Based on the collected information, I will systematically analyze the “same-age leadership succession” event at Taikang Life Insurance and the management vulnerabilities it exposes from the perspective of a professional financial analyst.

I. Background Analysis of the Same-Age Leadership Succession Event

1.1 Event Overview

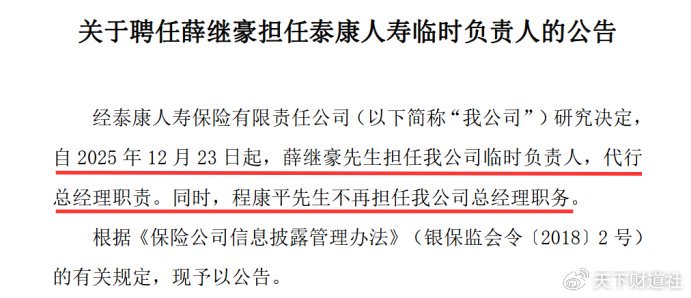

On December 17, 2025, Taikang Life Insurance issued a major personnel announcement stating that General Manager Cheng Kangping would retire, and Deputy General Manager Xue Jihao would take over the position of General Manager [1][2]. This personnel change has several notable characteristics:

Same-Age Succession Breaks Industry Norms

: Cheng Kangping was born in 1967, two years away from the mandatory retirement age of 60; the successor Xue Jihao was born in 1968, only one year younger than Cheng Kangping [2]. This stands in stark contrast to the “old mentoring new” age-gradient succession model common in the insurance industry, breaking industry conventions. Yu Fenghui, a specially-invited researcher at the China Financial Think Tank, pointed out that although Xue Jihao is close in age to his predecessor, which may lead to the same problem in the long run, it will not immediately become an unstable factor in the short term [1].

Critical Period of Strategic Transformation

: This personnel change occurs at a key node as Taikang Life Insurance approaches its 30th anniversary. In the first three quarters of 2025, the company achieved insurance business income of RMB 196.871 billion, representing a 3.77% year-on-year increase compared to 2024; its net profit reached RMB 24.772 billion, a substantial year-on-year growth of 168.94% [1]. However, behind this seemingly impressive performance lie profound management challenges.

Conclusion of Comprehensive Adjustments for Taikang Group’s Core Subsidiaries

: This personnel change marks the end of the comprehensive executive adjustments for three core subsidiaries under the Taikang Group over the past two years. Prior to this, Taikang Pension completed its core management position adjustments in 2024, and Taikang Online did so in November 2025 [2]. This synchronized adjustment reflects the Taikang Group’s re-examination of its overall strategic direction.

1.2 Performance Fluctuation Analysis

Looking at the performance over the past three years, Taikang Life Insurance shows significant volatility [2]:

| Year |

Operating Revenue (RMB 100 Million) |

Insurance Business Income (RMB 100 Million) |

Net Profit (RMB 100 Million) |

| 2021 |

2259 |

- |

258 |

| 2022 |

2031 |

1708.4 |

119 (Halved) |

| 2023 |

2351 |

2031.88 |

137 |

| 2024 |

2711 |

2283.24 |

147 |

The data reveals several key issues: In 2022, net profit halved compared to 2021, mainly due to declining investment returns, increased reserve provisions, and mounting underwriting pressure. Although net profit recovered slightly from 2023 to 2024, it is still in a profit recovery phase and has not fully returned to the 2021 level [2]. The year-on-year surge of 169% in net profit in the first three quarters of 2025 is not comparable to previous periods due to the company’s switch in accounting standards [2].

II. In-Depth Analysis of the Causes of Net Profit Decline

2.1 Inadequate Investment Capabilities

Investment income is a crucial source of profit for insurance companies, yet Taikang Life Insurance has underperformed in this area [2]:

Persistently Low Investment Yield

: In 2024, Taikang Life Insurance’s investment yield was only 3.2%, significantly lower than the industry average of 3.8%; in the first three quarters of 2025, its investment yield was 3.2%, ranking 45th among 72 life insurance companies, while the industry average stood at 3.7% [2]. This level reflects the company’s dilemma of weak asset-side returns in a low-interest-rate environment.

Investment Income Affects Profit Elasticity

: Low investment yields directly compress the company’s profit elasticity. When liability-side costs are relatively rigid, declining investment income means narrower interest margins, which not only impacts current profits but also restricts the company’s room for product pricing and market competition.

2.2 Persistent Liability-Side Pressure

Slowdown in Premium Growth

: In the first three quarters of 2025, insurance business income reached RMB 19.69 billion, with a year-on-year growth of only 3.77%, which is lower than the industry average [2]. This phenomenon reflects that the traditional growth model is facing bottlenecks.

