In-Depth Analysis of CHAGEE's Caffeine Controversy: Balancing Product Innovation and Health Risks for New Tea Beverage Brands

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the collected information, I will provide you with a systematic and comprehensive analysis report.

December 26, 2025, well-known blogger “Sleeping News” published a long article on Zhihu, directly accusing CHAGEE’s high-caffeine products of ‘skirting the line of quasi-drugs’[1]. The article was quickly shared across multiple platforms, and the related topic

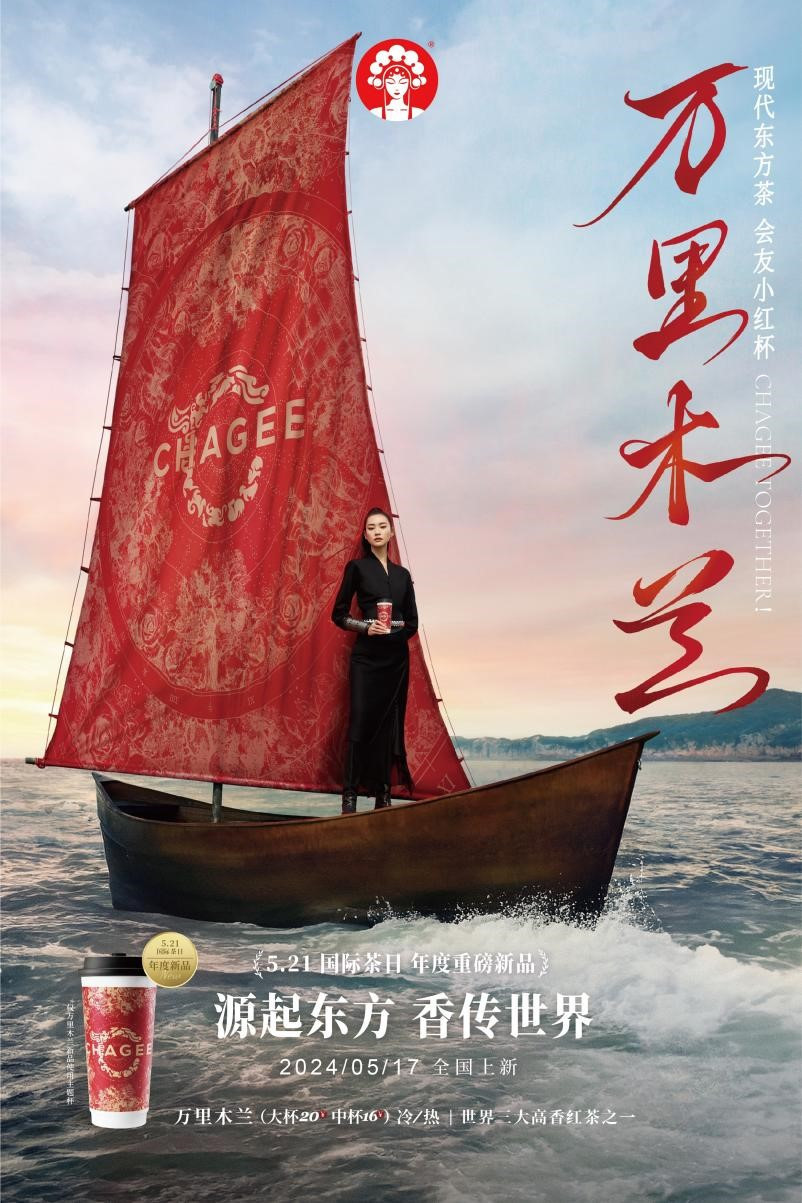

Notably, this is not the first time CHAGEE has been mired in controversy over caffeine. In May 2024, multiple netizens reported experiencing discomfort such as palpitations after drinking its “Wanli Magnolia” product, and some even “ended up in the hospital”[3]. Prior to that, jokes about insomnia like “Drink Wanli Magnolia in the afternoon, and “join the army for my father” at 3 a.m.” had widely circulated on social media.

