In-Depth Analysis of the Mao Geping Family's Share Reduction Incident and the Beauty IP Business Model

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected information, I will provide you with a systematic and comprehensive financial analysis report.

On the evening of January 6, 2026, Mao Geping Cosmetics Co., Ltd. (Stock Code: 01318.HK) released a share reduction announcement that attracted widespread market attention. A total of 6 shareholders, including controlling shareholder and Executive Director Mao Geping, Wang Liqun (Mao Geping’s spouse), Mao Niping (Mao Geping’s elder sister), Mao Huiping (Mao Geping’s elder sister), Wang Lihua (Wang Liqun’s younger brother), and Executive Director Song Hongquan, plan to collectively reduce their holdings of no more than 17.2 million H shares of the company through block trading within the next 6 months, accounting for 3.51% of the company’s total issued shares. Based on the closing price of HK$82 per share on that day, the scale of the share reduction can reach up to HK$1.41 billion[1][2][3].

The announcement clearly discloses that the proceeds from the share reduction will be used for, but not limited to, investment in beauty-related industry chains and ‘improving personal lives’[1]. This reason for the share reduction has sparked considerable controversy in the capital market, as members of the Mao Geping family chose to cash out a large sum despite already receiving high salaries and dividends from the company.

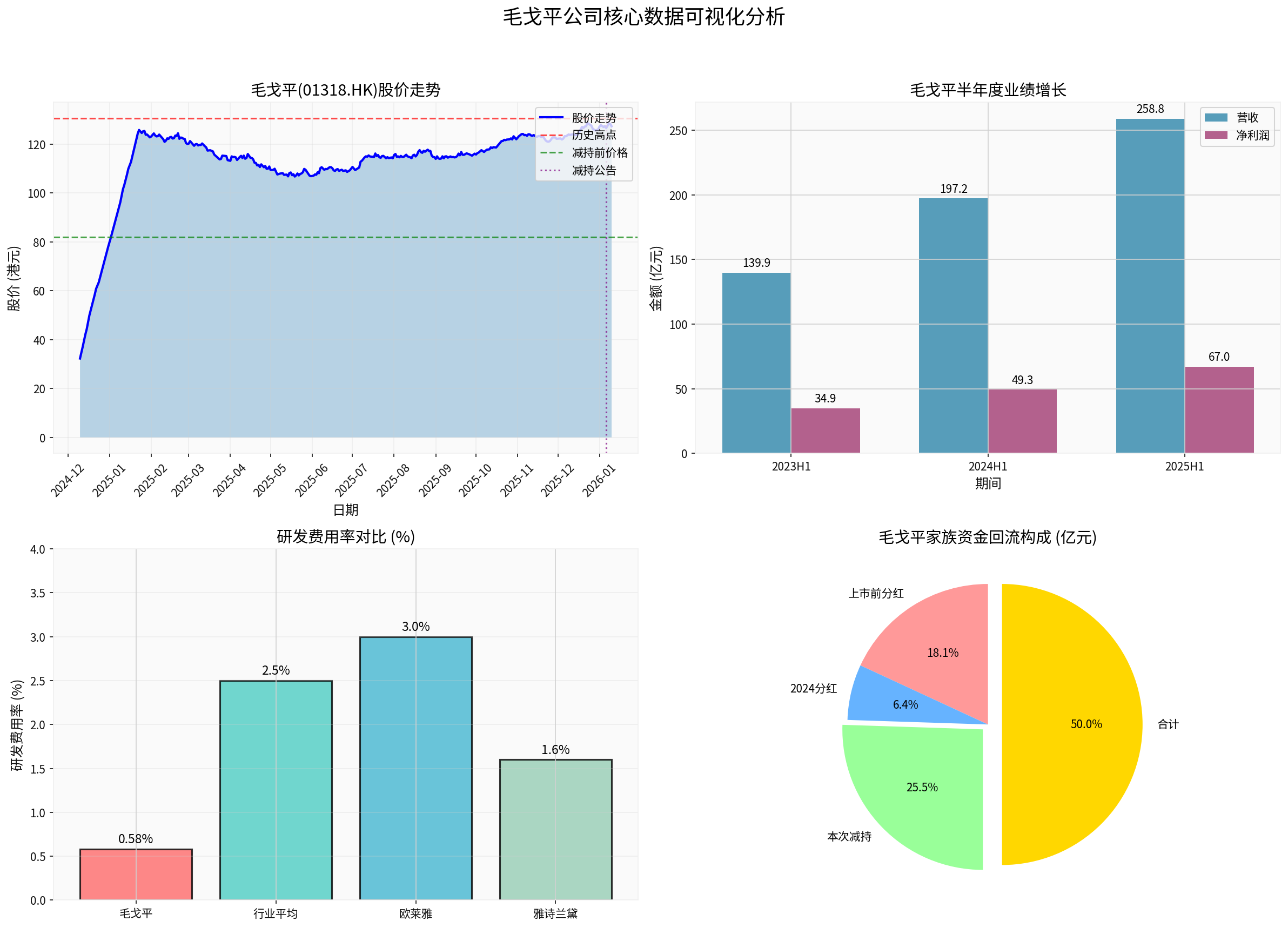

Mao Geping was successfully listed on the Hong Kong Stock Exchange on December 10, 2024, with an issue price of HK$29.8 per share, becoming the ‘first domestic makeup stock on the Hong Kong Stock Exchange’. After listing, the company’s stock price performed strongly, surging to HK$130.6 per share in June 2025, with a total market value exceeding HK$62.4 billion, earning it the nickname ‘Beauty Moutai’ among investors[1][2].

However, the good times did not last. Since then, the stock price has entered a volatile downward trend. As of before the release of the share reduction announcement (January 6, 2026), the stock price had fallen to around HK$82, a drop of nearly 40% from its peak, with a market value evaporation of approximately HK$19.3 billion[2][3]. It is worth noting that this share reduction came exactly one month after the lifting of restricted shares, sparking numerous market doubts about this ‘precisely timed’ move.

