Analysis of the Impact of Sustained Southbound Capital Inflows on the Hong Kong Stock Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data, I will systematically analyze the impact of sustained southbound capital inflows on the valuation and investment opportunities of the Hong Kong stock market for you.

According to the latest data, southbound capital investment in the Hong Kong stock market reached a high of

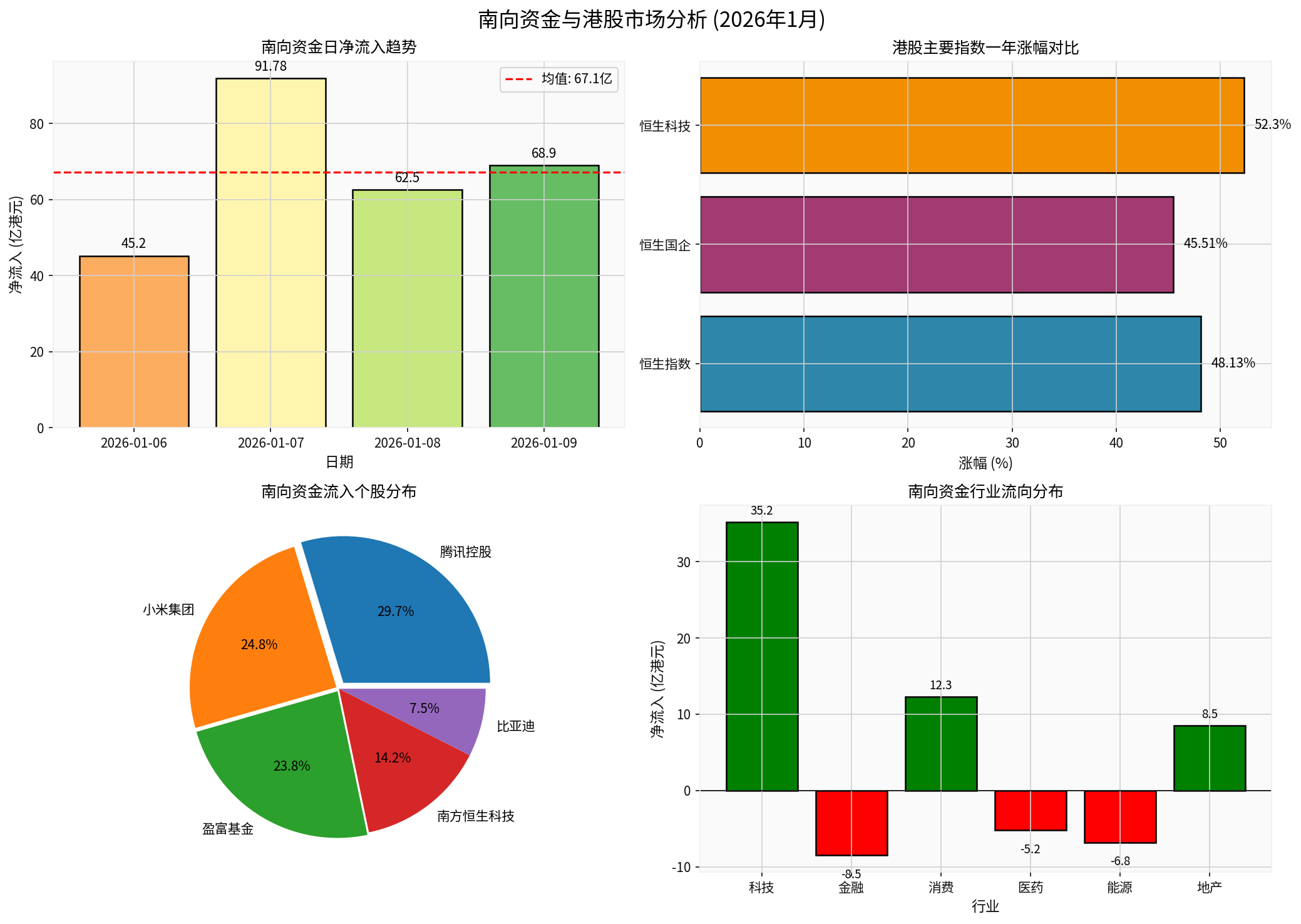

As of early January 2026, southbound capital has maintained a strong net inflow trend:

- January 7: Single-day net purchases amounted to approximatelyHK$9.178 billion, of which the Shenzhen-Hong Kong Stock Connect recorded a net inflow of HK$5.688 billion, and the Shanghai-Hong Kong Stock Connect recorded a net inflow of HK$3.490 billion [2]

- January 9: The total turnover of actively traded stocks under the Hong Kong Stock Connect reachedHK$36.462 billion, with a net purchase amount ofHK$691 million[3]

