Analysis of the Impact of XPeng Motors (XPEV)'s Overseas Layout on Global Competitiveness and Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the obtained data, I will systematically analyze the impact of XPeng Motors’ accelerated overseas manufacturing layout on its global competitiveness and valuation.

XPeng Motors’ overseas expansion has entered the

| Dimension | Details |

|---|---|

R&D Centers |

9 global R&D centers established worldwide (the Munich, Germany R&D center is the first in Europe) |

Localized Production Bases |

3 overseas plants: Indonesia (first overseas plant), Austria (first in Europe), Malaysia (to start mass production in 2026) |

Market Coverage |

Business launched in 60 countries and regions, ranking first in sales among Chinese new energy vehicle (NEV) makers in 10 markets |

Sales Network |

321 overseas sales and service outlets covering 52 countries and regions |

Charging Network |

Over 2.66 million accessible charging piles globally, covering 31 countries and regions |

According to the strategic plan disclosed by management, overseas manufacturing in 2026 will see

- Malaysian Plant: Mass production to start in 2026 with an annual capacity of 50,000 units, built as a strategic hub serving the entire ASEAN right-hand drive market [1]

- Product Line Expansion: Covering smart vehicles, Robotaxi (autonomous ride-hailing taxis), robots, and low-altitude flying vehicles (“Land Aircraft Carrier”) [0]

- Regional Deepening: Enter 10 new European countries; target top 3 in global NEV exports by 2027 [1]

- Charging Network Expansion: Roll out self-operated supercharging networks to European, Asian, and American markets [1]

XPeng Motors has moved beyond the simple product export stage; accelerated overseas localized production signifies a fundamental shift in its business model:

| Dimension | Traditional Export Model | Systematized Output Model |

|---|---|---|

Cost Structure |

High transportation and tariff costs | Local production reduces logistics and tariff costs |

Response Speed |

Long delivery cycle (30-45 days via sea freight) | Localized production enables rapid response to market demand |

Policy Risk |

Vulnerable to trade barriers and anti-dumping measures | Localized production avoids trade policy risks |

Brand Building |

Relies on dealer networks | Directly reaches end-users to strengthen brand awareness |

While its pure electric lineup has gained widespread recognition, XPeng Motors is vigorously promoting

He Xiaopeng admitted that when expanding into global markets, the company found that charging infrastructure in many countries lags far behind that of China, with unstable networks. Therefore, the “One Vehicle, Two Power Sources” strategy has become an inevitable choice to meet the diversified needs of global markets.

- G7 Super Extended-Range Version: Combined cruising range of 1,704 km, 1,108.3 km tested in extreme cold conditions

- P7+ Extended-Range Version: Combined cruising range of 1,550 km; BEV version has a cruising range of 725 km

- Price Competitiveness: Extended-range versions are priced close to their pure electric counterparts in the same class (approximately $25,200-$26,700)

The synergistic effects of overseas localized production and global R&D networks are emerging:

“The synergistic effects of localized production and global R&D networks are driving XPeng Motors’ overseas business into a period of rapid growth. From January to November 2025, XPeng Motors’ overseas deliveries reached 39,773 units, representing a year-on-year increase of 95%.” [1]

ASEAN is one of the core regions of XPeng Motors’ overseas strategy:

| Indicator | Data |

|---|---|

| 2025 Overseas Deliveries | 45,008 units, up 96% year-on-year |

| X9 Sales in Malaysia | Top-selling premium electric MPV |

| Rank of Pure Electric Brands in Malaysia | Ranks among the top 6 in cumulative sales |

| Market Outlook | Malaysia’s NEV sales grew over 200% year-on-year in 2024, with penetration rising rapidly |

XPeng Motors plans to deploy R&D and technological capabilities in ASEAN, aiming to build Malaysia into a regional technology hub [1].

The European market is a key battleground to test XPeng’s global competitiveness:

- Competitors: Industry giants such as Tesla, Volkswagen, and Stellantis

- Entry Strategy: Localized production in Austria (Magna Steyr plant in Graz) + Munich, Germany R&D center

- Product Strategy: The 2026 P7+ is a globally co-developed, simultaneously launched model, which went on sale in Brussels, Belgium, Europe on January 9 [1]

XPeng Motors is strategically transitioning from a “smart electric vehicle company” to a “physical AI company”:

| Technology | Features |

|---|---|

2nd-Generation VLA Large Model |

End-to-end visual-language-action model, a global foundation model with 72 billion parameters |

Tianji AIOS 6.0 System |

Intelligent operating system integrated with AI large model capabilities |

Self-Developed Turing AI Chip |

3 chips providing 2,250 TOPS of computing power, supporting Level 4 autonomous driving |

Robot Technology |

60% of the technology for the Iron Humanoid Robot is reused from the automotive business |

He Xiaopeng stated that the company “does not want to be just a car company that sells hardware at low prices” but “hopes to become a global technology company” [0].

