Analysis of Furui Medical (300049.SZ)’s Hong Kong Listing and Market Opportunities in NASH Drugs

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest information I have collected, I will provide a detailed analysis of Furui Medical’s Hong Kong listing and its development opportunities in the NASH drug market.

According to the latest reports, Furui Medical (Inner Mongolia Furui Medical Technology Co., Ltd., Stock Code: 300049.SZ) has launched its Hong Kong listing plan[1]. Through holding companies such as France-based Echosens, the company has formed a global layout with Beijing as its management center and Paris, France as its R&D frontier.

It is worth noting that this is not the company’s first attempt to spin off Echosens for a Hong Kong listing. As early as March 2017, Echosens submitted an application to the Hong Kong Stock Exchange, with ICBC International as its sole sponsor[2]. Historically, Furui Medical made two attempts to spin off Echosens for overseas listing in 2013 and 2014, both of which ended in failure.

Furui Medical has built a solid foundation for global business:

- Its core product, the FibroScan device, has been deployed worldwide, diagnosing tens of millions of patients each year

- The product has been recommended by multiple authoritative institutions including the World Health Organization (WHO), European Association for the Study of the Liver (EASL), and American Diabetes Association (ADA)

- More than 5,400 peer-reviewed papersandover 200 international guidelinesdemonstrate the efficacy of FibroScan in the diagnosis and treatment of liver diseases

- The product has obtained certifications such as EU CE, US FDA, and China NMPA[1]

FibroScan is the world’s first non-invasive, real-time detection device that diagnoses and monitors liver conditions by quantifying liver stiffness values, adopting

| Indicator | Value | Year-over-Year Growth |

|---|---|---|

| Echosens Operating Revenue | RMB 923 million | 10.98% |

| Echosens Net Profit | RMB 190.52 million | 8.26% |

| Overall Medical Device Business Revenue | RMB 482 million (First Half) | 13.8% |

The company adopts a

In March 2024,

More importantly,

According to industry analysis, the expansion of the NASH drug market will significantly drive demand for detection devices:

| Market Indicator | Forecast Data |

|---|---|

| Global NASH Patients | 300-400 million |

| Treated Patients in Europe and the US (in 3-5 years) | Tens of millions |

| High-Risk Population (US) | Approximately 100 million |

| High-Risk Population (Europe) | Over 200 million |

| Annual Testing Demand per Treated Patient | 3-4 times/year |

| Expected Annual Testing Demand | Over 100 million tests |

If all tests are charged on a pay-per-test basis, Echosens’ future revenue could reach

Furui Medical has established cooperative relationships with multiple international pharmaceutical companies:

- Novo Nordisk: The NASH indication for semaglutide was submitted for approval in the first quarter of 2025, and approval is expected by the end of September 2025. Large-scale screening will begin in the third quarter of 2025

- Eli Lilly, Boehringer Ingelheim: Over90% of their in-development NASH drugs use FibroScan for efficacy testing[4]

- Other pharmaceutical companies including Inventiva (France) and Zydus (India)[3]

In August 2025, Novo Nordisk obtained FDA approval for Wegovy for the treatment of MASH patients with moderate to severe liver fibrosis. At the same time,

