In-Depth Analysis Report on the Impact of the Expansion of China's Commercial Real Estate REITs

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Now, based on the collected data and information, I will prepare a systematic and comprehensive analysis report for you.

On December 31, 2024, the China Securities Regulatory Commission (CSRC) officially released the Announcement on Launching the Pilot Program for Commercial Real Estate Investment Trusts, formally including commercial properties such as office buildings and hotels into the investment scope of public REITs [1]. This policy marks a major leap for China’s public REITs market from the infrastructure sector to the commercial real estate sector. Drawing on the development experience of mature global markets, commercial properties such as commercial complexes, commercial retail properties, commercial office buildings, and hotels are important types of underlying assets for REITs. With a stock scale of up to 40 trillion yuan, China’s commercial real estate has an inherent need to revitalize assets and broaden equity financing channels through REITs [2].

Supporting policies have been optimized simultaneously, with the review period shortened from 30 days to 20 days and the interval for secondary offerings shortened to 6 months. These measures have significantly improved the issuance efficiency and flexibility of REITs products [3]. According to monitoring data from Cushman & Wakefield, as of the fourth quarter of 2025, the total stock of high-quality office buildings in the four first-tier cities of Beijing, Shanghai, Guangzhou, and Shenzhen reached 47.6 million square meters. The launch of commercial real estate REITs provides a new financing and exit channel for enterprises holding a large number of high-quality commercial office properties [1].

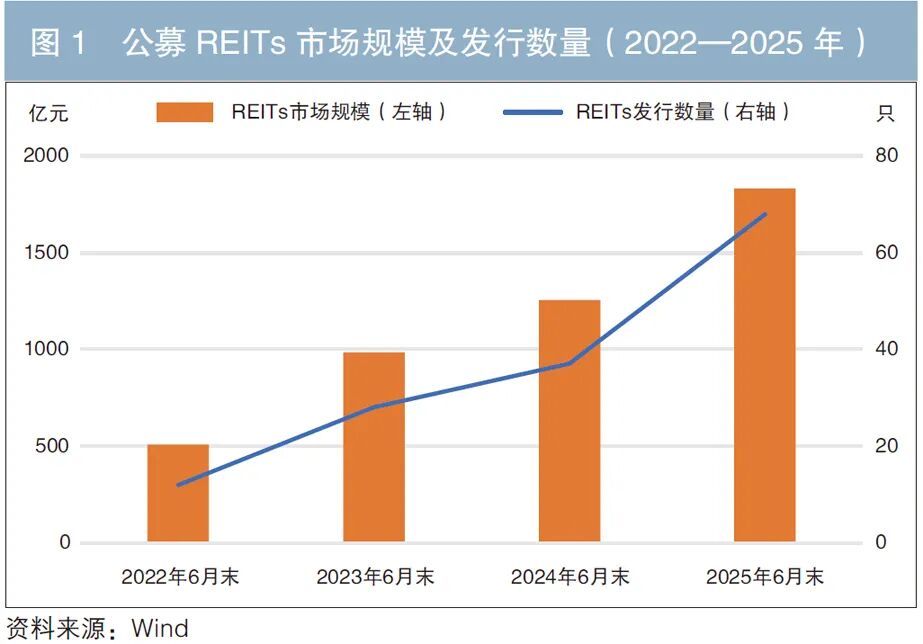

As of December 27, 2025, 78 REITs products have been listed on the Shanghai and Shenzhen Stock Exchanges, with a total financing amount of 209.9 billion yuan and a total market value of 219.9 billion yuan [2]. 2025 has become a landmark year for public REITs to shift from “regular issuance” to “high-quality development”, with 20 new issuances and 5 secondary offerings throughout the year, raising a total of 47.335 billion yuan [3]. Notably, China Shipping Commercial REIT managed by China Asset Management set a record of 320 times oversubscription, reflecting the strong market demand for high-quality commercial REITs assets [3].

In terms of market operation, the CSI REITs Total Return Index has risen by 19% since 2024, and REITs have gradually become an important category of assets for allocation [2]. In a low-interest rate environment, as an important tool for diversified allocation, the value of REITs in asset allocation will be further highlighted.

