Strategic Impact Analysis of Tempus' Collaboration with NYU Langone on Cancer Genomics Research

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the in-depth research above, I now present a comprehensive analysis report:

Tempus AI, Inc. (NASDAQ: TEM) announced a multi-year strategic collaboration with NYU Langone Health on January 12, 2026 [1][2]. The core objective of this collaboration is to drive transformation in advanced molecular analysis and data-driven cancer care, with a focus on supporting pan-cancer research at the Molecular Oncology Center under the Perlmutter Cancer Center [1].

The core of this collaboration is the launch of a prospective observational study titled

In addition, the collaboration includes a series of follow-up studies covering:

- Assay validation

- Biomarker discovery

- Biological modeling

- Real-world data analysis

- AI-driven predictive algorithm development [1][2]

| Data Dimension | Value Enhancement | Impact on Competitive Barriers |

|---|---|---|

| Longitudinal Cohort Data | ★★★★★ | High (difficult to replicate) |

| Multi-Cancer Coverage | ★★★★★ | High (breadth and depth) |

| Real-World Evidence | ★★★★☆ | Medium-High (regulatory value) |

As industry analysis points out, Tempus’ advantage lies in its unique

As a top academic medical center in the U.S., NYU Langone Health’s collaboration provides the following [1][2]:

- World-Class Scientific Research Endorsement: The Perlmutter Cancer Center enjoys a high reputation in oncology research

- Accelerated Clinical Validation Channel: New testing methods can be rapidly validated in real clinical settings

- Regulatory Communication Advantage: High-quality real-world data facilitates regulatory communication with the FDA

As stated by Dr. Shridar Ganesan, Director of the Molecular Oncology Center at the Perlmutter Cancer Center, this collaboration will “deepen the understanding of individual cancer biology, guide the application and development of targeted therapies, and evaluate treatment responses and drug resistance” [2].