According to data disclosed in CHAGEE’s official mini-program “Health Calculator”[1][4]:

| Product Name | Specification | Caffeine Content | Comparison Reference |

|---|---|---|---|

| Boya Juexian (Large, Hot) | 580ml | Approx. 220mg | Equivalent to 4.4 cans of Red Bull |

| Wanli Magnolia (Large, Hot) | 580ml | Approx. 235mg | Equivalent to 4.7 cans of Red Bull |

| Low-Caffeine Boya Juexian | 580ml | Approx. 110mg | Reduced by approx. 50% |

- Daily safe caffeine intake for adults: ≤400mg

- Recommended single intake: ≤200mg

- One can of Red Bull (250ml): Approx. 50mg caffeine

- One Starbucks Grande Americano (473ml): Approx. 200-300mg caffeine

From the data, the caffeine content of some CHAGEE products is indeed relatively high, with a single cup’s intake approaching or exceeding the recommended single intake limit.

Facing the escalating public opinion, the

‘Talking about toxicity without considering dosage is irresponsible. Although caffeine is classified as a Class II psychotropic drug in China for regulation, this mainly targets the production and trafficking of high-purity, non-edible caffeine. As a natural ingredient in food and beverages, its risks are fundamentally different from those of drugs.’

Experts including Wang Qing, President of the China Tea Marketing Association, Fu Shangwen, Researcher at the Tea Research Institute of the Chinese Academy of Agricultural Sciences, and Wang Yuefei, Head of the Tea Science Department at Zhejiang University, all clearly stated:

This incident reflects a serious cognitive blind spot among the public regarding tea ingredients[7]:

- Concept Confusion: Confusing natural caffeine in food with pure caffeine regulated as a drug

- Lack of Common Sense: Most consumers are unaware that tea naturally contains caffeine, and the caffeine content in dry tea (2%-5%) is even higher than that in coffee beans (1%-2%)

- Information Asymmetry: Consumers lack an intuitive understanding of how much caffeine a cup of milk tea can contain

As Zhong Kai, Director of the Food and Health Information Exchange Center, explained:

New tea beverage brands are facing an

| Demand | Contradiction |

|---|---|

| Healthy Image | ‘Fresh Leaf Milk Tea’ requires real tea and real milk |

| Taste Experience | High-concentration tea base is required to ensure rich tea aroma |

| Cost Control | Pre-prepared tea soup and tea powder are common industry choices |

According to industry reports, although the market size of China’s new tea beverage industry is close to RMB 370 billion in 2025,

In August 2024, HEYTEA took the lead in fully disclosing the caffeine content of its on-sale freshly prepared beverages and launched a

| Level | Caffeine Content | Recommendation |

|---|---|---|

| 🟢 Green Light | <50mg/cup | Drink at any time |

| 🟡 Yellow Light | 50-100mg/cup | Drink before afternoon |

| 🔴 Red Light | >100mg/cup | Drink in the morning |

This approach has been recognized by consumers; although the labeling is still not prominent enough in online ordering, it at least provides a reference quantitative standard.

In response to the controversy, CHAGEE launched ‘Low-Caffeine’ versions of Boya Juexian, Huatian Oolong and other products in March and May 2025 respectively, adopting

| Brand | Practice | Evaluation |

|---|---|---|

| HEYTEA | Caffeine traffic light classification | Relatively clear, but the online entry is hidden |

| CHAGEE | Mini-program health calculator | Data is public, but the reminder is not prominent enough |

| Nayuki’s Tea | Gradually promoting ingredient disclosure | Still in progress |

| Guming/Cha Baidao | Basic information labeling | Incomplete coverage |

- Clearly label caffeine content at key points in the ordering interface, rather than hiding it in secondary pages