The proportion of institutional investors in the current public REITs market continues to rise. As of the first half of 2025, the average proportion of institutional investors reached 97.21%, an increase of 0.8 percentage points compared to the end of 2024 [4]. In terms of investor type distribution, securities firms account for 46.35%, insurance institutions account for 23.27%, and industrial capital accounts for 19.73% [4]. The participation of securities firms has further increased, with a preference for equity-type sectors with high distribution rates, while insurance institutions favor assets with stable operations and steady cash flows.

| Investor Type | Proportion | Preference Characteristics |

|---|---|---|

| Securities Firms | 46.35% | Equity-type assets, high distribution rate assets |

| Insurance Institutions | 23.27% | Steady operation, stable cash flow assets |

| Industrial Capital | 19.73% | Strategic synergy, long-term holding |

The position scale of leading institutions continues to expand. As of the first half of 2025, the China Life group held positions exceeding 3 billion yuan, while leading securities firms such as Guotai Haitong, CITIC, CITIC Construction Investment, and CICC held positions of 5.76 billion yuan, 3.44 billion yuan, 3.27 billion yuan, and 3.22 billion yuan respectively [4].

The new policy focuses on guiding medium- and long-term funds such as insurance funds and social security funds to enter the market on the capital demand side, promoting the inclusion of REITs in the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect targets, and planning to enrich the REITs index system and innovative products such as ETFs [5]. The influx of medium- and long-term funds will promote the growth of REITs from “niche products” to a popular asset class, strengthening the depth and resilience of the market. In addition, the policy also proposes studying the establishment of flexible yield requirements linked to risk-free interest rates, optimizing the issuance pricing mechanism, and regulating inquiry and placement behaviors, aiming to ensure the rationality and fairness of market pricing [5].

The launch of commercial real estate REITs marks a critical window period for the real estate industry to transform from a “development logic” to an “operation logic”. A researcher from a banking institution pointed out that securitization is not only a change in financing methods but also a reconstruction of the asset value discovery mechanism [1]. Through tools such as REITs and private equity funds, the cash flow and operational efficiency performance of real estate will be directly converted into the basis for capital market pricing, which also puts forward higher requirements for the asset operation capabilities of asset holders [1].

According to estimates by securities firms, the stock scale of China’s commercial real estate can reach 40 trillion yuan. The launch of the pilot program will effectively revitalize such idle assets, unblocking the “investment-financing-operation-exit” value chain for real estate enterprises, while optimizing their cash flow, reducing liabilities, and preventing systemic risks in the industry [5]. This expansion accurately aligns with the national strategy of “revitalizing stock assets and optimizing incremental assets”. Through market-oriented securitization means, it injects financial vitality into “dormant assets”, which not only helps real estate enterprises alleviate debt pressure and achieve light-asset transformation but also provides high-quality equity asset supply for the capital market [5].

The current commercial real estate market shows obvious structural differentiation characteristics. Taking Shanghai as an example, in 2025, the Shanghai Grade A office building market saw a supply surge of 850,000 square meters, but the net absorption volume was only 401,800 square meters, a year-on-year decrease of 33.4% compared to 2024. The average vacancy rate of Grade A office buildings in the city rose to 23.4%, and the average rent dropped to 6.62 yuan per square meter per day [6]. The Beijing market is also under pressure. In the fourth quarter of 2025, the vacancy rate of Grade A office buildings in Beijing was 15.2%, with rent falling 5.6% month-on-month and 16.3% year-on-year [7].

| Property Type | Liquidity | Valuation Support | Possibility of Being Included in REITs |

|---|---|---|---|

| Office Buildings in Core Business Districts | Strong | Stable rent, high occupancy rate | High |

| Office Buildings in Secondary Areas | Weak | High vacancy rate, downward pressure on rent | Medium |

| High-Quality Shopping Malls | Strong | Large differences in operational capabilities | High |

| Hotel Assets | Medium | Large cyclical fluctuations | Caution |

The launch of commercial real estate REITs will reshape the valuation logic of commercial real estate. Xuxixi, Head of Investment and Capital Markets Operations for China at JLL, stated that the further expansion of China’s public REITs market will promote the accelerated transformation of the commercial real estate industry towards a refined asset management model, and bring liquidity premiums to projects with core locations and outstanding operational resilience [7].

From international experience, the pricing of commercial real estate in countries with mature REITs markets is usually based on core indicators such as NOI (Net Operating Income) capitalization rate and distribution rate. The policy proposes studying the establishment of flexible yield requirements linked to risk-free interest rates and optimizing the issuance pricing mechanism, which will promote the alignment of domestic commercial real estate valuation with international standards [5]. Public REITs have obvious advantages in valuation and pricing, with prominent strategic value of linking light and heavy assets. Combined with the domestic demand for revitalizing trillions of yuan in stock assets, the launch of commercial real estate REITs is expected to stimulate long-term growth vitality in the industry [5].

