Analysis Report on Tianpu Co., Ltd.'s Cross-Border AI Chip Incident and Information Disclosure Violation Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected detailed information and market data, I will conduct a comprehensive analysis of Tianpu Co., Ltd.'s cross-border AI chip incident and information disclosure violation risks.

Tianpu Co., Ltd. (Stock Code: 603266.SS), full name Ningbo Tianpu Rubber Technology Co., Ltd., is a typical traditional manufacturing enterprise mainly engaged in the R&D, production and sales of automotive rubber pipeline products [1][2]. According to the latest financial data, the company’s current market value is approximately RMB 29.2 billion, with a price-earnings ratio of 41.43 times, price-to-book ratio of 2.91 times, and current ratio of 2.90, indicating an overall sound financial condition [0].

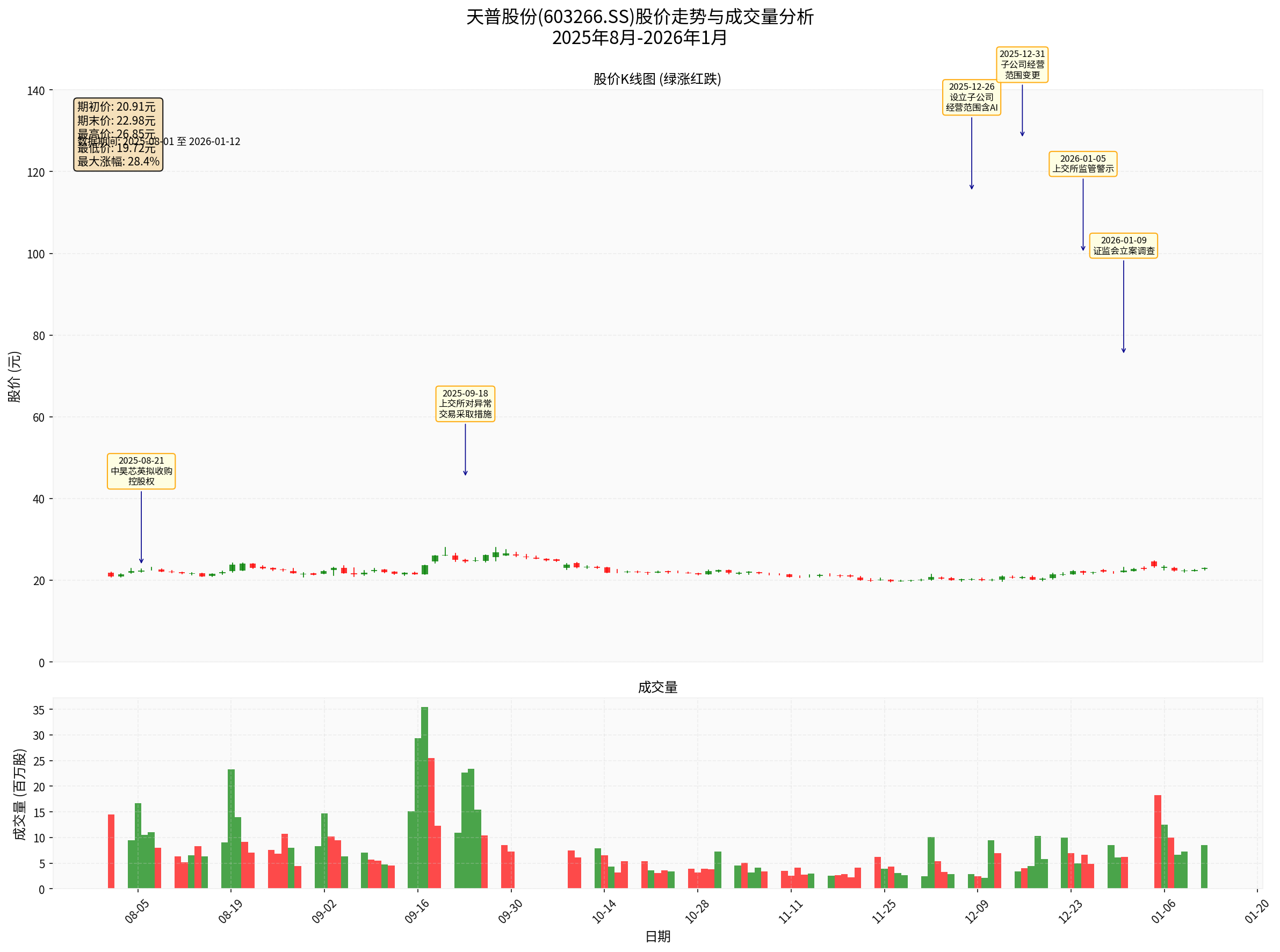

On August 21, 2025, Tianpu Co., Ltd. issued a major event announcement, stating that Zhonghao Xinying, an AI chip design enterprise, intends to obtain control of the company through “agreement transfer + capital increase to the controlling shareholder” [1][2]. Founded by Yang Gong Yifan, a post-1980s former Google principal engineer, Zhonghao Xinying claims to be the only enterprise in China that has mastered the R&D technology of high-performance TPU architecture AI-specific computing power chips and achieved mass production [2].

This cross-border merger and acquisition news ignited market speculation, and Tianpu Co., Ltd.'s stock price began to “skyrocket”. From August 22, 2025 to December 30, 2025, the company’s stock rose 718.39% cumulatively, with an annual increase of 1663.2%, making it the “second top-performing stock” on the 2025 gainers list [1][2].

