Impact Analysis of Duolingo CFO Matt Skaruppa's Departure

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected information, I will provide you with a comprehensive analysis report on the impact of Duolingo CFO Matt Skaruppa’s departure.

According to the 8-K filing submitted by Duolingo on January 12, 2026, the company’s Chief Financial Officer Matt Skaruppa will step down after nearly six years in office. Skaruppa joined Duolingo in early 2020 and was one of the core executives who helped the company complete its IPO in July 2021. He will serve as CFO until February 23, 2026, after which he will transition to a consultant role to support a smooth leadership transition [1][2].

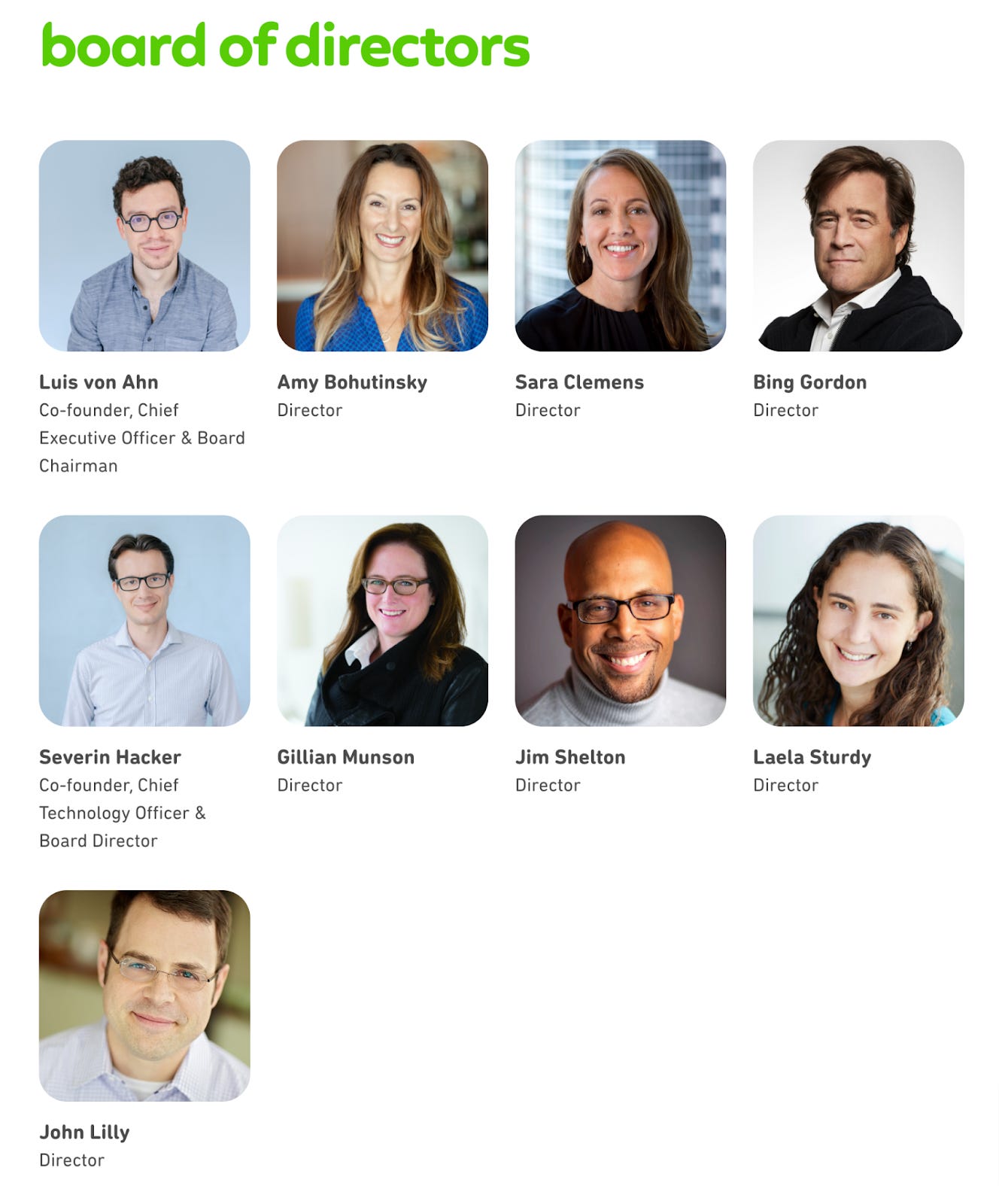

The new CFO will be succeeded by board member Gillian Munson, whose appointment will take effect on February 23, 2026. Munson has served as a Duolingo board member since 2019 and chairs the Audit, Risk and Compliance Committee [1].

