Analysis of the Commercialization Prospects of Brain-Computer Interface Technology and Valuation Impact for Hanwei Technology (300007)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data and information, I will provide a detailed report for your investment analysis.

Hanwei Technology currently has a market capitalization of approximately RMB 19.41 billion, with a share price of RMB 59.28. From a technical analysis perspective, the stock is in a sideways consolidation phase, with a reference price range of RMB 51.71 to RMB 60.79 [0]. However, the company’s current valuation indicators show significant bubble characteristics: the current price-to-earnings ratio (P/E) is as high as 237.5x, price-to-book ratio (P/B) is 6.68x, and price-to-sales ratio (P/S) is 8.22x [0]. From a financial health perspective, the company’s return on equity (ROE) is only 2.84%, with a net profit margin of 3.46%, indicating relatively weak profitability [0]. Meanwhile, free cash flow is negative (approximately -RMB 70.2 million), suggesting that the company is still in the investment and expansion phase, and its cash flow has not yet turned positive effectively [0].

The company’s financial stance is conservative, mainly reflected in its high depreciation and capital expenditure ratio, which may indicate that the company is making large-scale upfront investments to lay the foundation for future technological breakthroughs and business expansion [0]. In terms of debt risk, the company is classified as low-risk, which provides a relatively stable financial guarantee for subsequent technological R&D and commercialization exploration [0].

