In-Depth Analysis Report on Market Manipulation Suspicions Surrounding Maiwei Co., Ltd. (300751)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

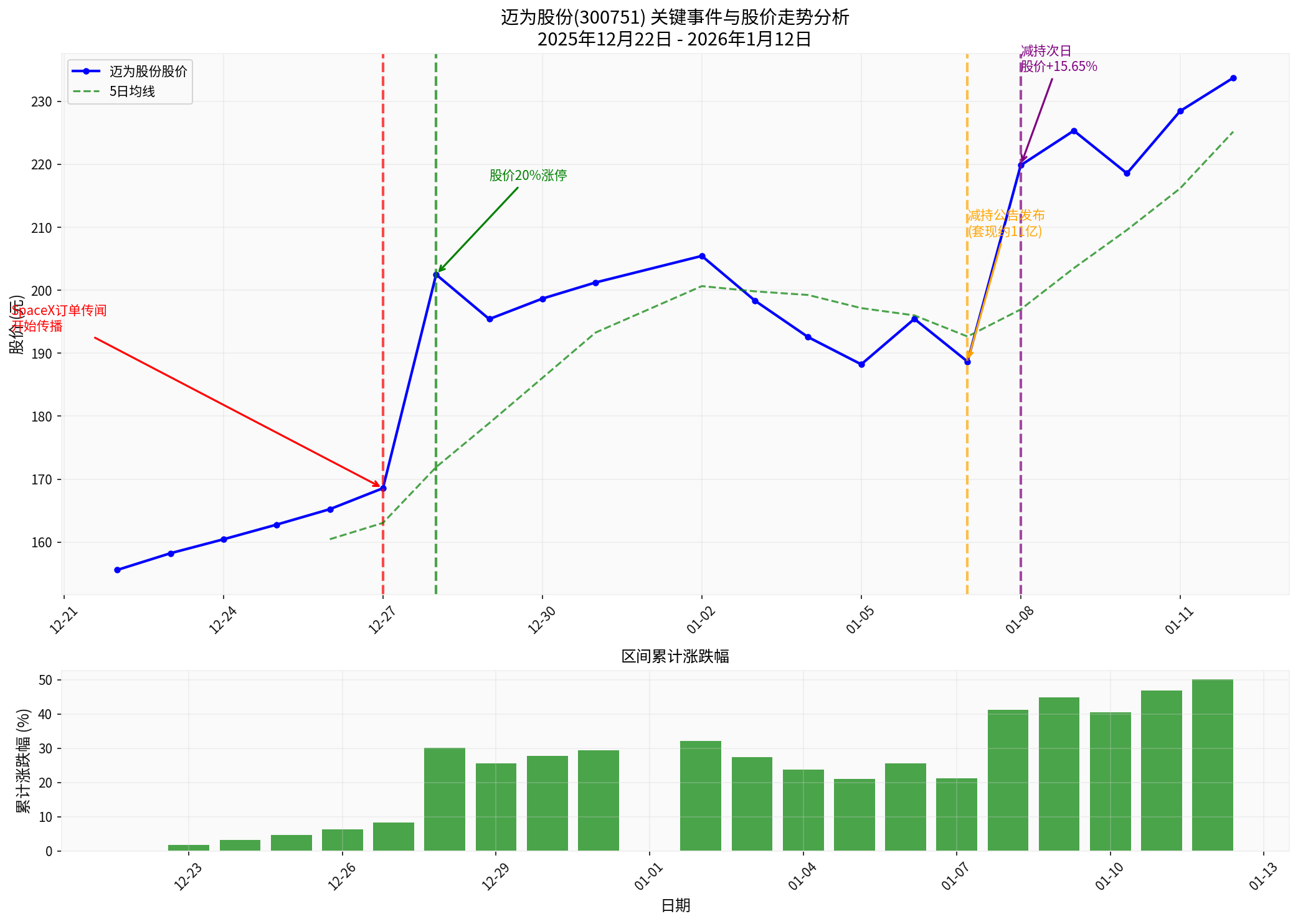

Based on comprehensive information from multiple sources, Maiwei Co., Ltd. has been involved in two major market events:

