Analysis Report on Liquidity Discount and Long-Term Valuation Recovery of Iluvatar CoreX (HK: 9903)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my analysis, below is the full report on the Hong Kong stock liquidity discount of Iluvatar CoreX and its impact on long-term valuation recovery:

- Stock Ticker: 9903.HK

- Listing Date: January 8, 2026

- Issue Price: HK$144.6

- Opening Price: HK$190.2 (31.54% first-day gain)

- IPO Fundraising Amount: HK$3.677 billion

- Market Capitalization: Approximately HK$35.4 billion

- The Hong Kong public offering received 414.24 timesoversubscription

- 18 top cornerstone investors were introduced, subscribing to 43%of the issued shares

- Covering industry chain leaders such as ZTE, 4Paradigm, and TFME, as well as financial institutions like UBS and China Asset Management [1][2]

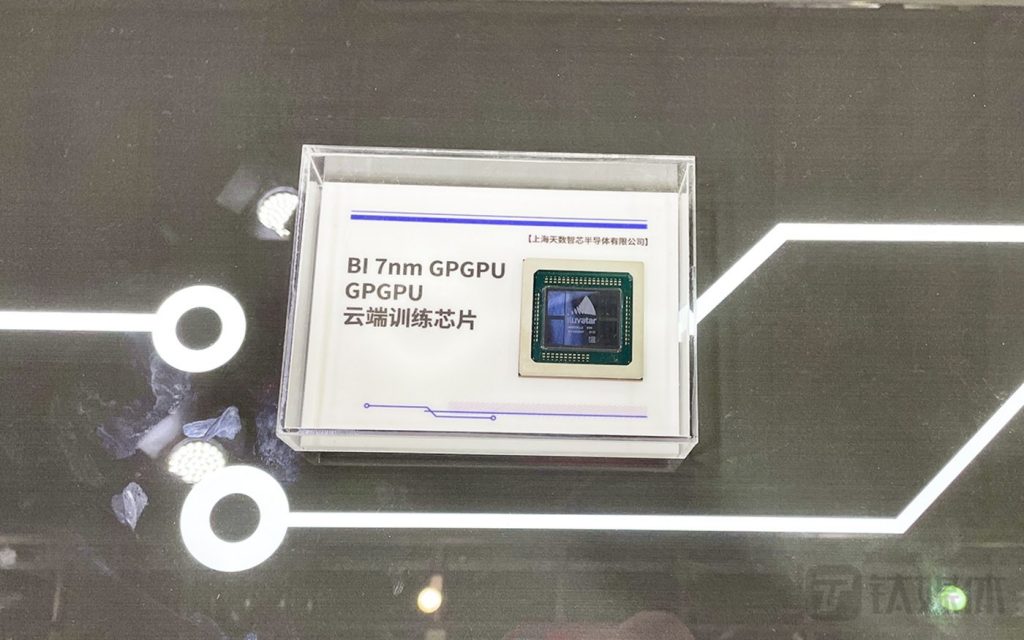

- The first Chinese enterprise to mass-produce inference GPUs

- The first Chinese enterprise to mass-produce training GPUs

- The first domestic GPU enterprise in China to achieve mass production using advanced 7nm process technology

The Hong Kong stock tech sector exhibits a significant valuation discount, which is caused by multiple structural factors:

| Valuation Comparison | Hang Seng Tech Index | ChiNext | STAR Market | Nasdaq 100 |

|---|---|---|---|---|

| P/E Ratio (PETTM) | 21-22x | 45x | 55x | 35x |

| Discount Range | Benchmark | -52% |

-61% |

-39% |

The valuation of the Hang Seng Tech Index still lags behind the ChiNext, positioning it as a “value depression” in the global tech landscape [3][4].

