Analysis of Sun Create Electronics (600990.SS)'s Sustained Losses and Assessment of the Military Electronics Industry's Prosperity

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data, I have prepared a comprehensive analysis report for you:

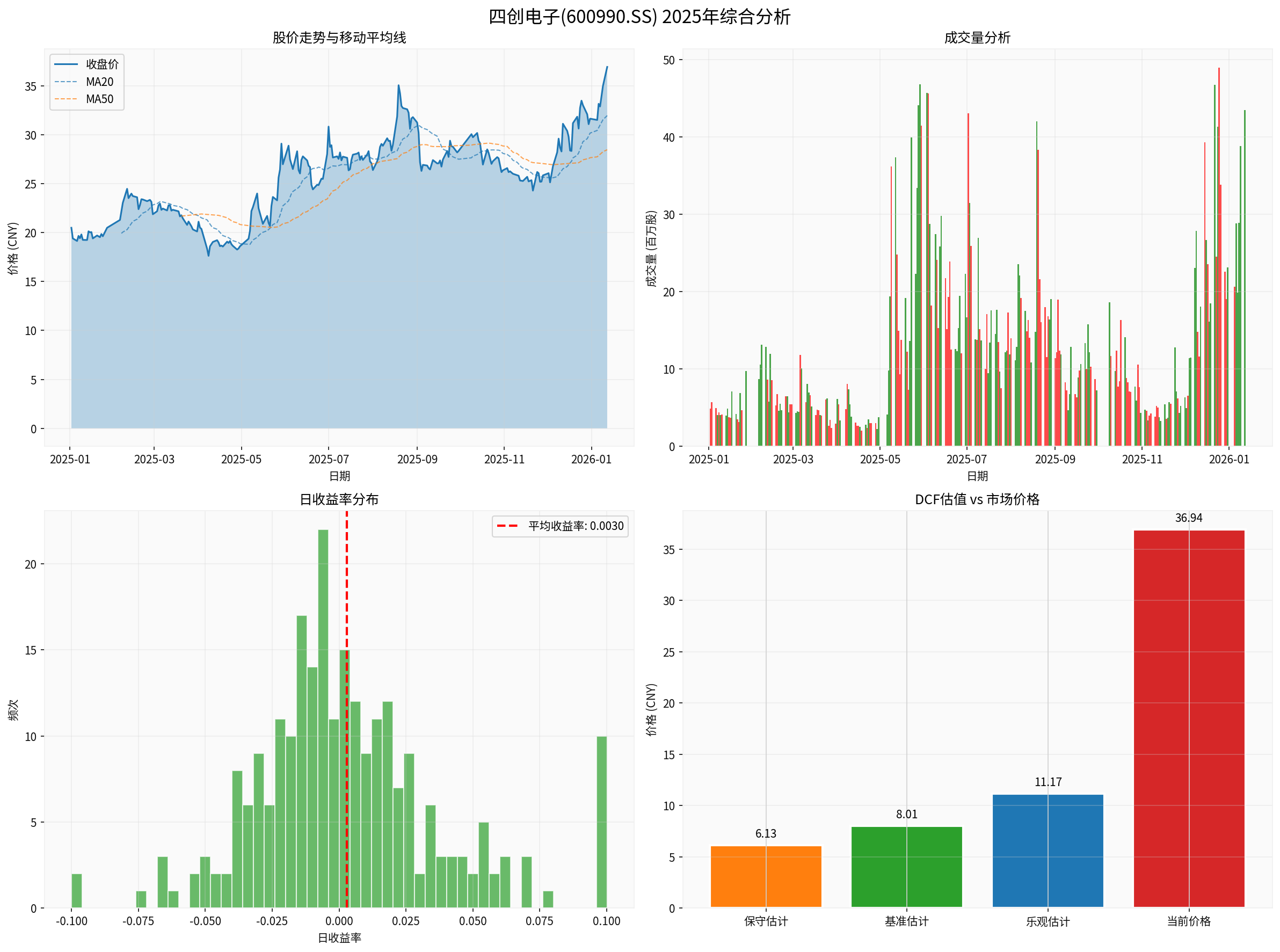

Sun Create Electronics Co., Ltd is a military electronics enterprise focusing on radar and electronic equipment manufacturing[0]. In terms of stock performance, the company has shown a strong upward trend since 2025:

| Time Period | Gain |

|---|---|

| 5-Day | +13.14% |

| 1-Month | +18.66% |

| 3-Months | +24.17% |

| 6-Months | +33.02% |

| 1-Year | +91.90% |

However, the strong stock performance is in serious contradiction with the company’s fundamentals.

