Capital Rotation from Big Tech to Value and Cyclical Sectors Underway in Early 2026

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Seeking Alpha analysis published on January 12, 2026, articulates a compelling thesis regarding a fundamental shift in market leadership that has significant implications for investment strategy and portfolio positioning [1]. The article characterizes the current market environment as exposing “lazy investing”—a reference to the widespread market concentration in mega-cap technology stocks that has dominated returns during 2023-2024. This rotation narrative is supported by multiple independent analytical sources and quantitative market data, creating a robust foundation for understanding the ongoing sector dynamics.

The sector performance data from January 12, 2026, provides immediate validation for the rotation thesis. Real estate stocks led daily gains at +1.36%, followed closely by industrials at +1.33% and basic materials at +1.28%, while technology posted a more modest +1.09% gain and communication services actually declined by 0.07% [0]. This pattern of value-oriented and economically sensitive sectors outperforming growth-oriented technology segments represents a meaningful departure from the market conditions that characterized the previous two years. The concentration of gains in sectors traditionally associated with economic cyclicality suggests that investors are increasingly seeking exposure to companies with more direct ties to macroeconomic growth rather than depending solely on the capital appreciation potential of artificial intelligence-focused technology giants.

Small-cap stocks have emerged as perhaps the most compelling evidence supporting the capital rotation narrative. The iShares Russell 2000 ETF (IWM) surged 6.2% during the first week of January 2026, representing what analysts have characterized as “one of the strongest seasonable openings in recent history” [3]. This performance follows the Russell 2000’s 12% gain during 2025, breaking an approximately fifteen-year period of large-cap outperformance relative to small-cap indices [2]. The valuation differential between these market segments has become particularly pronounced, with the Russell 2000 trading at a price-to-earnings ratio of 18.11x compared to the S&P 500’s 22x multiple—representing an 18% discount that creates compelling risk-adjusted return opportunities for value-oriented investors [2][4].

The Federal Reserve’s monetary policy trajectory has provided crucial support for this rotation dynamic. The three consecutive 0.25% interest rate cuts implemented during 2025 have directly reduced borrowing costs for smaller, often debt-dependent companies that comprise the majority of Russell 2000 constituents [2]. This monetary policy easing creates a liquidity tailwind that disproportionately benefits small-cap and cyclical stocks, which historically demonstrate higher sensitivity to interest rate movements due to their reliance on external financing and their more direct exposure to economic growth cycles. The combination of attractive valuations and supportive monetary conditions has created a favorable environment for the rotation into market segments that had been systematically undervalued during the period of technology sector dominance.

Market breadth expansion provides additional confirmation of the rotation’s sustainability. The S&P 500 rally has finally expanded beyond mega-cap technology leaders to include broader participation across all eleven GICS sectors, with market breadth reaching its healthiest levels in over three years [5]. This broadening of participation suggests that the current market advance is no longer dependent entirely on a handful of large-cap technology stocks for its momentum, which represents a more structurally sound advance from a technical and market structure perspective. Oppenheimer’s 2026 Market Outlook specifically notes that “cyclical sectors such as industrials and financials contributed meaningfully” to 2025 gains and anticipates “leadership expanding to small- and mid-cap stocks” in the coming periods [4].

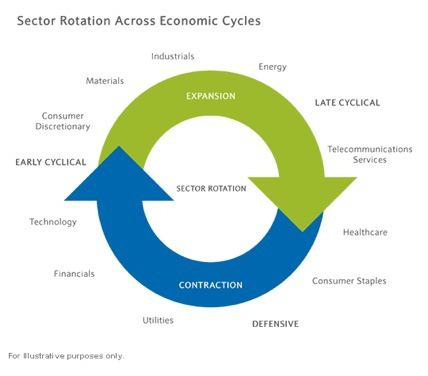

The capital rotation phenomenon reveals several interconnected dynamics that extend beyond simple sector performance differentials. The “Great Rotation” narrative signals a structural shift from the extreme concentration that defined 2023-2024, when a handful of mega-cap technology titans essentially dictated the direction of the entire market [5]. This concentration created a particular risk dynamic for portfolio managers, where the primary concern was missing technology rallies rather than being under-exposed to cyclical recovery opportunities. The current rotation fundamentally alters this risk calculus and requires corresponding adjustments to portfolio positioning and risk management frameworks.

The value factor’s resurgence represents another critical insight from the current market environment. Clearstead’s research confirms that “the value factor beat the growth factor in December as well as for the entirety of Q4” [6], marking a meaningful shift from 2025’s full-year dynamic where large-cap growth-oriented stocks outperformed value-oriented peers. This factor rotation suggests that the market is beginning to price in expectations for broader economic growth that would benefit companies across multiple sectors rather than exclusively those positioned to capture artificial intelligence-related capital expenditures. The persistence of this factor rotation will depend substantially on the delivery of earnings growth from the “other 493” S&P 500 components beyond the mega-cap technology leaders.

