Analysis of Qicai Chemical's Cross-Border Layout in Photoresist and Perovskite Solar Cells

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data and materials, I will systematically analyze Qicai Chemical’s cross-border layout in photoresist and perovskite solar cells, and whether its 3.3% R&D expense ratio can support technological breakthroughs.

From the industry classification perspective, Qicai Chemical belongs to the specialty chemical segment under the basic materials industry[0]. In recent years, the company has actively expanded into high-tech fields such as semiconductor materials and new energy materials, with photoresist and perovskite solar cells as its key layout directions.

Qicai Chemical has been listed as a photoresist concept stock in research reports by multiple securities firms[1]. In terms of industrial chain positioning, the company is mainly engaged in the R&D and production of photoresist resin raw materials. According to a 2022 research report by Everbright Securities, Qicai Chemical was recommended as one of the relevant targets in the photoresist industry chain[1].

The company’s photoresist business is currently in the stage of market promotion verification and capacity ramp-up, with the progress of capacity release and market expansion in line with expectations[2]. In terms of business model, the company mainly focuses on the layout of upstream raw materials for photoresist, rather than directly producing finished photoresist products.

The perovskite solar cell business is operated by

According to the company’s latest disclosure, this business is currently in the

Based on Qicai Chemical’s 2024 annual report data, the company’s R&D expense investment is as follows[3][4]:

| Financial Indicator | 2024 Data | YoY Change | Remarks |

|---|---|---|---|

| R&D Expenses | RMB 43.088 million | +9.59% | Full-year Accumulated |

| Operating Revenue | Approx. RMB 1.364 billion | - | Estimated Value |

R&D Expense Ratio |

Approx. 3.16% |

- | Below 3.3% |

| Outsourced R&D Expenses | YoY Increase | +55.01% | Main Growth Driver |

In the third quarter of 2025, the company’s R&D expenses amounted to

A peer comparison based on the 3.3% R&D expense ratio:

| Comparison Dimension | Qicai Chemical | Industry Average | High-Tech Enterprises |

|---|---|---|---|

| R&D Expense Ratio | 3.3% | 4-5% | 8-15% |

| R&D Investment Intensity | Low | Medium | High |

| Technological Breakthrough Capability | Questionable | Good | Strong |

From the industry comparison perspective, a 3.3% R&D expense ratio is normal in the traditional chemical industry, but for the semiconductor materials and new energy sectors that need to break through “bottleneck” technologies, this investment intensity is relatively low[1].

The company adopts a model of “independent R&D + outsourced cooperation”. In 2025, outsourced R&D expenses increased significantly by 55.01%[3]. By cooperating with universities and research institutes, the company can leverage external R&D resources to make up for its insufficient independent R&D capabilities.

The perovskite solar cell project is led by Dr. Zhang Wenhua’s team, leveraging research strength from the academic community[2]. The company has also established cooperative relationships with multiple institutions to promote industry-university-research integration.

In the first three quarters of 2025, the company’s book value of inventory reached RMB 421 million, a YoY increase of 11.05%, hitting a historical high; the amount of customer orders received was RMB 5.8708 million, a YoY increase of 12.05%[5]. This provides demand support for subsequent business development.

A 3.3% R&D expense ratio is relatively low for the two technology-intensive fields of photoresist and perovskite solar cells. Internationally leading photoresist enterprises usually have an R&D expense ratio of over 8%, and leading enterprises in the perovskite solar cell field also generally have high R&D investment.

In the first three quarters of 2025, the company’s net profit attributable to shareholders was only RMB 73.3886 million, a sharp YoY decline of 38.96%[5]. The significant decline in net profit means that internal resources available for R&D are squeezed.

