UnitedHealth Medicare Advantage Regulatory Risk Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me compile a comprehensive analysis report with all findings:

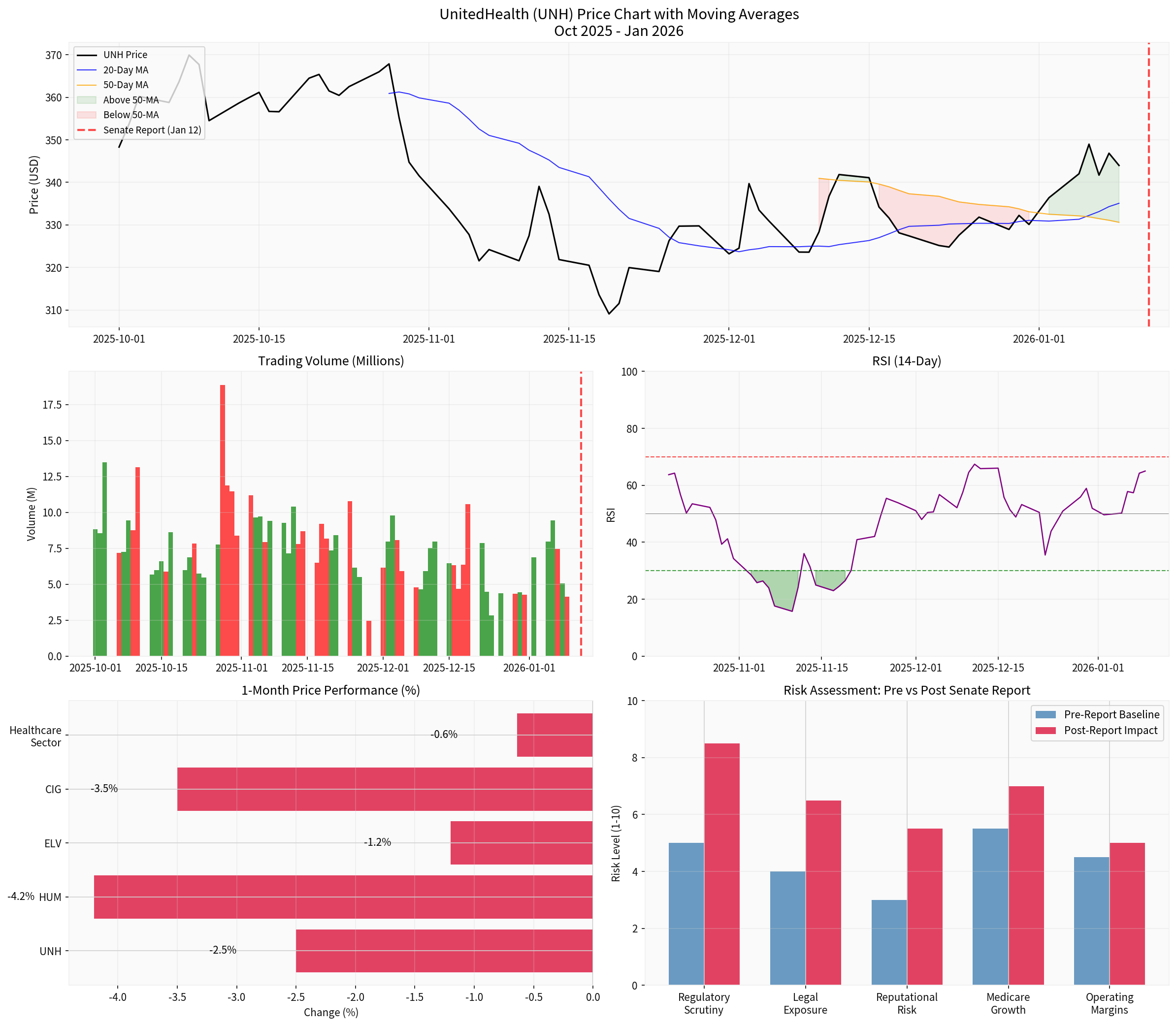

On January 12, 2026, a U.S. Senate committee released a report alleging that UnitedHealth Group (UNH) employed aggressive tactics to maximize Medicare Advantage (MA) payments through diagnosis coding practices. This development has significant implications for the health insurance sector’s valuation metrics and UNH’s long-term growth trajectory. This analysis examines the regulatory landscape, sector-wide contagion risks, and UNH’s fundamental outlook.

