In-Depth Investment Value Analysis Report on BE Semiconductor Industries (BESI.AS)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now collected sufficient data, let me provide you with a complete investment analysis report.

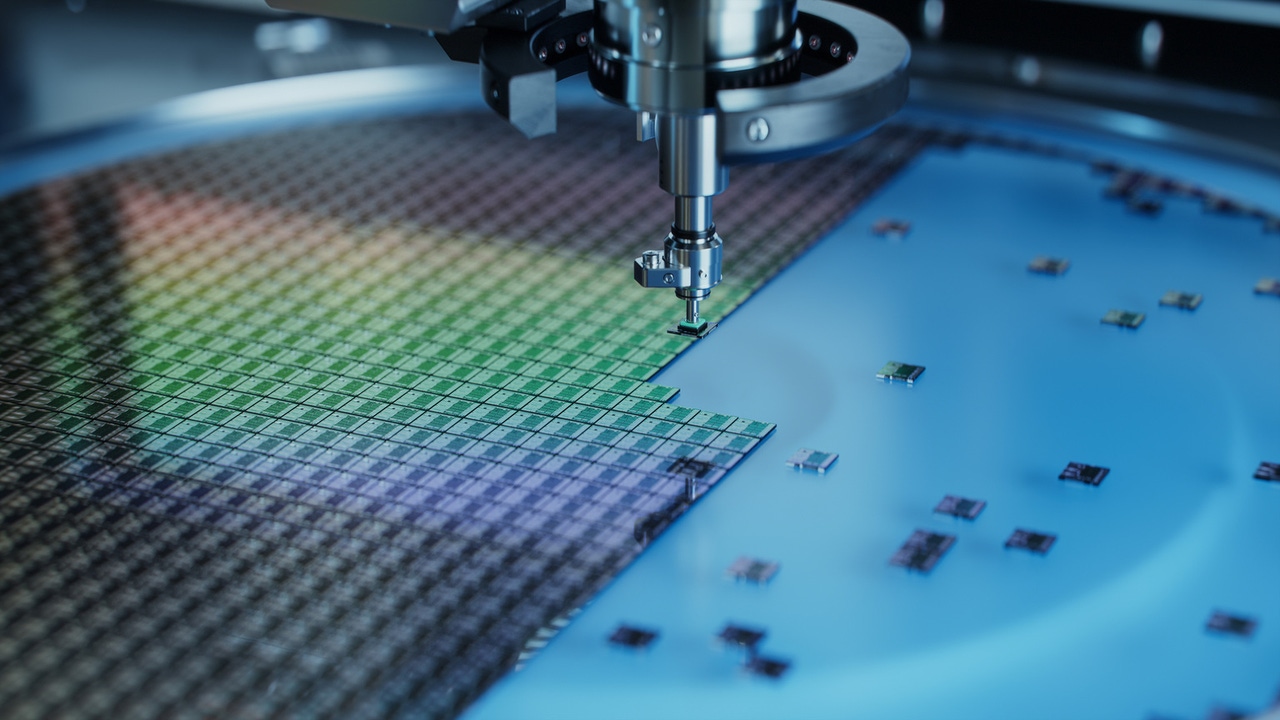

BE Semiconductor Industries N.V. (hereinafter referred to as “BESI” or “the Company”), a world-leading supplier of semiconductor packaging equipment, is at the core of the AI-driven semiconductor super cycle. The Company’s Q3 2025 orders grew 36.5% year-over-year, reaching €174.7 million, and the order growth momentum continued into the fourth quarter [1]. According to SEMI’s forecast, global semiconductor equipment sales will reach $133 billion in 2025 (a 13.7% year-over-year increase) and further climb to a record high of $156 billion in 2027, driven primarily by AI-related investments [2]. Leveraging its leading position in Hybrid Bonding technology, BESI is well-positioned to fully benefit from this structural growth trend. The current share price is €151.10, close to the average analyst target price of €152.64, placing the valuation in a reasonable range. However, considering the Company’s unique technological advantages and market position in advanced packaging, we believe it still offers medium-to-long-term allocation value [3].

BESI achieved 43% year-over-year order growth in Q4 2025. This strong growth is not an accident but the result of multiple structural factors. In-depth analysis of these drivers is critical to judging the sustainability of order growth.

Based on in-depth analysis of industry trends and the Company’s fundamentals, we believe BESI’s order growth has strong sustainability, but the following key variables need attention.

-

Sustained Expansion of AI Capital Expenditures: Major global technology companies (Meta, Microsoft, Google, Amazon, etc.) show no signs of slowing down capital expenditures in AI infrastructure. SK Hynix has fully booked its 2026 memory chip capacity, reflecting sustained strong demand for AI servers [6]. This trend will continue to support demand for advanced packaging equipment.

-

HBM4 Technology Upgrade Cycle: High Bandwidth Memory (HBM) is evolving to HBM4 technology, with 16-layer stacking technology set to become the standard configuration for next-generation AI chips. The production of HBM4 requires more advanced packaging technologies, including hybrid bonding and precision die attach technology. BESI’s die attach systems are core equipment for HBM production and will directly benefit from this technology upgrade.