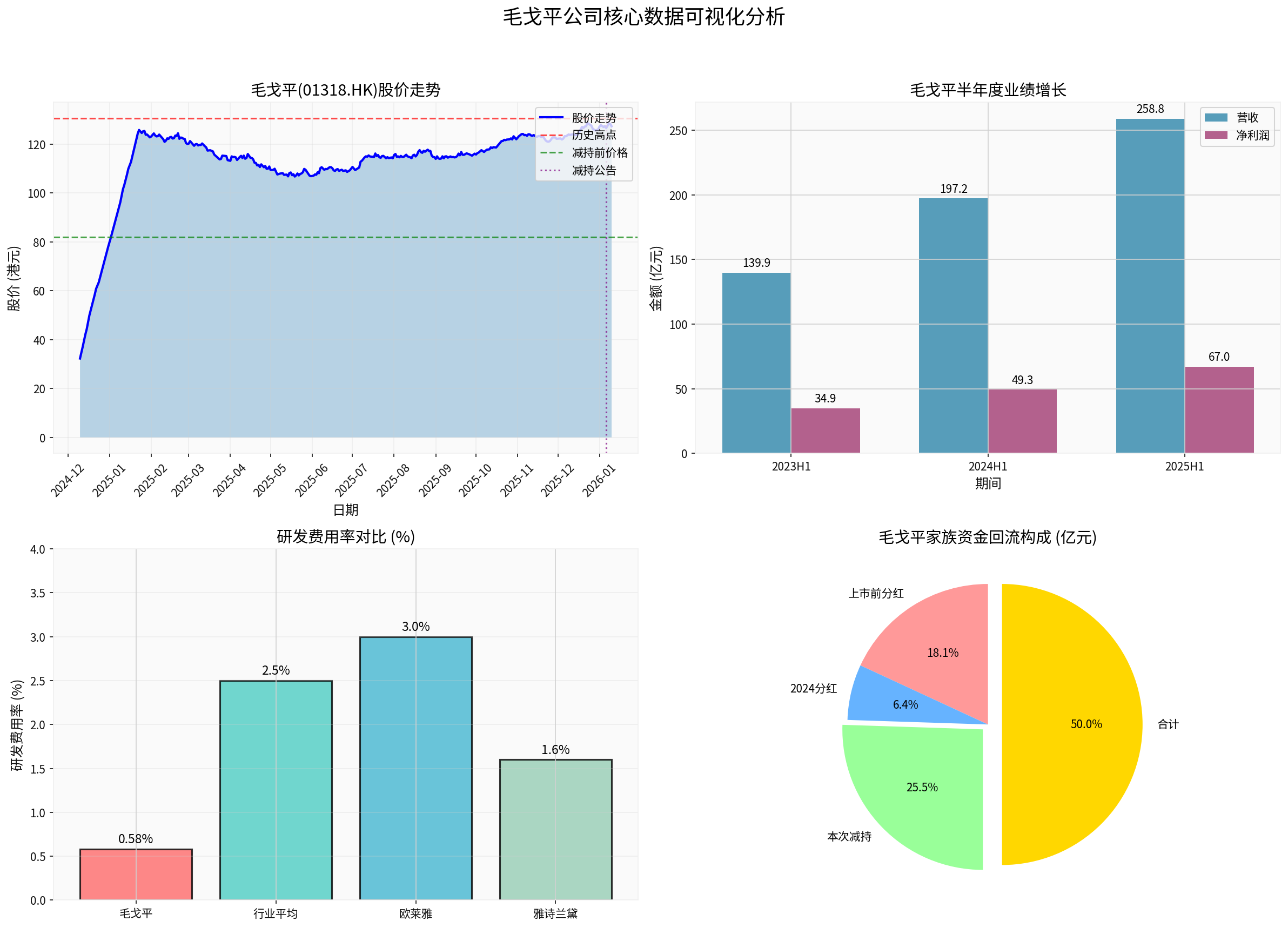

Despite the company’s stock price rising against the trend by 7.26% to close at HK$87.95, with a market value of HK$43.11 billion, after the share reduction news broke, marginal changes in the company’s fundamentals deserve attention. In the first half of 2025, the company achieved operating revenue of RMB 2.588 billion, a year-on-year increase of 31.28%; net profit reached RMB 670 million, a year-on-year increase of 36.11%[1]. Although this growth rate remains relatively fast, it has slowed down compared to previous periods. From January to June 2024, the company’s total revenue increased by 41% year-on-year, and net profit increased by 41% year-on-year, with equally strong performance in the same period in 2023[1].

From a comparison of semi-annual performance, the company’s revenue increased from RMB 1.399 billion in the first half of 2023 to RMB 2.588 billion in the first half of 2025, and net profit increased from RMB 349 million to RMB 670 million, maintaining a high compound growth rate. However, the gradual slowdown in growth has added a hint of uncertainty to the market’s judgment of the company’s future growth potential[1][4].