2025 delivery data validates the effectiveness of XPeng’s strategy:

- Total Deliveries: 429,445 units, up 126% year-on-year

- Average Monthly Deliveries: 35,787 units (reached 37,508 units in December 2025)

- MONA M03 Contribution: Accounts for over 40% of sales, becoming a mainstream mass-market smart car

- Overseas Sales Share: Overseas sales account for over 10% of total deliveries

| Indicator | Value |

|---|---|

Current Stock Price |

$20.02 |

Market Capitalization |

$19.02B |

52-Week Price Range |

$11.61 - $28.23 |

P/E (TTM) |

-23.50x (loss-making) |

P/B |

2.24x |

P/S |

1.90x |

Valuations under three scenarios based on the DCF model [0]:

| Scenario | Valuation | vs. Current Price |

|---|---|---|

Conservative Scenario |

$8.75 | -56.3% |

Base Scenario |

$31.55 | +57.6% |

Optimistic Scenario |

$32.79 | +63.8% |

Probability-Weighted Valuation |

$24.36 | +21.7% |

| Assumption Indicator | Conservative Scenario | Base Scenario | Optimistic Scenario |

|---|---|---|---|

| Revenue Growth Rate | 0.0% | 62.6% | 65.6% |

| EBITDA Margin | -22.6% | -23.8% | -25.0% |

| Terminal Growth Rate | 2.0% | 2.5% | 3.0% |

| Cost of Equity | 13.9% | 12.4% | 10.9% |

| WACC | 7.5% | 7.5% | 7.5% |

| Indicator | Value |

|---|---|

Consensus Target Price |

$29.50 |

Target Price Range |

$25.00 - $34.00 |

Upside Potential |

+47.4% |

Rating Distribution |

Buy: 62.5%, Hold: 18.8%, Sell: 18.8% |

Recent analyst actions indicate optimism:

- 2026-01-06: Freedom Capital Markets upgraded to Buy

- 2025-08-20: Citigroup maintained Buy rating

- 2025-08-19: B of A Securities maintained Buy rating

Overseas localized production will drive revenue growth through the following channels:

| Channel | Impact |

|---|---|

Market Scale Expansion |

60 target markets vs. single Chinese market |

Market Share Improvement |

Ranked 8th in global NEV sales in 2025 (7 of the top 10 are Chinese brands) [0] |

Capacity Release |

Malaysian plant with annual capacity of 50,000 units to start mass production in 2026 |

Product Line Expansion |

4 new models covering multiple price segments in 2026 |

Overseas localized production is expected to improve the company’s profit structure:

| Improvement Factor | Impact Mechanism |

|---|---|

Tariff Avoidance |

Avoids EU tariffs on Chinese electric vehicles (currently approximately 35-45%) |

Logistics Cost Reduction |

Localized production reduces long-distance transportation costs (accounting for 5-10% of total costs) |

Economies of Scale |

Increased output dilutes fixed costs |

Premium Capability |

Enhanced localized brand image supports price premiums |

| Catalyst | Expected Impact |

|---|---|

Mass Production at Malaysian Plant |

Q2 2026, verifying overseas production capabilities |

Sales Breakthrough in Europe |

Entry into 10 new European countries in 2026, validating market acceptance |

Robotaxi Launch |

“Street trials are imminent”, opening a new growth curve |

Profit Inflection Point |

Expected to achieve break-even in 2026-2027 |

| Risk Type | Details |

|---|---|

Policy Risk |

Uncertainty in EU tariff policies on Chinese electric vehicles, U.S. market access restrictions |

Competition Risk |

Head-on competition with Tesla, Volkswagen, and Stellantis in the European market |

Execution Risk |

Challenges in overseas localized production including supply chain, local adaptation, and quality control |

Technology Risk |

Validation of actual user experience for new technologies such as VLA, and quality stability during large-scale deliveries |

Macroeconomic Risk |

Global economic slowdown affecting NEV demand, geopolitical risks |

-

Competitiveness Dimension:

- The model upgrade from product export to systematized output greatly enhances its ability to enter international markets and risk resilience