Fluctuating Market Share

: A tracking rating report released by China Chengxin International shows that Taikang Life Insurance’s market share of scale premiums rose from 5.89% to 6.30% between 2022 and 2023, but fell back to 5.85% in 2024 [2]. The fluctuation in market share reflects challenges to the company’s position in industry competition.

2.3 Reserve Provision Pressure

In accordance with regulatory requirements, insurance companies need to set up liability reserves for future policy claims. In an environment of declining interest rates, a downward adjustment of the reserve discount rate will lead to an increase in reserve provisions, thereby eroding current profits. This was also one of the important reasons for the halving of the company’s net profit in 2022 [2].

III. Product and Management Vulnerabilities Exposed by a 183% Surrender Rate

3.1 Alarming Surrender Data

According to Taikang Life Insurance’s third-quarter 2025 solvency report, the surrender rates of some of the company’s products are alarmingly high [1][2]:

Top 3 Products by Annual Cumulative Comprehensive Surrender Rate

:

Taikang Rider Health Life B Term Critical Illness Insurance

: 182.92% annual cumulative comprehensive surrender rateTaikang Taiyue Life (Winner Version) Annuity Insurance

: 110.94% annual cumulative comprehensive surrender rateTaikang e-Wealth B Whole Life Insurance (Universal Type)

: 42.6% annual cumulative comprehensive surrender rate

Even more shocking is that second-quarter data shows that the

Taikang Shunxin Endowment Insurance

has an annual cumulative comprehensive surrender rate as high as 1079.01% [3]. This means that the scale of surrenders for this product far exceeds its existing policy scale, which may involve a large number of short-term surrenders or surrenders resulting from complaint handling after sales misrepresentation.

Quarterly Surrender Amounts

: In the third quarter of 2025, the products with the highest surrender amounts were “Taikang Winner Life Whole Life Insurance (Unit-Linked Type)” at RMB 4.812 billion, “Taikang Winner Wealth B Whole Life Insurance (Unit-Linked Type)” at RMB 612 million, and “Taikang Winner Life 2020 Whole Life Insurance (Unit-Linked Type)” at RMB 599 million [1].

3.2 Analysis of Product Design Flaws

Imbalance Between Protection and Returns

: The 183% surrender rate of the health insurance product reflects that the product failed to fully consider the actual needs of customers during the design phase [1]. For example, as a term critical illness insurance, Taikang Rider Health Life B Term Critical Illness Insurance may have failed to meet customer expectations in terms of coverage period, payment methods, or coverage scope.

Product Maturity Mismatch

: Products with high surrender rates are mostly concentrated in short-term or medium-term products, which reflects that the company may have overemphasized short-term premium scale while neglecting the long-term stability and customer stickiness of products during the maturity design phase [3].

Inadequate Management of Return Expectations

: The high surrender rates of annuity insurance and universal insurance products indicate that there may be issues such as exaggerated returns and hidden fees in the sales process, leading customers to surrender when actual returns do not match expectations [1].

3.3 Sales Management Vulnerabilities

Widespread Sales Misrepresentation

: The Black Cat Complaint Platform has received over 5,400 cumulative complaints against Taikang Life Insurance, with a large number of complaints pointing to sales misrepresentation, such as salespersons concealing or exaggerating returns, and deducting fees without reason [2]. In 2024, the company received 10,160 complaints referred by regulators, of which sales-related complaints accounted for as high as 79% [4].

Weak Channel Control

: The third-quarter 2025 solvency report shows that the head office was warned and fined RMB 4.27 million for issues such as entrusting unqualified institutions to engage in insurance sales activities between 2021 and June 2022 [1]. This reflects serious vulnerabilities in the company’s sales channel management.

Inadequate Compliance Training

: Multi-level institutions, from branch companies to marketing service offices, have received regulatory penalties for issues such as sales misrepresentation to deceive policyholders and providing policyholders with benefits outside the scope of insurance contracts [2], indicating that compliance awareness has not been implemented throughout the entire sales system.

3.4 Operational Management Vulnerabilities

Defective Surrender Handling Mechanism

: Such a high surrender rate indicates that the company lacks effective management mechanisms in terms of surrender early warning, customer service, and problem handling [3]. When a large number of customers surrender their policies collectively, it not only affects cash flow but also exposes the company’s shortcomings in customer relationship maintenance.

Weak Renewal Management

: In 2024, complaints related to renewal and fee payment accounted for 7% of total complaints [4], reflecting the company’s shortcomings in customer renewal management and its failure to effectively identify and retain high-value customers.

Missing Product Seminar Management

: The Heilongjiang Heihe Central Branch was penalized for failing to implement internal systems properly and failing to retain audio-visual records of the full process of product seminars [2], indicating that the company has vulnerabilities in the control of product sales processes.