According to the facts identified in the SSE Regulatory Warning Letter (SSE Public Supervision Letter No. [2026] 0001), Tianpu Co., Ltd. has committed the following information disclosure violations [1][3][4]:

| Time Node | Regulatory Measure | Main Content |

|---|---|---|

| September 18, 2025 | SSE Self-Regulatory Supervision | Adopted measures such as suspending account trading for investors with abnormal trading [2] |

| December 31, 2025 | Regulatory Work Letter | Suspected information disclosure violations [2] |

| January 5, 2026 | Regulatory Warning Letter | Issued regulatory warnings to the company and senior executives [1][3][4] |

| January 9, 2026 | CSRC Investigation | The announcement on abnormal stock price fluctuations is suspected of material omissions [1][2] |

According to Article 78 of the Securities Law, information disclosed by information disclosure obligors shall be true, accurate and complete, and shall not contain false records, misleading statements or material omissions [2]. Tianpu Co., Ltd.'s acts were identified by regulators as:

-

Inaccurate information disclosure:Knowing that there was no plan to carry out AI-related business, the company established a subsidiary with AI-related business scope and changed its business scope within a short period [1]

-

Incomplete information disclosure:Failed to provide targeted explanations regarding the subsidiary in the abnormal fluctuation announcement [1]

-

Insufficient risk warning:May mislead investors’ decision-making [3][4]

