Analysis of the Gap Between Iluvatar CoreX and NVIDIA's Software and Hardware Ecosystem

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on collected data, I will systematically analyze the gap between Iluvatar CoreX and NVIDIA in terms of integrated software and hardware ecosystem from multiple dimensions.

| Dimension | NVIDIA CUDA Ecosystem | Iluvatar CoreX Ecosystem |

|---|---|---|

| Number of Developers | Over 5 million [1] | Early stage of domestic developer ecosystem |

| Open Source Community Years | Nearly 20 years of accumulation (2006 to present) [2] | Launched DeepSpark in 2019 [3] |

| Libraries & Tools | 350+ CUDA libraries [1] | Under continuous development |

| Framework Adaptation | Full coverage | Compatible with mainstream frameworks |

NVIDIA’s CUDA ecosystem, after nearly 20 years of meticulous cultivation, has formed the world’s largest GPU developer community. The core competitiveness of this ecosystem lies in the fact that parallel computing courses at top universities worldwide almost all teach CUDA, and graduates are “CUDA-ready” talent when entering the workplace [2]. Although Iluvatar CoreX’s DeepSpark open source community has gathered more than 400 algorithm models [3], there is still an order-of-magnitude gap in terms of developer count, community activity, and knowledge accumulation.

| Indicator | NVIDIA | Iluvatar CoreX |

|---|---|---|

| Cooperating Enterprises | 40,000 enterprise users [1] | 290 cumulative customers [3] |

| Deployment Scenarios | Hundreds of thousands | Over 900 [4] |

| AI Model Support | Hundreds of thousands | 450+ models [3] |

| Industry Penetration | Full industry coverage | Finance, healthcare, education, transportation, etc. [3] |

NVIDIA’s platform powers over 75% of the world’s TOP500 supercomputers, and holds a market share of over 95% in the workstation graphics market [1]. In contrast, Iluvatar CoreX has delivered products to over 290 customers, covering key industries such as financial services, healthcare, and transportation [3], but its overall scale is still in a period of rapid growth.

-

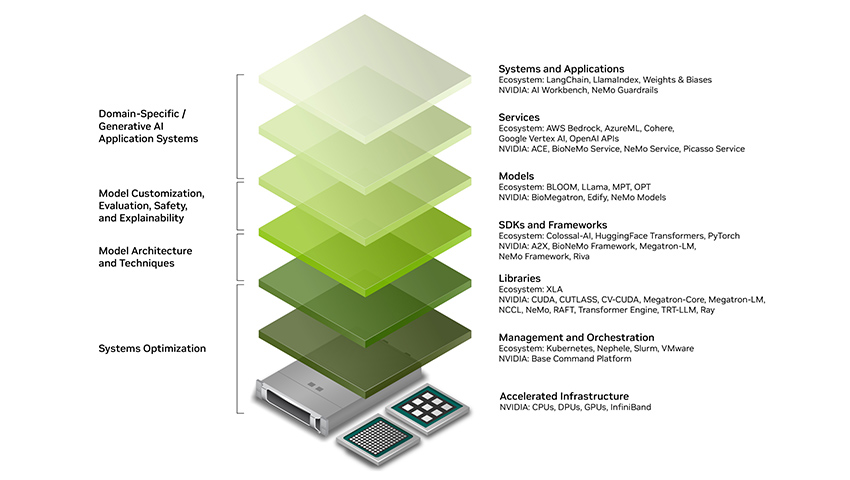

CUDA Programming Model: Launched in 2006 and evolving to this day, CUDA has become the “gold standard” for GPU programming [5]. It is not just a programming framework, but a complete software-hardware collaboration system:

- Hardware Binding: Can only run on NVIDIA GPUs

- Low-Level Optimization: Developers can finely control GPU resources

- Mature and Stable: Validated through billions of GPU-hours of real-world use

-

Complete Software Stack:

