Analysis Report on Lululemon (LULU) Q4 Fiscal 2025 Earnings Guidance Update

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to Lululemon’s updated Q4 Fiscal 2025 earnings guidance[1][2][3]:

| Metric | Guidance Range | Expected Value/Status |

|---|---|---|

Net Revenue |

$3.50B - $3.585B | Near upper end of range |

Diluted Earnings Per Share |

$4.66 - $4.76 | Near upper end of range |

Gross Margin |

Unchanged | Stable |

Selling, General & Administrative Expenses |

Unchanged | Stable |

Effective Tax Rate |

Unchanged | Stable |

This guidance update was released ahead of the ICR Conference, and the company clearly stated that there have been no operational changes, and its existing growth strategy remains unchanged[4].

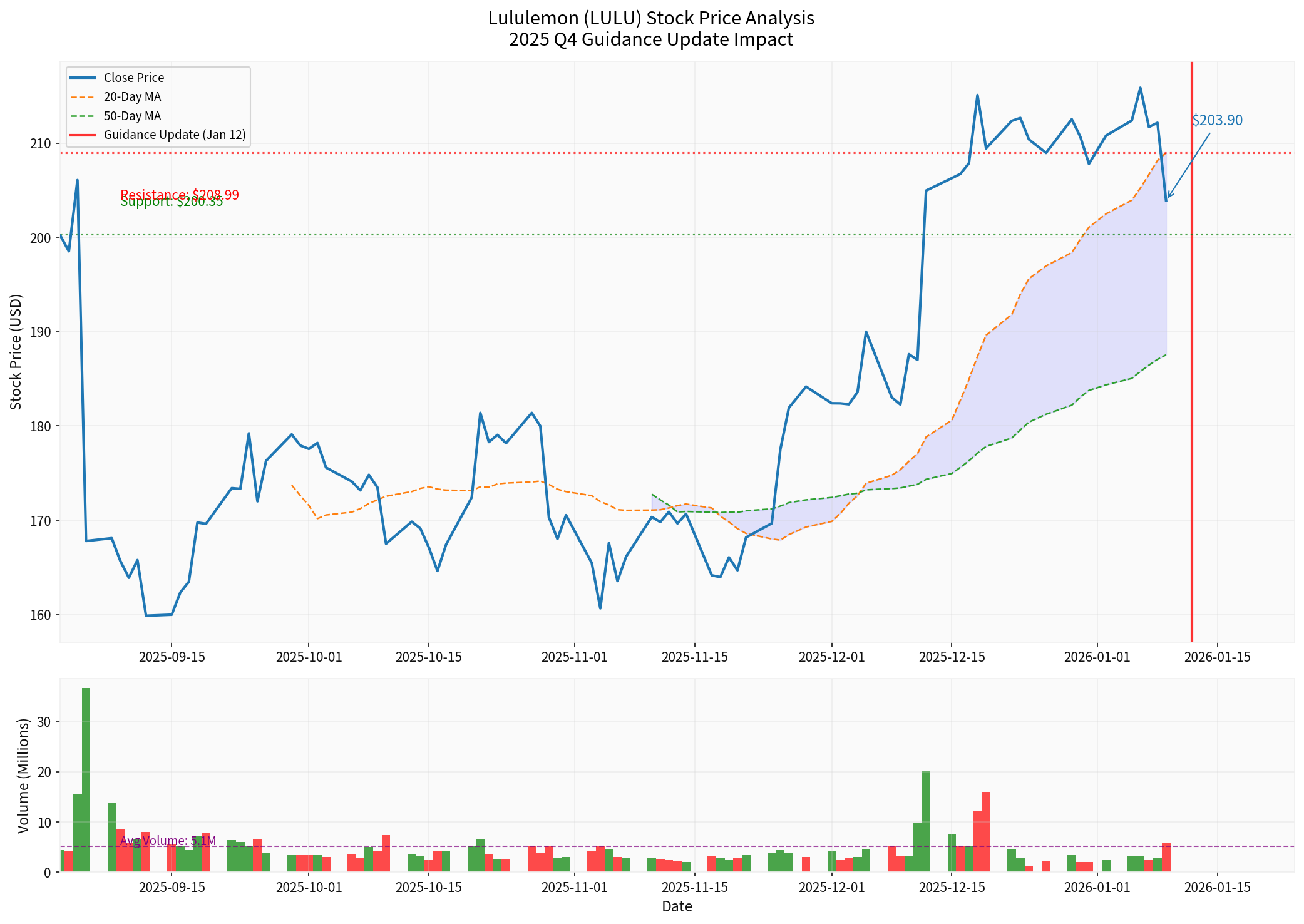

As of January 9, 2026, Lululemon’s closing price was

- Support Level: $200.35

- Resistance Level: $208.99

- Current Price: $203.90 (In the middle of the range)

