Comprehensive Analysis of the Strong Performance of Fengli Intelligence (301368)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Fengli Intelligence (301368.SZ) entered the strong stock pool on January 12, 2026. The stock has been active recently and has become a focus of market attention. According to market data analysis[1], the company’s strong performance is mainly driven by

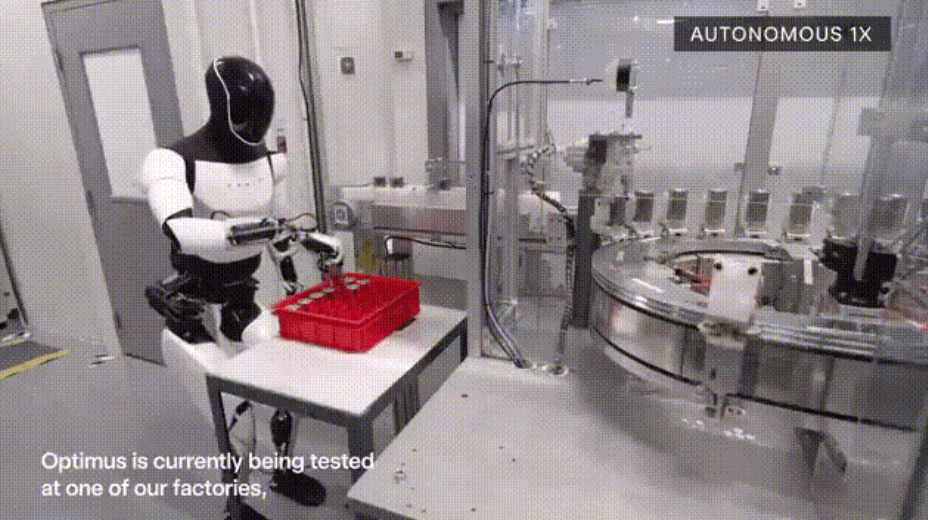

From an industry perspective, Fengli Intelligence’s main business covers four sectors: gear products, precision reducers, intelligent cockpit drive components, and lightweight pneumatic tools[4]. The company’s products have entered the supply chain of several well-known robotics enterprises, including Xingdong Era, a startup incubated by the Institute for Interdisciplinary Information Sciences, Tsinghua University, supplying core transmission components such as harmonic reducers, planetary reducers, and small and micro reducers[5]. More notably, the company’s harmonic reducer products have passed reliability verification for some modules of Tesla’s robotics project and obtained small-batch trial production orders. It is also the core transmission module supplier for the U.S. robotics enterprise Figure 02 in its China supply chain[2]. This deep collaboration with global top robotics enterprises constitutes an important support for the company’s valuation premium.

From a financial perspective, Fengli Intelligence is in a critical period of strategic transformation. According to its 2025 third-quarter report, the company achieved operating revenue of RMB 372 million, a year-on-year increase of 0.18%, but its net profit attributable to shareholders was only RMB 1.0378 million, a significant year-on-year decrease of 93.44%[4][6]. The sharp decline in net profit is mainly due to: upfront R&D investment, high depreciation costs during the capacity ramp-up phase, and the fact that new businesses such as humanoid robots are still in the investment stage[2].

In terms of profitability, the company’s gross profit margin is 11.71%, a year-on-year decrease of 3.19 percentage points, which is lower than the industry average of 22.64%[6]. This reflects the practical dilemma that the company’s traditional business is under pressure while new production capacity has not yet achieved economies of scale. However, its asset-liability ratio is 35.22%, lower than the industry average of 39.81%, indicating a relatively stable financial structure with a certain ability to resist risks.

Institutions are optimistic about the company’s future development. Forecasts from Tianfeng Securities, Pacific Securities and other institutions show that operating revenue is expected to reach RMB 640 million, RMB 890 million and RMB 1.35 billion from 2025 to 2027, respectively, while net profit attributable to shareholders is expected to reach RMB 41 million, RMB 72 million and RMB 118 million[4]. This forecast is based on the assumption that the company’s harmonic reducer production capacity will be released and orders will continue to materialize.

From a technical analysis perspective, Fengli Intelligence has recently exhibited typical characteristics of a strong stock. According to market review data, the stock hit the daily limit on January 8, 2026, with a limit-up price of RMB 73.46, a gain of 19.99%, and sealed the board at 14:29:57, which is a late-trading limit-up, indicating strong market buying interest[1][3]. The company’s total market capitalization is approximately RMB 8.8 billion, and its floating market capitalization is approximately RMB 4.7 billion, making it a typical small-cap growth stock.