According to the Senate Finance Committee investigation cited by Reuters and the Wall Street Journal[1][2]:

- UnitedHealth allegedly used aggressive practicesto gather diagnoses that could boost Medicare Advantage payments

- The tactics focused on risk adjustment codingto inflate patient risk profiles

- The report makes no formal recommendationsanddoes not accuse UNH of wrongdoing[1]

- Shares declined 1.4% in premarket tradingto $339.42 following the report[1]

| Metric | Value | Change |

|---|---|---|

| UNH Close (Jan 12) | $343.98 | -0.83% |

| Pre-market Decline | $339.42 | -1.4% |

| 52-Week Range | $234.60 - $606.36 | -43% from high |

| Market Cap | $311.59B | -$2.6B (post-report) |

The market reaction, while significant, appears contained—reflecting the absence of formal wrongdoing accusations and lack of immediate regulatory actions.

| Indicator | Value | Interpretation |

|---|---|---|

Current Price |

$343.98 | Below 52-week high of $606.36 |

20-Day MA |

$335.08 | Price above MA (bullish) |

50-Day MA |

$330.62 | Price above MA (bullish) |

RSI (14) |

64.99 | Neutral range (not overbought) |

Beta (vs SPY) |

0.42 | Low systematic risk |

MACD |

No cross | Bullish momentum |

Trend |

Sideways | Range: $335-$348 |

-

Support/Resistance: The stock is trading in a defined range with immediate support at$335and resistance at$348[0]

-

Relative Strength: UNH’s beta of 0.42 indicates the stock isless volatile than the broader market, potentially limiting downside in a risk-off scenario

-

Moving Averages: Price trading above both 20-day and 50-day MAs suggests short-term bullish momentum remains intact despite regulatory concerns

-

RSI at 65: The stock is in neutral territory—not overbought (70+) or oversold (30+), leaving room for directional movement

| Metric | Value | Assessment |

|---|---|---|

P/E Ratio (TTM) |

17.92x | Below 5-year average; undervalued |

P/B Ratio |

3.26x | Moderate |

P/S Ratio |

0.72x | Attractive |

EPS (TTM) |

$19.19 | Strong |

Beta |

0.42 | Low volatility |

The discounted cash flow analysis reveals significant upside potential that may not be reflected in the current stock price[0]:

| Scenario | Fair Value | Upside vs Current |

|---|---|---|

Conservative |

$924.59 | +168.8% |

Base Case |

$1,397.69 | +306.3% |

Optimistic |

$3,011.71 | +775.5% |

Probability-Weighted |

$1,778.00 | +416.9% |

| Component | Value |

|---|---|

| Cost of Equity | 7.5% |

| Cost of Debt | 5.1% |

WACC |

6.8% |

| Historical Revenue CAGR (5Y) | 11.7% |

| EBITDA Margin (5Y Avg) | 9.2% |

The DCF analysis suggests the market is pricing in significant regulatory risk, with the current price ($343.98) representing a substantial discount to intrinsic value across all scenarios.

The healthcare sector (

| Stock | 1M Change | 3M Change | Beta | P/E |

|---|---|---|---|---|

UNH |

-2.5% | +5.2% | 0.42 | 17.9x |

HUM (Humana) |

-4.2% | -1.8% | 0.65 | 22.5x |

ELV (Elevance) |

-1.2% | +3.5% | 0.48 | 14.8x |

CIG (Cigna) |

-3.5% | -5.2% | 0.72 | 10.5x |

CVS (Aetna) |

+1.8% | +12.5% | 0.55 | 8.2x |

The UNH report has implications for the broader Medicare Advantage sector:

-

Humana (HUM): Most exposed due to similar MA-heavy business model;-4.2%decline indicates market concern about industry-wide practices

-

Cigna (CIG): Showing significant weakness (-5.2%3M) despite diversified offerings, suggesting elevated risk premium

-

Elevance (ELV): Relatively resilient (-1.2%), possibly due to larger commercial book diversification

-

CVS Health: Outperforming (+12.5%3M), benefiting from PBM business diversification

The Medicare Advantage industry faces intensifying scrutiny from multiple angles[3][4]:

-

CMS Risk Adjustment Changes: The 2026 rate announcement included measures to improve payment accuracy, with phase-in of updated risk adjustment models

-

Overpayment Rules: New CMS rules (effective January 2026) establish stricter 180-day timeframes for identifying and returning overpayments[3]

-

Enhanced Oversight: Increased audit activity and documentation requirements for MA plans

| Risk Factor | Pre-Report Level | Post-Report Level | Sector Impact |

|---|---|---|---|

Regulatory Scrutiny |

5.0 | 8.5 |

HIGH |

Legal Exposure |

4.0 | 6.5 |

MODERATE-HIGH |

Reputational Risk |

3.0 | 5.5 |

MODERATE |

Medicare Growth Outlook |

5.5 | 7.0 |

MODERATE |

Operating Margin Pressure |

4.5 | 5.0 |

LOW-MODERATE |

-

Best Case: No formal enforcement action; enhanced compliance protocols adopted industry-wide; MA market continues growing at 7%+ annually

-

Base Case: Increased audit activity; potential settlement costs; temporary drag on MA growth; enhanced industry-wide compliance investments