| Indicator | Status | Interpretation |

|---|---|---|

Trend Judgment |

Sideways Consolidation | No clear directional signal[0] |

MACD |

No Crossover Signal | Bearish Tilt[0] |

KDJ |

K:42.8, D:48.8 | Bearish Tilt[0] |

RSI |

Normal Range | No Overbought/Oversold Signals[0] |

Beta |

1.02 | Moves in line with the broader market[0] |

Technical analysis shows that Lululemon is currently in a

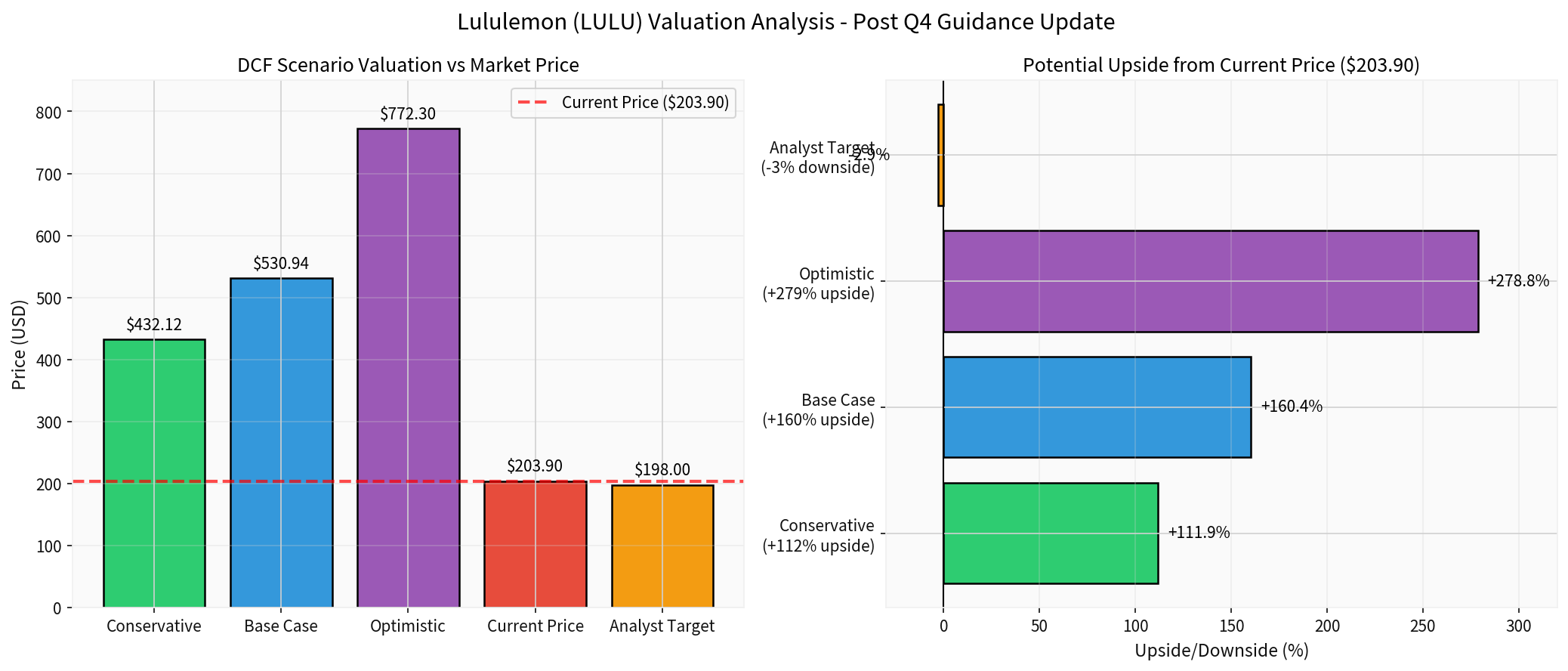

Based on DCF valuation analysis, Lululemon’s current intrinsic value is significantly undervalued[0]:

| Scenario | Intrinsic Value | Upside from Current Price |

|---|---|---|

Conservative Scenario |

$432.12 | +111.9% |

Base Case Scenario |

$530.94 | +160.4% |

Bullish Scenario |

$772.30 | +278.8% |

Probability-Weighted Value |

$578.45 | +183.7% |

- WACC (Weighted Average Cost of Capital): 11.1%

- 5-Year Revenue Compound Annual Growth Rate (CAGR): 24.5%

- EBITDA Margin: 25.7%

- Beta Coefficient: 1.02[0]

| Metric | LULU | Industry Average | Assessment |

|---|---|---|---|

Price-to-Earnings (P/E) Ratio |

13.88x | Below Average | Relatively Undervalued |

Price-to-Book (P/B) Ratio |

5.09x | Average | Reasonable |

Return on Equity (ROE) |

39.22% | Above Average | Excellent[0] |

Net Profit Margin |

15.72% | Above Average | Good[0] |

Operating Profit Margin |

22.04% | Above Average | Good[0] |

| Rating | Number | Percentage |

|---|---|---|

| Buy | 32 | 46.4% |

| Hold | 33 | 47.8% |

| Sell | 4 | 5.8% |