Southbound capital shows an obvious concentration on leading targets, with the main net inflow targets including:

| Stock | Net Inflow (HK$100 million) | Net Inflow Ratio | Capital Trend |

|---|---|---|---|

| Tencent Holdings | 19.53 | 14.71% | Sustained Inflow |

| Xiaomi Corporation-W | 16.34 | 22.31% | Net Purchases for 7 Consecutive Days |

| Tracker Fund of Hong Kong | 15.68 | 11.46% | Accumulate on Dips |

| Southern Hang Seng Technology | 9.38 | 12.52% | Sustained Inflow |

| BYD Company Limited | 4.93 | 13.30% | Stable Inflow |

Sustained southbound capital inflows have driven a significant valuation recovery in the Hong Kong stock market:

| Index | 1-Year Return | Current P/E Ratio | Historical Percentile |

|---|---|---|---|

| Hang Seng Index | +48.13% | 10.2x | Low |

| Hang Seng China Enterprises Index | +45.51% | 8.5x | Low |

| Hang Seng Technology Index | +52.3% | 22.4x | Median |

Despite the Hang Seng Index soaring nearly 30% in 2025, the current price-to-earnings ratio is still around

- Valuation Advantage Remains: The Hong Kong stock market still enjoys an obvious valuation discount compared to A-shares and U.S. stocks

- Attract Incremental Capital: The low-valuation environment will continue to attract allocation from southbound capital and foreign capital

- Room for Valuation Recovery: There is still an opportunity for double growth from profit growth combined with valuation expansion

Zhou Hanying, QDII Fund Manager of Invesco Great Wall, pointed out that southbound capital played a

It is widely believed in the industry that Hong Kong stock investment is shifting from “

| Stage Characteristics | 2025 | 2026 |

|---|---|---|

| Driving Factor | Valuation Recovery | Profit-Driven |

| Investment Strategy | Track Beta | Stock-Specific Alpha |

| Uptrend Feature | Universal Rally | Structural Differentiation |

| Stock-Picking Requirement | Correct Track | Performance Realization |

Many public fund managers judge that the beta opportunity of universal stock rallies within Hong Kong stock industries may weaken in 2026, and the upward momentum will come more from

Based on southbound capital flows and market prospects, it is recommended to focus on the following areas:

- Tencent Holdings: Southbound capital continues to increase positions, with high certainty of performance recovery

- Xiaomi Corporation-W: Net purchases for 7 consecutive days, with its smart car business providing new growth momentum

- BYD Company Limited: Leading new energy vehicle company, benefiting from the recovery of industry prosperity

- China Life Insurance: Net inflow ratio of 11.86%, with attractive valuation

- Tracker Fund of Hong Kong, Hang Seng China Enterprises ETF: Capital has obvious willingness to accumulate on dips

- CSPC Pharmaceutical Group: Net inflow ratio as high as 29.42%

- 3SBio: Net inflow ratio of 25.52%, with a single-day increase of 7.16%

- Real Estate: Single-day increase of 1.36%, the best performer

- Industry: Increase of 1.32%, benefiting from economic recovery

The following risk factors should be noted:

- Crowded Trading Risk: Excessive capital concentration in popular tracks may face adjustment pressure

- Performance Falsification Risk: Companies that only tell stories without actual performance realization face valuation pullback

- Liquidity Volatility: The pace of southbound capital inflows may slow down

- External Uncertainty: Geopolitical changes and U.S. Federal Reserve policy adjustments

- Continuous Improvement in Capital Liquidity: Southbound capital has become the most important source of incremental capital in the Hong Kong stock market, with inflow scale hitting a record high in 2025

- Valuation Recovery Continues: Despite a large increase, the valuation of Hong Kong stocks is still at a historical low, with medium- to long-term allocation value

- Investment Strategy Shift: From “Lazy Win Track Beta” to “Select High-Quality Alpha”, performance becomes the core stock-picking criterion

- Structural Opportunities as Main Focus: The market will show obvious differentiation in 2026, so select targets with high performance certainty

| Investment Type | Recommended Strategy |

|---|---|

| Long-Term Allocation | Hong Kong stock index funds (Tracker Fund of Hong Kong, Southern Hang Seng Technology) |

| Thematic Investment | Focus on leading companies in booming tracks such as AI, semiconductors, and innovative drugs |

| Value Investment | Focus on high-dividend, low-valuation financial and real estate sectors |

| Trading Opportunities | Seize volatility opportunities brought by sustained southbound capital inflows |

[1] Zhitong Finance Network - Hong Kong Stock Connect Capital Flow Statistics (https://finance.sina.com.cn/stock/hkstock/ggscyd/2026-01-12/doc-inhfyxew7704523.shtml)

[2] CLS.com - Southbound Capital Net Purchases Near HK$9.2 Billion (https://www.cls.cn/detail/2250796)

[3] Securities Times Network - List of Stocks with Continuous Net Purchases via Hong Kong Stock Connect (https://www.stcn.com/article/detail/3584145.html)

[4] China Investment Corporation - 2026 Hong Kong Stock Market Investment Outlook (https://www.chiefgroup.com.hk/cn/financial/media/dp?id=13476)

[5] Securities Times Network - New Strategies of Public Funds for Southbound Investment in 2026 (https://www.stcn.com/article/detail/3585097.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.