- CUDA compiler, debugger, and analysis tools

- High-performance libraries such as cuDNN and cuBLAS

- Inference optimization tools such as TensorRT and TRT-LLM

- NGC (NVIDIA GPU Cloud) container registry

Iluvatar CoreX adopts a pragmatic strategy of “short-term compatibility, long-term independence” [4]:

- Driver layer fully supports mainstream Linux distributions such as Ubuntu, CentOS, and Kylin

- Compatible with x86 and ARM architecture CPUs

- Deeply adapts to mainstream AI frameworks such as PyTorch, TensorFlow, and PaddlePaddle

- Supports high-performance inference engines such as vLLM and TensorRT

However, this compatibility strategy faces policy risks from NVIDIA’s April 2024 announcement banning the running of CUDA software on other GPUs via translation layers [6].

| Cost Dimension | NVIDIA Platform | Iluvatar CoreX Platform |

|---|---|---|

| Code Migration | Native execution | Average migration time reduced by 50% [7] |

| Learning Curve | Rich mature tutorials | Emerging platform with limited learning resources |

| Issue Resolution | Massive solutions on Stack Overflow | Limited community resources |

| Stability Verification | Decades of iterative optimization | Under continuous optimization |

Through the innovative “one-time deployment, continuous adaptation” mechanism, Iluvatar CoreX enables mature applications to be deployed on the same day, iterative versions to be adapted within a week, and emerging complex models to be put into operation within two weeks [4]. The Zhikai 100 is compatible with the CUDA ecosystem, with average migration time reduced by more than 50% compared to mainstream market products [7].

NVIDIA has built full-stack technical capabilities from chips to systems:

- GPU Architecture: From Ampere to Hopper to Blackwell, each generation of architecture brings revolutionary performance improvements

- NVLink Interconnect: The NVLink domain of the Blackwell system can connect 144 GPUs, with a total bandwidth of up to 259TB/s [1]

- CPU Integration: Tight coupling of Grace CPU and GPU

- DPU Network: Spectrum-X Ethernet supports large-scale GPU interconnection

Iluvatar CoreX’s TianGai 100 uses a 7nm process, has 24 billion transistors, and 32GB HBM2 memory [7], but it is still in the catching-up stage in terms of large-scale interconnection and system-level integration.

| Verification Dimension | NVIDIA | Iluvatar CoreX |

|---|---|---|

| Supercomputing Verification | Adopted by over 75% of TOP500 supercomputers | Gradually expanding in domestic supercomputing applications |

| Large Model Training | Full support for trillion-parameter models | Supports training of 10-billion-parameter large models [7] |

| Industry Verification | In-depth verification across all industries | Verified in 900+ deployment scenarios [4] |

This is the most direct financial reflection of the ecosystem gap:

| Indicator | NVIDIA | AMD (2nd Place) | Gap |

|---|---|---|---|

| Data Center Gross Margin | 72%-75% [2] | 50%-53% [2] | 20+ percentage points |

| Pricing Power | Extremely strong | Weak | Premium from ecosystem lock-in |

| R&D Investment | FY2025: USD 12.91 billion [2] | Relatively limited | Circular reinforcement |

NVIDIA’s CUDA moat directly translates to pricing power: the gross margin of its data center business stabilizes at 72% to 75%, which is almost unheard of in the hardware industry, and is more like the profit structure of a monopolistic software platform [2]. In contrast, domestic GPU manufacturers face significant pressure on pricing power due to ecosystem disadvantages.