- Skaruppa will remain in office until late February to ensure a complete handover with the new CFO

- The arrangement to transition to a consultant role avoids the loss of key knowledge

- Munson, as an existing board member, already has an in-depth understanding of the company’s strategy

- CEO Luis von Ahn publicly expressed high trust in Munson: “I look forward to working with her in this new role. I believe she is the right leader to help us seize opportunities and drive long-term growth” [1]

During Skaruppa’s tenure, Duolingo achieved the following strategic results:

| Strategic Area | Achievements |

|---|---|

IPO and Capital Operations |

Successfully completed listing and established public market financing capabilities |

Revenue Growth |

Delivered financially disciplined growth for six consecutive years |

Profitability |

Transitioned from a cash-burning model to sustainable profitability |

AI Transformation |

Accelerated AI application to achieve personalized courses and user growth |

User Monetization |

Converted strong user engagement into paid subscription revenue |

Munson stated in her announcement: “As a board member, I have had close contact with the leadership team and have a deep understanding of Duolingo’s culture, operational discipline, and growth momentum. Few companies simultaneously possess such high user engagement, strong financial fundamentals, and such far-reaching influence” [1].

Despite the well-planned transition arrangements, the following strategic execution risks remain:

- Munson’s Execution Experience: She previously participated in corporate governance primarily at the board level, and directly assuming the CFO role requires a shift from supervisor to executor

- Reconstruction of Investor Relations: As a new face, she needs to rebuild trust with institutional investors

- Continuity of AI Strategy: Skaruppa played a key role in driving the AI-driven growth strategy, and the new CFO needs to maintain a balance in the pace of AI investment

Duolingo’s stock price has come under significant pressure recently, adding complexity to the CFO departure event:

| Time Period | Stock Price Performance |

|---|---|

| Past Week | -7.80% |

| Past Month | -15.93% |

| Past Three Months | -49.23% |

| Past Six Months | -55.50% |

| Past Year | -47.84% |

The current stock price is $165.26, approaching the 52-week low of $162.23 [3]. The company’s market capitalization is $7.64 billion, down more than 50% from its all-time high.

The initial market reaction following the announcement of the CFO’s departure was relatively mild, with the stock price falling approximately 6.59% on the day. This reaction is within the normal range for the following reasons:

- Advance Announcement: The company provided over one month of transition period, avoiding market shock from an abrupt departure

- Internal Promotion: Selecting an existing board member as the successor sends a signal of stability

- Quarterly Data Support: The concurrently released preliminary Q4 results show approximately 30% growth in daily active users, with bookings meeting expectations [1]

- Analyst consensus rating remains “Buy”, with 13 analysts issuing a Buy recommendation [3]

- Consensus target price is $290, representing 75.5% upside from the current stock price [3]

- Gillian Munson has financial leadership experience in the technology industry (served as CFO of Vimeo and Iora Health) [1]

- The company’s fundamentals remain strong: net profit margin of 40.03%, return on equity (ROE) of 38.57% [3]

- Wells Fargo lowered its target price to $160, indicating a cautious stance from some institutions [4]

- Several executives have recently sold shares (Matt Skaruppa sold approximately $1.62 million worth of stock on January 2, 2025) [5]

- The stock’s performance has significantly lagged the market over the past year (-47.84%)

Gillian Munson has extensive financial leadership experience:

| Company/Institution | Position |

|---|---|

| Duolingo | Board Member, Chair of the Audit, Risk and Compliance Committee (2019-present) |

| Vimeo | Chief Financial Officer |

| Iora Health, Inc. | Chief Financial Officer |

| XO Group Inc. | Chief Financial Officer |

| Union Square Ventures | Leadership Position |

| Allen & Company | Investment Banking Division |

| Symbol Technologies | Executive Position |

| Morgan Stanley | Early Career |

| Phreesia | Current Board Member and Audit Chair [1] |

Munson’s appointment brings the following strategic value to the company:

- Institutional Knowledge: As a six-year board member, she has a deep understanding of the company’s strategic direction, operational model, and corporate culture

- Audit Expertise: Having served as the chair of the Audit Committee for a long time, she is familiar with financial reporting, risk management, and internal controls

- Public Market Experience: She has led capital market affairs for multiple companies, including financial management work at Vimeo

- Industry Network: Her extensive connections in the technology and health technology sectors will facilitate future strategic collaborations

- There is an essential difference between Munson’s previous supervisory role as a director and her executive role as CFO

- She needs to quickly adapt to the transition from “supervisor” to “leader”

- The collaboration chemistry with the management team (especially CEO Luis von Ahn) remains to be verified

Duolingo also released preliminary results for the fourth quarter of 2025 [1]:

- Daily Active User (DAU) Growth: Approximately 30%, demonstrating continued strong user engagement

- Bookings: Reached or slightly exceeded the upper end of the previous guidance range ($329.5 million - $335.5 million)

CEO Luis von Ahn stated: “As we mentioned in our Q3 shareholder letter, we prioritize better teaching and user growth, and we executed well on this strategy in the fourth quarter. While we are pleased with the preliminary results, we plan to continue making meaningful investments in our products, even if this involves short-term trade-offs.”