| Indicator | Value |

|---|---|

| Current Stock Price | RMB 81.24 |

| 1-Year Increase | 176.33% |

| 6-Month Increase | 115.78% |

| Market Capitalization | USD 21.553 billion |

| P/E (TTM) | 172.59x |

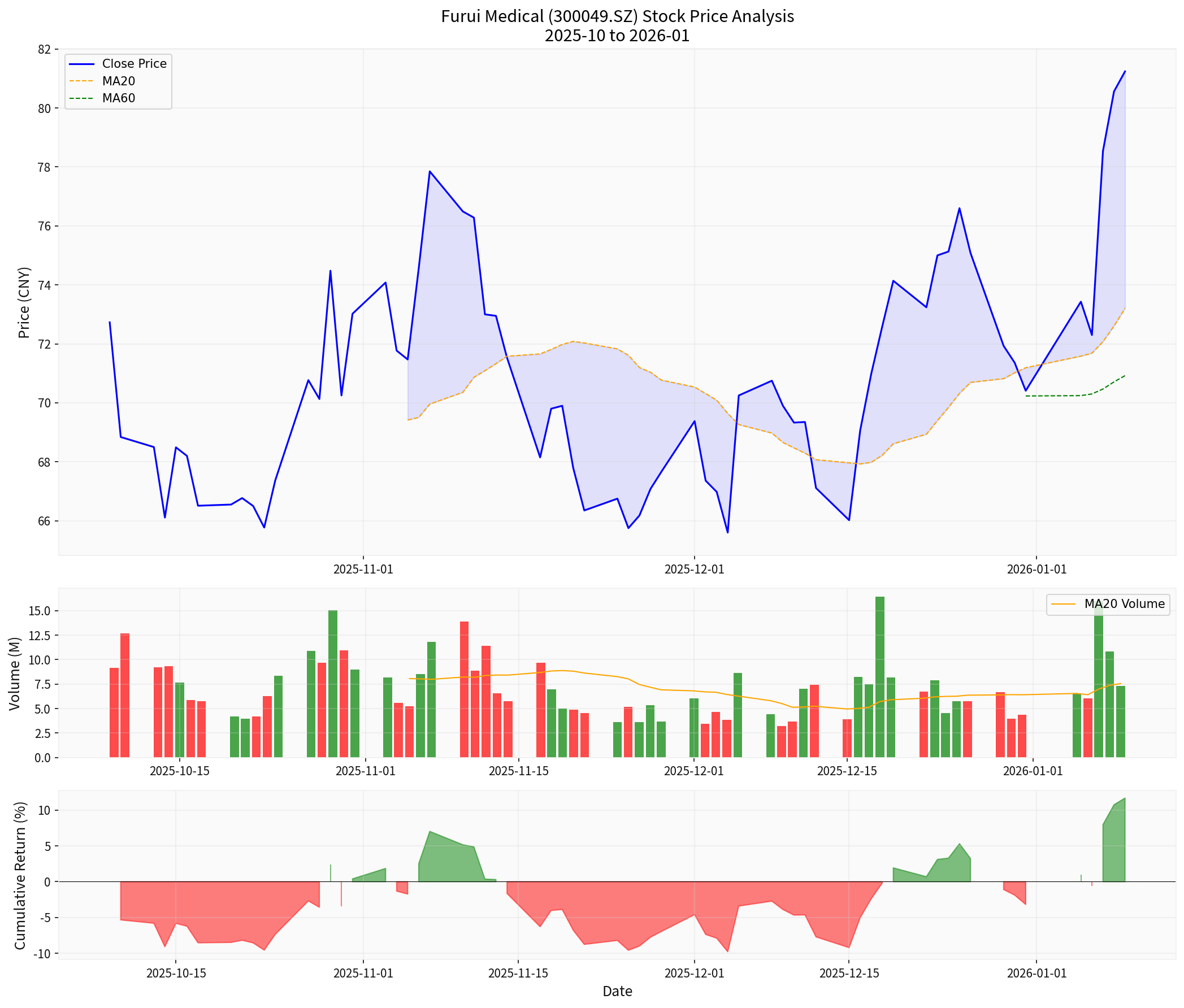

Based on the latest technical analysis[8]:

- Trend Status: Upward trend (to be confirmed)

- Buy Signal: 01/07

- Support Level: RMB 75.14

- Resistance Level: RMB 82.63

- Next Target: RMB 86.16

- Beta Coefficient: -0.37 (low correlation with the market)

- NASH drug approvals drive explosive demand for testing— The first drug has been approved, and more drugs are pending approval

- Expansion of pay-per-test model— The 2025 target is to install an additional 2,400 devices, representing a significant increase from the current installed base

- Advancement of internationalization strategy— The Hong Kong listing will enhance international brand influence and attract global capital

- Strong patent barriers— Patent protection in European and US markets lasts until 2039, granting exclusive rights

- Uncertainty in listing process: The H share issuance is still subject to multiple approvals

- Industry competition: New competitors may emerge in the liver disease detection sector

- Policy risks: Changes in pharmaceutical industry policies may affect business operations

- High valuation: The current P/E ratio is 172x, which is at a historical high

According to the assessment targets of the company’s equity incentive plan[5]:

- Net profit after deducting non-recurring gains and losses in 2024 will be no less than RMB 200 million

- Net profit after deducting non-recurring gains and losses in 2025 will be no less than RMB 300 million

- Net profit after deducting non-recurring gains and losses in 2026 will be no less than RMB 400 million

[1] Eastmoney - Furui Medical Plans Hong Kong Listing, Re-launches International Layout (https://finance.eastmoney.com/a/202512183595605140.html)

[2] Zhitong Finance - After Two Failed Spin-off Listings, A-Share Listed Furui Medical Sends Its Subsidiary Echosens to Hong Kong Again (https://www.sohu.com/a/130240074_323087)

[3] Great Wall Securities - In-Depth Report on Furui Medical (300049.SZ) (https://pdf.dfcfw.com/pdf/H3_AP202308141594348059_1.pdf)

[4] EET China - Earn 4 Billion Euros Easily? A Study on the Correlation Between Furui Medical and the NASH New Drug Market (https://www.eet-china.com/mp/a405856.html)

[5] Furui Medical 2024 Annual Report (https://www.fu-rui.com/uploads/upload/files/20250516/d288de73293f9b47f71fa8f29b542f96.pdf)

[6] Great Wall Guorui Securities - Industry Weekly Report (https://pdf.dfcfw.com/pdf/H3_AP202403191627130376_1.pdf)

[7] Soochow Securities - Insight into Global Cutting-Edge Technologies, Deeply Cultivating Innovative Drugs and Their Industrial Chains (https://pdf.dfcfw.com/pdf/H3_AP202511041774909764_1.pdf)

[8] Jinling AI Technical Analysis System - Technical Indicator Data for 300049.SZ

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.