- The “One Vehicle, Two Power Sources” strategy effectively adapts to the uneven charging infrastructure globally

- AI intelligent driving technology provides differentiated competitive advantages to support brand premium capabilities

-

Valuation Dimension:

- DCF base scenario valuation of $31.56, representing a 57.6% upside from the current price

- Probability-weighted valuation of $24.36, representing a 21.7% upside from the current price

- Analyst consensus target price of $29.50, representing a 47.4% upside from the current price

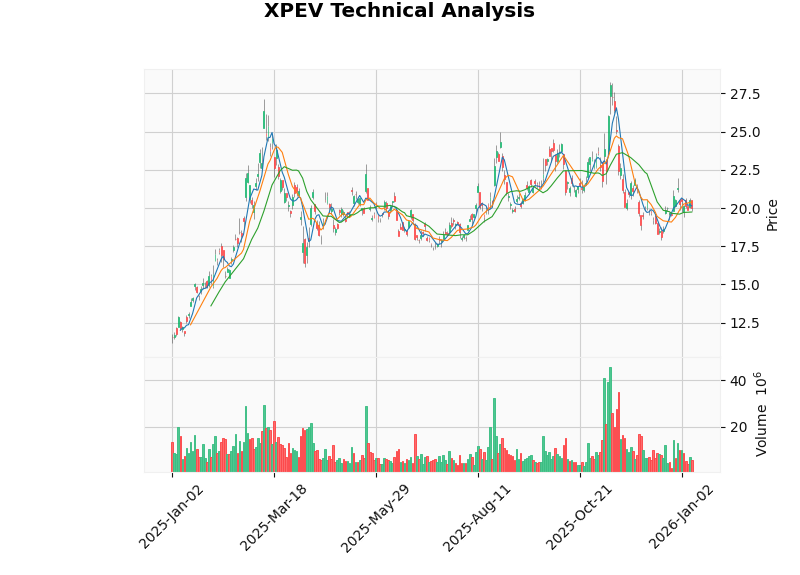

The current technical outlook shows a

- Trend Judgment: Neutral (no obvious upward or downward trend)

- Price Range: $19.58 (support) / $20.46 (resistance)

- MACD Indicator: No crossover signal, slightly bullish

- KDJ Indicator: K=33.3, D=41.8, J=16.4, slightly weak

- RSI Indicator: Within the normal range

| Valuation Method | Valuation | vs. Current Price | Rating |

|---|---|---|---|

| DCF Conservative Scenario | $8.75 | -56.3% | Overvalued |

| DCF Base Scenario | $31.55 | +57.6% | Significantly Undervalued |

| DCF Optimistic Scenario | $32.79 | +63.8% | Significantly Undervalued |

| Probability-Weighted DCF | $24.36 | +21.7% | Slightly Undervalued |

| Analyst Consensus | $29.50 | +47.4% | Significantly Undervalued |

Current Stock Price |

$20.02 | - | - |

- Q1 2026: Mass production progress of the Malaysian plant

- Q2 2026: Mass production and delivery of the “Land Aircraft Carrier” flying vehicle, launch of Robotaxi street trials

- March 2026: 2025 Q4 financial report (expected to be released on 2026-03-17)

- Full Year 2026: Progress in entering 10 new European markets, increase in overseas sales share

[0] Jinling AI Financial Database - XPeng Motors (XPEV) Real-Time Quotes, Company Profile, Financial Analysis, Technical Analysis, DCF Valuation Data (2026-01-11)

[1] Securities Times Network - “XPeng Motors’ Third Overseas Localized Production Project to Settle in Malaysia” (https://www.stcn.com/article/detail/3541525.html)

[2] Gasgoo Auto - “The Second Half of Smart EVs: XPeng’s Strategy Evolves” (https://auto.gasgoo.com/news/202601/9I70441859C109.shtml)

[3] 21st Century Business Herald - “Insights into XPeng’s 2026 Confidence and Determination from Two Interviews” (https://www.21jingji.com/article/20260109/herald/4264adefcf91ae97371ba92fc7e24fd7.html)

[4] Benzinga - “China’s Xpeng CEO Touts ‘Physical AI’ Vision” (https://www.benzinga.com/markets/asia/26/01/49806868)

[5] Interesting Engineering - “‘World’s longest range’ hybrid SUV launched by China’s Xpeng” (https://interestingengineering.com/transportation/xpeng-world-longest-range-hybrid-suv)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.