Comprehensive Analysis of Sidea Co., Ltd. (301629) Strong Performance: Mid-term Opportunities and Short-term Risks of a Domestic Substitution Leader

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Sidea Co., Ltd. (301629.SZ) has entered the strong stock pool today, with a cumulative increase of 85.41% in the past 6 months, becoming a star target in the semiconductor equipment sector[0]. As the first mainland Chinese enterprise to achieve mass production of 12-inch wafer probers, the company has a significant scarcity advantage in domestic substitution and aligns with the national “Specialized, Sophisticated, Unique, New” (Zhuangjing Texin) strategic development direction. Currently, the technical aspect shows a sideways consolidation pattern, with the KDJ indicator being bullish but approaching the overbought zone. The fundamentals are sound but the valuation is relatively high (PE ratio of 221x). Comprehensive judgment: Short-term adjustment pressure exists, while the mid-term upward logic remains intact. It is recommended to pay attention to layout opportunities around the 20-day moving average.

Sidea Co., Ltd. is a star IPO stock in the 2025 A-share market, with a first-day gain of 202.08%, earning RMB 63,900 per winning lot, ranking among the top five “big profit lot” IPOs of the year[1]. This strong debut made the company a market focus, continuously attracting significant capital attention. The IPO effect combined with high market expectations provides sustained upward momentum for the stock price. It is worth noting that 2025 A-share IPOs showed a hot “zero break” trend, with overall market sentiment being bullish, and technology IPOs in particular being highly sought after by capital.

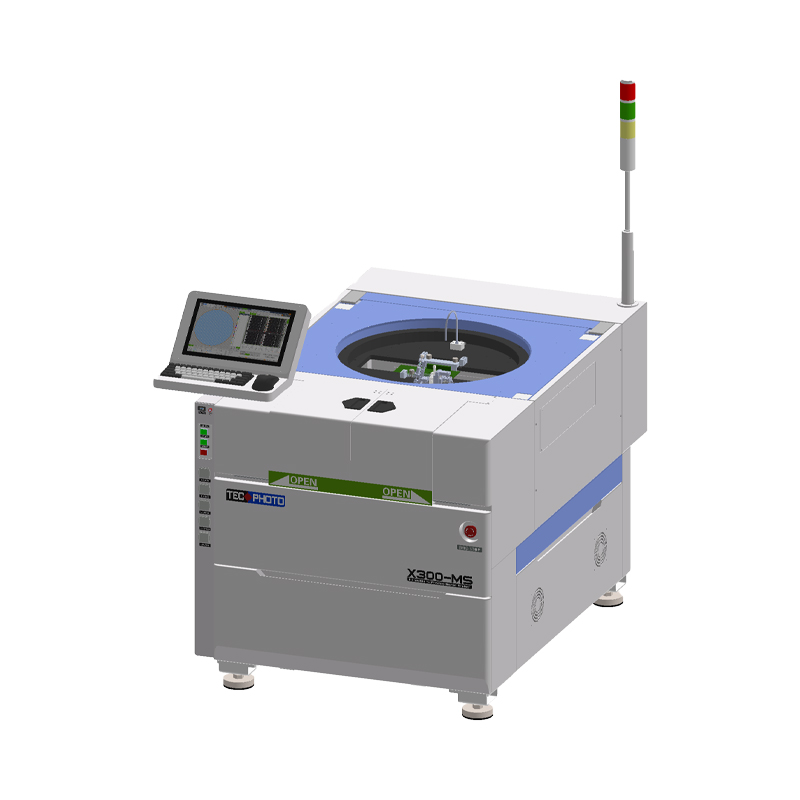

Against the backdrop of Sino-US technological competition, domestic substitution of semiconductor equipment has become a key direction of national strategic development. Founded in 2003, Sidea Co., Ltd. has focused on the semiconductor testing equipment field for over 20 years, and is a leading domestic enterprise in probe testing technology and mass production of wafer probers[2]. The company’s independently developed PT-930 and GT-3000 series wafer probers have successfully achieved industrial application of 12-inch wafer probers, filling a domestic gap. This scarcity theme makes it a core target in the main line of domestic substitution investment in semiconductors, with a unique market position.

The company has been awarded the title of National Key “Little Giant” Enterprise under the “Specialized, Sophisticated, Unique, New” initiative, aligning with national strategic development directions and having expectations of policy support[2]. From an industry perspective, the prosperity of sub-sectors such as memory chips and advanced packaging has increased by about 10%-14%, and the semiconductor equipment sector as a whole is favored by capital[3]. The recovery of industry fundamentals provides a favorable external environment for the company’s performance growth, further strengthening the market’s optimistic expectations for the company’s future development.

From the recent price performance, Sidea Co., Ltd. shows significant strong characteristics. It has a 5-day gain of +10.80%, a 1-month gain of +16.88%, a 3-month gain of +36.80%, and a 6-month gain of as high as 85.41%[0]. The current stock price of RMB 277 is in the high range of the 52-week interval (143.70-305.00), with about 10% upside to the historical high of RMB 305. Although it closed down 2.30% (-RMB 6.52) on the day, the trading volume reached 2.39 million shares, which is 26% higher than the 30-day average volume of 2.02 million shares, indicating strong capital willingness to absorb[0].

| Indicator | Value | Signal Judgment |

|---|---|---|

| KDJ | K:70.6, D:64.1, J:83.8 | Neutral-bullish, approaching overbought zone |

| MACD | No crossover signal | Bullish pattern |

| RSI(14) | Normal range | Not in overbought zone |

| Beta | -1.47 | Negatively correlated with the market, independent trend |

The KDJ indicator shows that the K and D values are in the bullish zone, but the J value reaches 83.8, close to the overbought threshold, suggesting potential short-term adjustment pressure. The MACD indicator maintains a bullish pattern without a death cross signal. RSI is in the normal range and does not issue an overbought warning. It is worth noting that the Beta value is -1.47, indicating that the stock is negatively correlated with the market and has a relatively independent trend, which is common among small and medium-cap growth stocks[0].