According to the analysis framework, the main factors affecting the liquidity discount of Hong Kong tech stocks include:

-

Market Liquidity Differences(Impact Level: 8.5/10)

- The average daily turnover of Hong Kong stocks is approximately 1/3 that of A-shares

- The proportion of institutional investors is relatively low

-

Investor Structure(Impact Level: 7.8/10)

- High retail investor participation leads to greater volatility

- Foreign allocation ratios fluctuate due to geopolitical impacts

-

Trading Mechanism Differences(Impact Level: 6.5/10)

- T+2 settlement system

- Relatively limited derivative tools

-

Exchange Rate Risk Exposure(Impact Level: 5.5/10)

- Hong Kong dollar is pegged to the US dollar, exposing RMB investors to exchange rate fluctuations

-

Geopolitical Risk Premium(Impact Level: 7.2/10)

- Uncertainty brought by China-US tech competition

Data from Morgan Stanley shows that:

Compared to peer companies, Iluvatar CoreX’s IPO issuance structure has significant advantages in liquidity management:

| Indicator | Iluvatar CoreX | Biren Technology | Industry Average |

|---|---|---|---|

| Cornerstone Investor Subscription Ratio | 43% |

~30% | 20-35% |

| Issue PS Multiple | 60x |

200x+ | 100-150x |

| Hong Kong Public Offering Ratio | 10% | 17.39% | 10-15% |

| Estimated Free Float Size | ~HK$2.1 billion |

Relatively Large | HK$1.5-3 billion |

- The 43% cornerstone lock-up ratio is in the “golden range” (Huatai Securities research shows 20%-50% is the optimal range)

- It locks in selling pressure while retaining sufficient liquidity space

- An excessively high cornerstone ratio will lead to insufficient liquidity, while an excessively low ratio lacks institutional endorsement [5]

The strong market demand reflected by

- Investors recognize the company’s long-term value

- Supply-demand imbalance in the initial listing period may trigger a buying frenzy

- Provides a sufficient liquidity foundation for subsequent transactions

The 18 cornerstone investors include:

- Industrial Capital: ZTE, 4Paradigm, TFME —— casting a “technology trust vote” with real capital

- Financial Capital: UBS, Fullgoal Fund, China Asset Management —— reflecting institutions’ optimism about long-term growth potential

This dual recognition from “industry + capital” translates into tangible liquidity support.

Data shows that the market share of domestic general-purpose GPUs (calculated by shipment volume) is growing rapidly:

- 2022: 8.3%

- 2024: 17.4%

- 2025 (estimated): 25%

- 2027 (estimated): 38%

- 2029 (estimated): Exceed 50%

As an industry leader, Iluvatar CoreX will fully benefit from this structural substitution process.

- Cumulative Net Purchases by Southbound Capital: Approximately HK$1.35 trillion (a record high) [3]

- Foreign Capital Inflow: US$4.6 billion net inflow into the Chinese stock market in September 2025 (a one-year high)

- Annual Inflow into Passive Funds: Exceeded US$18 billion, surpassing last year’s US$7 billion level

The Hong Kong stock tech sector is experiencing a double resonance of capital and valuation.

| Indicator | 2022 | 2023 | 2024 | H1 2025 |

|---|---|---|---|---|

| Revenue (CN¥100 million) | 1.89 | 3.21 | 5.40 | 3.24 |

| YoY Growth Rate | - | 69.8% | 68.2% | 64.2% |

| Number of Customers | 22 | - | - | 290 |

| Cumulative Shipment Volume | - | - | - | Over 52,000 units |

| Actual Deployment Times | - | - | - | 900+ |

- Revenue Compound Annual Growth Rate (CAGR): 68.8%

- Gross Profit Margin: Stable above 50%

- Revenue Contribution from Top 5 Customers: Decreased from 94% to 38%(significant improvement in customer diversification)

- Loss Status: Achieved commercialization validation earlier than peers

| Comparison Dimension | Iluvatar CoreX | Biren Technology | Moore Threads (A-share) |

|---|---|---|---|

| Issue PS Ratio | 60x |

200x+ | Over 400% Price Surge |

| PS Valuation | Rational |

Relatively High | Extremely Optimistic |

| Pullback Risk | Low |

High | Very High |

| Upside Potential | Sufficient |

Limited | Already Overdrawn |

Among the “Four Little Dragons” of domestic GPUs, Iluvatar CoreX has the most rational valuation and sufficient margin of safety [5].