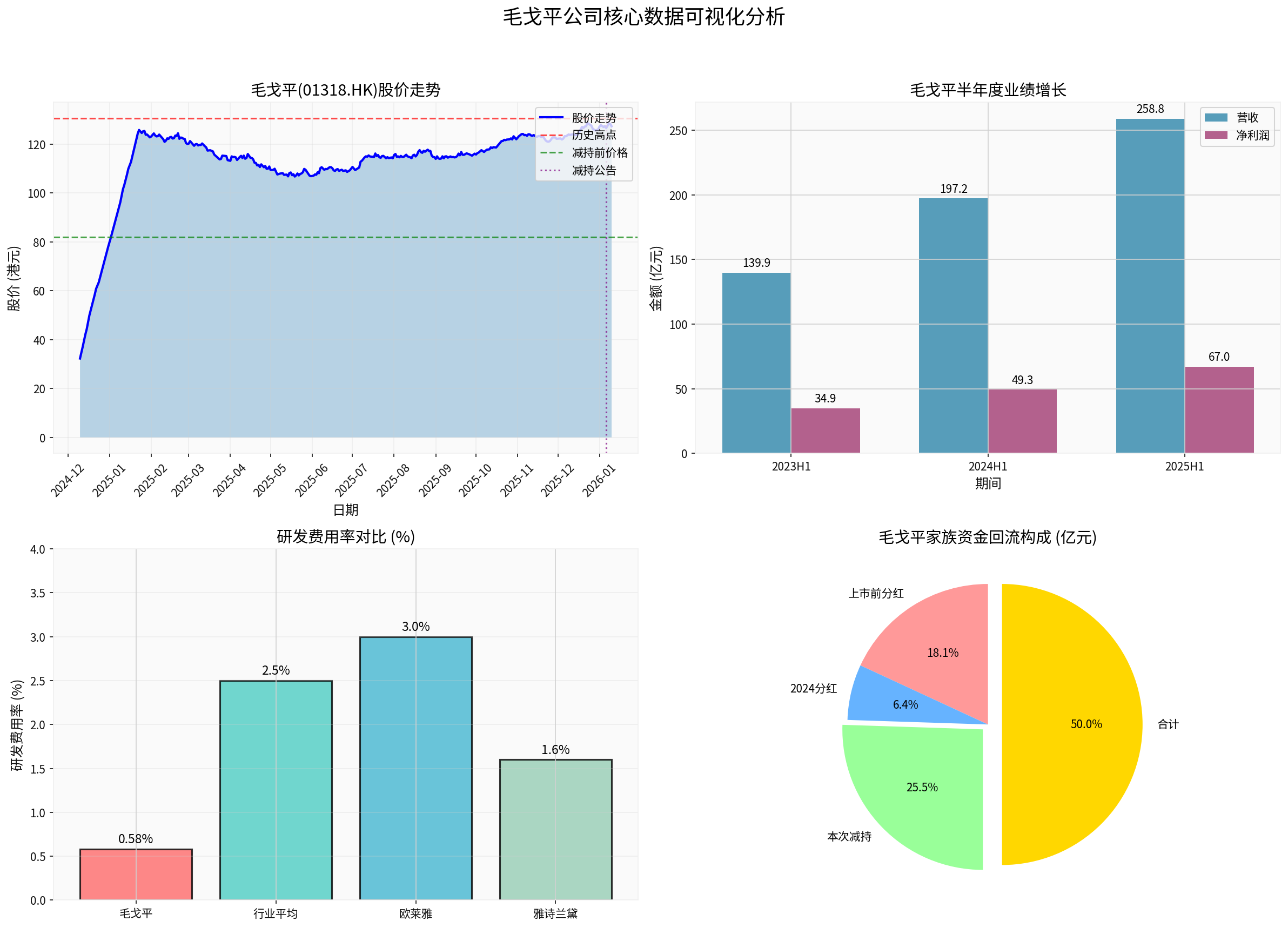

The cash-out behavior of the Mao Geping family is not the first time. Before listing, the company conducted two large-scale dividend distributions: a dividend of RMB 500 million in February 2024 and another RMB 500 million in April, totaling RMB 1 billion. Based on the fact that founder Mao Geping and his family members held nearly 90% of the shares at that time, the vast majority of the dividends went to the family[1][2]. After listing, the company distributed another dividend of RMB 353 million in 2024, with family members taking about RMB 250 million according to their shareholding ratios.

If the dividends from the two years and the cash-out from this share reduction are combined, the Mao family has received more than RMB 2 billion in capital returns from the company[3]. This dual cash-out model of ‘dividend + share reduction’ has sparked investor doubts about the company’s governance and shareholder return policies.

The family members on the share reduction list all hold key positions within the company, with compensation levels at the top of the industry. According to 2024 financial report data, Mao Geping’s annual salary is as high as RMB 6.534 million, President Song Hongquan’s is RMB 5.282 million, the annual salaries of the two elder sisters Mao Niping and Mao Huiping both exceed RMB 4 million, and even Wang Lihua, the brother-in-law with the ‘lowest’ annual salary, can earn RMB 1.469 million[2].