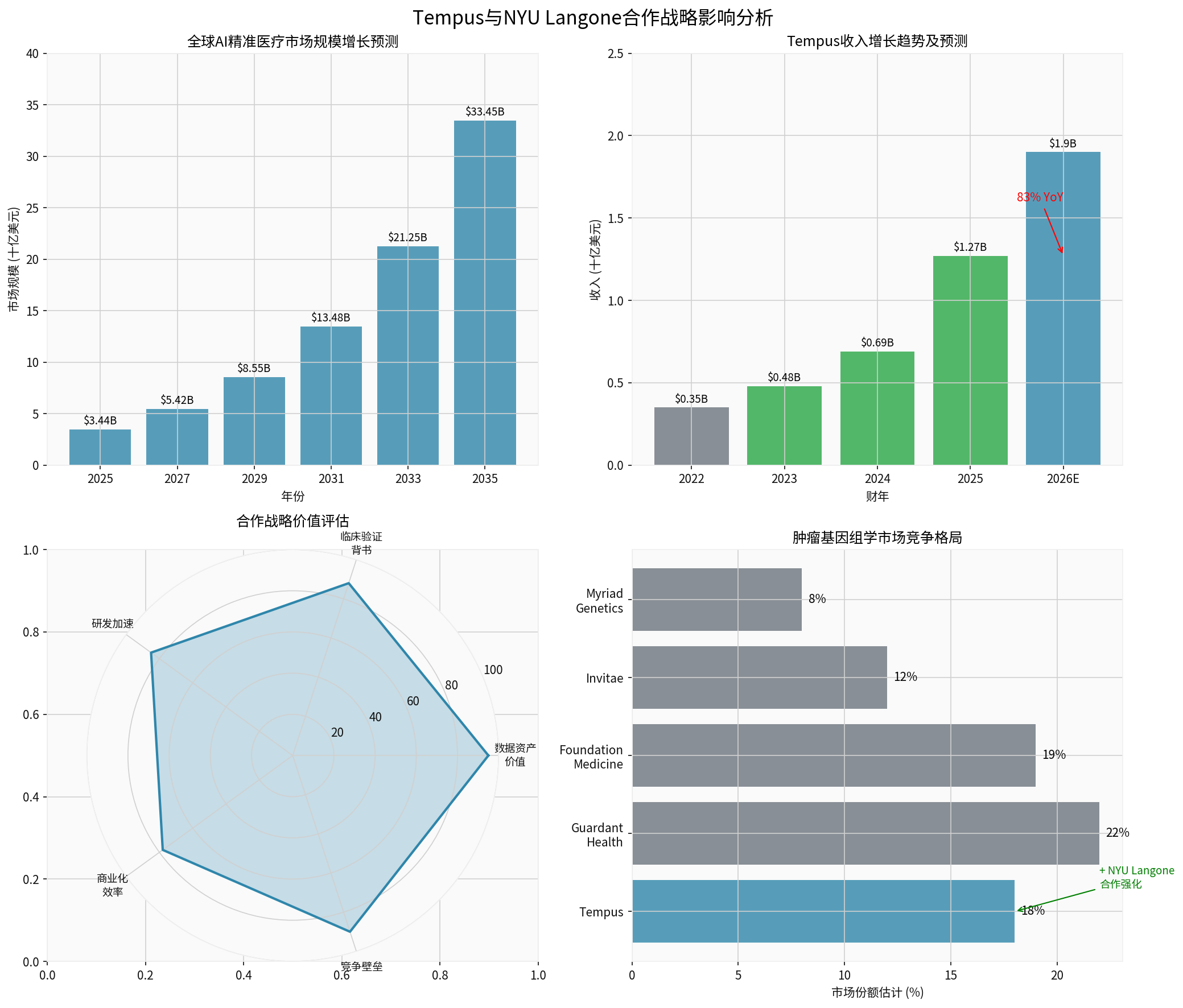

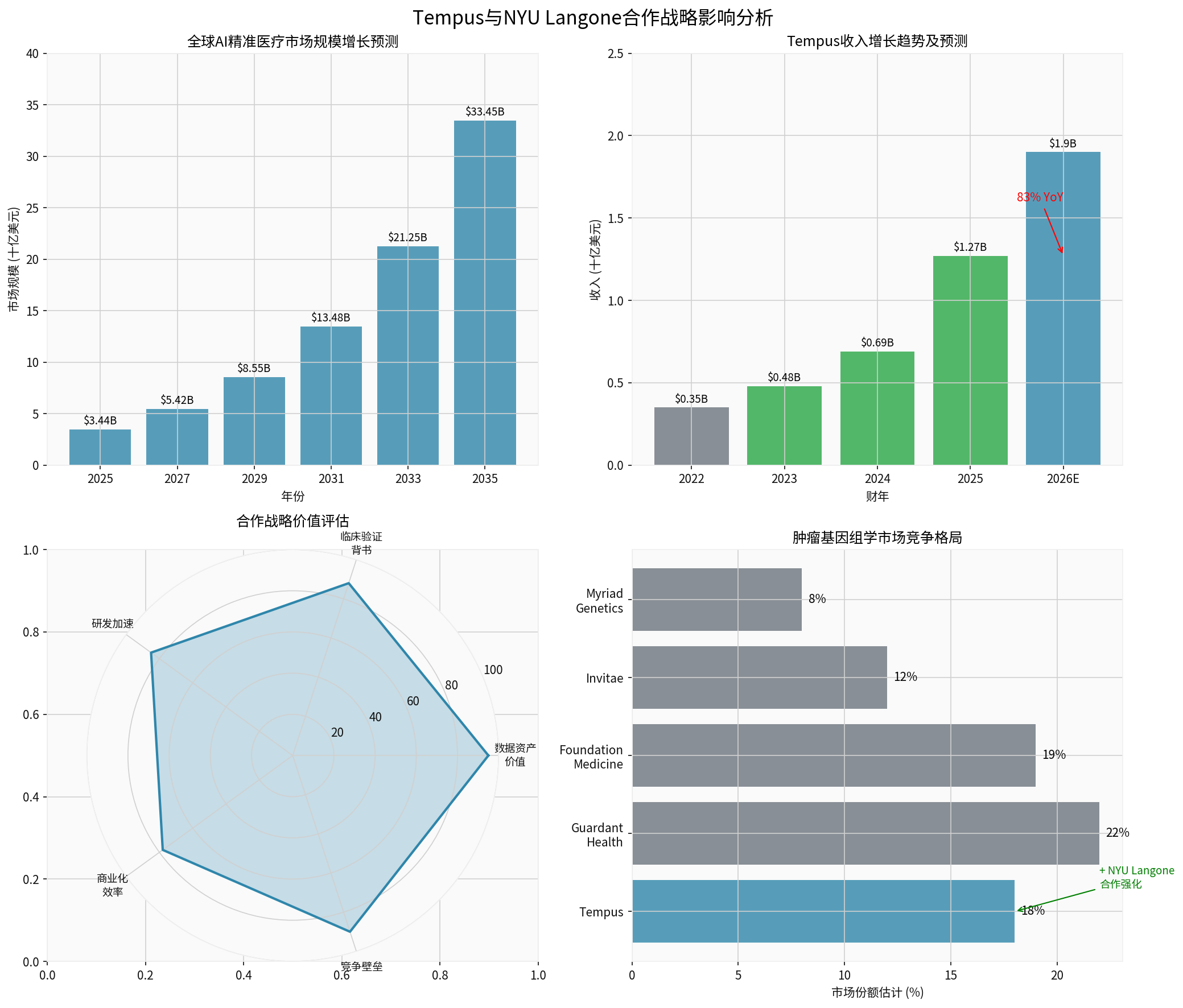

According to market analysis, Tempus’ competitive position in the oncology genomics market is undergoing positive changes:

- Key Competitors(Guardant Health, Foundation Medicine, etc.) may be forced to pursue similar academic collaborations

- Deepened Technical Moat: Longitudinal data gives Tempus’ AI algorithms a sustained accuracy advantage

- Advancement of Platform Strategy: Tempus is transitioning from a pure diagnostic company to a “diagnostics + data + AI” platform [3]

The global AI-powered precision medicine market is in a stage of explosive growth:

- Market Size: Projected to grow from $3.44 billion in 2025 to $33.45 billion in 2035, representing a compound annual growth rate (CAGR) of 25.54% [4][5]

- Oncology Segment: Dominates among all treatment areas, benefiting from rising cancer incidence, increased demand for targeted therapies, and government policy support [4]

- North American Market: Accounts for the largest share, supported by advanced medical infrastructure, a favorable regulatory environment, and substantial R&D investment [5]

Tempus’ 2025 performance provides strong support for its collaboration strategy:

| Financial Indicator | 2025 Actual | YoY Change | Strategic Significance |

|---|---|---|---|

| Total Revenue | $1.27 billion |

+83% | Validates business model feasibility |

| Diagnostic Services Revenue | $955 million | +111% | Dual-drive growth from oncology testing and genetic testing |

| Data & Applications Revenue | $316 million | +31% | Steady growth in data licensing business |

| Total Contract Value (TCV) | > $1.1 billion |

- | Enhances long-term revenue certainty [6] |

Oncology testing volume increased by approximately 26%, and genetic testing volume rose by around 29%, indicating continuous improvement in Tempus’ market penetration [6].