Lululemon has consistently delivered

| Fiscal Quarter | Actual EPS | Consensus EPS | Beat Margin | Actual Revenue | Consensus Revenue | Beat Margin |

|---|---|---|---|---|---|---|

| Q3 FY2025 | $2.59 | $2.22 | +16.67% | $2.57B | $2.48B | +3.38% |

| Q2 FY2025 | $3.10 | - | - | $2.53B | - | - |

| Q1 FY2025 | $2.60 | - | - | $2.37B | - | - |

The global athleisure market is showing strong growth momentum[1]:

- 2026 Market Size: $415.28B

- 2031 Projected Market Size: $647.21B

- Compound Annual Growth Rate (CAGR): 9.28%

- Nike: Losing market share, under pressure in the Chinese market[1]

- Adidas: Upgraded 2024 results, but facing tariff pressure[1]

- Lululemon: Regaining momentum after a series of disappointing results[3]

- Vuori: Gained endorsement from supermodel Kaia Gerber, increasing appeal to young consumers[1]

- Alo Yoga: Leveraging celebrity endorsements from Hailey Bieber, Kendall Jenner, etc.[1]

- Gymshark: 9% revenue growth in 2024, opened its first U.S. flagship store[1]

- On Running / Hoka: Continued expansion in the running shoe segment[1]

- International Expansion Potential: The Chinese market contributes 28.1% of revenue, with significant growth potential for international business[0]

- Product Structure Advantage: Women’s products account for 61.6%, men’s products account for 25.3%, with a balanced product mix[0]

- E-Commerce Channel Growth: Continuous improvements to mobile applications and virtual shopping tools[1]

