Iluvatar CoreX (09903.HK): MACD Golden Cross Analysis and Short-Term Buy Value Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my analysis, below is the MACD Golden Cross Analysis and Short-Term Buy Value Assessment for Iluvatar CoreX (09903.HK):

| Item | Data |

|---|---|

| Offer Price | HK$144.6 |

| First-Day Opening Price | HK$190.2 (+31.54%) |

| First-Day Closing Price | HK$156.8 (+8.44%) |

| Latest Closing Price (Approx.) | HK$167.5 (as of January 12) |

| Current Increase | +15.84% |

| Market Capitalization | Approx. HK$40 Billion |

| Indicator | Value | Interpretation |

|---|---|---|

| MACD Line | 2.50 | Above the Signal Line |

| Signal Line | 1.77 | - |

| MACD Histogram | +0.73 | Positive and expanding |

| 2-Day Moving Average | HK$166.35 | Stock price is above the moving average |

| 3-Day Moving Average | HK$164.40 | Stock price is above the moving average |

- Bullish Moving Average System: The current stock price (HK$167.5) has broken above the 2-day and 3-day moving averages, with short-term moving averages trending upward[0]

- High Market Popularity: The IPO received 414 times oversubscription, indicating high recognition from the capital market[1]

- Solid Fundamentals: The compound annual growth rate (CAGR) of revenue from 2022 to 2024 reached 68.8%, and the revenue in the first half of 2025 was RMB 324 million, a year-on-year increase of 64.2%[2]

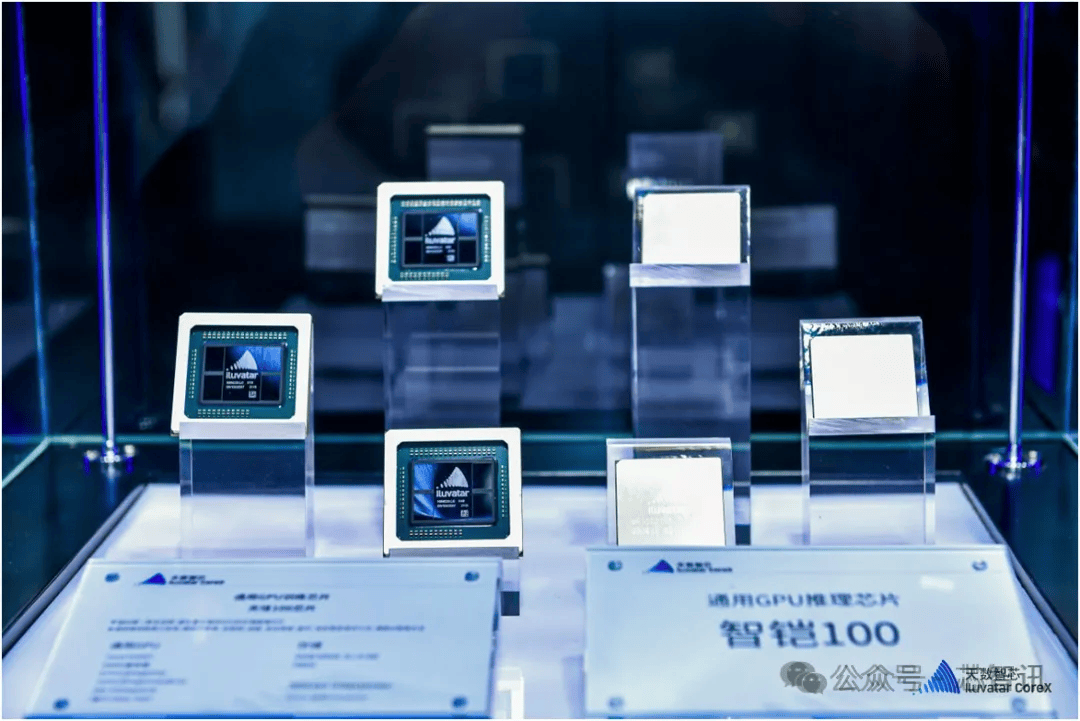

- Technological Leadership: The first domestic enterprise to achieve mass production of inference and training general GPU chips[3]

- High Volatility for New Stock: The stock fell sharply from the intraday high of HK$190.2 to HK$156.8 on the first day of listing[1]

- Declining Trading Volume: Trading volume has gradually decreased from 15 million shares on the first day to 6.8 million shares, indicating weakening upward momentum[0]

- Relatively High Absolute Stock Price: The stock price of over HK$160 may limit retail investor participation

- Sustained Losses: The cumulative loss from 2022 to the first half of 2025 was approximately RMB 2.87 billion[1]

| Strategy Type | Recommendation |

|---|---|

Short-Term (1-2 Weeks) |

Insufficient data to support the validity of the MACD golden cross; it is recommended to wait and see for more confirmed technical signals |

Medium-Term (1-3 Months) |

Consider accumulating on dips if the stock price pulls back to the HK$140-150 range |

Risk-Taking Investors |

May participate with a small position, and set a strict stop-loss (below HK$150) |

Based on market analysis, as a leader in the domestic GPU track, some analysts have given Iluvatar CoreX a

From the perspective of the MACD golden cross, Iluvatar CoreX

- Insufficient data sample, unable to confirm the validity of the golden cross

- Trading volume is on a declining trend, with upward momentum weakening

- High volatility in the initial stage of listing, requiring time to establish an equilibrium price

However, from a mid-to-long-term perspective, the domestic GPU track where the company operates has huge import substitution potential. In addition, the company has achieved large-scale mass production and has a solid customer base, giving it good mid-to-long-term investment value. It is recommended that investors maintain attention and wait for clearer technical patterns before making decisions.

[1] Sina Finance - “Surge of 31.54%! Iluvatar CoreX Lists on HKEX” (https://finance.sina.com.cn/roll/2026-01-08/doc-inhfqpsv1366092.shtml)

[2] Securities Times - “Iluvatar CoreX Officially Lists on HKEX, Enters the Main Battlefield of Domestic GPU Stock Substitution” (https://www.stcn.com/article/detail/3578117.html)

[3] AAStocks - “HK Stock Movement | Iluvatar CoreX Rises Over 32% on Debut” (https://www.aastocks.com/tc/stocks/analysis/stock-aafn-con/09903/GLH/GLH2244581L/hk-stock-news)

[4] East Money Caifuhao - “Iluvatar CoreX Rises Up to 45.23%, Is This the End? No, It’s Still Undervalued!” (https://caifuhao.eastmoney.com/news/20260107182842169170760)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.