IV. Analysis of Compliance Risks and Regulatory Penalties

4.1 Summary of Penalty Situations

In the third quarter of 2025, institutions at all levels under Taikang Life Insurance received a total of 10 administrative penalties, with a total fine of RMB 5.608 million [1][2]:

Head Office Level

: The head office was warned and fined RMB 4.27 million for issues such as failing to use approved or filed insurance clauses and rates, inaccurate expense recording, and entrusting unqualified institutions to engage in insurance sales activities [1].

Branch Level

: In the third quarter, branch companies received 5 administrative penalties, central branches received 3, and branch companies/marketing service offices received 1 [1].

Typical Violations

:

- Fujian Ningde Central Branch: Sales misrepresentation to deceive policyholders, providing policyholders with benefits outside the scope of insurance contracts [2]

- Dalian Branch: Falsifying commissions to embezzle funds, fined RMB 1 million [3]

- Qinghai Branch: Providing benefits outside the scope of contracts, fined RMB 1.65 million [3]

- Jilin Central Branch: Failing to strictly perform management duties for individual insurance agents [2]

4.2 Analysis of Compliance System Defects

Ineffective Implementation of Compliance Systems

: The types of issues involved in the penalties are diverse, ranging from sales misrepresentation to untrue financial data, which reflects that although the company has compliance systems, they have not been effectively implemented at the execution level [2][3].

Weak Internal Control

: Frequent compliance issues caused by lost branch licenses and poor management indicate that the company has systematic defects in internal control and branch management [3].

Lack of Compliance Culture

: A large number of sales-related complaints and penalties indicate that the “customer-centric” concept has not been implemented throughout the entire sales and service process [2][4].

V. Channel Transformation Dilemmas and Strategic Challenges

5.1 Imbalanced Channel Structure

High Reliance on Bancassurance Channel

: Premium growth in 2024 mainly relied on the bancassurance channel, which has low profit margins and low customer stickiness, affecting the company’s profit quality [2]. The top two products by premium income in the same period were both dividend-type products from the bancassurance channel, further confirming the issue of channel dependence.

Slow Transformation of Individual Insurance Channel

: The individual insurance channel was once the absolute main force of Taikang Life Insurance, but as the transformation of individual insurance enters a deep phase, the transformation of the agent team is slow, and the value of new policies is under pressure and declining [2]. This reflects the company’s lag in channel reform.

5.2 Management Challenges of Institutional Adjustments

Large-Scale Branch Closures

: Since 2024, Taikang Life Insurance has closed more than 500 branches, and approximately 280 branches have been closed in 2025, representing a reduction of over 11% [1][3]. Although this adjustment helps reduce costs and improve efficiency, it also brings challenges to management and service continuity.

Service Network Risks

: While streamlining institutions, how to ensure uninterrupted service, maintain strict management, and use technological empowerment to compensate for the impact of reduced physical outlets has become a pending issue [2].

Personnel Adjustment Pressure

: In 2024, “cash paid to and on behalf of employees” decreased from approximately RMB 6.9 billion in 2023 to RMB 6.4 billion, a reduction of nearly RMB 500 million [1]. Although personnel streamlining reduces costs, it may also affect service quality and customer experience.

5.3 Solvency and Rating Pressure

Decline in Solvency Adequacy Ratio

: As of the end of the third quarter of 2025, the company’s core solvency adequacy ratio was 195.24%, a decrease of 29.14 percentage points compared to the end of the previous quarter; the comprehensive solvency adequacy ratio was 284.16%, a decrease of 37.04 percentage points compared to the end of the previous quarter [1].

Downgrade in Comprehensive Risk Rating

: The comprehensive risk rating was AA in the first quarter of 2025, and was downgraded to A in the second quarter [2]. The rating downgrade reflects that regulators have put forward higher requirements for the company’s risk governance, internal control compliance, and operational refinement, and may also restrict the development of new businesses and the choice of investment strategies.

VI. Systematic Reflection on Management Vulnerabilities

6.1 Strategic Issues

Path Dependence on Traditional Models

: Taikang Life has long relied on the outdated model of a large-scale sales force and high-yield savings-type products, and is facing growth bottlenecks in the deep phase of industry transformation [2]. This model can achieve rapid expansion during economic upturns, but is unsustainable in an environment of declining interest rates and stricter regulation.

Lagging Innovation and Transformation

: Most of the company’s management team are from the “post-1965” and “post-1970” generations. Industry insiders believe that although this team has rich experience, it is prone to organizational inertia and lags in understanding emerging business formats [2]. The same-age leadership succession does not fundamentally solve the problem of the management team’s age structure, which may affect the company’s innovation capability and market sensitivity.

