In-depth Analysis of the Catering Industry's Tolerance Limit for Food Delivery Platform Subsidy Wars

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

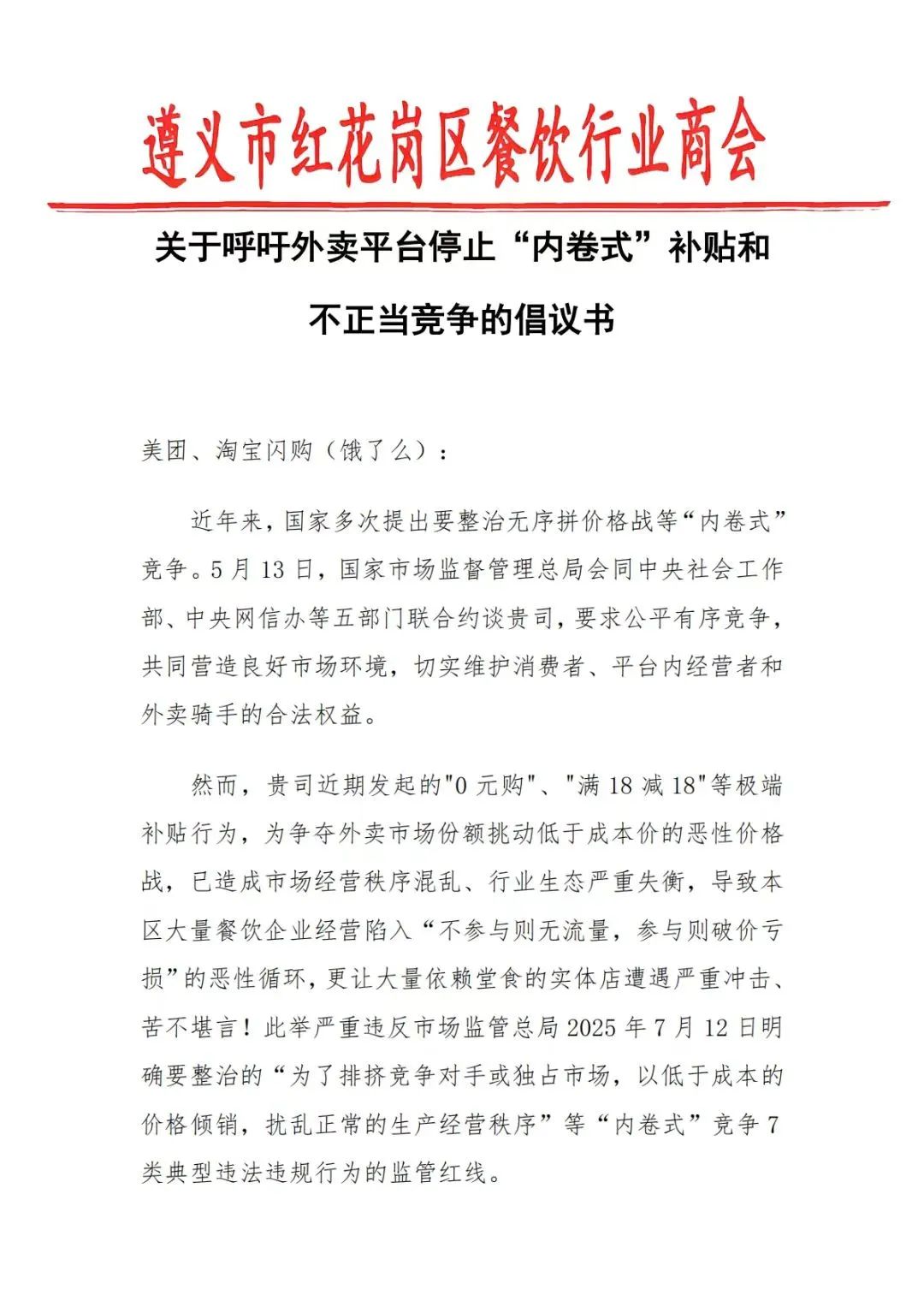

In 2025, China’s food delivery industry experienced an unprecedented "three-way rivalry" landscape. JD officially entered the food delivery market in February, Taobao integrated Ele.me and upgraded it to "Taobao Flash Purchase", while Meituan fully defended its core territory. The three platforms launched fierce subsidy competitions focusing on tea beverages and high-frequency consumption scenarios, rolling out extreme promotions such as "¥0 Milk Tea" and "Spend ¥18, Get ¥18 Off" [1].