- Brand Premium Capability: High-end positioning maintains a favorable gross margin level

| Factor | Impact |

|---|---|

| Q4 guidance near upper end of range | Indicates signs of holiday season sales rebound[2][3] |

| Consistent earnings beat performance | Improved management execution |

| Significant undervaluation per DCF model | 183% upside potential for probability-weighted value from current price[0] |

| ROE as high as 39.22% | Strong shareholder return capability |

| High industry growth | 9.28% CAGR market provides a favorable backdrop |

| Risk | Impact |

|---|---|

Activist Investor Pressure |

Elliott Management holds over $1 billion in shares, may push for changes[5] |

Founder Governance Challenges |

Chip Wilson nominated three independent director candidates[6][7] |

Intensified Competition |

Brands like Vuori and Alo Yoga are capturing market share[1] |

Tariff Policy Uncertainty |

Supreme Court delays tariff ruling, policy risks remain[8] |

Leadership Transition Period |

Uncertainty in strategy execution during CEO search |

-

Significance of Earnings Guidance: Q4 revenue and EPS guidance are near the upper end of the range, indicatingsigns of a reboundin holiday season sales, a positive signal following a series of disappointing results[2][3]

-

Valuation Attractiveness: The current stock price of $203.90 corresponds to a P/E ratio of 13.88x, which is below the historical average. The DCF model shows112% upside potentialeven under conservative assumptions[0]

-

Neutral Technical Picture: The stock is trading in the consolidation range of $200.35-$208.99, with no clear directional signal[0]

-

Optimistic Industry Outlook: The global athleisure market has a CAGR of 9.28%, providing a favorable growth backdrop for Lululemon[1]

- Conservative Target: $280 (~37% upside from current price)

- Reasonable Target: $350 (~72% upside from current price)

- Bullish Target: $450 (~121% upside from current price)

- Release of Q4 financial results on March 26, 2026

- CEO successor appointment

- Same-store sales growth in the U.S. market (Chinese business and international expansion are core growth drivers)

- Progress of tariff policies

[1] Mordor Intelligence - Athleisure Market Size, Trends & Share Analysis Report (https://www.mordorintelligence.com/industry-reports/athleisure-market)

[2] Investing.com - Lululemon expects holiday-quarter revenue, profit to be at top end of prior forecast (https://www.investing.com/news/stock-market-news/lululemon-expects-holidayquarter-revenue-profit-to-be-at-top-end-of-prior-forecast-4441405)

[3] Bloomberg - Lululemon Rises as Holiday Sales Show Signs of Rebound (https://www.bloomberg.com/news/articles/2026-01-12/lululemon-rises-as-holiday-sales-show-signs-of-rebound)

[4] Business Wire - Lululemon Updates Revenue and Earnings Expectations for Q4 Ahead of ICR Conference (http://www.businesswire.com/news/home/20260112187515/en/)

[5] CNBC - How activist Elliott can help reinvigorate athleisure giant Lululemon (https://www.cnbc.com/2026/01/10/how-activist-elliott-can-help-reinvigorate-athleisure-giant-lululemon.html)

[6] Retail Insider - Chip Wilson’s Board Picks Reveal Lululemon’s Deeper Problem (https://retail-insider.com/retail-insider/2026/01/chip-wilsons-board-picks-reveal-lululemons-deeper-problem/)

[7] Yahoo Finance - The Bull Case For Lululemon Could Change Following Chip Wilson’s Boardroom Challenge (https://finance.yahoo.com/news/bull-case-lululemon-athletica-lulu-100816830.html)

[8] The Fool - Why Lululemon Stock Was Sliding Today (https://www.fool.com/investing/2026/01/09/why-lululemon-stock-was-sliding-today/)

[0] Gilin AI Financial Database - Market Data, Technical Analysis, Financial Analysis, DCF Valuation

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.