For comparison, Hou Juncheng, Chairman of Proya, a leading A-share beauty company, had an annual salary of only RMB 3.15 million in 2024. This means that the compensation of Mao Geping’s family members is generally higher than that of executives in the same industry[2]. Against the background of high salaries and high dividends, the share reduction reason of ‘improving lives’ seems unconvincing.

It is worth noting that among the 6 executive directors participating in the share reduction, except for President Song Hongquan, the other 5 are all close relatives of Mao Geping: spouse Wang Liqun, elder sisters Mao Niping and Mao Huiping, and brother-in-law Wang Lihua[2][3]. This ‘whole family mobilization’ style of share reduction is relatively rare among listed companies, reflecting the strong family influence in the company’s governance structure and the potential differences in interest demands between public shareholders and family shareholders.

Mao Geping’s business model has significant differentiated characteristics, with its core barrier lying in the scarce IP endorsement of founder Mao Geping as China’s ‘Magic Makeup Artist’ and his profound understanding of Eastern aesthetics[5][6]. According to a research report from Zheshang Securities, Mao Geping is the only domestic beauty brand to enter the forefront of the high-end beauty camp. Based on 2023 retail sales (excluding personal care companies), Mao Geping Co., Ltd. ranks No. 14 in China’s high-end beauty market, making it the only Chinese company among the top 15 high-end beauty groups; the Mao Geping brand ranks No. 28 among China’s high-end beauty brands, with a market share of 0.8%[5].