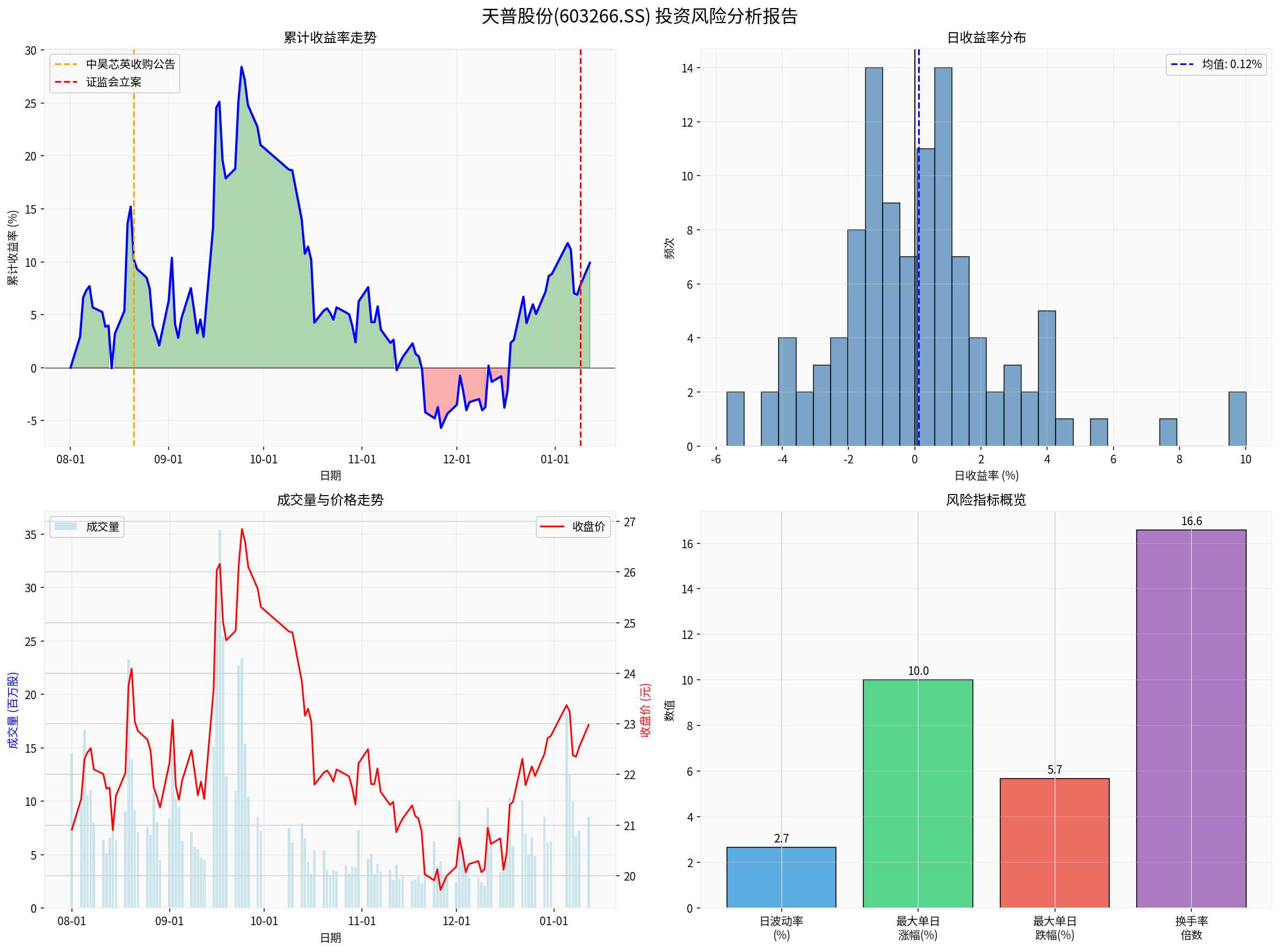

Tianpu Co., Ltd.'s surge and plunge fully demonstrate the severe impact of information disclosure violations on stock prices. According to data analysis:

| Statistical Indicator | Value |

|---|---|

| Initial Price on August 1, 2025 | RMB 20.91 |

| Peak Price on September 24, 2025 | RMB 26.85 |

| Maximum Peak Gain | 28.4% |

| Average Daily Volatility | 2.72% |

| Maximum Single-Day Gain | 10.01% |

| Maximum Single-Day Drop | -5.68% |

- Cumulative Return Trend:Shows the process of the stock price surging and then falling, with key event nodes clearly marked

- Daily Return Distribution:Shows a significant peak and fat tail feature, indicating frequent extreme fluctuations

- Relationship between Trading Volume and Price:Shows that trading volume increased abnormally during the surge, with extremely high turnover rate

- Risk Indicator Overview:Quantitatively shows characteristics of high volatility and high turnover rate [0]

Based on analysis of public information, Tianpu Co., Ltd. attracted multiple types of institutional investors [1][2]:

However, these institutional investors generally showed a “fast in, fast out” characteristic, almost all exiting the top ten tradable shareholders after holding for a short quarter [1]. As of the end of the third quarter of 2025, institutions still holding Tianpu Co., Ltd. include China Galaxy (0.76%), China Merchants Securities International (0.6%), and Goldman Sachs Group (0.28%) [1].

According to the analysis by Lawyer Liu Peng from Shanghai Huzi Law Firm, investors meeting the following conditions can conduct pre-registration for claims [2]:

Tentative Claim Conditions:Investors who bought Tianpu Co., Ltd.'s stock on or before December 31, 2025, and sold it after January 1, 2026 or still held it and suffered losses

Investors can protect their rights through the following channels:

- Register for pre-registration of claims with a professional law firm

- Send contact information to the designated email address (suopeibao@126.com)

- Wait for the CSRC investigation results to be released before initiating the formal claim process [2]

The Tianpu Co., Ltd. case reveals a typical “hot topic hype” information disclosure violation model in the capital market [4]:

Establish AI-related subsidiary → Trigger market speculation → Abnormal stock price fluctuations →

Announce "no AI business plan" → Change subsidiary's business scope → Regulatory intervention and investigation

The essence of this model is that listed companies take advantage of the market’s pursuit of hot concepts, create relevance to hot topics through selective disclosure or ambiguous statements, and stimulate stock price increases [4].

