Analysis of Real Kingda's IPO Fundraising and Capital Utilization Efficiency

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the public information I collected, I will analyze Real Kingda’s IPO fundraising and capital utilization efficiency. It should be noted that no exact information about the “RMB 80 million wealth management plan” you mentioned was found in public materials, but I can conduct an analysis based on the typical capital management model of IPO companies.

Real Kingda (Mingguang Real Kingda Technology Co., Ltd.) is mainly engaged in the R&D, production and sales of technologies for high efficiency, long service life, energy conservation, green and environmental protection of ironmaking blast furnaces, as well as the required refractory materials. Its products are widely used in well-known domestic iron and steel enterprises such as Baowu Group, Shougang Group, Angang Group, Hegang Group, Shagang Group and Anfeng Iron and Steel[1].

- Proposed Listing Board: Beijing Stock Exchange (BSE)

- Proposed Fundraising Amount: RMB 334,981,000 (approx. RMB 335 million)

- Number of Shares to Be Issued: 44.35 million shares

- Sponsor: Kaiyuan Securities

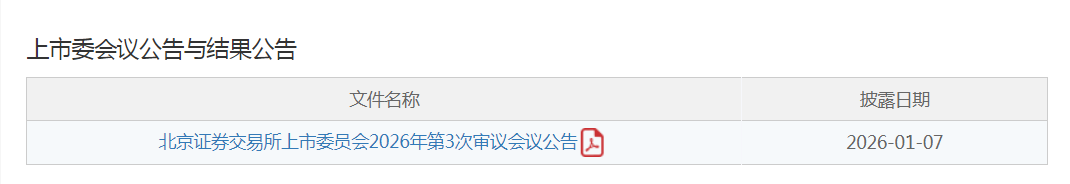

- Listing Review Meeting Date: January 14, 2026, the 3rd Review Meeting of the 2026 Listing Committee of the Beijing Stock Exchange[1][2]

The raised capital will be invested in the following two projects:

- Construction Project of Intelligent Equipment Base and R&D Center for New Carbon Capture Process in Metallurgy and Energy-Saving, Long-Life New Materials

- Technical Transformation and Expansion Project of Composite Metallic Phase Taphole Clay Production Line[1]

| Indicator | 2022 | 2023 | 2024 |

|---|---|---|---|

| Operating Revenue | RMB 403 million | RMB 467 million | RMB 476 million |

| Net Profit Attributable to Shareholders | RMB 59.85 million | RMB 92.27 million | RMB 84.84 million |

It is worth noting that in the first half of 2025, the company’s operating revenue decreased by 19.21% year-on-year, and its net profit attributable to shareholders excluding non-recurring gains and losses decreased by 7.79% year-on-year, indicating performance fluctuation pressure[1]. Meanwhile, the amount of orders on hand in 2024 was RMB 39.26 million, a significant decrease from RMB 116.07 million in 2023.

From the perspective of the company’s business characteristics, it is rational for Real Kingda to use the raised capital for the following directions:

- The carbon capture project in metallurgy is in line with the national “Double Carbon” strategic goals

- Energy-saving, long-life new materials meet the green and low-carbon transformation needs of the iron and steel industry

- The technical transformation and expansion project of the composite metallic phase taphole clay production line will enhance the company’s production capacity

- Meet the continuous demand of the iron and steel industry for high-efficiency refractory materials

Based on public information, the capital utilization efficiency of Real Kingda’s IPO fundraising can be evaluated from the following dimensions:

The funded projects are highly relevant to the company’s main business, all focusing on technological upgrading and capacity expansion around the refractory material main business, with clear capital investment directions.

Considering the construction cycle and capacity release process of the funded projects, it is expected to take 2-3 years to achieve the expected benefits.

According to industry practices, IPO raised capital may be temporarily idle during use:

- Less capital is used in the preliminary preparation stage of the project

- Phased investment leads to capital precipitation in accounts

- Time lag in payment of project funds

According to common practices of listed companies, cash management with idle raised capital is a common approach:

- The China Securities Regulatory Commission (CSRC) allows listed companies to use temporarily idle raised capital for cash management on the premise that the implementation of funded projects is not affected

- The investment scope is limited to low-risk products with high safety and good liquidity

- Hunan Hualian Ceramics used no more than RMB 150 million of idle raised capital for cash management[3]

- Tianneng Co., Ltd. used no more than RMB 300 million of idle raised capital for cash management[4]

- The annualized yield of wealth management products is usually between 2% and 3%

- Strict control over investment varieties is required to ensure capital security

If a company claims to need funds for main business development through IPO fundraising on the one hand, and uses the funds for wealth management on the other, it is indeed easy to arouse market doubts.

In fact, this does not constitute a substantive contradiction:

- IPO funds are used in batches according to project progress

- Cash management with temporarily idle capital can improve capital utilization efficiency

- It does not affect the normal implementation of funded projects

To judge whether there is a contradiction, attention should be paid to:

- Whether the raised capital is managed in a special account and earmarked for designated purposes

- Whether the amount of wealth management matches the scale of idle capital

- Whether it affects the progress of funded projects

- Focus should be paid to the performance decline in the first half of 2025

- The decline in orders on hand may affect future revenue

- The refractory material industry is highly competitive

- Fluctuations in raw material prices affect profitability

- Whether the funded projects can reach production capacity on schedule

- Whether the expected benefits can be achieved

Real Kingda’s RMB 335 million IPO fundraising for main business expansion and technological upgrading is commercially rational. As for the “RMB 80 million wealth management plan” you mentioned, if it does exist, it may be the company’s regular management of temporarily idle capital, which is common among listed companies.

- There is no contradiction between IPO fundraising and wealth management with idle capital; the key is whether it affects the implementation of funded projects

- Attention should be paid to the actual progress of funded projects and the realization of expected benefits

- The company’s performance fluctuations and decline in orders on hand are the risk points that need more attention

It is recommended that investors read the company’s prospectus in detail, pay attention to the contents of regulatory inquiry responses, and comprehensively evaluate the company’s investment value before making investment decisions.

[1] Securities Times · e Company - “IPO Radar | Real Kingda to Face Initial Listing Review Next Week, Performance Fluctuations Once Triggered Regulatory Inquiries” (https://finance.eastmoney.com/a/202601083612573590.html)

[2] Eastmoney - “IPO Weekly: 6 Enterprises to Face IPO Listing Review Soon” (https://finance.eastmoney.com/a/202601123615388818.html)

[3] Prospectus of Hunan Hualian Ceramics Co., Ltd. (https://pdf.dfcfw.com/pdf/H2_AN202509181746132587_1.pdf)

[4] Gelonghui - “Tianneng Co., Ltd. (688819.SH): Plans to Use Temporarily Idle Raised Capital with a Maximum Balance of No More Than RMB 300 Million for Cash Management” (https://caifuhao.eastmoney.com/news/20260108163939722344340)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.