-

Optimistic 2026 Guidance: The Company’s management stated on the earnings call that it expects 2026 business growth to be stronger than 2025, with new growth drivers including the gradual recovery of the smartphone market, continued penetration of hybrid bonding technology, and the launch of new product lines such as TCNext [1].

-

Macroeconomic Uncertainty: The semiconductor industry is highly cyclical, and a global economic slowdown may affect end demand, which in turn could impact equipment investment decisions.

-

Customer Concentration Risk: The main customers of semiconductor packaging equipment are a small number of large OSAT (Outsourced Semiconductor Assembly and Test) manufacturers and Integrated Device Manufacturers (IDMs). High customer concentration may lead to order volatility.

-

Valuation Pressure: The current price-to-earnings (P/E) ratio is approximately 80x, which is in a historically high range (the 5-year average P/E is approximately 45x). If order growth fails to continue exceeding expectations, the share price may face valuation compression risk [7].

Based on the Company’s financial data, BESI demonstrates excellent profitability and financial health [7][8]:

| Financial Metric | Value | Industry Position |

|---|---|---|

| Gross Margin | 61-63% (Q4 Guidance) | Industry-leading Level |

| Net Profit Margin | 25.61% | Significantly Above Industry Average |

| ROE | 34.20% | Excellent Shareholder Return Capability |

| Current Ratio | 5.75 | Extremely Strong Liquidity |

| R&D Expenditure Growth | 31.7% (2024) | Sustained Innovation Investment |

The Company’s profitability is built on its technological leadership and high-value-added product portfolio. The 61-63% gross margin is top-tier in the semiconductor equipment industry, reflecting the Company’s technological barriers and pricing power in advanced packaging equipment. The substantial growth in R&D expenditure indicates that the Company is actively preparing for the next technology cycle, laying the foundation for long-term growth.

The semiconductor equipment industry is at the start of a new structural bull market, with the AI revolution bringing unprecedented growth momentum to the industry. According to SEMI’s year-end equipment forecast report, global semiconductor equipment sales will reach $133 billion in 2025, representing a 13.7% year-over-year increase [2]. This forecast has been raised from the previous $110.8 billion, reflecting stronger-than-expected actual demand. Looking ahead, sales are expected to reach $145 billion in 2026 and further climb to a record high of $156 billion in 2027, setting new historical highs for three consecutive years.

The impact of AI on the semiconductor equipment industry is systemic and in-depth, reshaping the investment logic of the entire industrial chain.

| Investment Theme | Beneficiary Logic | Beneficiary Targets |

|---|---|---|

| AI Chip Packaging Equipment | Increasing Penetration of Advanced Packaging | BESI, ASMPT |

| HBM Equipment | HBM Capacity Expansion | BESI, Kulicke & Soffa |

| Hybrid Bonding Technology | Next-Generation Packaging Standard | BESI |

| Wafer Fabrication Equipment | Advanced Process Capacity Construction | Applied Materials, Lam Research |

| Testing Equipment | Increasing Chip Complexity | Teradyne, Advantest |

Based on technical analysis tool data [7]:

- MACD: No crossover signal, but maintains a bullish arrangement, indicating that the medium-term trend is still biased upward

- KDJ Indicator: K value 73.8, D value 74.9, J value 71.7, approaching the overbought zone, sending a bearish-leaning signal

- RSI Indicator: In the normal range, no overbought or oversold signal

- Beta Coefficient: 1.12, slightly higher volatility relative to the broader market

| Valuation Metric | BESI Value | Industry Average | Evaluation |

|---|---|---|---|

| P/E (TTM) | 80.64x | ~35x | Significant Premium |

| P/S (TTM) | 20.70x | ~8x | Significant Premium |

| EV/OCF | 62.65x | ~25x | Significant Premium |

Considering BESI’s fundamentals, technological advantages, and valuation level, we assign an

-

Leading Position in AI Packaging Technology: BESI’s technological advantages in hybrid bonding and advanced die attach make it a core beneficiary of AI chip capacity expansion. Hybrid bonding technology is transitioning from the early adoption phase to volume production, and the Company is expected to enter a period of rapid order and revenue growth.

-

Strong Profitability and Healthy Cash Flow: A gross margin of over 60% and a net profit margin of over 25% provide the Company with sufficient financial flexibility to support sustained R&D investment and shareholder returns. The current ratio of 5.75 ensures strong resilience against short-term fluctuations.

-

Positive Analyst Sentiment: 13 out of 22 analysts have given a “Buy” rating, while only 1 recommends selling [3]. Although the current share price is close to the target price, the €190 target price from institutions such as Needham still provides approximately 25% upside potential.

-

Broad Long-Term Growth Space: According to SEMI’s forecast, the semiconductor equipment market will reach $156 billion in 2027, representing a 50% increase from $104 billion in 2024 [2]. As an important player in the backend equipment sector, BESI is expected to outperform the industry average growth rate.

-

Valuation Risk: The current 80x P/E ratio has fully priced in market expectations; if order growth or earnings fail to exceed expectations, the share price may face significant adjustments.

