In-Depth Analysis Report on the Photoresist Project of Qicai Chemical (300758.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data, I will conduct a systematic and comprehensive analysis of Qicai Chemical’s photoresist project.

The “Technical Transformation Project for 2,000 Tons/Year Photosensitive Intermediates and 600 Tons/Year High-Performance Photoresist Series Products” undertaken by a subsidiary of Qicai Chemical has made substantial progress. This project is mainly used to produce photosensitizer raw materials, one of the components of photoresist, and has now achieved mass production and external sales[1]. This marks the company’s official entry into the commercialization stage from the R&D stage in the photoresist field.

According to the latest financial data, the company has received photoresist-related orders totaling RMB 5.8708 million, a year-on-year increase of 12.05%, indicating that the products have gained initial market recognition and started to contribute to revenue[2]. However, judging from the order scale, it is still in the early stage of market expansion.

The technical barriers in the photoresist industry are mainly reflected in the following aspects. First is the complexity of formulations. Photoresist products need to be customized according to different application requirements, with a wide variety of product categories. Minor differences in the proportion of raw materials in the formula will directly affect the performance of the photoresist, and these formulas are difficult to replicate through reverse engineering[3]. This makes it difficult for new entrants to break through technical barriers in a short period of time.

The upstream raw material market is basically monopolized by foreign manufacturers, and the high dependence on imports increases the production cost and supply chain risks of domestic photoresist. Resin, which accounts for the largest proportion (about 50%) of the cost structure of photoresist, has an extremely low localization rate. Especially for resins used in high-end photoresist, almost all of them need to be imported. Additives, accounting for about 35%, face similar difficulties[3].

Photoresist manufacturers need to purchase lithography machines for internal formula testing and adjust formulas based on verification results. However, lithography machines are not only expensive but also limited in quantity, and their supply may be restricted by foreign countries. Especially for EUV lithography machines, only ASML can supply them in batches globally, which further restricts the R&D progress of domestic high-end photoresist[3].

Products need to go through a strict customer verification cycle of more than 2 years. Downstream customers are extremely cautious in selecting photoresist suppliers and usually adopt a certified procurement model[3]. Although Qicai Chemical has achieved mass production, it still needs a long certification cycle to obtain bulk orders from major customers.

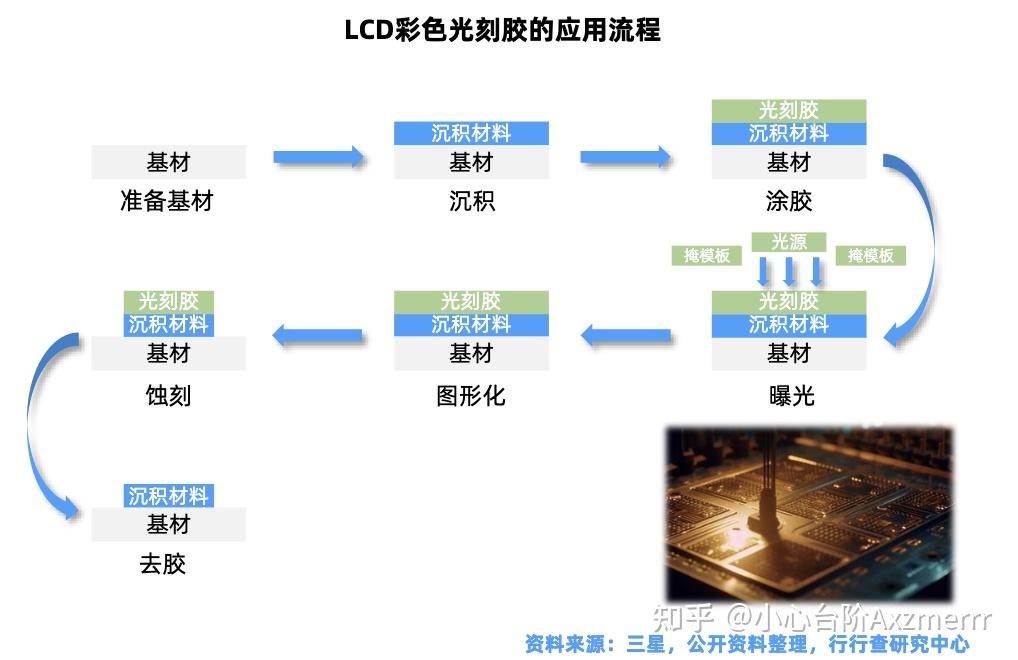

According to industry data, the localization rate of photoresist in various sub-sectors shows obvious stratification: the localization rate of PCB wet film photoresist is about 50%, achieving a relatively high degree of domestic substitution; the localization rate of LCD color photoresist is only 5%; among semiconductor photoresist, the localization rate of G/I-line is about 30% (the highest), KrF is about 5%, ArF is less than 1%, and EUV photoresist has not yet achieved mass production[3].