From a capital flow perspective, institutional funds such as E Fund SZSE Robot Industry ETF and China AMC CSI Robot ETF have continued to increase their holdings. Among them, E Fund SZSE Robot Industry ETF holds 2.3319 million shares, an increase of 1.9591 million shares from the previous period; China AMC CSI Robot ETF holds 2.0208 million shares, an increase of 414,300 shares from the previous period[4]. The continuous inflow of institutional funds reflects the market’s recognition of the company’s position in the robotics industry chain.

Fengli Intelligence has focused on the small-module gear field for nearly 30 years, with 55 patents (including 20 invention patents), accumulating solid technical barriers[1]. As a global preferred supplier of Bosch, the company holds Bosch’s global product inspection-exempt release certificate, which fully demonstrates that its product quality and technical level have been recognized by world-leading customers[5].

In terms of capacity layout, the company has built a small-module gear production line with an annual capacity of 8 million units in Vietnam, and a new energy vehicle transmission gear production line with an annual capacity of 200,000 units in Malaysia[5]. The overseas capacity layout not only helps avoid trade barriers, but also enables proximity services to global customers and improves supply chain response efficiency.

In August 2025, the company disclosed a RMB 730 million private placement plan, which will be fully invested in the intelligent manufacturing project of precision power gears for new energy vehicles and the technical transformation project of precision transmission components for high-end intelligent equipment[2]. Meanwhile, according to the investor relations activity record on December 11, 2025, the company’s actual controller cumulatively increased its holdings by approximately RMB 350 million to RMB 500 million in 2025, demonstrating firm confidence in the company’s long-term development[3]. The dual signals of the actual controller’s large-scale share increase and private placement for capacity expansion convey the management’s positive expectations for the company’s future to the market.

Fengli Intelligence is involved in several hot concept sectors, including humanoid robots, harmonic reducers, dexterous hands, new energy vehicles, and nuclear power (controllable nuclear fusion transmission devices)[3]. The superposition of multiple concepts enables the company to continue to benefit from investment enthusiasm in different themes, increasing market attention and the sustainability of capital inflows.

Comprehensive assessment shows that the company has high short-term market attention, but investors need to be vigilant against the risk of sentiment reversal. The scores across various dimensions are: concept popularity 4.0/5 (humanoid robots are a long-term market theme), capital flow 3.5/5 (institutions continue to focus, but turnover rate is relatively high), technical indicators 3.0/5 (need to observe support strength after the limit-up), fundamental support 2.5/5 (performance is under pressure, but long-term growth logic is clear), valuation rationality 2.0/5 (valuation is significantly overextended)[4].

Fengli Intelligence’s strong performance mainly stems from the dual drivers of

However, investors should pay attention to the following key points: First, the current valuation is extremely high (PE of approximately 4188x), which mainly reflects the market’s optimistic expectations for the future, and actual fundamental support still needs time to be verified[1]; Second, the company is in a transitional pain period with a sharp decline in net profit, and the recovery of profitability still depends on the release of new production capacity and the materialization of orders[6]; Third, there is a high component of concept speculation, so investors need to be vigilant against short-term correction risks caused by fading market sentiment[3].

From an operational perspective, the stock has short-term support in the RMB 60-65 range, with the previous high of RMB 73-75 as a resistance level. Aggressive investors can participate with a small position, but should set a stop-loss level at RMB 63-65; Conservative investors should mainly wait and see, and consider positioning after a pullback to around RMB 60; Investors with low risk appetite should remain cautious, as the current valuation has fully priced in optimistic expectations[4].

[0] Jinling Analysis Database (Market Data, Technical Indicators, Analysis Tools)

[1] Sina Finance - Analysis of Fengli Intelligence’s Limit-Up on January 8, 2026

[2] Caifuhao - Fengli Intelligence’s Harmonic Reducers Supplied to Tesla’s Robotics Project

[3] East Money - Hot Stock Limit-Up Review on January 8

[4] Futu NiuNiu - Analysis of Fengli Intelligence’s Past and Present

[5] Fengli Intelligence Investor Relations Activity Record

[6] Sohu Securities - Fengli Intelligence Income Statement

[7] Securities Times - Fengli Intelligence’s Chips Continue to Concentrate

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.