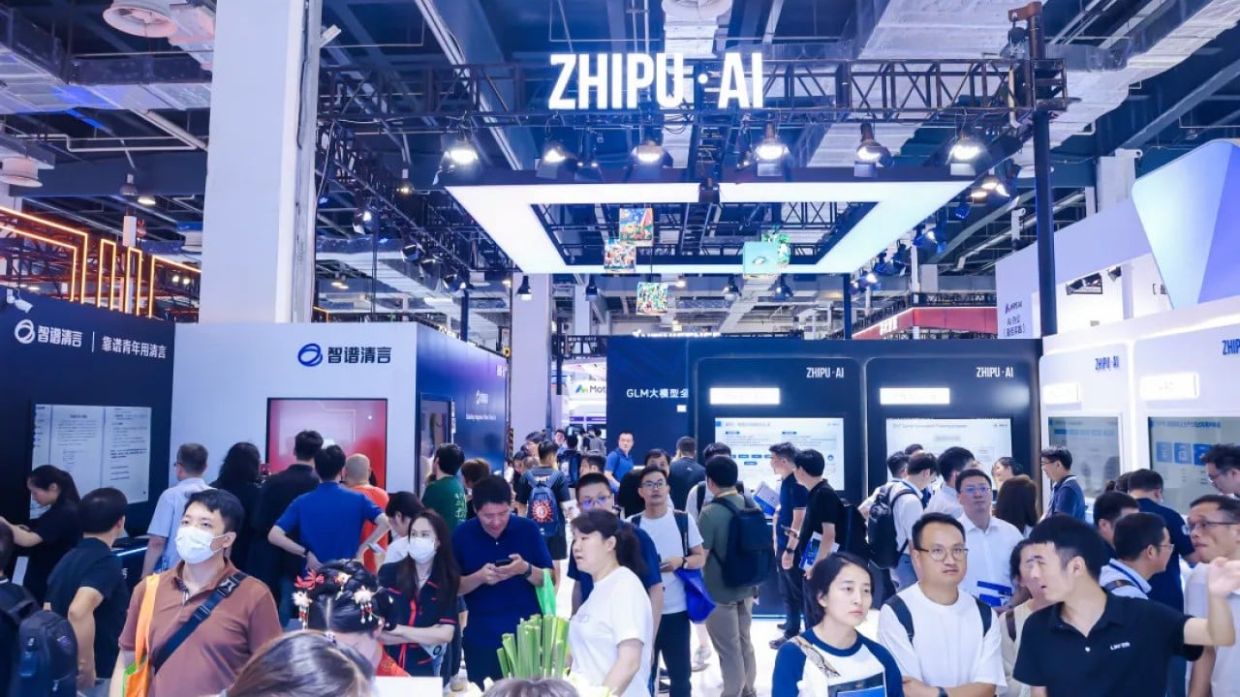

Analysis of Zhipu AI's HKEX Listing Performance and Commercialization Prospects of Large Models

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data, Jinling AI provides you with a professional analysis of Zhipu AI’s listing performance and the commercialization prospects of large models:

Zhipu AI (Stock Code: 02513.HK) officially listed on the

| Indicator | Data |

|---|---|

Offer Price |

HK$116.2 per share |

Opening Price |

HK$120 per share |

Closing Price |

HK$131.5 per share |

First-Day Gain |

+13.17% |

Total Market Capitalization |

HK$57.89 billion |

Funds Raised |

Approximately HK$4.173 billion |

Zhipu has attracted an all-star cornerstone investor lineup, including 11 cornerstone investors such as core state-owned assets in Beijing, leading insurance capital, and large public offering funds, with a total subscription of HK$2.98 billion, accounting for more than 70% of the total issuance[1][3].

As a major shareholder, Meituan’s shareholding corresponds to a market value of HK$2.263 billion, with an unrealized book profit of nearly HK$2 billion. Tech giants such as Tencent and Alibaba also participated in the investment as early as 2023[3].

Zhipu has demonstrated strong revenue growth momentum[4][5]:

| Year | Revenue (RMB 100 million) | YoY Growth Rate |

|---|---|---|

| 2022 | 0.57 | — |

| 2023 | 1.25 | +119% |

| 2024 | 3.12 | +150% |

| 2025H1 | 1.91 | +325% |

Zhipu adopts a dual-track commercialization path of “

| Business Model | Revenue Share (2024) | Description |

|---|---|---|

Local Deployment |

84.5% | Provides customized solutions for government and enterprise customers |

Cloud MaaS |

15.5% | API calls, enterprise services |

As of 2025, Zhipu has empowered

Despite rapid revenue growth, Zhipu still faces sustained losses[4][6]:

| Year | Net Loss (RMB 100 million) |

|---|---|

| 2022 | 1.44 |

| 2023 | 7.88 |

| 2024 | 29.58 |

| 2025H1 | 23.58 |

- Massive R&D Investment: In 2024, R&D expenditure reached RMB 2.195 billion, which ismore than 7 times its revenue

- High Computing Power Costs: In 2024, computing power service fees reached RMB 1.553 billion, accounting for over 70% of R&D expenditure

Based on 2024 revenue, Zhipu ranks

| Indicator | Data | Source |

|---|---|---|

| 2024 Chinese Large Model Development Platform Market Size | RMB 1.69 billion | [7] |

| 2025 Projected Market Size | RMB 2.37 billion | [7] |

| 2030 Projected Market Size | RMB 25 billion | [7] |

| 2025 Chinese AI Large Model Market Size | Expected to exceed RMB 49.5 billion | [8] |