| Financial Metric | Value | Assessment |

|---|---|---|

| Price-to-Earnings (P/E) Ratio | 19.50x | Relatively Reasonable |

| Price-to-Book (P/B) Ratio | 5.76x | Moderately High |

| Net Profit Margin | 40.03% | Very Healthy |

| Return on Equity (ROE) | 38.57% | Excellent |

| Current Ratio | 2.82x | Financially Robust |

| EV/Operating Cash Flow | 18.45x | Moderate [3] |

There is a significant divergence between the current stock price of $165.26 and analyst target prices:

- Highest Target Price: $460 (KeyBanc)

- Lowest Target Price: $160 (Wells Fargo)

- Consensus Target Price: $290

- Potential Upside: 75.5% [3]

This valuation divergence reflects different market judgments on Duolingo’s growth prospects and the sustainability of its profitability.

| Date | Institution | Rating | Target Price |

|---|---|---|---|

| 2026-01-08 | Wells Fargo | Maintain Underweight | $160 |

| 2026-01-05 | B of A Securities | Upgrade to Buy (from Neutral) | $250 |

| 2025-12-11 | Jefferies | Maintain Hold | $220 |

| 2025-12-03 | DA Davidson | Maintain Neutral | $205 |

| 2025-11-11 | DA Davidson | Maintain Neutral | $300 [3][4] |

- Emphasize AI-driven growth potential

- Believe current valuation is attractive

- Optimistic about the continued effectiveness of the gamification strategy

- Express concern over the slowdown in daily active user growth in the fourth quarter

- Believe valuation still needs further correction

- Question the sustainability of profitability

Analysts have not made strongly negative comments on the CFO transition event itself, which indicates:

- Munson’s qualifications are recognized: Her board experience and financial background are considered qualified

- Focus remains on business fundamentals: Analysts are more concerned with user growth, revenue, and profitability

- Stability of transition arrangements: The orderly handover has reduced uncertainty risks

- Executive Turnover Risk: The departure of key executives may cause short-term fluctuations in strategic execution

- Valuation Correction Risk: In the current market environment, any negative news may trigger further declines in the stock price

- Growth Sustainability Risk: While 30% DAU growth is strong, it has slowed compared to previous growth rates

- Increased Competition Risk: AI-driven language learning tools such as ChatGPT pose new challenges

- Leadership Renewal: Introducing a new perspective may bring optimizations to financial management

- AI Investment Opportunities: Leverage AI to further personalize learning experiences and improve paid conversion rates

- Category Expansion: Growth potential in new areas such as math, chess, and music

- International Market Growth: User growth potential in emerging markets

The impact of Matt Skaruppa’s departure on Duolingo’s strategic execution and investor confidence is generally manageable, for the following reasons:

- Well-planned transition arrangements: The over-one-month transition period and consultant role ensure a smooth handover

- Excellent qualifications of the successor: As a six-year board member, Munson has a deep understanding of the company

- Robust fundamentals: 30% user growth, healthy profit margins, and abundant cash flow

- Analyst consensus remains Buy: Despite significant divergence in target prices, most analysts maintain a positive rating

Investors should pay attention to the following indicators:

- Earnings Release on February 26, 2026: The first earnings conference call after the CFO transition

- Munson’s First Public Appearance: Observe her interactions with analysts and investors

- 2026 Guidance Update: The impact of the new CFO on the full-year performance outlook

- User Growth Trend: Whether DAU growth can be maintained or rebound

For existing investors:

- Hold as the primary strategy: Fundamentals are robust, valuation has corrected significantly, and panic selling is unnecessary

- Monitor transition progress: Closely observe the new CFO’s leadership style and strategic continuity

For potential investors:

- Accumulate on dips: The current stock price is near the 52-week low, providing a favorable entry opportunity

- Dollar-cost average: Given that market volatility may continue, it is recommended to build positions in batches

- Set stop-loss: Considering market uncertainty, it is recommended to set a 10-15% stop-loss level

[1] SEC 8-K Filing - Duolingo CFO Transition (2026-01-12)

https://www.sec.gov/Archives/edgar/data/1562088/000162828026001730/duol-20260108.htm

[2] Yahoo Finance - Duolingo CFO Matt Skaruppa to step down after nearly six years

https://finance.yahoo.com/news/duolingo-cfo-matt-skaruppa-step-122108011.html?.tsrc=rss

[3] Jinling AI - Duolingo Company Profile and Market Data

[0]

[4] Investing.com - Duolingo stock hits 52-week low at 165.42 USD

https://za.investing.com/news/company-news/duolingo-stock-hits-52week-low-at-16542-usd-93CH-4058010

[5] Investing.com - Duolingo CFO Matthew Skaruppa sells $1.62 million in stock

https://www.investing.com/news/insider-trading-news/duolingo-cfo-matthew-skaruppa-sells-162-million-in-stock-93CH-3798008

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.