-

Customer Concentration Risk: The Company’s revenue mainly comes from a small number of large customers, which may lead to significant order volatility.

-

Macroeconomic Risk: The semiconductor industry is highly cyclical; an economic recession may lead to a decline in end demand and a cut in capital expenditures.

-

Technology Iteration Risk: Semiconductor technology is evolving rapidly; if the Company fails to keep up with technological trends, it may lose its competitive advantage.

-

Exchange Rate Risk: As a European company, BESI reports in euros, but a significant portion of its revenue comes from the Asian market. Exchange rate fluctuations may affect its profitability.

| Company | Ticker | P/E | 2025 Expected Growth Rate | Investment Theme | Rating |

|---|---|---|---|---|---|

| BE Semiconductor | BESI.AS | 80.64x | 12% | AI Packaging Equipment | Overweight |

| ASMPT | 0522.HK | 18.5x | 8% | Semiconductor Packaging Equipment | Hold |

| Lam Research | LRCX.US | 22.3x | 15% | Wafer Fabrication Equipment | Buy |

| Applied Materials | AMAT.US | 25.6x | 12% | Wafer Fabrication Equipment | Buy |

| Teradyne | TER.US | 28.4x | 10% | Testing Equipment | Hold |

From a valuation perspective, BESI’s P/E ratio is significantly higher than its peers, reflecting a premium for market expectations of high growth in the Company’s AI packaging business. Lam Research and Applied Materials have more reasonable valuations and benefit from the overall expansion of the frontend equipment market.

| Allocation Ratio | Target | Rationale |

|---|---|---|

| 30% | Lam Research (LRCX) | Leader in wafer fabrication equipment, benefits from AI logic chip expansion |

| 25% | Applied Materials (AMAT) | Full-category equipment platform, benefits from advanced process investment |

| 20% | BE Semiconductor (BESI) | High-beta target in AI packaging equipment, technologically leading |

| 15% | Teradyne (TER) | Leader in testing equipment, benefits from increasing chip complexity |

| 10% | Cash | Opportunity to add positions |

BE Semiconductor Industries is in a favorable position within the AI-driven semiconductor super cycle. The Company’s 43% order growth has strong sustainability, supported by the following factors: sustained strong demand for AI chip packaging, obvious leading advantages in hybrid bonding technology, and rapid expansion of the advanced packaging market. SEMI predicts that the semiconductor equipment market will achieve double-digit growth for three consecutive years from 2025 to 2027, providing a favorable industry environment for BESI.

From a valuation perspective, the current 80x P/E ratio has fully priced in market expectations. However, considering the Company’s technological barriers in AI packaging equipment, excellent profitability, and positive analyst sentiment, we believe BESI still offers medium-to-long-term allocation value. Investors may consider building positions in batches near the support level and holding for 12-18 months to fully benefit from the industry growth cycle.

It should be noted that the semiconductor industry is highly cyclical, and order growth may be volatile. In addition, the current valuation is at a historical high; if growth expectations are not met, the share price may face adjustment risks. It is recommended that investors make prudent decisions based on their own risk preferences and investment horizons.

[1] BE Semiconductor Industries N.V. Q3 FY2025 Earnings Call Transcript. Yahoo Finance. (https://finance.yahoo.com/quote/BESI.AS/earnings/BESI.AS-Q3-2025-earnings_call-339118.html)

[2] Global Semiconductor Equipment Sales Projected to Reach a Record of $156 Billion in 2027 - SEMI Reports. SEMI. (https://www.semi.org/en/semi-press-release/global-semiconductor-equipment-sales-projected-to-reach-a-record-of-156-billion-dollars-in-2027-semi-reports)

[3] BE Semiconductor Industries NV (BESI) Stock Forecast & Price Target. Investing.com. (https://www.investing.com/equities/be-semicond-consensus-estimates)

[4] Hybrid Bonding Market. MarketsandMarkets. (https://www.marketsandmarkets.com/Market-Reports/hybrid-bonding-market-2641237.html)

[5] 2026 Advanced Packaging Outlook Report. TechInsights. (https://www.techinsights.com/outlook-reports-2026/advanced-packaging-outlook-report)

[6] What’s Ahead in 2026 for the Semiconductor Industry. Sourceability. (https://sourceability.com/post/whats-ahead-in-2026-for-the-semiconductor-industry)

[7] Jinling AI - BESI.AS Company Overview and Technical Analysis Data

[8] BE Semiconductor Industries N.V. Announces Q3-25 Results. Globe Newswire. (https://www.globenewswire.com/news-release/2025/10/23/3171740/0/en/BE-Semiconductor-Industries-N-V-Announces-Q3-25-Results.html)

[9] Advanced Semiconductor Packaging Market Analysis. Precedence Research. (https://www.precedenceresearch.com/insightimg/advanced-semiconductor-packaging-market-size.webp)

[10] BE Semiconductor: Guidance Disappoints; Long-Term Outlook Strong. Morningstar. (https://global.morningstar.com/en-gb/stocks/be-semiconductor-guidance-disappoints-long-term-outlook-strong)

Report Generation Date: January 12, 2026

Product Name: Jinling AI

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.