Based on the latest financial data[0][1], Sun Create Electronics’ key financial indicators show that the company is still in a state of deep loss:

| Indicator | Value | Evaluation |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | -33.53x |

In loss status |

| Return on Equity (ROE) | -15.95% |

Significantly negative |

| Net Profit Margin | -19.04% |

Sustained losses |

| Operating Profit Margin | -18.86% |

Losses expanding |

| Current Ratio | 1.15 | Barely healthy |

| Quick Ratio | 0.76 | Tight liquidity |

- The company has recorded annual losses for three consecutive years

- Loss per share of $0.17 in Q3 2025

- Revenue of $514 million in the latest fiscal year (2024), but net losses continue to expand

A DCF valuation model using three scenarios shows[0]:

| Valuation Scenario | Intrinsic Value | Deviation from Current Price |

|---|---|---|

| Conservative Estimate | 6.13 CNY | -83.4% |

| Base Estimate | 8.01 CNY | -78.3% |

| Optimistic Estimate | 11.17 CNY | -69.8% |

| Probability-Weighted | 8.44 CNY | -77.2% |

The current share price of 36.94 CNY is

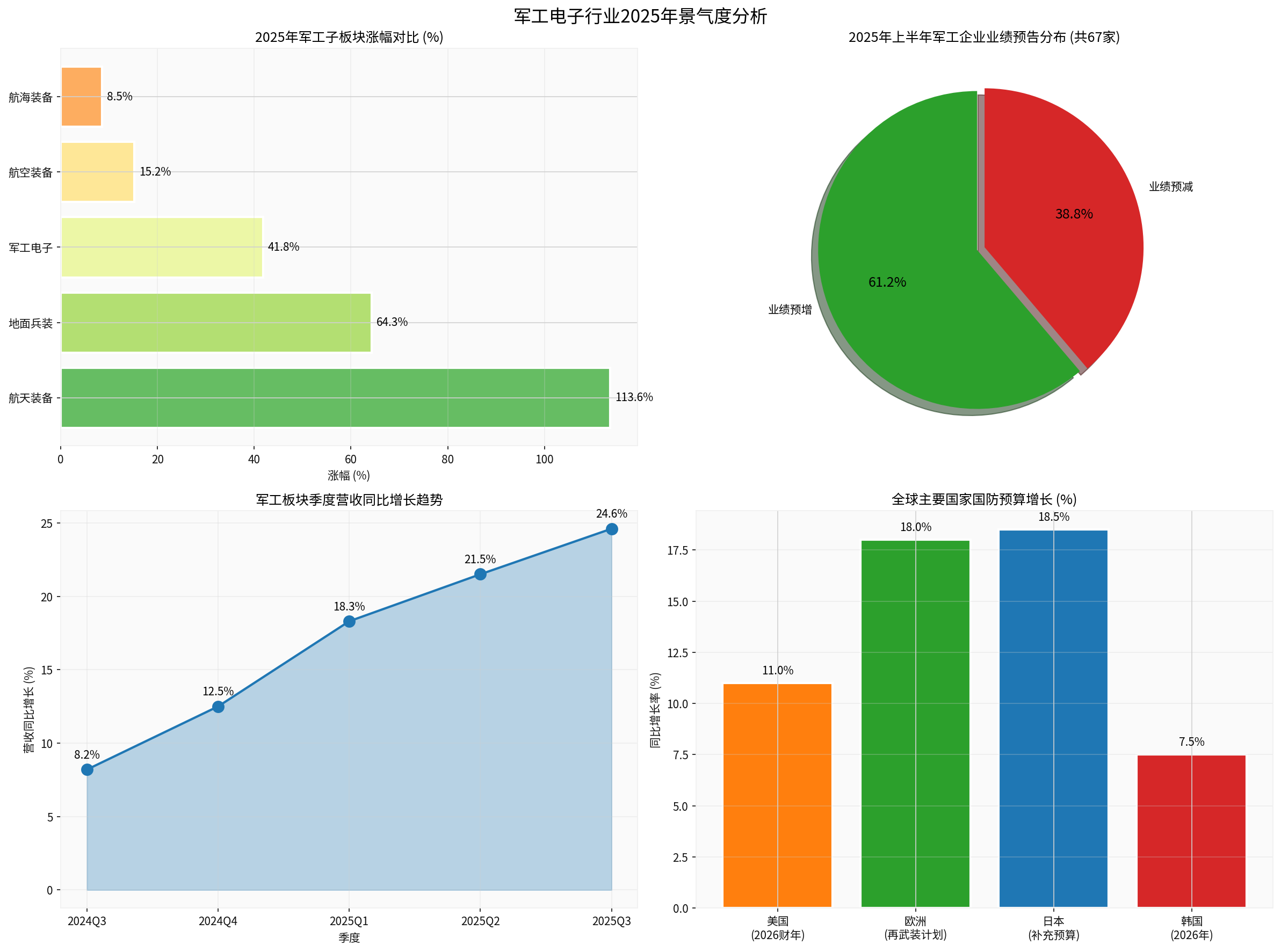

According to industry research data[2][3], the prosperity of the military electronics industry has

| Sector | 2025 Gain | Evaluation |

|---|---|---|

| Aerospace Equipment | +113.6% |

Leading the rally |

| Ground Ordnance | +64.3% |

Strong |

Military Electronics |

+41.8% |

Steady rebound |

| Aviation Equipment | +15.2% | Moderate |

| Marine Equipment | +8.5% | Lagging |

- In Q3 2025, the military sector’s revenue grew 24.6%year-on-year

- Net profit attributable to parent companies surged 22.3%year-on-year

- Maintained double-digit growth for three consecutive quarters

- Among the 67 military enterprises that have released semi-annual report forecasts, 41 are expected to see growth(accounting for 61.2%), while 26 are expected to see declines