-

Distorted resource allocation:Capital flows from genuine companies to “storytelling” enterprises, forming a “bad money drives out good money” situation [4]

-

Impaired price discovery mechanism:Excessive speculative hype causes stock prices to deviate from fundamentals, interfering with the market’s normal pricing function [4]

-

Damaged market credibility:Non-compliant information disclosure undermines the credibility foundation of the capital market and increases investors’ transaction costs [4]

-

Amplified investment risks:Investors make decisions based on misleading information and bear unnecessary investment losses [4]

Since the comprehensive deepening of the registration system reform, regulators have continuously strengthened information disclosure supervision [4]:

- CSRC:Intensified investigation efforts, forming a strong deterrent against information disclosure violations

- Stock Exchanges:Through inquiry letters, regulatory work letters, etc., promptly require listed companies to clarify the accuracy and completeness of statements related to hot topics

- Compliance Bottom Line:Listed companies should “tell the truth in a timely and complete manner”, which is the basic requirement for compliant information disclosure regarding hot topics [4]

-

Closely monitor regulatory progress:Track the CSRC investigation progress and pay attention to the company’s subsequent announcements

-

Evaluate position risks:Re-examine investment decisions and consider whether fundamentals support the current valuation

-

Prepare rights protection materials:Collect transaction records and prepare for possible claims

-

Pay attention to performance after resumption of trading:After resuming trading on January 12, 2026, the stock price has already hit a daily limit down, and the subsequent trend remains uncertain [2]

-

Beware of concept hype:Avoid blindly chasing hot concept stocks, especially traditional enterprises conducting cross-border mergers and acquisitions in hot fields such as AI

-

Verify information disclosure:Pay attention to the completeness and accuracy of the company’s announcements and be alert to selective disclosure

-

Evaluate valuation rationality:The annual increase of 1663% far exceeds any fundamental support, which is a typical speculative bubble

-

Pay attention to regulatory signals:Regulatory measures such as SSE warning letters and CSRC investigations are often risk warning signals

The Tianpu Co., Ltd. case provides important warnings for all capital market participants:

| Participant | Lessons and Enlightenments |

|---|---|

| Listed Companies | Information disclosure compliance is the bottom line; “hot topic hype” is not worth the cost |

| Investors | Invest rationally, stay away from concept hype, and enhance risk identification capabilities |

| Institutional Investors | Strengthen due diligence to avoid becoming “bag holders” |

| Regulatory Authorities | Continuously strengthen information disclosure supervision to maintain market fairness and justice |

Tianpu Co., Ltd.'s cross-border AI chip incident is a typical case of information disclosure violations by a listed company. Taking advantage of the market’s pursuit of the AI concept, the company stimulated its stock price to surge more than 16 times in just over four months by establishing a subsidiary with AI-related business scope and creating relevance to the hot topic. However, this “hot topic hype” act ultimately led to severe regulatory punishment: the company and responsible persons received regulatory warnings from the SSE, and the CSRC initiated an investigation procedure.

From the perspective of investor protection, this event highlights three core issues:

-

Direct consequences of information disclosure violations:The stock price surged and then plummeted, exposing investors to huge loss risks

-

Availability of rights protection channels:Affected investors can file claims through legal channels

-

Importance of risk prevention:Investors should enhance risk awareness and be alert to concept hype traps

Against the backdrop of the in-depth advancement of the registration system, regulators are continuously intensifying efforts to crack down on information disclosure violations. Listed companies should strictly abide by the basic principles of “truthfulness, accuracy, completeness and timeliness” for information disclosure, and investors should also establish a rational investment concept to jointly maintain the healthy and stable development of the capital market.

[1] CLS - “16x Surge Stock Under CSRC Investigation; Multiple Institutions Once Appeared in Top 10 Tradable Shareholders” (https://www.cls.cn/detail/2253599)

[2] 21st Century Business Herald - “Investigation Launched! 16x Surge Stock Suspected of Material Omissions; Who’s ‘Dancing on the Edge of a Knife’?” (https://www.21jingji.com/article/20260112/herald/6a4cf5e99f27b24e395ab03d38a3684c.html)

[3] Securities Times - “16x Surge Stock Hit by Major Negative News! CSRC: Launch Investigation!” (https://www.stcn.com/article/detail/3584488.html)

[4] Sina Finance - “Hot Topic Hype in Information Disclosure: Compliance is the Bottom Line” (https://finance.sina.com.cn/jjxw/2026-01-12/doc-inhhamhr5521563.shtml)

[0] Jinling AI Financial Database - Real-time Quotes and Historical Data of Tianpu Co., Ltd. (603266.SS)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.