The artificial intelligence theme is undergoing a significant evolution in how investors conceptualize its market implications. Rather than being confined to technology sector returns, artificial intelligence is becoming a “whole economy” phenomenon driving efficiency gains across all eleven GICS sectors [4]. This secular transformation creates investment opportunities that extend well beyond mega-cap technology leaders to include companies in traditional cyclical industries that are successfully implementing artificial intelligence applications to improve operational efficiency, reduce costs, and enhance competitive positioning. The broadening of the artificial intelligence investment thesis supports the rotation into value and cyclical sectors by providing a fundamental narrative for why these previously out-of-favor segments may deserve reassessment.

Market concentration in U.S. stocks has revived investor interest in equal-weight ETF approaches as an alternative to traditional cap-weighted indexing strategies [7]. Invesco’s analysis highlights that the extreme concentration in market-cap weighted indices has prompted investors to seek diversified exposure through vehicles that allocate more evenly across market segments. This shift in investor preferences has potential implications for flow dynamics, as capital may gradually redirect from traditional cap-weighted indices toward equal-weight strategies that provide more natural exposure to the market segments benefiting from the current rotation.

The capital rotation presents a differentiated opportunity set that warrants careful consideration against the associated risk factors. Value stocks exhibiting growth profiles, strong cash flows, and healthy balance sheets represent compelling risk-adjusted return opportunities, particularly given their significant valuation discounts relative to mega-cap technology counterparts [1]. Small-caps offer historical outperformance potential—analysts note that small-cap stocks historically outperform large-caps by 2.85% annually—combined with current valuation discounts that enhance the risk-reward proposition [2]. Cyclical sectors including industrials and materials may benefit from structural tailwinds including infrastructure spending initiatives, defense budget increases, and government policies supporting domestic manufacturing and housing construction.

Several risk factors require ongoing monitoring and assessment. The sustainability of market breadth expansion depends on earnings delivery from the “other 493” S&P 500 components that have begun participating in the current rally [1]. Should these companies fail to demonstrate earnings growth commensurate with their price appreciation, the rotation could reverse as investors retreat to the relative safety and predictability of mega-cap technology leaders. Inflation resurgence represents another significant risk factor that could force Federal Reserve policy reversal, disproportionately impacting small-caps and cyclical stocks that have benefited from the current easing cycle.

Election cycle uncertainties may introduce regulatory headwinds for certain sectors, particularly those in regulated industries or those perceived as benefiting from current policy frameworks [1]. Portfolio managers must also consider the tactical implications of the rotation for existing positions, as overweight technology allocations require rebalancing and sector diversification becomes increasingly important for capturing the breadth of the current market advance. The January Effect seasonal pattern may provide temporary momentum support for small-cap outperformance, but investors should distinguish between sustainable structural rotation and transient seasonal dynamics when making allocation decisions.

The opportunity window for capitalizing on the current rotation appears to be open, with multiple supporting factors converging to create favorable conditions. Fed policy remains accommodative, valuations in value and cyclical segments remain attractive relative to growth alternatives, and market technicals support continued breadth expansion. However, as with all market regime transitions, the rotation’s sustainability will ultimately be determined by the delivery of fundamental corporate earnings growth across the broader market rather than continued multiple expansion driven by monetary policy alone.

The evidence supporting a meaningful capital rotation from mega-cap technology into value and cyclical sectors has strengthened considerably in early January 2026. Sector performance data, small-cap momentum indicators, valuation differentials, and market breadth metrics all corroborate the Seeking Alpha thesis that the market is undergoing a significant leadership transition [0][1]. The Russell 2000’s 18% valuation discount to the S&P 500, combined with the Fed’s accommodative monetary policy stance and the broadest market participation in over three years, creates a confluence of factors that historically precedes extended periods of value and small-cap outperformance.

The characterization of the current environment as exposing “lazy investing” highlights the importance of active sector allocation decisions in capturing the breadth of opportunities available in the current market [1]. The traditional strategy of maintaining heavy technology concentration that served investors well during 2023-2024 may no longer represent the optimal approach, as the risk-reward dynamics have shifted to favor diversified exposure across economically sensitive segments. Fund managers and individual investors should evaluate their current sector allocations against the backdrop of the emerging rotation and consider whether defensive rebalancing into value and cyclical positions is appropriate given their specific risk tolerances and investment time horizons.

The medium-term outlook for the rotation depends on several key variables that warrant continued monitoring: the trajectory of Federal Reserve policy, the delivery of earnings growth from the broader market beyond mega-cap technology leaders, the resolution of election cycle uncertainties, and the persistence of the value factor’s current momentum. The convergence of attractive valuations, supportive monetary conditions, and expanding market breadth creates a favorable environment for value-oriented investment strategies, though investors should remain cognizant of the risks associated with sector rotation trades and maintain appropriate diversification across their portfolios.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.