Qicai Chemical has entered the sub-sector of photosensitive intermediates and photoresist, focusing mainly on photosensitizer raw materials, one of the components of photoresist. From the perspective of technical path, the company has chosen a strategy of entering from upstream materials. The advantages of this strategy are: compared with direct photoresist production, the technical threshold is relatively controllable; the downstream application scope is wider; and it has synergistic effects with the company’s original fine chemical business[2].

Against the background of Sino-US trade frictions and Japan’s restrictions on photoresist exports to South Korea, domestic substitution of photoresist has risen to a national strategic demand. Photoresist, which usually has a shelf life of less than 6 months, cannot be stocked in large quantities, making supply chain security and independent controllability a top priority, which provides a rare window of opportunity for domestic enterprises to realize domestic substitution[3].

In the first three quarters of 2025, the company’s net profit attributable to parent shareholders was RMB 73.3886 million, a year-on-year decrease of 38.96%[2]. The main reason for the sharp decline in net profit is that the company is in a period of strategic investment, and has stocked up a large amount of “provisions” for the photoresist and perovskite projects — the book value of inventory reached RMB 421 million, a year-on-year increase of 11.05%, hitting a historical high. The company’s net sales margin was only 6.90%, a sharp year-on-year decline of 36.76%, indicating certain pressure on cost control and product pricing[2].

The company’s current credit impairment loss was -RMB 0.2707 million (the negative sign represents a reversal), indicating that while the company is fully developing new businesses, it is still optimizing the financial risk control of its traditional businesses. In addition, the company’s asset-liability ratio is at a controllable level, and its financial status is relatively stable[0].

The company’s current price-to-earnings ratio (TTM) is 69.25 times, and the price-to-book ratio is 3.02 times. Its valuation is relatively high in the chemical industry, which mainly reflects the market’s growth expectations for the company’s photoresist business[0].

The value of Qicai Chemical is entirely tied to the success of the two “future stories”: photoresist and perovskite. If successful, it will leap to become a technology giant; if failed, it may be dragged down by huge investments. The core of tracking this company lies not in quarterly profit figures, but in the production progress and customer certification progress of its subsidiary’s photoresist project[2].

The photoresist photosensitizer sector that Qicai Chemical has entered does have high technical barriers, mainly reflected in: the accumulation of formulation know-how, the supply security of upstream raw materials, the acquisition of lithography machine verification equipment, and the strict certification cycle of downstream customers. However, compared with the most high-end ArF/EUV photoresist, the technical threshold of photosensitizers is relatively controllable, which is one of the reasons why the company was able to achieve mass production first[3].

The company’s “cross-border technological revolution” strategy has both risks and opportunities. On the one hand, the company has technical accumulation in fine chemicals, which has certain synergistic effects with the photoresist business; on the other hand, the photoresist industry is highly competitive, requiring continuous technical investment and customer expansion. It is recommended that investors focus on: the customer certification progress of photoresist products, order growth, and the progress of raw material localization.

[0] Jinling API - Company Profile and Financial Data of Qicai Chemical (300758.SZ)

[1] Sina Finance - “Technical Transformation Project for 600 Tons/Year High-Performance Photoresist Series Products Undertaken by Subsidiary Has Achieved Mass Production and External Sales” (https://finance.sina.com.cn/7x24/2025-12-16/doc-inhazaxc9825838.shtml)

[2] East Money - “Hidden Champion in Photoresist, the Only Undervalued Leading Enterprise in Perovskite Batteries, Institutional Investors Heavily Increase Positions” (https://caifuhao.eastmoney.com/news/20260112114639475796830)

[3] Yuanzhan Huiku - “2025 Photoresist Localization Analysis Report: Supply Chain Breakthrough Behind the RMB 15.2 Billion Chinese Market” (https://www.baogaobox.com/insights/251205000023486.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.