactions becoming a new valuation anchor.

- In 2025, China’s innovative drug BD transactions hit a record high (USD 135.7 billion), and MNCs are willing to pay a higher premium for Chinese innovative assets, which marks a significant improvement in the status of China’s innovative drug assets in the global innovation landscape.

- The arrival of the milestone payment era verifies the continuous value creation capability of China’s innovative drugs, which helps reshape the global market’s trust system in Chinese innovation.

| Valuation Dimension | Traditional Logic | Emerging Logic |

|---|---|---|

| Pricing Anchor | Domestic Medical Insurance Negotiation | Domestic Medical Insurance + Overseas BD Dual-Track |

| Valuation Driver | Single Pipeline Value | Platform Capabilities + Pipeline Matrix |

| Competitive Advantage | Domestic Market Share | Global Competitiveness + Differentiation |

| Value Validation | Sales Data | BD Transactions + Milestone Fulfillment |

| Risk Assessment | R&D Failure Risk | Full-Life Cycle Risk |

- Regulatory Risk:The marketing authorization application for GR1803 still needs to go through multiple procedures such as review, on-site inspection, and approval, with uncertainties remaining

- Commercialization Risk:Even after marketing, sales volume growth will still be affected by factors such as market competition and pricing

- R&D Risk:Other products in development may face the risk of clinical failure

- Policy Risk:The intensity of medical insurance cost control may exceed expectations

[1] China.org.cn Finance - Zhixiang Jintai’s GR1803 Conditional Marketing Authorization Application Accepted, Commercialization Puzzle Accelerates (https://finance.eastmoney.com/a/202601083612917479.html)

[2] CS.com.cn - Zhixiang Jintai’s GR1803 Conditional Marketing Authorization Application Accepted (https://www.cs.com.cn/ssgs/gsxw/202601/t20260109_6532511.html)

[3] Eastmoney.com - Innovative Drugs Surge in Afternoon Trading! Myeloma Injection Receives Marketing Approval (https://finance.eastmoney.com/a/202601093614111231.html)

[4] Sina Finance - USD 135.7 Billion! 2025 China Innovative Drug Overseas BD Transactions Hit Record High (https://finance.sina.com.cn/stock/relnews/hk/2026-01-04/doc-inhfctqp2857071.shtml)

[5] Jiemian News - 2025 BD Transactions Exceed USD 130 Billion (https://stcn.com/article/detail/3545954.html)

[6] Securities Times - Institutions: Pharmaceutical Sector Valuation Has Shown Significant Structural Recovery Trend (https://stcn.com/article/detail/3545954.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.