The current technical pattern shows a sideways consolidation, with the main price range between RMB 239.19 and RMB 285.64[0]. The 20-day moving average of RMB 239.20 forms an important support level, with the upper resistance level around RMB 285.64. Short-term moving averages are in a bullish arrangement, forming support for the stock price. Comprehensive judgment: There is no obvious trend signal on the technical side, short-term pressure from the resistance level exists, and the mid-term trend remains upward.

Sidea Co., Ltd.'s main business covers the R&D, production, and sales of special semiconductor equipment. Its main products include wafer probers, die probers, AOI equipment (wafer defect inspection), exposure machines (meeting lithography needs for 4-6 inch wafers), and sorters (high-capacity, high-precision products)[2]. The company’s industry position in the prober field is particularly prominent: it is the first mainland Chinese enterprise to achieve industrial application of 12-inch wafer probers, breaking the long-term monopoly of international manufacturers in this field.

From a downstream application perspective, probers are key testing equipment in the semiconductor wafer manufacturing process, used to conduct electrical performance tests on chips on wafers. As semiconductor process nodes continue to shrink, the requirements for the precision and stability of testing equipment are increasing, and the technical threshold has accordingly risen. Sidea Co., Ltd.'s deep accumulation in this field constitutes its core competitive advantage.

From the perspective of financial indicators, the company presents a relatively healthy financial situation. The net profit margin of 13.08% is at a good level, indicating that the company’s products have certain profitability. The current ratio of 5.13 and quick ratio of 3.69 show that the company has very strong short-term solvency and low financial risk[0]. ROE (Return on Equity) of 4.93% is at a medium level, with room for further improvement. It is worth noting that the company shows aggressive accounting characteristics, and the quality of earnings needs continuous attention[0].

Currently, the company’s price-to-earnings (PE) ratio is as high as 221.53x, and the price-to-book (PB) ratio is 9.92x, with a valuation level significantly higher than the industry average[0]. The high valuation reflects the market’s expectations of the company’s high future growth, but it also means that the stock price is more sensitive to underperformance. If market sentiment shifts or the company’s performance growth fails to meet expectations, there is considerable room for valuation compression, and investors need to be alert to the risk of valuation correction.

The continuous expansion of trading volume in recent periods is an important support for Sidea Co., Ltd.'s strong performance. The daily trading volume of 2.39 million shares is 26% higher than the average level, and the 30-day average trading volume has remained at a high level of 2.02 million shares[0]. The volume-price coordination shows that capital follows up actively during the rise, forming a positive cycle. Technically, the bullish arrangement of short-term moving averages, the bullish MACD pattern, and capital inflow form resonance, supporting the stock price to remain strong.

The semiconductor sector rose 0.67% today, and the technology sector as a whole performed actively, providing a favorable sector environment for Sidea Co., Ltd.[0]. From a thematic investment perspective, concepts such as domestic substitution, “Specialized, Sophisticated, Unique, New”, and semiconductor equipment are all current market hotspots, with capital continuously flowing into related sectors. Sidea Co., Ltd. has multiple thematic concepts, coupled with its secondary new stock attribute, making it a priority choice for capital allocation.

The 2025 IPO market has high overall enthusiasm, and the “zero break” phenomenon reflects an increase in market risk appetite. Against this background, IPOs, especially technology IPOs with hot themes, are likely to obtain excess returns. As a scarce target in the semiconductor equipment field, Sidea Co., Ltd. has continued to receive market attention since its listing, and the IPO effect provides additional valuation premium support for it.

Sidea Co., Ltd. (301629.SZ) is a leading domestic enterprise in semiconductor probe testing equipment, and the first mainland Chinese enterprise to achieve industrial application of 12-inch wafer probers, with a significant scarcity advantage in domestic substitution. The company has been included in the list of National Key “Little Giant” Enterprises under the “Specialized, Sophisticated, Unique, New” initiative, aligning with national strategic development directions. Its financial situation is healthy, with strong liquidity and solvency, but its relatively high valuation (PE ratio of 221x) deserves attention.

Technically, the stock price is in a sideways consolidation pattern, with the 20-day moving average providing support but facing short-term pressure from the resistance level. The continuous expansion of trading volume shows high capital attention, but the KDJ indicator approaching the overbought zone suggests short-term adjustment needs. From the perspectives of capital, fundamentals, and thematic investment, the mid-term upward logic remains intact.

For investors paying attention to this stock, it is recommended to take the 20-day moving average (RMB 239) as an important reference price. When accumulating on dips, reasonable stop-loss levels should be set to control risks. The current stock price is close to the 52-week high, so chasing highs requires caution. Waiting for a better entry opportunity is a more prudent strategy.

[0] Jinling Analysis Database - Market Data, Technical Indicators, Financial Analysis

[1] Time Weekly - 2025 A-share IPO “Big Profit Lots” Analysis

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.