Research data from the research group led by Professor Zhang Jun of the School of Economics, Fudan University shows that during the intensified competition period in July 2025, the average daily total orders (food delivery + in-store dining) of merchants increased by 7%, but the average daily actual received revenue of merchants decreased by approximately 4% [2]. This dilemma of "growing order volume but declining revenue" profoundly reveals the systemic impact of subsidy wars on the catering industry.

In the face of the escalating "involutionary" competition, regulators have continuously taken actions to rectify the situation:

- May 13, 2025: The State Administration for Market Regulation (SAMR) held its first interview with JD, Meituan, and Ele.me, requiring fair and orderly competition and compliant operations [3]

- July 18, 2025: Regulators held another interview, emphasizing "rationality, standardization, main body responsibility, multi-win, and healthy sustainability" [3]

- August 1, 2025: The three platforms successively released statements, promising to standardize promotional activities and restrict irrational subsidies [4]

- January 9, 2026: The Office of the State Council Anti-Monopoly and Anti-Unfair Competition Committee launched a special investigation into the market competition status of the food delivery platform service industry [1]

Behind the tough regulatory measures is the widespread bloodletting of the industry value chain. Platforms, merchants, and riders have all suffered varying degrees of "internal injuries" [1].

According to industry research data, the cost structure of catering enterprises has the following characteristics:

| Cost Item | Average Industry Proportion | Notes |

|---|---|---|

Ingredient Cost |

35%-45% | Controlled at 35%-45% for hot pot restaurants; Haidilao’s was 37.9% in 2024 [5] |

Labor Cost |

20%-30% | One of the core expenditures for hot pot and fast food formats [5] |

Rent Cost |

10%-20% | Haidilao’s can be as low as around 1% due to brand advantages [5] |

Platform Commission |

6%-8% | Meituan’s technical service fee standard; actual comprehensive cost reaches 17%-19% [6] |

Marketing Promotion |

2%-3% | Includes technical service fees and promotion expenses [5] |

Utilities (Water, Electricity, Gas) |

3%-5% | Proportion increases significantly in summer [5] |

Low-value Consumables |

Approximately 3% | Daily operation consumables [5] |

Other Expenses |

≥3.5% | Includes miscellaneous fees, internet services, training, etc. [5] |

The overall net profit margin of the catering industry is generally low:

| Brand/Format | Net Profit Margin | Notes |

|---|---|---|

Industry Average |

Approximately 5%-10% | Well-managed restaurants can reach 15% [7] |

Haidilao |

Approximately 11% | High level in the industry [5] |

Xiabuxiabu |

-5% to -12% | Still in loss in H1 2025 [5] |

Nanchengxiang |

Doubled | Optimized after closing unprofitable stores [8] |

Light Food Delivery |

20%-25% | For well-operated stores [9] |

Taking food delivery business as an example, the cost composition of a single order is more complex:

- Original order amount: ¥19.4

- Deductions:

- Activity cost borne by merchant: ¥9.5 (48.9%)

- Technical service fee: ¥1.05 (5.4%)

- Delivery service fee: ¥2.9 (14.9%)

- Other fees: ¥0.9 (4.6%)

- Actual received revenue: ¥5.05 (26%)

- Milk tea ingredient cost: ¥5-¥6

- Result: Received revenue is almost equal to cost, or even results in a loss[4]

Based on industry data, the tolerance limit of catering merchants in subsidy wars can be analyzed from the following dimensions:

According to Fudan University’s research data:

- Intensifying Competition Period: The average total profit (food delivery + in-store dining) of merchants decreased by approximately 1.7%

- Intensified Competition Period: The average total profit decline expanded to8.9%[2]

This means that when the profit decline exceeds 8%-10%, a large number of small and medium-sized merchants will face survival crises.