- Potential selling pressure after the expiration of cornerstone investors’ lock-up period

- Market sentiment digestion period for new stocks

- Impact of the overall liquidity environment of Hong Kong stocks

- Supply-demand imbalance in the initial listing period supports the stock price

- Continuous performance validation provides fundamental support

- Sustained enthusiasm for the AI computing power track

- High-speed growth of 2025 performance is realized

- Market share continues to rise to over 20%

- Institutional investors gradually complete position building

- Southbound capital continues to increase allocation to the tech sector

- Liquidity discount narrows by 10-20%

- PS valuation recovers to the 80-90x range

- Performance Outbreak Period: Revenue is expected to exceed CN¥2 billion, with significant improvement in profitability

- Consolidated Market Position: Domestic GPU market share exceeds 30%, becoming an industry leader

- Improved Liquidity: Inclusion in major indices (such as the Hang Seng Tech Index) leads to increased passive capital allocation

- Valuation Alignment: Valuation gap with peer A-share companies narrows to within 20%

- Liquidity discount is basically eliminated

- PS valuation reaches 100-120x

- Market capitalization is expected to exceed HK$80-100 billion

- Liquidity Discount Exists Objectively but Shows Marginal Improvement: The valuation of the Hong Kong stock tech sector is at a historical low, with significant upward recovery potential

- Iluvatar CoreX’s Liquidity Conditions Are Better Than Peers: 43% cornerstone lock-up, 414 times oversubscription, and 18 top cornerstone investors provide multiple guarantees

- Clear Long-Term Valuation Recovery Path: Resonance formed by accelerated industrial substitution, continuous capital inflow, high-speed performance growth, and sufficient margin of safety

- Discount Will Narrow Significantly Within 2-3 Years: The liquidity discount is expected to narrow from the current 30-40% to the industry average of 10-15%

- Geopolitical Risk: China-US tech competition may affect chip export controls and foreign capital allocation

- Intensified Industry Competition: Price cuts by international giants may compress profit margins of domestic manufacturers

- Technological Iteration Risk: Rapid evolution of GPU technology may render existing products obsolete

- Liquidity Volatility: Overall market sentiment of Hong Kong stocks may affect short-term stock price performance

| Investment Type | Recommended Strategy | Expected Return | Risk Level |

|---|---|---|---|

| Long-Term Value Investment | Core allocation to share the growth dividend of domestic GPUs | 30-50% annualized | Medium-Low |

| Phased Opportunity | Accumulate positions on dips 3-6 months after listing | 20-40% | Medium |

| IPO Subscription Strategy | Participate actively, hold appropriately on the first listing day | 30%+ on the first day | Low |

[1] Securities Times - “China’s First General-Purpose GPU Enterprise Iluvatar CoreX Officially Lists on HKEX, Opens 31.54% Higher” (January 8, 2026) https://www.stcn.com/article/detail/3578078.html

[2] Zhitong Finance - “China’s First General-Purpose GPU Enterprise Iluvatar CoreX (09903) Lists on Hong Kong Stock Exchange, Opens 31.54% Higher!” https://hk.investing.com/news/stock-market-news/article-1260092

[3] Securities Times - “From Discount to Highlight: Hong Kong Stock Tech Sector, the ‘Golden Pit’ of Chinese Assets in the AI Era” (November 21, 2025) https://stcn.com/article/detail/3504910.html

[4] Jiemian News - “Navigating Volatility, Restructuring Growth: Valuation Re-rating of Hong Kong Stock Tech Amid Liquidity Recovery and Deepening AI Industry” (December 19, 2025) https://www.jiemian.com/article/13784710.html

[5] Mei Gang Tan An - “Iluvatar CoreX’s IPO Market Capitalization to Reach HK$35.4 Billion, Have You Joined This AI Computing Power Carnival?” (January 4, 2026) https://view.inews.qq.com/a/20260104A03SPL00

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.