There are currently two main commercialization paths[6]:

| Path | Representative Enterprises | Characteristics |

|---|---|---|

B-end Services |

Zhipu | Local deployment for government and enterprise customers, high customer unit price but high customization costs |

C-end Applications |

MiniMax | Global C-end monetization, steep revenue growth but great challenges in user retention |

Zhipu’s B-end model is relatively stable — the 2024 Chinese large language model market size is approximately RMB 5.3 billion, of which

| Challenge | Specific Performance |

|---|---|

High Costs |

The training cost of a 100-billion-parameter model ranges from RMB 300 million to RMB 500 million; customers recognize the effectiveness of DeepSeek but are cost-sensitive[9] |

Data Bottlenecks |

Enterprise data is scattered, lack of dataset construction from an AI perspective, and insufficient high-quality industry corpora[9] |

Insufficient Engineering Capabilities |

Implementation requires solving issues such as full-system full-link, software-hardware integration, and large-scale customization[9] |

Cognitive Bias |

Business leaders have overly high expectations for AI, while technical teams are concerned about implementation[9] |

- General-Purpose Large Models: Zhipu, Moonshot AI, etc., continue to invest in basic model R&D

- Vertical Domain Models: 01.AI, Baichuan Intelligence shift to industry applications and vertical domains

- On-Device Models: Moonshot AI, Juxing Star bet on deep thinking and on-device deployment[3]

Liu Debing, Chairman of Zhipu Huazhang, said: “Open source and commercialization are symbiotic, not mutually exclusive.” The ecological prosperity brought by open source will eventually be converted into commercial users, and it is expected that when AI becomes social infrastructure in the future, it will contain

- MaaS Platformization: Transition from local deployment to cloud API calls

- Agent: From passive response to active planning, becoming the next-generation technological high ground

- Multimodal Fusion: From “stitching-style” to “native multimodal”[7]

- First-Mover Advantage in the Market: As the “world’s first large model stock”, Zhipu has established significant brand awareness and customer base

- Technological Barriers: Backed by technology transfer from Tsinghua University, the GLM series models complete a base iteration every 2-3 months[1]

- Policy Support: AI is a national strategic emerging industry, enjoying policy dividends

- High Revenue Growth: Three-year CAGR of over 130%, verifying commercial feasibility

- Sustained Loss Risk: R&D investment continues to increase, and the loss expands faster than revenue growth

- Customer Concentration Issue: The top five customers account for over 40% of revenue, and there is a “yearly replacement” characteristic (no overlapping customers)[6]

- Intensified Competition: Tech giants such as ByteDance and Alibaba continue to increase investment in large model businesses

- Valuation Pressure: The HK$57.89 billion market capitalization corresponds to high expectations, requiring continuous verification of commercialization capabilities

According to Frost & Sullivan data, Zhipu ranks first among independent general-purpose large model developers, but its market share is only 6.6%, indicating that the industry as a whole is still highly fragmented[4]. Regarding the competition of cutting-edge models, HSBC Research believes that high sunk costs will lead to market rationalization, eventually forming an oligopolistic pattern dominated by a few giants and coexisting with small professional players[10].

Zhipu AI delivered a strong performance on its first day of listing (+13.17%), reflecting the market’s high recognition of the “world’s first large model stock” and optimism about the long-term value of the AI track. However, the commercialization of large models is still in the early exploration stage, and

From the perspective of commercialization prospects:

- Short-Term (1-2 Years): Zhipu will continue to promote the dual-track strategy of “MaaS + Local Deployment”, focusing on increasing the proportion of cloud deployment, with the goal of raising API business revenue to 50%

- Mid-Term (3-5 Years): With the improvement of technological maturity, cost reduction, and accumulation of industry data, large-scale AI implementation is expected to accelerate

- Long-Term: Under the vision of AI becoming social infrastructure, a trillion-level market space is promising, but structural challenges such as costs, data, and engineering need to be addressed

For investors, Zhipu AI represents

[1] Securities Times - “World’s First Large Model Stock” Zhipu Exceeds HK$57 Billion in Market Capitalization on Its First Listing Day (https://www.stcn.com/article/detail/3580246.html)

[2] Sina Finance - Zhipu AI Surges 13.17% on Its First Listing Day (https://finance.sina.com.cn/roll/2026-01-08/doc-inhfreqi3630259.shtml)

[3] Time Weekly - The World’s First Large Model Stock Is Born! Zhipu Surges 13.17% on Its First Listing Day (https://cn.investing.com/news/stock-market-news/article-3156519)

[4] Securities Times - Zhipu Spints to Become the “World’s First Large Model Stock” (https://www.stcn.com/article/detail/3550275.html)

[5] OFweek - Zhipu and MiniMax Compete for the “First Large Model Stock” (https://m.ofweek.com/ai/2025-12/ART-201712-8420-30677284.html)

[6] The Paper - RMB 176.5 Billion, Capital Frenzy Over Two Large Model Leaders (https://m.thepaper.cn/newsDetail_forward_32351566)

[7] Volcengine - Research Report on the Latest Developments of AI Large Models (November 2025 Issue) (https://developer.volcengine.com/articles/7577300596110295078)

[8] CSDN - 2025 In-Depth Report on the AI Large Model Industry (https://deepseek.csdn.net/68649d8fa6db534ba2b581b1.html)

[9] Securities Times - Where Will the AI Industry Go in the Next Decade? (https://www.stcn.com/article/detail/3497925.html)

[10] Wall Street CN - Six Key Issues in the Early Stage of the AI Cycle (https://wallstreetcn.com/articles/3762835)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.