Based on the strategic advantages brought by the collaboration, Tempus’ growth path can be divided into three phases:

┌─────────────────────────────────────────────────────────────────────┐

│ Tempus Long-Term Growth Path │

├─────────────────────────────────────────────────────────────────────┤

│ Short-Term (1-2 Years) │

│ ├── Revenue Growth: 50%+ CAGR for testing services + data licensing │

│ ├── Customer Expansion: Reach 100+ pharma data collaboration clients │

│ │ (currently over 70) │

│ └── Product Line: 2-3 AI diagnostic products receive FDA approval │

├─────────────────────────────────────────────────────────────────────┤

│ Mid-Term (3-5 Years) │

│ ├── Platformization: Establish industry-leading oncology data platform│

│ ├── Globalization: Expand into European and Japanese markets │

│ └── Profitability: Achieve positive operating margin via scale effects│

├─────────────────────────────────────────────────────────────────────┤

│ Long-Term (5-10 Years) │

│ ├── Ecosystem Building: Develop AI-assisted decision-making system │

│ │ covering the entire diagnosis and treatment cycle │

│ ├── Internationalization: Establish presence in key global markets │

│ └── Industry Standard: Become the gold standard for precision medicine│

│ data and analysis │

└─────────────────────────────────────────────────────────────────────┘

Tempus’ core technology assets include the following [3][7]:

| Product/Service | Features | Strategic Value |

|---|---|---|

xT Test |

Next-generation sequencing (NGS) panel that analyzes DNA and whole-transcriptome RNA of solid tumors | Flagship product integrated with AI algorithms to provide treatment recommendations |

xF Test |

Blood-based NGS test that detects circulating tumor DNA | Addresses limitations of invasive biopsies and enables dynamic monitoring |

AI Algorithms |

HRD scoring, MSI testing, tumor origin identification, etc. | Trained on Tempus’ massive dataset, leading in accuracy |