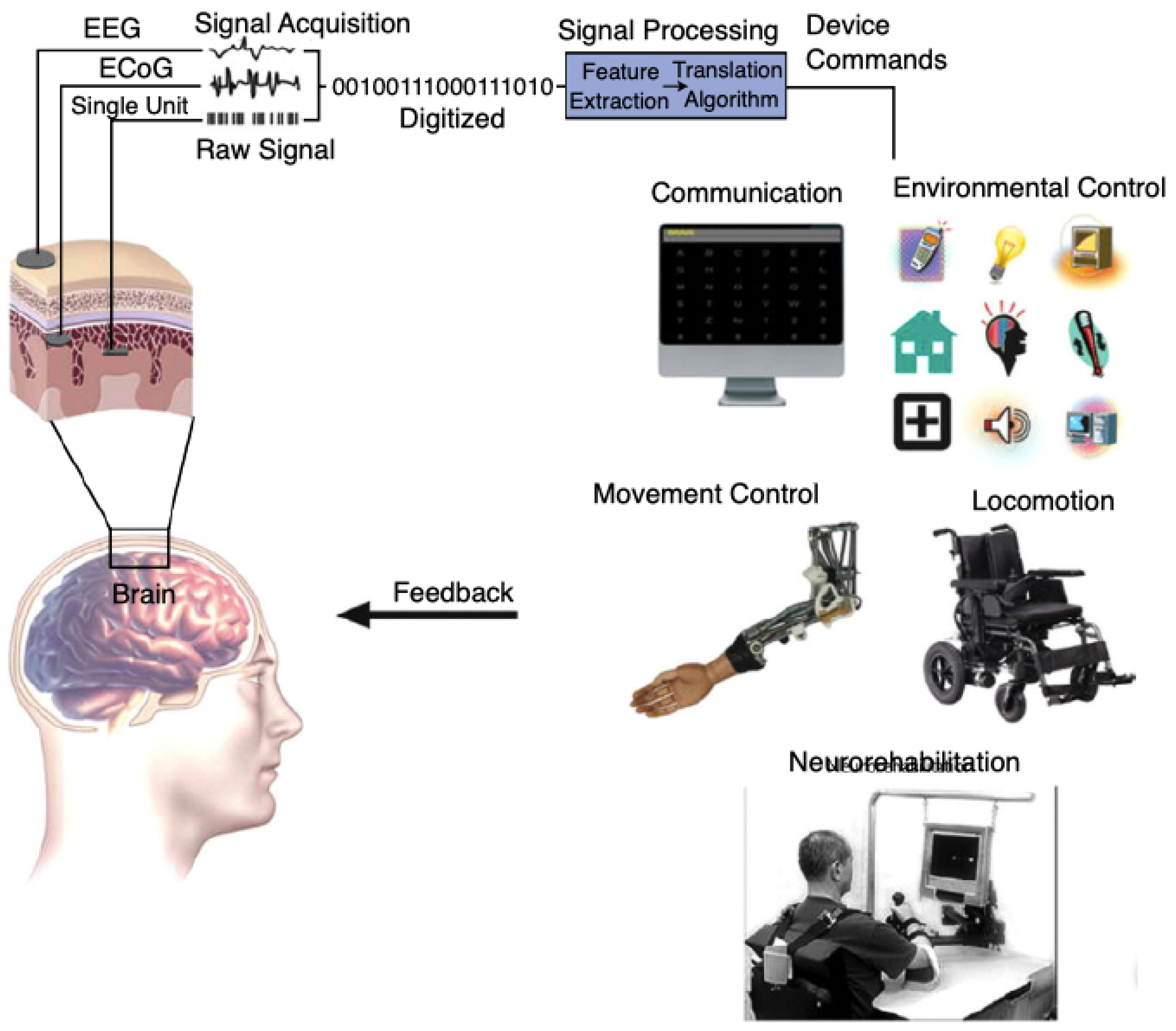

According to the company’s official responses on interactive platforms [1][2], Hanwei Technology’s technology reserves in the brain-computer interface field mainly focus on the following directions:

- Non-invasive Flexible Brain-Computer Interface Materials:A new generation of brain-computer interface materials developed based on flexible micro-nano sensor technology

- Collaborative Monitoring Technology for Complex Brain Information:Enables collaborative collection and analysis of multi-dimensional brain signals

- Implantable Flexible Neural Electrode Materials:Neural electrodes made of flexible materials to reduce the trauma of implantation surgery

- Arrayed Flexible Electrode Technology:Achieves broader brain region signal coverage through electrode arrays

Hanwei Technology carries out its flexible micro-nano sensor business through its holding subsidiary Suzhou Nengsida, and conducts R&D cooperation with medical institutions and university research teams [2]. This industry-university-research cooperation model is conducive to accelerating technology verification and application scenario development, but it also means that the commercialization process is relatively slow.

The company clearly stated that the above-mentioned technology reserves are still in the early stage, and commercial implementation has uncertainties [1]. This is a key risk factor that investors need to focus on.

The brain-computer interface industry is in a period of policy dividends, which provides a favorable external environment for the commercialization of Hanwei Technology’s technology. In July 2025, the Ministry of Industry and Information Technology and six other departments jointly issued the Implementation Opinions on Promoting the Innovative Development of the Brain-Computer Interface Industry, which clearly set industry development goals: achieve key technological breakthroughs and build 2 to 3 industrial clusters by 2027; cultivate 2 to 3 global leading enterprises by 2030 [2]. More notably, in October 2025, brain-computer interface was included in the Recommendations of the Central Committee of the Communist Party of China on Formulating the 15th Five-Year Plan for National Economic and Social Development for the first time, listed as one of the six future industries alongside quantum technology and nuclear fusion [2].

In terms of market size, the global brain-computer interface market size is expected to reach USD 2.94 billion in 2025, and is projected to grow to approximately USD 12.4 billion by 2034 [3]. With international leading enterprises such as Neuralink planning to launch large-scale production in 2026, and breakthroughs in surgical robot technology, the industry is expected to enter a period of accelerated commercialization in the next few years [3].

-

Technological Synergy Effect:Hanwei Technology has deepened its presence in the sensor field for many years, with a complete industrial ecosystem foundation of “sensors - intelligent instruments - IoT solutions” [4]. The company is building a multi-dimensional sensor matrix covering “olfaction - touch - balance - force control - vision” to provide a stereoscopic perception system for embodied intelligent robots [4]. The synergy between brain-computer interface technology and the existing sensor platform is expected to form a differentiated competitive barrier.

-

Policy and Capital Support:Strategic emphasis at the national level will guide more capital into this field. According to industry investment and financing data, investment enthusiasm in the brain-computer interface industry rebounded significantly in 2025, with more than half of the funds invested in invasive overall solutions [2]. If Hanwei Technology can seize this opportunity, it is expected to receive more support for R&D and industrialization funds.

-

Broad Downstream Application Scenarios:Brain-computer interface technology has broad application prospects in fields such as medical rehabilitation, auxiliary communication, intelligent control, and brain function assessment. With the aging population and the increase in the number of patients with neurological diseases, there is rigid demand for medical-grade brain-computer interface products.

-

Insufficient Technological Maturity:The company clearly stated that its technology reserves are still in the early stage, which means there is still a long way to go before commercial products are launched. Brain-computer interface technology involves interdisciplinary fields such as materials science, neuroscience, and microelectronics, with high technical barriers and long R&D cycles.

-

Regulatory Approval Uncertainties:As a Class III medical device, brain-computer interface products need to go through strict clinical trials and regulatory approval processes. Currently, domestic invasive brain-computer interface has just entered the clinical verification stage [2], and the regulatory framework is still being improved.