Catering merchants face a structural contradiction:

- Rigid Costs: Rent (10%-20%), labor (20%-30%), ingredients (35%-45%) – these costs are difficult to adjust quickly

- Flexible Revenue: Customer unit price, order volume – fluctuated sharply due to subsidy wars

- Result: When revenue declines by more than 10%, the proportion of rigid costs will exceed the break-even point [5]

| Merchant Type | Tolerance Ability | Main Dilemmas |

|---|---|---|

Brand Chains |

Strong | Possess supply chain bargaining power and brand premium, with relatively smaller revenue decline [2] |

Medium-sized Merchants |

Medium | Have certain scale effects but lack bargaining chips with platforms |

Micro, Small Merchants |

Fragile | Have low bargaining power, forced to bear subsidy costs, and weak risk resistance [4] |

Micro-level case studies reveal the dilemmas faced by merchants:

- Customer unit price decreased by 20% due to subsidies

- In-store dining stores are trapped in the dilemma of "no customers without price cuts, loss-making with price cuts" [4]

- Platform commission rate: 23%

- Ingredient cost: Approximately 30%-35%

- After deductions, the gross profit margin of food delivery is approximately 45%

- After excluding rent, labor, and other costs, the net profit margin is approximately 20%-25%

- In winter, combined with platform coupon usage and declining order volume, the gross profit margin corresponding to actual received profit is only 20%-30% [9]

- Discount rate for hot pot food delivery: 60%-70% (15%-25% lower than in-store dining)

- Food delivery commission: Approximately 18% (Meituan/Ele.me)

- Net profit from ¥200,000 food delivery revenue is only approximately ¥5,000 (2.5%), and some stores even suffer losses [5]

Research shows that merchants not participating in subsidies also cannot stay "uninvolved" [1]:

- Large-scale food delivery subsidies lead consumers to concentrate on participating merchants

- Non-participating merchants lose both food delivery and in-store customers

- A dilemma of "less profit with subsidies, fewer orders without subsidies" forms

- Eventually forced to join subsidy wars, falling into a vicious cycle [1]

- Survival-focused Brands: Treat subsidies as a "lifeline", with a surge in short-term orders but long-term erosion of brand value [10]

- Bloodletting Brands: High-end positioning is impacted, data assets outflow, and user stickiness is diluted [10]

- Ecosystem-focused Brands: Rely on scale advantages to negotiate better terms, stabilizing the profit base [10]

| Time Node | Number of Closures | Closure Rate | Data Source |

|---|---|---|---|

| Full Year 2024 | Over 3 million | Approximately 40% | Industry Statistics [8] |

| H1 2025 | 1.61 million | Average 6 closures per minute | Industry Statistics [8] |

| Platform | Financial Indicator | Change Range |

|---|---|---|

| JD | Operating Profit Margin (2025Q2) | Dropped from 3.6% to -0.2% [1] |

| Meituan | Adjusted Net Profit (2025Q2) | Dropped from ¥13.6 billion to ¥1.49 billion (-89%) [1] |

| Alibaba | Adjusted EBITA (2025Q3) | Decreased by 78% year-on-year [1] |

| Indicator | Change Range |

|---|---|

| Total Profit of Merchants (Food Delivery + In-store Dining) | Decreased by 8.9% during the intensified competition period [2] |

| Actual Received Revenue of Merchants (Food Delivery + In-store Dining) | Decreased by approximately 4% [2] |

| Revenue Decline of Independent Stores | Greater than that of brand chains [2] |

Based on the above data, the tolerance limit of the catering industry for food delivery platform subsidy wars can be summarized as follows:

- Most small and medium-sized merchants will be unable to cover rigid costs

- Fall into the dilemma of "busier but more loss-making"

- The wave of store closures will accelerate

- Merchants are forced to choose between "cut prices to maintain volume" and "maintain prices and lose volume"

- May reduce ingredient quality to maintain profits

- The "bad money drives out good money" effect emerges

- When the combined proportion of platform commissions, activity concessions, delivery costs, etc., exceeds 30%-35% of revenue

- Merchant profit margins are compressed to below 5%

- A large number of merchants will choose to withdraw from platforms or close stores

Catering merchants are not facing a single pressure, but a

- Platform Pressure: Commission adjustments, activity participation requirements, traffic allocation mechanisms

- Cost Pressure: Continuous increases in rent, labor, and ingredient costs

- Competition Pressure: Peer price wars, increased consumer price sensitivity

- Consumption Pressure: Expected price rebound after subsidies are scaled back

Subsidy wars expose the

- The catering industry inherently has low profit margins (5%-10%)