6.2 Operational Issues

Inadequate Product Competitiveness

: Products with high surrender rates are concentrated in health insurance and annuity insurance, reflecting the company’s shortcomings in product innovation and differentiated competition [1][2].

Poor Customer Service Experience

: The continuous high volume of complaints, with over 100,000 total complaints in 2024 [4], indicates that the company needs to significantly improve its customer service experience.

Need to Strengthen Risk Control Capabilities

: The company faces multi-dimensional risks from the investment side, liability side, compliance risks, and operational risks, requiring a more comprehensive risk management system [2].

6.3 Organizational Issues

Weak Compliance Culture Building

: Multi-level and multi-type violation penalties indicate that the company has a long way to go in building a compliance culture, which needs to be strengthened from systems, processes, assessments, and other aspects [1][2][3].

Incomplete Internal Control System

: Issues such as out-of-control branch management and ineffective implementation of internal systems reflect that the company has systematic defects in its internal control system [2][3].

Inadequate Talent Echelon Building

: The same-age leadership succession reflects the company’s lack of long-term planning in talent training and echelon building, and its failure to form a reasonable age structure and professional capability allocation [2].

VII. Improvement Suggestions and Future Outlook

7.1 Optimization of Product Management

Strengthen Market Research

: Deeply understand the real needs of customers, optimize product design, and provide more personalized and diversified service solutions [1].

Optimize Product Maturity Structure

: Reasonably design product maturities, avoid over-reliance on short-term products, and improve product stability and customer stickiness.

Manage Return Expectations

: Accurately communicate product returns and risk characteristics during the sales process, and avoid misleading customers with exaggerated returns.

7.2 Strengthening of Compliance System

Improve Compliance Systems

: Establish and improve compliance management systems, unify penalty standards, and strictly pursue accountability [4].

Enhance Compliance Training

: Continuously strengthen internal management and training to ensure compliance in operations [1].

Build a Compliance Culture

: Integrate compliance awareness into corporate culture, and make the “customer-centric” concept run through the entire sales and service process.

7.3 Deepening of Channel Transformation

Balance Channel Development

: While developing the bancassurance channel, accelerate the transformation of the individual insurance channel, and improve channel profitability and customer value contribution [2].

Empower Channels with Technology

: Use digital means to improve channel efficiency and service quality, and compensate for the impact of reduced physical outlets.

Improve Agent Quality

: Strengthen agent training and assessment, and improve professional capabilities and service levels.

7.4 Building of Investment Capabilities

Improve Investment Yield

: In a low-interest-rate environment, optimize the asset allocation structure and improve the return level of the investment portfolio [2].

Strengthen Investment Risk Management

: Establish a more prudent investment risk management system to control the impact of investment fluctuations on profits.

Expand Investment Channels

: Explore diversified investment channels within the scope of compliance to improve the stability of investment returns.

VIII. Conclusion

The “same-age leadership succession” event at Taikang Life Insurance is not just an ordinary personnel change, but a concentrated reflection of multiple challenges faced by the company in the critical period of industry transformation. The halving of net profit from RMB 2.58 billion in 2021 to RMB 1.19 billion in 2022, and the 183% surrender rate of health insurance products, together reveal systemic management vulnerabilities in product design, sales management, compliance risk control, and other aspects.

The new CEO Xue Jihao faces severe challenges: How to improve profit quality while maintaining business scale? How to optimize product structure while controlling surrender rates? How to ensure service quality while streamlining institutions? These issues require systematic strategic thinking and solutions.

For Taikang Life Insurance, its 30th anniversary is both a milestone and a new starting point. The company needs to fundamentally reflect on the limitations of its traditional development model, and carry out comprehensive reforms in product innovation, channel transformation, compliance construction, customer service, and other aspects. Only in this way can it maintain a leading position in fierce market competition and achieve high-quality and sustainable development.

References

[1] Sina Finance - “Veteran” Retires, Deputy General Manager Promoted: RMB 1.9 Trillion Taikang Life Faces Critical Transformation Period (https://finance.sina.com.cn/jjxw/2025-12-20/doc-inhcncif1131409.shtml)

[2] Sina Finance - Same-Age Leadership Succession at Taikang Life on Its 30th Anniversary: The Twilight and Rebirth of the Traditional Life Insurance Model (https://cj.sina.cn/articles/view/6230739408/1736189d000101tbvi)

[3] New Finance View - Growing Pains of Taikang Life: Dual Challenges of High Surrender Rate and Strategic Transformation (https://www.xincai.com/article/nfpuwrk1279750)

[4] Taikang Life Insurance Official Website - 2024 Annual Information Disclosure Report of Taikang Life Insurance Co., Ltd. (https://m.taikanglife.com/mobile/uploader/informationFile/2025/04/30/1ada8ab3-7d83-4175-a88d-8db3c55ee698.pdf)