The company’s unique business model is reflected in three dimensions:

From the perspective of key financial indicators, the company’s performance is quite impressive:

| Indicator | 2024 | H1 2025 | Industry Average |

|---|---|---|---|

| Gross Profit Margin | 72.4% | 84.2% | Approximately 65-70% |

| Sales Expense Ratio | 53.9% | 53.1% | Approximately 35-45% |

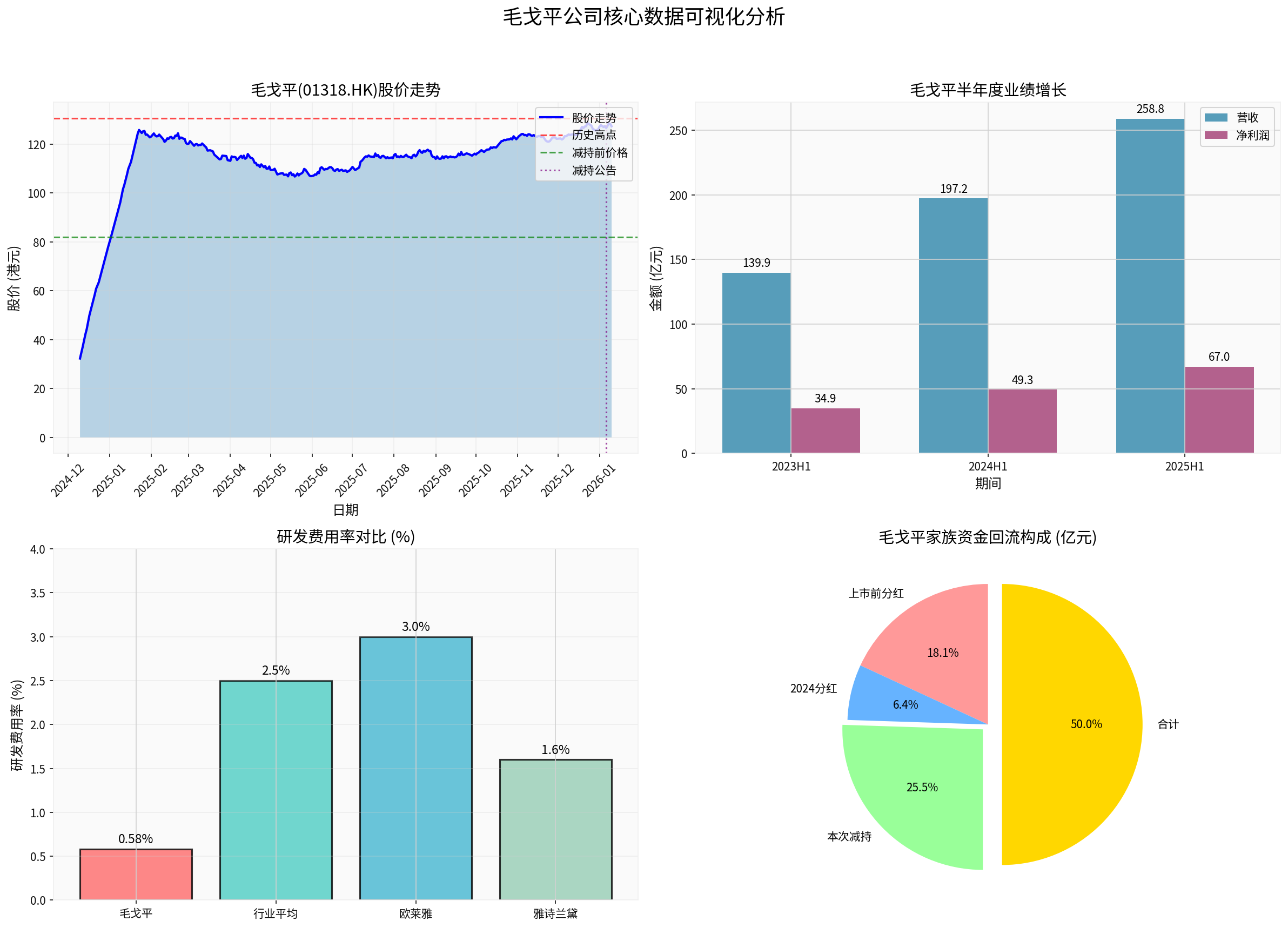

| R&D Expense Ratio | 0.83% | 0.58% | Approximately 2-3% |

| Net Profit Margin | 22.7% | 25.9% | Approximately 10-15% |

Data source: Company announcements and industry research[1][5]

The company’s gross profit margin is as high as 84.2%, far exceeding the industry average, reflecting strong brand premium capability. However, a sales expense ratio of over 53% means that a large amount of revenue is spent on marketing and promotion, while the R&D expense ratio has been consistently below 1%, which has become a focus of market attention[1][5].