- Refer to HEYTEA’s ‘traffic light’ classification to establish an identification system that is easy for consumers to understand

- Retain classic products to meet the needs of caffeine-tolerant groups

- Launch low-caffeine/low-caffeine series to meet the needs of sensitive groups

- Like the coffee industry promoting low-caffeine coffee, cultivate a market of ‘choice based on demand’

- Continuously popularize the relationship between tea and caffeine in physical stores, mini-programs, and social media

- Avoid passive response until a crisis breaks out

It is recommended that the China Tea Marketing Association, the New Tea Beverage Professional Committee, etc., take the lead in formulating the

Self-reported data by brands is often questioned; complete reports from authoritative third-party testing institutions should be introduced to enhance credibility.

In March 2025, 50 national food safety standards including the “General Rules for the Labeling of Prepackaged Foods” issued by the National Health Commission and the State Administration for Market Regulation have clearly prohibited misleading terms such as ‘zero additives’[7]. It is recommended to further refine the caffeine labeling requirements for freshly made and sold tea beverages to provide unified guidance for the industry.

From the 2024 “creamer (Bingbolang)” controversy to the 2025 year-end caffeine controversy, the core problem exposed by CHAGEE is:

Brands need to recognize: Transparency is not a threat, but the foundation of long-term trust.

| Trend | Interpretation |

|---|---|

Health Upgrade |

From marketing concept to ingredient transparency |

Product Stratification |

Meeting the diverse needs of consumers with different physiques |

Regular Popular Science |

Bridging the public cognitive gap |

Pre-emptive Crisis PR |

Active popular science is better than passive response |

As Wang Yuefei, Director of the Tea Research Institute of Zhejiang University, said:

On the surface, CHAGEE’s caffeine controversy is a ‘false alarm’ triggered by self-media, but it deeply reflects the

In the short term, popular science clarification from authoritative departments and legal rights protection by brands can calm public opinion; but in the long term,

Against the backdrop of increasing health awareness, ‘tasty’ and ‘healthy’ are no longer an either-or choice, but a mandatory question that brands must answer well. Those brands that truly respect consumer needs, adhere to product quality, and promote industry transparency will stand out in this health-oriented wave.

[1] The Paper - “From Creamer to Caffeine, CHAGEE’s ‘Sin’ is Not the Tea” (https://m.thepaper.cn/newsDetail_forward_32266516)

[2] World Journal - “Milk Tea Becomes a Quasi-Drug? CHAGEE Caught in Caffeine Controversy” (https://www.worldjournal.com/wj/story/121345/9245171)

[3] 36Kr - “CHAGEE, Trapped Not Only in ‘Insomnia’” (https://m.36kr.com/p/3631992234722565)

[4] 4A Advertising Network - “Shanghai Narcotics Control Office Rapidly Debunks False Claims, CHAGEE’s Reputation Reverses Dramatically” (https://www.4anet.com/p/01kdsvj828zc2y9wj2b5dn98v7)

[5] CCTV News/Beijing Daily - Popular Science Article by the Shanghai Narcotics Control Commission Office

[6] Xinhua News - “Tea Experts Comment on ‘Caffeine’ Anxiety: Linking Tea Beverages to ‘Drugs’ is a Slander of Chinese Tea Culture” (http://www.news.cn/food/20251228/187fc75d9b77461aa8c12d177abb283c/c.html)

[7] Yangcheng Evening News Network - “Behind CHAGEE’s Caffeine Controversy: How Pseudo-Science Creates Food Safety Anxiety?” (https://news.ycwb.com/ikimvkjtkm/content_53894135.htm)

[8] Tencent News - “The Other Side of CHAGEE’s ‘Handmade’ Food Safety Crisis: Slowing Performance and Halved Stock Price” (https://news.qq.com/rain/a/20260107A01JCC00)

[9] China News Service and Other Comprehensive Reports - CHAGEE’s 2025 Product Upgrades and Response Measures

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.