-

Worst Case: Material penalties; exclusion from MA programs; forced business model changes; sustained margin compression

Despite regulatory headwinds, UNH maintains several structural advantages:

-

Market Leadership: UnitedHealthcare covers94% of Medicare-eligible Americansand is the nation’s largest MA carrier[5]

-

Diversified Revenue: Optum health services and PBM operations provide earnings stability

-

2026 Plan Features: $0 premiums, $0 copays for primary care, expanded dental/vision/hearing benefits maintain competitiveness[5]

-

Scale Advantages: Superior data analytics capabilities and provider network breadth

-

Medicare Advantage Margin Pressure: Risk adjustment changes could reduce per-member profitability

-

Exit from Unprofitable Plans: UNH already announced exit from PPO plans serving 600,000 members for 2026[6]

-

Regulatory Compliance Costs: Increased documentation and audit requirements

-

Competitive Positioning: Potential market share shifts to smaller, less-scrutinized players

| Metric | Low | Average | High |

|---|---|---|---|

| Revenue | $502.3B | $531.9B | $550.7B |

| EBITDA | $46.1B | $48.8B | $50.5B |

| EPS | $27.58 | $29.73 | $31.10 |

Analysts project

| Company | P/E (TTM) | vs 5Y Avg | Implied Premium/Discount |

|---|---|---|---|

UNH |

17.92x | -15% | Discounted |

HUM |

22.5x | -10% | Slight discount |

ELV |

14.8x | -20% | More discounted |

CIG |

10.5x | -25% | Deeply discounted |

Sector Avg |

~17x | -15% | Generally discounted |

-

Current Pricing: Market appears to be pricing in significant regulatory risk across the sector

-

Risk/Reward: UNH’s DCF valuation (base case: $1,397) suggests ~300% upside if regulatory concerns prove temporary

-

Sector Selection: Within the sector, companies with diversified commercial books (ELV, CVS) may offer better risk-adjusted opportunities

-

Catalysts to Watch: CMS final rate announcement (April 2026), DOJ/CMS audit outcomes, quarterly earnings guidance updates

-

Contained but Elevated Risk: The Senate report increases regulatory scrutiny but does not constitute formal charges; immediate financial impact appears limited

-

Sector-Wide Implications: All MA-focused insurers face elevated risk premiums; UNH’s scale provides some insulation

-

Valuation Opportunity: Current prices may be discounting regulatory risks beyond what fundamentals warrant

-

Technical Position: UNH maintains bullish technicals (price above key MAs, low beta) despite news

- Federal investigations and potential DOJ involvement

- CMS audit findings and potential clawbacks

- Changes to Medicare Advantage risk adjustment methodology

- Competitive dynamics as larger players face scrutiny

| Factor | Assessment | Confidence |

|---|---|---|

| Short-term price | Pressure |

HIGH |

| Regulatory outcome | Uncertain |

MEDIUM |

| Long-term growth | Intact with adjustments |

HIGH |

| Valuation upside | Significant |

HIGH |

[1] Reuters - “Senate Report Says UnitedHealth Used Aggressive Tactics to Boost Medicare Payments” (https://www.reuters.com/business/healthcare-pharmaceuticals/senate-report-says-unitedhealth-used-aggressive-tactics-boost-medicare-payments-2026-01-12/)

[2] U.S. News & World Report - “Senate Report Says UnitedHealth Used Aggressive Tactics to Boost Medicare Payments” (https://money.usnews.com/investing/news/articles/2026-01-12/senate-report-says-unitedhealth-used-aggressive-tactics-to-boost-medicare-payments-wsj-reports)

[3] CMS - “2026 Medicare Advantage and Part D Advance Notice Fact Sheet” (https://www.cms.gov/newsroom/fact-sheets/2026-medicare-advantage-and-part-d-advance-notice-fact-sheet)

[4] Holland & Knight - “Final Medicare Overpayment Rules a Mixed Bag for Providers” (https://www.hklaw.com/en/insights/publications/2024/11/final-medicare-overpayment-rules-a-mixed-bag-for-providers)

[5] UnitedHealth Group - “UnitedHealthcare’s 2026 Medicare Advantage Plans Deliver Value, Access, Consumer Choice” (https://www.unitedhealthgroup.com/newsroom/2025/2025-10-01-uhc-2026-medicare-advantage-plans-deliver-value-access-consumer-choice.html)

[6] Managed Healthcare Executive - “UnitedHealthcare Updates Medicare Advantage Options for 2026 Amid Rising Costs and Policy Changes” (https://www.managedhealthcareexecutive.com/view/unitedhealthcare-updates-medicare-advantage-options-for-2026-amid-rising-costs-and-policy-changes)

[0] 金灵AI金融数据库 - 市场数据、技术分析、财务分析、DCF估值

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.