- Data Scale Barrier: Covers approximately 40% of U.S. oncologists, and has accumulated one of the largest clinical-genomic datasets in the industry [3]

- Regulatory First-Mover Advantage: Has obtained FDA approval for some AI algorithms, which new entrants will take years to replicate

- Flywheel Effect: Positive cycle of testing → data → AI → more testing

- Improved Data Quality: Longitudinal data has higher value for AI training than cross-sectional data

- Expanded Clinical Scenarios: The collaboration covers the entire patient treatment journey, resulting in more comprehensive data dimensions

- Accelerated Algorithm Iteration: Real-world feedback enables continuous optimization of AI models

- Competitors such as Guardant Health and Foundation Medicinemay pursue collaborations with similar top academic centers [3]

- Big Tech Companies(Google Health, Microsoft Healthcare) may increase investment in medical AI

- Traditional Diagnostic Companies(Quest, LabCorp) may catch up via mergers and acquisitions

| Risk Type | Specific Performance | Potential Impact |

|---|---|---|

| Profitability | Still in a loss-making state (ROE of -67.96%) | Sustained cash burn may affect long-term development |

| Valuation Pressure | Current P/E ratio of -59.08x, with high market expectations | Missed performance expectations may lead to a stock price pullback |

| Execution Risk | Founder-controlled structure may lead to governance issues | Risk of inconsistency in strategy execution [3] |

- Compliance requirements for data privacy regulations such as HIPAA and GDPR

- Regulatory approval pathways for medical AI algorithms are still evolving

- Uncertainty regarding medical insurance reimbursement policies

| Assessment Dimension | Rating | Explanation |

|---|---|---|

| Strategic Collaboration Value | ★★★★★ | Collaboration with NYU Langone significantly enhances data assets and academic endorsement |

| Market Position | ★★★★☆ | Top 3 player in the oncology genomics field |

| Technical Barriers | ★★★★★ | Integrated AI + data + diagnostics platform is difficult to replicate |

| Growth Potential | ★★★★☆ | Positioned in a high-growth track with enormous market space |

| Profitability | ★★☆☆☆ | Not yet profitable; need to monitor improvement in operating leverage |

- Strong Growth Momentum: 83% year-over-year revenue growth in 2025 validates business model feasibility [6]

- Solid Data Advantage: Collaborations with top institutions like NYU Langone further strengthen competitive barriers

- Promising Track Outlook: AI-powered precision medicine market has a CAGR of over 25%, with Tempus in a favorable competitive position

- Positive Analyst Consensus: 90% of analysts give a Buy rating, with an average target price representing a 30.8% premium over the current price [8]

The current valuation reflects market expectations for high growth; investors should pay attention to the following:

- Whether revenue growth can sustain a 50%+ rate

- When operating losses will narrow to break-even

- Erosion of market share due to changes in the competitive landscape

[1] Business Wire - “Tempus and NYU Langone Health Announce Strategic Collaboration to Advance Precision Oncology” (https://www.businesswire.com/news/home/20260112696916/en/Tempus-and-NYU-Langone-Health-Announce-Strategic-Collaboration-to-Advance-Precision-Oncology)

[2] Yahoo Finance - “Tempus and NYU Langone Health Announce Strategic Collaboration” (https://finance.yahoo.com/news/tempus-nyu-langone-health-announce-133000446.html)

[3] MLQ.ai - “Tempus AI (TEM): At the Crossroads of Diagnostics and Data” (https://mlq.ai/research/tempus-ai-tem-deep-dive/)

[4] Towards Healthcare - “AI in Precision Medicine Market to Climb at 25.54% CAGR till 2035” (https://www.towardshealthcare.com/insights/ai-in-precision-medicine-market-size)

[5] Delveinsight - “AI in Precision Medicine Market Outlook and Forecast to 2032” (https://www.delveinsight.com/report-store/ai-in-precision-medicine-market)

[6] Business Wire - “Tempus Announces Preliminary Fourth Quarter and Full Year 2025 Results” (https://www.businesswire.com/news/home/20260111442047/en/Tempus-Announces-Preliminary-Fourth-Quarter-and-Full-Year-2025-Results)

[7] Emil Hartela - “Tempus AI: deep dive” (https://www.emilhartela.com/p/tempus-ai-deep-dive)

[8] Jinling AI - Company Profile Data (NASDAQ: TEM)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.