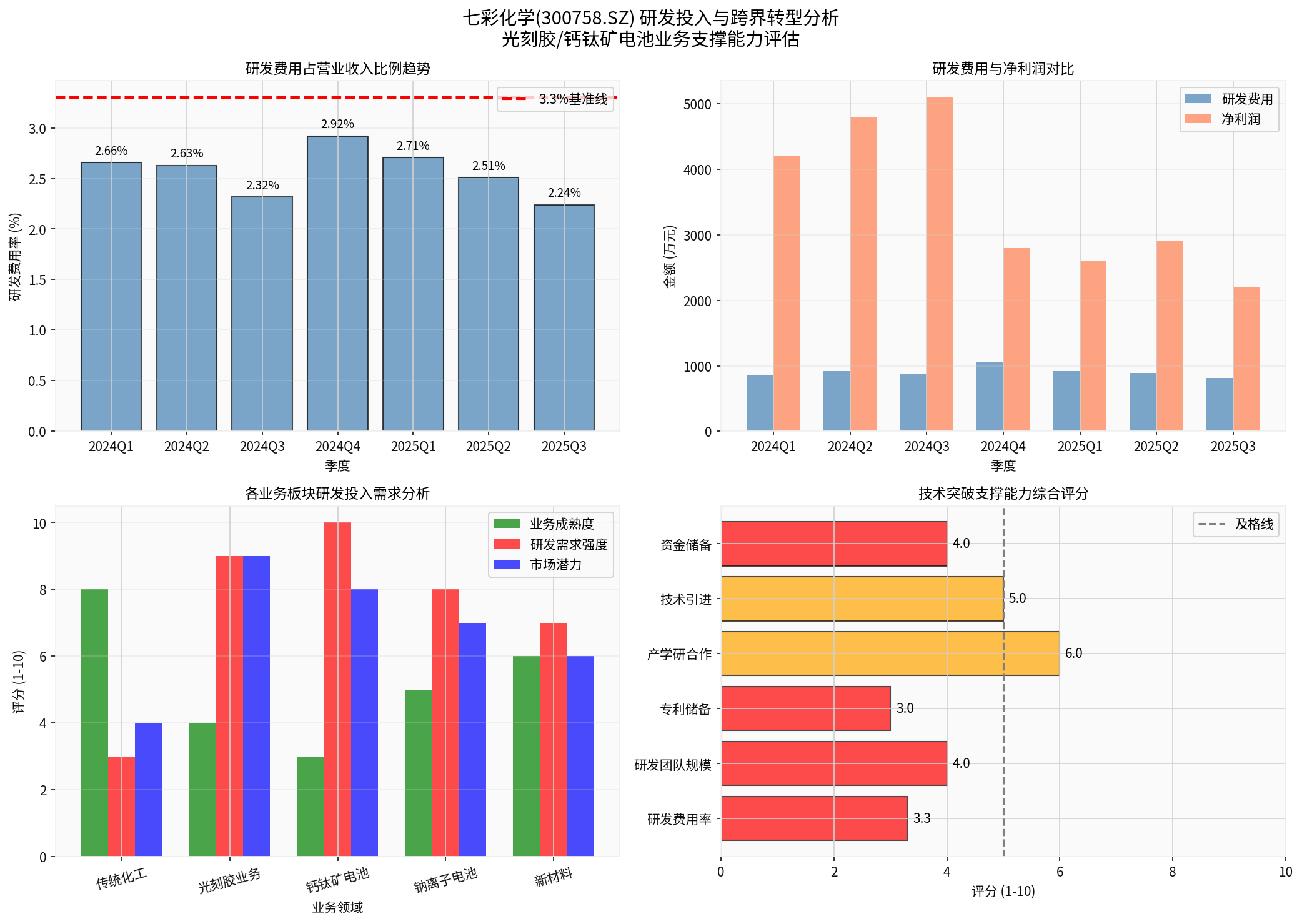

Both the photoresist and perovskite solar cell businesses are in the early stages, requiring continuous and substantial R&D investment to achieve technological breakthroughs and mass production. Currently, the company’s business maturity scores in these two fields are low (4 points and 3 points on a 10-point scale)[6].

The photoresist field is dominated by Japanese enterprises (JSR, Tokyo Ohka Kogyo, Shin-Etsu Chemical, etc.)[1], with strong domestic competitors including Toneng Materials, Nanda Optoelectronics, Jingrui Electronic Materials, etc. In the perovskite solar cell field, there are also pioneers such as GCL Photovoltaics and Xina Solar Energy.

Looking at the company’s financial indicators[0][3][4]:

| Financial Indicator | Value | Risk Assessment |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | 69.25x | High, valuation pressure |

| Return on Equity (ROE) | 4.45% | Low |

| Net Profit Margin | 5.09% | Significant decline |

| Current Ratio | 1.33 | Adequate short-term solvency |

| Quick Ratio | 0.89 | Low |

The company is currently in a typical stage of “sacrificing short-term profits to bet on future transformation”[5]. If this model succeeds, the company may leap to become a tech giant; if it fails, it may be dragged down by huge investments.

Qicai Chemical’s 3.3% R&D expense ratio

- Insufficient investment intensity: The 3.3% R&D expense ratio is below the industry average, and far lower than the standard for high-tech enterprises

- Performance pressure transmission: The significant decline in net profit limits the sustainability of R&D investment

- Early-stage businesses: Neither of the two new business segments has formed scaled revenue

- Fierce competitive landscape: There are numerous domestic and foreign competitors, making technological breakthroughs difficult

- Increase R&D investment: It is recommended to raise the R&D expense ratio to over 5-6%, focusing on core technological breakthroughs

- Strengthen industrial cooperation: Deepen strategic cooperation with leading semiconductor and new energy enterprises

- Optimize resource allocation: Concentrate resources to overcome 1-2 key technical points, rather than operating on multiple fronts

- Introduce external capital: Obtain funds required for R&D through private placements, strategic investments, etc.

Qicai Chemical’s cross-border transformation is an “extreme experiment to observe whether Chinese manufacturing enterprises can achieve a thrilling leap through cross-border technology investment”[5]. Investors need to pay close attention to the production progress of the company’s photoresist project, the progress of customer certification, as well as the measured efficiency of perovskite R&D and the dynamics of partners.