- Representative Enterprise Performance:

- Hongyuan Electronics: Net profit up 41%-61% year-on-year

- Torch Electronics: Net profit up 50%-70% year-on-year

According to industry research information[2]:

- Inventory replenishment cycle starts: Passive components enter the inventory replenishment stage

- “14th Five-Year Plan” concluding effect: Downstream demand has “broken the ice”, releasing backlogged orders from earlier periods

- Exports open up incremental growth: Breakthroughs have been made in military trade exports, with remarkable results in actual combat tests

- Guide Infrared: Signed an 879 million CNY model equipment system procurement agreement

- Yaguang Technology: Signed a 396 million CNY production preparation agreement

Sun Create Electronics’ sustained losses are an

| Factor | Analysis |

|---|---|

Product Structure |

Focused on complete radar systems, greatly affected by the procurement rhythm of models |

Customer Concentration |

High dependence on a single model |

Cost Pressure |

The trend of miniaturization and integration of military electronics compresses gross margins |

R&D Investment |

Sustained high R&D investment cannot be converted into performance in the short term |

The military electronics industry shows obvious

| Enterprise Type | Performance Characteristics |

|---|---|

Leading Enterprises |

Full order books, expected performance growth, valuation recovery |

Segment Champions |

Focus on core components, benefit from domestic substitution |

Traditional Complete Equipment Manufacturers |

Performance fluctuates greatly due to model cycles |

Troubled Enterprises |

Pressured by governance flaws or poor product sales, sustained losses |

- As the first year of the “15th Five-Year Plan” in 2026, military investment is expected to maintain growth

- Construction of new-quality combat capabilities is accelerating, with key development in fields such as unmanned intelligence, underwater combat, and network-electronic attack and defense

- The U.S. 2026 fiscal year defense budget reaches $960 billion, up 11% year-on-year

- European “rearmament” plan: €800 billion over 4 years

- Japan’s military expenditure has increased significantly for two consecutive years

- South Korea’s military expenditure will be increased by 7.5% in 2026

- China’s military product exports have moved from the “shortcoming filling” stage to the “capability output” stage

- 81% of Pakistan’s imported equipment comes from China

- Actual combat tests have enhanced international reputation

| Theme | Key Directions |

|---|---|

New-Quality Combat Capabilities |

Unmanned/anti-unmanned equipment, military intelligence, missiles and radars |

Military Trade |

Main equipment manufacturers, missile and radar export enterprises |

Civil-Military Integration |

Commercial aerospace, gas turbines, domestic large aircraft |

| Question | Conclusion |

|---|---|

| Why has Sun Create Electronics sustained losses? | Individual operational issues, affected by product structure and model cycles |

| Is the military electronics industry’s prosperity declining? | No , it has actually shown a significant rebound trend |

| Does industry differentiation exist? | Yes , high-quality enterprises have obvious recovery, while troubled enterprises are under pressure |

- Sun Create Electronics’ sustained losses do not representa downward trend in the military electronics industry’s prosperity

- The industry as a whole has shown an upward turning pointtrend, with both revenue and net profit growing in Q3

- Public funds increased their allocation to the military sector for the first timein Q2, with their holding size increasing by 23% month-on-month

- The military electronics sector has risen 41.8%in 2025, reaching a historically high level

- The procurement rhythm of military equipment falls short of expectations

- Uncertainty in the progress of military market expansion

- Sustained price reduction pressure on products of some enterprises

- Sun Create Electronics’ current valuation carries overvaluation risk

[0] Jinling AI Brokerage API Data - Sun Create Electronics (600990.SS) Company Overview, Financial Analysis and DCF Valuation

[1] Jinling AI Brokerage API Data - Sun Create Electronics (600990.SS) Financial Statement Analysis

[2] Cailianshe - “Order ‘Warmth’ Transmits to Performance: Will Military Electronics Step on the Gas in the Second Half of the Year?” (https://finance.eastmoney.com/a/202507303471307140.html)

[3] Report Pai - “2025-2026 Annual Strategy for the Military Industry” (https://www.baogaopai.com/article-284276-1.html)

[4] Sina Finance - “2026 Annual Strategy for the Military Industry: Layout for the 15th Five-Year Plan, Grasp New-Quality Capabilities and Military Trade” (https://stock.finance.sina.com.cn/stock/view/paper.php?symbol=sh000001&reportid=820782780303)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.