- High rigid costs (rent + labor account for 30%-50% in total)

- Almost no "buffer" to absorb additional shocks

- Increasing dependence on food delivery platforms

- Imbalanced profit contribution ratio between in-store dining and food delivery

- Continuous weakening of merchant bargaining power

- Participate in competition rationally, shift from "capital-driven" to "innovation-driven"

- Build a healthy merchant ecosystem, avoid killing the goose that lays the golden eggs

- Explore sustainable profit models

- Optimize cost structure, improve operational efficiency

- Develop a multi-channel model combining in-store dining and food delivery

- Build private domain traffic, reduce platform dependence

- Continuously improve industry norms and standards

- Protect the legitimate rights and interests of small and medium-sized merchants

- Guide the healthy development of the industry

-

Tolerance Limit: The tolerance limit of catering merchants in subsidy wars is approximately8%-10% profit decline; exceeding this threshold will trigger large-scale store closures.

-

Structural Fragility: The root cause lies in the catering industry’s inherent low profit margins (5%-10%) and high rigid cost structure, which cannot withstand additional shocks.

-

Multi-party Losses: There are no winners in subsidy wars – platforms suffer losses, merchants bleed revenue, riders face pressure, and consumers benefit in the short term but bear the risk of quality decline in the long run.

-

Regulatory Necessity: National-level investigations and interventions are necessary to promote the return of the industry to rational development.

- Under regulatory pressure, platforms will gradually reduce irrational subsidies

- Merchant profits are expected to stabilize but will be difficult to recover to pre-subsidy levels

- The industry will enter a new stage of "rational competition"

- Platform business models will be reconstructed, shifting from "burning money to seize market share" to "creating value through services"

- Merchants will accelerate digital transformation, improving operational efficiency

- Industry concentration may increase, with head brands’ advantages becoming more prominent

- The food delivery industry will form a healthier ecosystem

- The interests of platforms, merchants, and consumers will tend to be balanced

- High-quality development will become the main theme of the industry

[1] Shanghai Observer - State Intervenes Again as Food Delivery Industry’s "Involution" Intensifies (https://www.shobserver.com/staticsg/res/html/web/newsDetail.html?id=1049652&sid=11)

[2] Research Group, School of Economics, Fudan University - Research on the Impact of Food Delivery Subsidy Wars on Merchants (https://www.shobserver.com/staticsg/res/html/web/newsDetail.html?id=1049652&sid=11)

[3] State Administration for Market Regulation - Official Announcement on Interviews with Food Delivery Platforms (https://www.shobserver.com/staticsg/res/html/web/newsDetail.html?id=1049652&sid=11)

[4] Sina Finance - 2026 Regulatory Sword Unsheathed! Is the End Near for Food Delivery Platforms’ "Burning Money to Seize Stock Market"? (https://finance.sina.com.cn/stock/t/2026-01-10/doc-inhfvxak0116173.shtml)

[5] Operation Pie - 10,000-word Article: 42 Operational Indicators and Financial Models Every Catering Professional Must Understand (https://www.yunyingpai.com/extend/1056698.html)

[6] The Beijing News - Food Delivery Profit Margin Topic Sparks Debate, Meituan Faces the Instant Retail Exam (https://m.bjnews.com.cn/detail/1744985870168789.html)

[7] ABC POS - Profit of Opening a Restaurant in the US (https://www.abcpos.com/post/zai-mei-guo-kai-can-guan-li-run)

[8] Winshang - How Can Catering Professionals Survive Amid Low Performance and Store Closure Waves? (https://m.winshang.com/news737679.html)

[9] The Paper - ¥500 Billion Market: Is "Pretty Food" Not a Good Business? (https://m.thepaper.cn/newsDetail_forward_32217238)

[10] Futu News - 2025 Tea Beverage Industry Summary: Closures, Going Overseas, Nostalgia Trends (https://news.futunn.com/post/67036384)

[11] Eastmoney - State Intervenes Again as Food Delivery Industry’s "Involution" Intensifies (https://wap.eastmoney.com/a/202601093614610971.html)

[12] Tencent News - Instant Retail Battle: Who Bleeds, Who Grows? (https://news.qq.com/rain/a/20260103A01EUE00)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.