- Hardware Binding: CUDA can only run on NVIDIA GPUs

- Code Assets: The CUDA code accumulated by enterprises is like chains; abandoning it means giving up huge investments over the past decade

- Human Capital: 4 million CUDA developers worldwide have adapted to this ecosystem, and the cost of learning a new platform is high

- Established strategic cooperation with downstream leaders such as ZTE, TeamSAFE, and Kingsoft Office [8]

- Adopted innovative industry-finance integration business models such as Sinxin Leasing, shifting from “selling products” to “providing computing power services” [8]

- Delivered over 52,000 general-purpose GPU products cumulatively [3]

- Insist on Independent R&D: Chose a full independent R&D route from its establishment to avoid core IP being controlled by others [4]

- Open Ecosystem Strategy:

- Led the formulation of national standards such as the “Artificial Intelligence Chip Technical Specification”

- Cooperated with Shanghai AI Laboratory to connect to DeepLink

- Co-built laboratories with universities, training over 1,000 chip talents cumulatively [4]

- Integrated Training and Inference: Built the only complete general-purpose computing power system in China that integrates “cloud-edge collaboration and training-integration” [3]

| Gap Dimension | Short-term Strategy | Long-term Strategy |

|---|---|---|

| Developer Ecosystem | Compatible with CUDA to reduce migration costs | Build an independent programming framework |

| Industry Verification | Deepen cooperation with top industry customers | Expand to more vertical sectors |

| Toolchain | Adapt to mainstream frameworks | Develop independent optimization tools |

| Interconnection Technology | Compatible with mainstream standards | Develop high-speed interconnection technology |

The gap between Iluvatar CoreX and NVIDIA in integrated software and hardware ecosystem is all-round, but it is not insurmountable. Although NVIDIA’s CUDA moat is solid, its closed nature also creates opportunities for challengers. Through the strategy of “compatibility & openness, co-construction & sharing”, Iluvatar CoreX has made significant progress in the domestic market—it ranked top 5 in China’s GPGPU market by revenue in 2024 [9], and achieved H1 2025 revenue of RMB 324 million, representing a 64.2% year-on-year increase [3].

Future competition will depend on:

- Ecosystem Openness: Whether it can attract more third-party developers to participate in ecosystem construction

- Performance Breakthrough: Whether it can achieve performance comparable to international leading levels in next-generation products

- Industry Deep Cultivation: Whether it can establish irreplaceable advantages in key vertical sectors

The case of Iluvatar CoreX proves that Chinese hard technology enterprises are rising along a new path of “technological breakthrough → ecosystem construction → commercial closed-loop”. With the continuous growth of domestic computing power demand and the strengthening of policy support, the domestic GPU ecosystem is expected to achieve substantive breakthroughs in the next few years.

[1] NVIDIA Development Strategy Research (2024) - Hansen Fluid

(http://www.hansenfluid.com/en/data-center/nvidia_c.htm)

[2] The Secret of 70% Gross Margin: CUDA, NVIDIA’s “Software Tax” - FOMO Institute

(https://fomosoc.substack.com/p/70cudanvidia-17nvda)

[3] Iluvatar CoreX Lists on HKEX: What Gives This Shanghai GPU Enterprise Confidence? - The Paper

(https://www.thepaper.cn/newsDetail_forward_32341813)

[4] Iluvatar CoreX: Decoding the Breakthrough and Rise of China’s “Low-Key King” of General-Purpose GPUs - Tencent News

(https://news.qq.com/rain/a/20260108A02NXE00)

[5] GPU Platform Ecosystem: Comparative Analysis of NVIDIA CUDA and AMD ROCm - 51CTO

(https://server.51cto.com/article/821000.html)

[6] 30 Domestic GPU Companies Disappear Daily: Why Do These 5 Thrive? - CYZone

(https://m.cyzone.cn/article/776578)

[7] TianGai 100 - Iluvatar CoreX Official Website

(https://www.iluvatar.com/productDetails?fullCode=cpjs-yj-xlxl-tg100)

[8] Investor Portfolio for Industry Linkage: The Deep Collaboration Code Behind Iluvatar CoreX’s HKEX Listing - Sohu

(https://q.stock.sohu.com/cn/news.html?textId=965971264&type=120&tab=200&code=cn_600410&date=2026/0108)

[9] Project Scope - HKEXnews Disclosure

(https://www.hkexnews.hk/listedco/listconews/sehk/2025/1230/11969957/2025123000079_c.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.