Based on the above analysis, institutional investors can follow the following framework when allocating commercial real estate REITs:

| Priority | Asset Type | Key Indicators | Risk-Return Characteristics |

|---|---|---|---|

| ★★★★★ | High-Quality Shopping Malls | Occupancy rate ≥95%, stable annual transaction volume | Stable cash flow, strong counter-cyclicality |

| ★★★★☆ | Office Buildings in Core Business Districts | Vacancy rate <15%, high-quality tenants | Good liquidity, strong valuation support |

| ★★★☆☆ | Regional Commercial and Trade Complexes | Stable annual transaction volume, good operational efficiency | Good growth potential, location needs attention |

| ★★☆☆☆ | Community Commerce | Strong counter-cyclicality, stable customer base | Limited scale, average liquidity |

| ★☆☆☆☆ | Hotel Assets | Large cyclical fluctuations, complex operations | Need caution, high professional threshold |

Public REITs have both the “bond-like” feature of stable dividends and the “stock-like” feature affected by capital expectations. When investing in REITs, it is still necessary to remain vigilant about the fundamentals of assets and attach importance to the evaluation and pricing of medium- and long-term assets [4]. The following risk factors need to be focused on:

- Liquidity Risk:REITs products have relatively weak liquidity; need to pay attention to market capacity and trading activity

- Interest Rate Risk:REITs valuation is negatively correlated with interest rates; may come under pressure during interest rate hike cycles

- Operational Risk:The operational efficiency of underlying assets directly affects distribution income

- Market Risk:Short-term market sentiment may cause prices to deviate from intrinsic value

The expansion of China’s commercial real estate REITs to include office buildings and hotel assets is an important practice of the capital market serving the real economy, and has a far-reaching impact on the asset allocation of institutional investors and the reassessment of commercial real estate value:

-

Institutional Investor Level:Expands asset allocation boundaries, provides a diversification tool with low correlation to stocks and bonds, matches the allocation needs of medium- and long-term funds such as insurance funds, and promotes the transformation of REITs from “niche products” to a popular asset class.

-

Commercial Real Estate Level:Reconstructs the asset value discovery mechanism, promotes the transformation of the industry from a “high-leverage, high-turnover” development model to a refined operation model of “investment-financing-operation-exit”, and brings liquidity premiums to core high-quality assets.

-

Market Ecosystem Level:Builds a three-dimensional upgrading framework of “expansion + capital introduction + product innovation”, providing financial support for the revitalization of stock assets and industry transformation.

Looking ahead to 2026 and beyond, the commercial real estate REITs market is expected to show the following development trends:

- Continuous Expansion of Market Scale:It is expected that the first batch of commercial real estate REITs products will be issued and launched in 2026, and the market will enter a stage of regular development

- Optimization of Investor Structure:With the inclusion of REITs in the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, as well as product innovations such as REITs ETFs, the investor group will become more diversified

- Increased Importance of Operational Capabilities:The refined operational capabilities of asset holders will become core competitiveness, promoting high-quality development of the industry

- Internationalization of Valuation System:Gradual alignment with valuation methods in mature international markets, improving market pricing efficiency and fairness

As a “golden bridge” connecting capital and physical assets, commercial real estate REITs will play a more important role in building a modern infrastructure system and promoting the transformation of new models for real estate development [5].

[1] CLS.com - China’s Public REITs See Explosive Growth: 78 Products Reach a Scale of 220 Billion Yuan (https://www.cls.cn/detail/2249516)

[2] Economic Information Daily - Commercial Real Estate REITs Take Off, Market Accelerates Expansion with Scale Exceeding 200 Billion Yuan (http://jjckb.xinhuanet.com/20260105/ced7df61091e47989ab24e9436944f01/c.html)

[3] Cushman & Wakefield Beijing 2025 Year-End Press Conference - Internal Data

[4] CICC - 2026 REITs Outlook: Navigating New Waters, Uncovering Value (https://www.163.com/dy/article/KIQMG3PL05568W0A.html)

[5] Sina Finance - New Policy Leads High-Quality Development: Commercial Real Estate REITs “Break the Ice” to Support the Real Economy (https://finance.sina.com.cn/money/bond/2026-01-07/doc-inhfnvir2040788.shtml)

[6] Phoenix Net Real Estate - Cushman & Wakefield 2025 Year-End Review: Supply-Demand Game in Shanghai Office Market, Steady Growth in Retail Market Consumption (https://fengcx.com/news/detail/57268926.shtml)

[7] Sina Finance - Vacancy Rate of Grade A Office Buildings in Beijing Decreased by 0.3 Percentage Points Month-on-Month in the Fourth Quarter of 2025 (https://finance.sina.com.cn/jjxw/2026-01-10/doc-inhfvnnq0343185.shtml)

Report Compiled by: Jinling AI Financial Analysis Team

Data Cut-Off Date: January 13, 2026

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.