Hedge Funds Position for 'Donroe Doctrine' Trade Following Maduro Capture

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

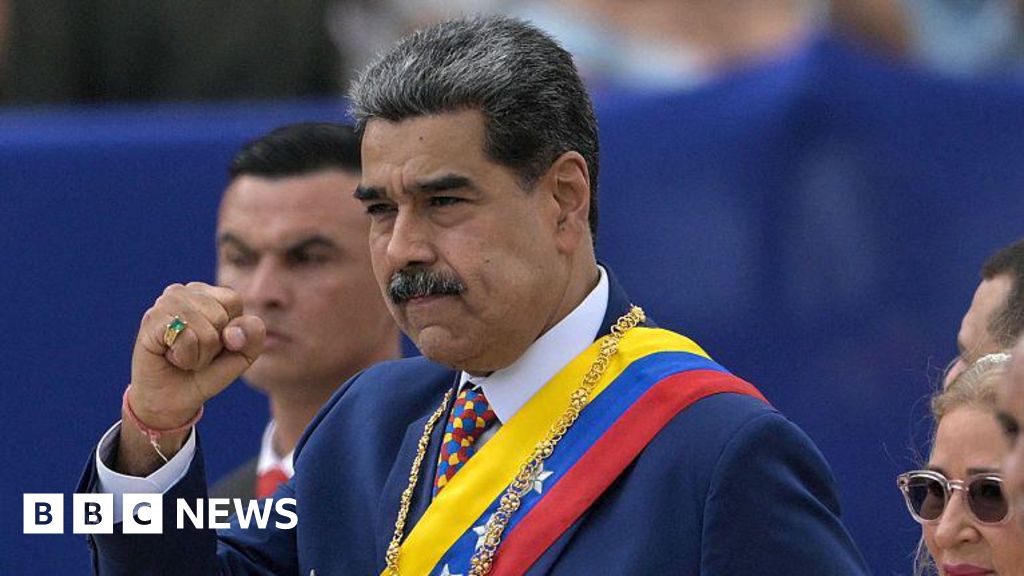

The capture of Venezuelan President Nicolás Maduro by U.S. forces on January 3, 2026, represents a pivotal geopolitical inflection point with far-reaching implications for global financial markets, particularly in the emerging market debt and energy sectors [1][2]. This event marks the practical implementation of what market participants are now termed the “Donroe Doctrine”—President Trump’s modern reinterpretation of the 1823 Monroe Doctrine, asserting definitive U.S. dominance over the Western Hemisphere [3][4]. The doctrine’s core objectives encompass maintaining regional stability to deter migration, preventing Chinese and Russian influence in neighboring nations, and securing U.S. access to Venezuela’s substantial petroleum reserves [3].

The immediate market response has been pronounced, with Venezuelan sovereign bonds trading at approximately 42 cents on the dollar—representing a 27% increase from pre-event levels of 33 cents—while PDVSA bonds similarly surged to around 33 cents from 26 cents [1][2]. The Venezuelan Country Index within the EMBI framework recorded a 30% gain on January 5 alone, positioning it as the top performer for 2025 with a remarkable 99% annual return [1][2]. These movements reflect market optimism regarding potential debt restructuring and the revival of Venezuela’s oil sector under a more U.S.-friendly administration.

The transitional political landscape remains complex and uncertain. Following Maduro’s capture—executed during a raid in Caracas on January 3—the U.S. government has deemed his regime illegitimate due to disputed elections, with Maduro now facing U.S. narcotics trafficking charges [3]. Interim President Delcy Rodríguez has initiated exploratory diplomatic talks with Washington, though her authority remains contested [5]. The presence of armed militias patrolling Caracas and the uncertain alignment of military leadership create significant governance risks, while foreign actors including Cuba, Iran-linked elements, and Russia reportedly maintain embedded positions within Venezuela’s security apparatus [1][3][6].

The investment thesis centers on the substantial value creation potential within Venezuela’s $150-170 billion in defaulted financial claims, comprising approximately $60 billion in defaulted government and PDVSA bonds dating to November 2017, and an additional $90-110 billion in bilateral loans from China and Russia, arbitration awards, and court judgments [1]. Hedge funds have been accumulating positions for years in anticipation of a resolution, with the current geopolitical development providing a potential catalyst for significant repricing.

Altana Credit Opportunities Fund represents the most aggressive positioning, maintaining a 100% allocation to Venezuelan debt since 2020 with entry prices around 6 cents on the dollar [1]. The fund’s early mover advantage has positioned it to capture substantial returns as the 30% early 2026 gain demonstrates. Broad Reach Capital entered the market in late 2024 at prices of 20-25 cents, achieving approximately 12% net returns in 2025 and benefiting from the continued momentum [1]. Winterbrook Capital has maintained multi-year distressed positions with an event-driven strategy targeting the precise repricing opportunity now materializing [1].

