Analysis of the Sustainability of Illuvatar's 2025 H1 Revenue Growth

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest public information and market data, I conducted a systematic analysis of the growth drivers and sustainability of Illuvatar’s 64.24% year-on-year revenue growth in H1 2025.

According to the prospectus data, the company’s shipment volume reached 15,000 units in H1 2025, a record high, which is about 2.3 times that of the same period in 2024 [1]. As of June 30, 2025, the company has delivered a total of over 52,000 general-purpose GPU products to more than 290 customers [2]. The products cover multiple key industries including financial services, healthcare, transportation, manufacturing, and retail.

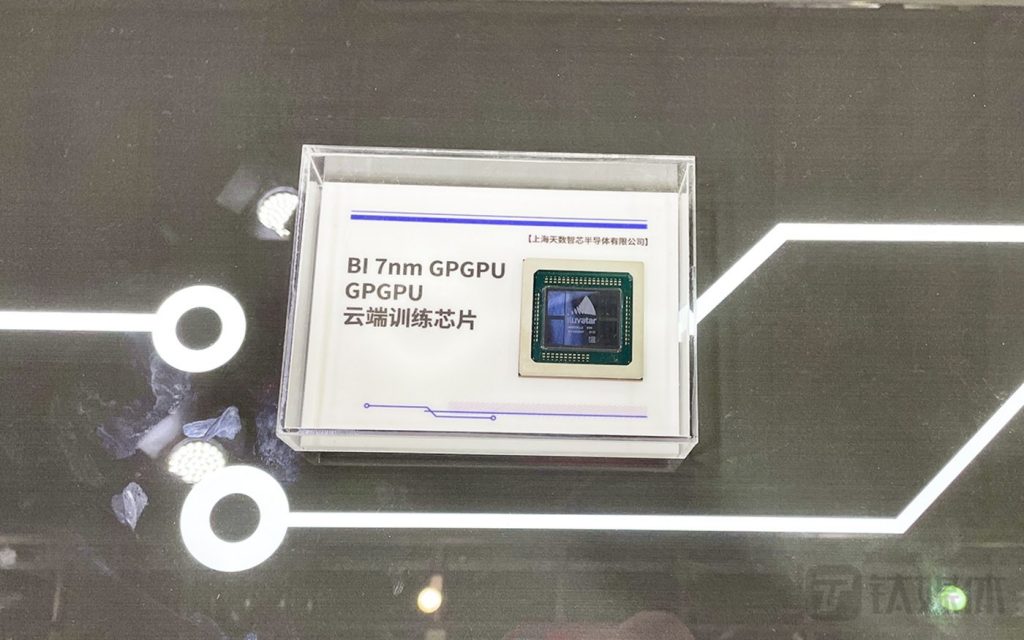

The company has currently formed a product portfolio centered on the “TianGai” series (training chips) and “ZhiKai” series (inference chips) [3]:

- TianGai 100: Adopts 7nm process technology, with 24 billion transistors, supporting the training of over 200 AI models

- ZhiKai 100: Delivers up to 384TOPS@int8 computing power, compatible with the CUDA ecosystem, reducing migration costs by more than 50%

In H1 2025, the revenue share of the company’s top five customers dropped sharply from over 70% to 38.6% [1], indicating that the customer structure is improving, reducing the risk of reliance on major customers.

Against the backdrop of the booming development of artificial intelligence and high-performance computing, the United States continues to tighten chip export restrictions against China, driving demand for domestic substitution [1]. According to Frost & Sullivan data, the localization rate of general-purpose GPUs in China was only 3.6% in 2024, and it is expected to exceed 31% by 2029.

| Factor | Analysis |

|---|---|

Strong Market Demand |

The general-purpose GPU market in China achieved a compound annual growth rate of 70.1% from 2022 to 2024, and is expected to maintain a high growth rate of around 30% from 2025 to 2029 [1] |

Huge Space for Domestic Substitution |

NVIDIA currently occupies 91.9% of the Chinese market, leaving broad room for the improvement of localization rate [1] |

Leading Technical Strength |

The company is the first domestic enterprise to mass-produce general-purpose GPU chips for both inference and training, and the first to achieve milestones using 7nm process technology [2] |

Sufficient Capital Support |

Cumulative fundraising exceeds HK$5.5 billion, with approximately HK$3.7 billion raised in the Hong Kong IPO, 80% of which will be invested in R&D [2][3] |

Gradually Improved Ecosystem |

Compatible with the CUDA ecosystem, supports mainstream domestic and overseas deep learning development frameworks, and is adapted to various server manufacturers [4] |

| Risk Type | Details |

|---|---|

Sustained Losses |

Net loss of RMB 609 million in H1 2025, with losses expanding by 52.3% year-on-year, and R&D costs continuing to exceed revenue [1] |

Supply Chain Risks |

Dependence on US-based EDA software, IP cores and other key technical tools, and changes in US export control policies may bring supply chain risks [1] |

Fierce Market Competition |

Peer companies such as Moore Threads, Muxi Semiconductor, and Biren Technology have gone public one after another, intensifying market competition [2] |

Customer Concentration |

Although improved, the customer concentration of 38.6% is still at a relatively high level [1] |

Pressure of Technology Iteration |

International giants continue to promote H200, B200 series products, and the company needs to accelerate its catch-up [3] |

Notably, the company’s gross profit margin has increased from 45.1% in H1 2024 to 50.1% in H1 2025 [2], showing certain signs of improvement. Meanwhile, the company announced that it will release a roadmap for three future generations of GPGPU products on January 26, 2026, covering innovative architecture designs and cloud AI training and inference products for the internet, and plans to compete with NVIDIA’s H200 and B200 series [2].

[1] Pedaily - “4 Domestic GPU Companies Go Public in 35 Days, Cumulative Market Value Surges by RMB 680 Billion” (https://news.pedaily.cn/202601/559698.shtml)

[2] Securities Times - “Another Domestic General-Purpose GPU Company Arrives! Illuvatar Rises 8.44% on its Debut” (https://www.stcn.com/article/detail/3580307.html)

[3] C114 Communications Network - “Illuvatar Lists on the Hong Kong Stock Exchange: Market Value Exceeds HK$40 Billion” (https://m.c114.com.cn/w16-1303684.html)

[4] CYZone - “30 Companies Disappear Every Day, Why Are These 5 Domestic GPU Companies Thriving?” (https://m.cyzone.cn/article/776578)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.