- Origin Time: On the evening of December 27, 2025, rumors began to circulate intensively on investor communities such as Eastmoney and Snowball

- Core Content: Claiming that Maiwei Co., Ltd. has secured a SpaceX order for HJT equipment worth approximately USD 500 million, corresponding to an annual heterojunction production capacity of about 7GW

- Subsequent Development: On January 8, 2026, another rumor emerged stating “SpaceX will start factory inspection trips next week, with Maiwei Co., Ltd. as the first stop”

- Announcement Time: On the evening of January 7, 2026

- Disposal Entities: Controlling shareholder Zhou Jian and related person Wang Zhenggen

- Disposal Quantity: A total of no more than 5.4 million shares, accounting for approximately 1.94% of the total share capital

- Cash Proceeds: Approximately RMB 1.1 billion

| Date | Event | Stock Price Performance | Trading Volume |

|---|---|---|---|

| 2025-12-27 | SpaceX rumors began to circulate | - | - |

| 2025-12-28 | Rumors intensified | 20% daily limit increase | Significant volume surge |

| 2026-01-07 | Share disposal announcement released | Closed lower | - |

| 2026-01-08 | Trading day after the disposal announcement | Surged 15.65%, approaching the daily limit | RMB 4.792 billion |

From December 22, 2025, to January 12, 2026, the stock price of Maiwei Co., Ltd. rose from RMB 155.58 to RMB 233.73, with a

According to a report from media outlet “Gantanhang”, the company has never issued an official clarification or verification regarding the major market rumors, maintaining a silent stance. The report stated: “As a leading space photovoltaic equipment company in the eyes of investors, Maiwei Co., Ltd. should give investors a clear stance—Is it true or false?”[1]

- The rumors first appeared in investor communities in the form of research posts in a “brokerage tone”, released through non-official channels[1]

- When the media contacted the relevant company, the latter clearly stated that “it has not received any notification from SpaceX”[1]

- The subsequent factory inspection rumor was commented as “extremely unprofessionally fabricated, far inferior to the level of the author of polysilicon rumors”[1]

The actual controllers planned to cash out approximately RMB 1.1 billion when the stock price was in a historical high range, and the share disposal time window was chosen after the rumors intensified, during the most euphoric phase of market sentiment[2].

| Evaluation Dimension | Risk Level | Explanation |

|---|---|---|

| Timeliness of Information Disclosure | High Risk | Failed to promptly clarify major rumors |

| Timing Correlation | High Risk | High correlation between rumors and share disposal plan |

| Abnormality of Market Reaction | High Risk | Stock price surged after release of negative news |

| Credibility of Rumors | Low Risk | Lack of official confirmation, suspicious source |

- Potential Information Manipulation: Unverified major order rumors were intensively spread on social media, driving a short-term surge in the stock price

- Potential Insider Trading for Share Disposal: The timing of the actual controllers’ share disposal highly coincides with the peak of market sentiment

- Potential Collusion in Stock Hype: Maintained silence during the intensification of major rumors, suspected of colluding in market hype to cash out at high prices

- Information Verification: Investors should maintain a prudent attitude towards unofficially confirmed market rumors, avoiding chasing rising prices and selling on dips

- Compliance Attention: It is recommended to pay attention to whether regulators will launch investigations or inquiries into this incident in the future

- Risk Control: Considering the stock’s huge short-term increase (over 114% in the past 3 months[0]), investors should pay attention to the risk of a pullback from high levels

[0] Jinling AI - Real-Time Quotes and Market Data of Maiwei Co., Ltd.

[1] Gantanhang Technology - “Maiwei Co., Ltd., Did You Really Secure a SpaceX Order?” (https://m.sohu.com/a/974957356_121323879)

[2] Public Securities Journal - “Stock Price Surged 15.65% in a Day, Maiwei Co., Ltd.‘s Actual Controllers’ Disposal Plan Failed to Halt the Uptrend” (https://www.163.com/dy/article/KIPH2RVB0519BOCB.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.