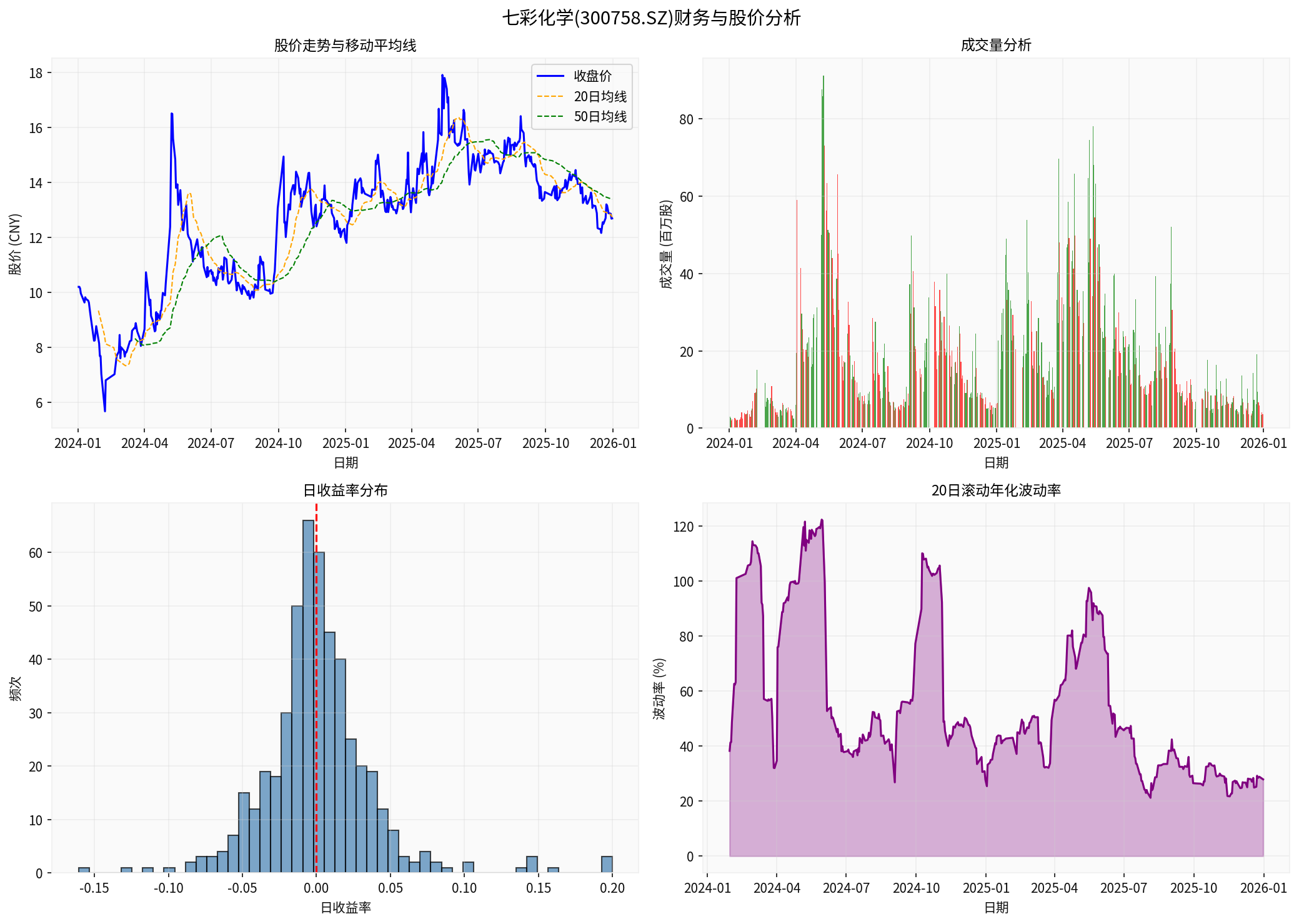

The chart above shows Qicai Chemical’s stock price trend, trading volume, yield distribution, and volatility analysis from 2024 to 2025. It can be seen from the chart that the company’s stock price experienced significant fluctuations in 2024, with an annualized volatility of up to 60.14%, reflecting the market’s sensitive reaction to the company’s transformation expectations.

The chart above analyzes Qicai Chemical’s R&D investment and transformation support capabilities from four dimensions:

- R&D expense ratio trend (below 3.3% in most quarters)

- Comparison of R&D expenses and net profit (R&D investment is eroded by net profit)

- Analysis of R&D demand of each business segment (highest R&D demand for photoresist and perovskite solar cells)

- Comprehensive score of technological breakthrough support capability (below the passing line in multiple dimensions)

[0] Jinling API - Qicai Chemical (300758.SZ) Company Overview and Financial Data

[1] Everbright Securities - Rapid Expansion of Mature Processes by Mainland Wafer Foundries, Domestic Photoresist Enterprises Face Major Opportunities (2022)

[2] SZSE Interactive Platform - Qicai Chemical Investor Q&A (2025)

[3] Qicai Chemical 2024 Annual Report

[4] Qicai Chemical 2024 Semi-Annual Report

[5] Eastmoney - Hidden Champion in Photoresist, the Only Undervalued Leading Player in the Scarce Perovskite Solar Cell Sector, Institutions Heavily Position Themselves (January 2026)

[6] Jinling AI - Qicai Chemical R&D Investment and Cross-Border Transformation Analysis Model

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.