The investment strategy involves accumulating distressed sovereign and corporate debt at deep discounts, anticipating that a regime change will enable restructuring at significantly higher valuations while potentially unlocking collateral assets including Citgo Petroleum—PDVSA’s U.S. refining subsidiary with approximately $19 billion in registered claims [1]. However, investors must navigate complex creditor hierarchies, with bondholders, arbitration award holders (notably ConocoPhillips holding an $8.7 billion ICSID award), and bilateral lenders competing for limited oil revenue streams [1].

Venezuela’s petroleum sector presents both extraordinary opportunity and substantial execution challenges. Current production stands at approximately 800,000 barrels per day, representing a dramatic decline from 3.5 million barrels daily in the late 1990s [1]. The White House has set ambitious targets of reaching 3 million barrels daily within 18 months, though analysts view this timeline as optimistic given the decayed state of infrastructure [1][7]. Pipeline updates alone require an estimated $58 billion investment, with comprehensive sector rebuilding potentially demanding $110-183 billion [1].

Major U.S. oil companies have signaled cautious approaches pending critical prerequisites. ExxonMobil CEO Darren Woods has articulated clear conditions for re-entry, emphasizing the need for robust safeguards and comprehensive legal frameworks before committing capital—particularly given historical experience with asset seizures under previous Venezuelan governments [8]. The gap between White House enthusiasm and corporate caution suggests that the anticipated $100 billion investment plan discussed in recent meetings will require substantial de-risking mechanisms before materializing [8].

The analysis reveals several risk dimensions requiring careful investor attention. Credit and creditor conflict risks represent the most immediate concern, as multiple claimant classes will compete for oil revenue in any restructuring scenario [1]. The presence of Chinese and Russian bilateral loans creates geopolitical complexity, while arbitration award holders maintain strong legal positions that could complicate restructuring frameworks.

Sanctions uncertainty remains a critical consideration. Executive orders from 2017-2018 effectively block most Venezuelan debt dealings, and any meaningful reactivation of trading will require explicit OFAC licensing guidance [1]. Investors must monitor General License amendments and new Treasury Department guidance that could either enable or constrain transaction activity.

Political transition risks encompass multiple scenarios. Diosdado Cabello’s hardline Chavismo faction may attempt to disrupt any transition, while Interim President Rodríguez’s control over military and security forces remains uncertain [1]. The potential for armed conflict or civil unrest could materially impact asset valuations and operational feasibility.

Execution risks in the oil sector should not be underestimated. Venezuela’s petroleum infrastructure is over 50 years old, and the technical workforce has been substantially depleted during the economic collapse [1][7]. Production ramp-up timelines proposed by the White House face significant skepticism from industry participants and energy analysts.

U.S. policy commitment uncertainty introduces additional risk, as long-term administration support remains contingent on political viability and sustained prioritization of Western Hemisphere dominance as a policy objective [1].

The Donroe Doctrine extends beyond Venezuela, with potential implications for other regional relationships facing U.S. pressure. Colombia confronts scrutiny over cocaine production and trafficking, while Mexico faces combined pressure on migration and drug trafficking issues [3][4]. Most dramatically, indications of potential U.S. action regarding Greenland—despite its NATO membership—suggest a broader willingness to employ aggressive diplomatic and potentially military pressure to achieve hemispheric objectives [3][9].

These broader developments create both opportunity and risk for regional emerging market investments, as policy shifts could affect capital flows, trade relationships, and political stability across Latin America. Portfolio managers should monitor these dynamics for potential spillover effects affecting Colombian, Mexican, and Brazilian exposures [1].

The U.S. capture of Maduro and subsequent hedge fund positioning represents a significant transformation in Venezuela’s political and economic trajectory, with implications extending to global energy markets and emerging market debt valuations. Venezuelan sovereign and PDVSA bonds have demonstrated substantial appreciation following the event, validating the multi-year distressed debt strategies employed by specialized hedge funds. However, the investment thesis faces material execution risks across political transition, sanctions resolution, creditor negotiations, and oil sector rebuilding dimensions. Major U.S. oil companies have indicated willingness to participate only with robust legal protections, suggesting that the pace of sector revitalization may fall short of policy objectives. Investors should monitor sanctions guidance, political stability indicators, creditor committee formation, and oil company positioning as key catalysts and risk signals moving forward.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.