-

Risk of Intensified Competition:The brain-computer interface track has attracted many enterprises to deploy, including international giants such as Neuralink and Synchron, as well as domestic enterprises such as Sanbo Brain Hospital, Chengyitong, and Innovative Medical [2][3]. Hanwei Technology needs to accelerate technological breakthroughs and market expansion to gain a favorable position in the competition.

-

Profitability Pressure:The company’s current net profit margin is only 3.46%, and free cash flow is negative. The cultivation of new businesses requires continuous capital investment [0]. Without strong growth in the main business, large-scale investment in brain-computer interface R&D may further compress profit margins.

The information about brain-computer interface technology breakthroughs is more of a conceptual positive, and it is difficult to directly reflect on financial performance. From the perspective of stock price performance, the company’s share price has risen by 167.27% in the past year and 52.27% in the past 6 months [0], which has partially reflected the market’s expectations for this concept. The current P/E ratio of 237.5x is based on expectations of high future growth; if the technology commercialization process is less than expected, there is a risk of valuation correction.

If the brain-computer interface technology can be successfully commercialized, Hanwei Technology is expected to open up a new growth curve. The company’s technical accumulation in the flexible sensor field provides it with differentiated advantages. Once the products pass clinical verification and obtain regulatory approval, it is expected to occupy a place in the medical-grade brain-computer interface market. Referring to industry development trends, the global brain-computer interface market is expected to reach tens of billions of US dollars by 2030; even if Hanwei Technology only captures 1-2% of the market share, it will bring considerable revenue growth.

| Scenario | Key Assumptions | Valuation Impact |

|---|---|---|

Optimistic Scenario |

Brain-computer interface technology is commercialized before 2027, and its revenue contribution exceeds 10% in 2028 | P/E may remain at 100-150x, with upside potential for the stock price |

Neutral Scenario |

Technology commercialization progress meets expectations, and performance contribution gradually starts in 2029-2030 | Current valuation is relatively high, and performance verification is required; P/E may fall back to 50-80x |

Pessimistic Scenario |

Technology commercialization encounters obstacles or is surpassed by competitors | Valuation may return to that of the traditional sensor business, with P/E falling back to 30-40x |

Hanwei Technology’s brain-computer interface technology does represent a breakthrough in cutting-edge technology, but it is still in the early stage of technology reserves, and the commercialization process has major uncertainties. The company’s current P/E ratio of 237.5x has fully or even overly reflected the market’s expectations for this concept, while the profitability of its main business has not yet reached the level to support this valuation [0]. For investors with higher risk tolerance, Hanwei Technology can be regarded as a strategic allocation target in the brain-computer interface track, but it is necessary to be prepared for long-term holding; for investors with lower risk tolerance or those seeking certainty, it is recommended to wait for the commercialization process to become clearer before entering.

- Failure of technology commercialization or significant delay in progress

- Intensified industry competition, with technological advantages being caught up or surpassed

- Changes in regulatory policies leading to delays in the commercialization timeline

- Downward macroeconomic trends affecting downstream demand and the company’s overall performance

- Risk of stock price correction due to unmet market expectations under high valuation

It is recommended that investors continue to pay attention to the following progress: the results of the company’s cooperation with medical institutions and university research teams, the progress of clinical trials, the progress of regulatory approval, the launch plan of brain-computer interface products, and changes in relevant policies.

[0] Jinling AI - Market Data and Financial Analysis of Hanwei Technology (300007.SZ)

[1] Sina Finance - Hanwei Technology: Brain-Computer Interface Technology is in Early Reserve Stage, Commercialization Has Uncertainties (January 10, 2026)

https://finance.sina.com.cn/stock/relnews/dongmiqa/2026-01-10/doc-inhfvsui4657442.shtml

[2] Securities Times - The Ultimate Interactive Entry: When Brain-Computer Interface Approaches the Eve of Industrial Explosion (January 2026)

https://www.stcn.com/article/detail/3572243.html

[3] OFweek - Brain-Computer Interface: Expected to Unlock the Ultimate Form of Human-Machine Collaboration (January 2026)

https://m.ofweek.com/medical/2026-01/ART-11157-8420-30678213.html

[4] Eastmoney.com - Investor Relations Activity Record of Hanwei Technology Group Co., Ltd. (December 2025)

https://pdf.dfcfw.com/pdf/H2_AN202512241807343921_1.pdf

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.