Although Mao Geping has achieved remarkable results in the high-end beauty sector, the sustainability of its business model faces multiple challenges:

Despite the above risks, Mao Geping’s business model also has certain supporting factors for sustainability:

The share reduction behavior of the Mao Geping family reflects some problems in corporate governance. First, family members dominate the board of directors, resulting in relatively limited participation and voice for public shareholders. Second, the timing of high dividends and share reduction cash-out has sparked market concerns about interest transfer by major shareholders. Third, the statement of ‘improving personal lives’ as a share reduction reason seems imprudent against the background of the founder family already receiving high returns, which may damage investor confidence[2][3].

It is worth noting that despite the controversy sparked by the share reduction news, the company’s stock price did not plummet after the announcement was released; instead, it rose against the trend by 7.26%[1][2]. Market analysis suggests that this is mainly due to the support of the company’s strong performance and investors’ long-term recognition of Mao Geping’s business model. However, against the background of the stock price halving from its peak and a market value evaporation of nearly HK$20 billion, the urgent cash-out behavior of family members still cast a shadow over market confidence[2].

The Mao Geping case provides important implications for the beauty IP business model:

From a valuation perspective, Mao Geping’s current price-to-earnings ratio (TTM) is approximately 30-40 times, which is within a reasonable range compared to similar domestic beauty companies. The company’s high gross profit margin and net profit margin reflect strong brand premium capability, but slowing growth, insufficient R&D investment, and uncertainties in governance may suppress its valuation[5].

- Risk of negative public opinion related to personal IP

- Risk of continuous decline in department store channels

- Risk of intensified industry competition

- Risk of consumption recovery falling short of expectations

- Risk of declining product competitiveness due to insufficient R&D investment

- Risk of market confidence fluctuations caused by corporate governance and major shareholder cash-outs[5]

- Continued rising trend of domestic beauty brands

- Continuous expansion of the high-end consumer market

- Incremental space brought by category diversification

- Positive cycle of channel upgrade and brand strength enhancement[5][6]

The HK$1.41 billion share reduction incident by the Mao Geping family reflects the deep-seated contradiction between personal IP and corporate development in the beauty IP business model. In the short term, although the large-scale cash-out behavior of family members on top of high salaries and dividends is controversial, the company’s strong performance provides certain support for its stock price. In the long term, Mao Geping’s unique business model (personal IP endorsement + in-depth department store channel cultivation + experiential services) has differentiated competitive advantages in the high-endization process of domestic beauty products, but its sustainability faces multiple challenges such as reliance on personal IP, insufficient R&D investment, and single-brand structure.

For investors, it is recommended to pay attention to the following key indicators: changes in R&D expense ratio, progress in brand matrix expansion, optimization of channel structure, and measures to improve corporate governance. Against the backdrop of the rise of domestic beauty brands, Mao Geping’s long-term development potential as the ‘first domestic makeup stock on the Hong Kong Stock Exchange’ is still worthy of follow-up observation, but in the short term, it is necessary to carefully evaluate the impact of the share reduction behavior on market sentiment and valuation.

Whether the title of ‘Beauty Moutai’ can last ultimately depends on the continuous improvement of product strength itself and the standardization of corporate governance structure.

[1] Blue Whale News - “Cash-Out of HK$1.41 Billion! The Mao Geping Family Reduces Holdings in ‘Mao Geping’ for Investment and Personal Life Improvement” (https://wap.eastmoney.com/a/202601073611703432.html)

[2] Sina Finance - “Reducing Holdings by HK$1.4 Billion for ‘Life Improvement’, Mao Geping’s Relatives Cash Out First” (https://finance.sina.com.cn/roll/2026-01-12/doc-inhfzcnx6945444.shtml)

[3] The Paper - “After a Market Value Evaporation of Over HK$19 Billion, the Mao Geping Family ‘Cashes Out’ to Improve Lives” (https://m.thepaper.cn/newsDetail_forward_32343857)

[4] Economic Observer Network - “Mao Geping’s Share Reduction Attracts Market Attention, Sparked Hot Discussion on High-End Beauty Development” (http://www.eeo.com.cn/2026/0108/777870.shtml)

[5] Zheshang Securities - “In-Depth Analysis of Mao Geping Co., Ltd.: Re-Discussing Mao Geping’s Business Model and Core Barriers” (https://pdf.dfcfw.com/pdf/H3_AP202502101642945200_1.pdf)

[6] Ebrun - “Who is Bullish on Mao Geping?” (https://www.ebrun.com/20250422/577946.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.