In-Depth Analysis Report on Three Squirrels' Lifestyle Store Model: Feasibility Assessment of Offline Channel Transformation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data and information, I will conduct an in-depth analysis of whether Three Squirrels’ lifestyle store model can improve the profitability of its offline channels.

According to financial data, Three Squirrels’ offline store business is facing severe challenges. From 2022 to the first half of 2025, the revenue contributed by offline channels has shown a continuous downward trend:

| Time Period | Offline Revenue (RMB 100 million) | Proportion of Total Revenue |

|---|---|---|

| 2022 | 9.4 | 12.9% |

| 2023 | 3.6 | 5.0% |

| 2024 | 4.0 | 3.8% |

| H1 2025 | 1.87 | 3.41% |

This data indicates that despite the company’s continuous investment in offline channel expansion, the contribution of offline business to overall revenue has declined instead of increasing, and it can even be described as “marginalized” [1][2].

As of the first half of 2025, Three Squirrels has only 353 offline stores. Compared with leading enterprises in the industry, this number is negligible:

- Wanchen Group: 15,365 stores [1]

- Mingming Mangmang: 16,783 stores [1]

Three Squirrels’ number of stores is not even a fraction of the two leading brands, and it has almost no competitiveness in the bulk snack track.

Three Squirrels’ offline exploration journey has been full of setbacks:

- 2018-2020: Launched a franchise model, expanded in the form of “Squirrel Alliance Stores”, and opened about 700 new franchise stores in 2020

- 2021: Rapid expansion brought a heavy burden, and more than 300 stores were closed

- 2022-2023: Closed about 550 and 250 stores respectively [1]

- Second Half of 2023: Restarted offline strategy, launched the “Community Snack Store” format, focusing on white-label low prices, and opened nearly 150 stores that year

- May 2024: Adjusted franchise strategy, launched a new model (40 ㎡ store area, initial investment of RMB 250,000), but with little effect

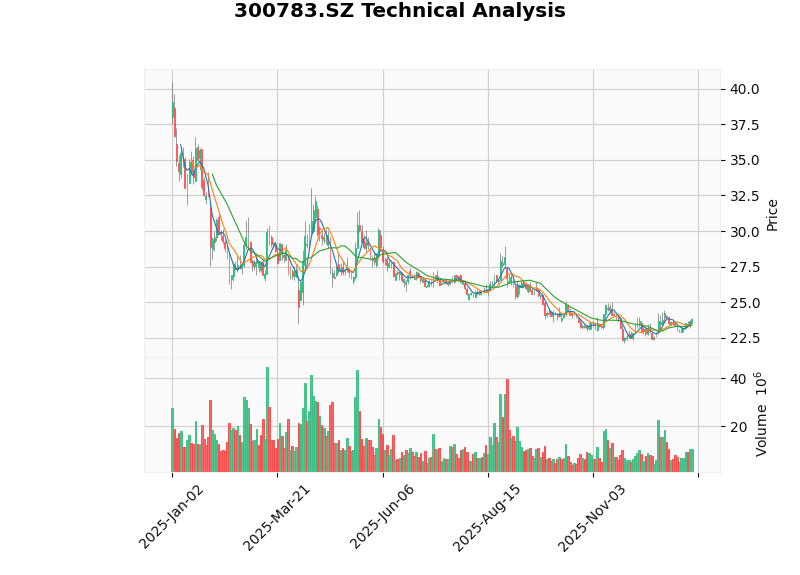

The chart above shows Three Squirrels’ recent stock price trend, with the current price at $23.80, in a sideways consolidation phase, showing a neutral trend technically [0].

In May 2025, Three Squirrels officially announced the launch of the

| Dimension | Traditional Store | Lifestyle Store Model |

|---|---|---|

Area |

Approximately 40 ㎡ | 560 ㎡ (first store) |

Category |

Nut snacks | Rice, flour, oil, fresh produce, daily chemical care, prepared dishes, sanitary napkins, etc. |

Number of SKUs |

Approximately 200 | 1,000+ |

Positioning |

Snack specialty store | One-stop family service platform |

In June 2025, Three Squirrels opened its first pilot lifestyle store in Wuhu, Anhui. The performance data of this store is as follows:

- Store Area: 560 square meters

- Number of SKUs: 1,000+ products

- Turnover in First 3 Days of Opening: Exceeded RMB 1 million

- Cumulative Foot Traffic: Approximately 25,000 person-times

From the data, the foot traffic and sales performance of the first store in the initial opening period were relatively impressive, with an estimated average daily sales of about RMB 330,000, which is much higher than the level of traditional snack stores [2][3].

The launch of the lifestyle store model marks a fundamental shift in Three Squirrels’ strategic positioning:

- From a single snack brand→Full-category family consumption platform

- From a vertical niche market→High-frequency daily necessities market

- From product sales-oriented→Scenario-based life solutions

On October 15, 2025, Three Squirrels further extended this model to the online channel, launching its first online store on JD Supermarket to achieve online-offline synergy [2].

Traditional snack consumption is a low-frequency, occasional demand, while categories covered by lifestyle stores such as rice, flour, oil, and daily chemical care are high-frequency daily consumption. This category expansion helps to:

- Increase customer repurchase rate

- Increase customer lifetime value

- Allocate store fixed costs

After expanding from single-category snacks to full categories, it is theoretically possible to significantly increase customers’ single consumption amount. Referring to other full-category retail formats, it is expected that the average transaction value can be increased by 2-3 times.

Compared with the red ocean competition in the bulk snack track, the “one-stop family shopping” positioning of lifestyle stores belongs to a relatively blue ocean field, which can avoid direct price wars with leading enterprises such as Wanchen Group and Mingming Mangmang.

Three Squirrels has long adopted an OEM model, and its ability to control the quality of upstream production capacity is relatively weak. After expanding categories from snacks to fresh produce, the requirements for the supply chain have increased exponentially. Food safety issues have frequently occurred (nearly 5,000 complaints on the Black Cat Complaint Platform) [1], and further category expansion will increase the difficulty of quality control.

“Internet companies are good at traffic operation and hit product creation, while offline retail relies more on supply chain efficiency and refined operations. Three Squirrels is too eager for success, with aggressive strategies but insufficient execution capabilities.” [3]

The fundamental difference between online genes and offline operation logic may become the main obstacle to the implementation of the lifestyle store model.

The specific investment amount and operating costs of the first 560 ㎡ lifestyle store have not been disclosed. Considering:

- Larger store area means higher rental costs

- Full-category operation requires more complex inventory management

- Fresh produce categories have the risk of loss

Its actual profit model remains to be verified.

In October 2024, Three Squirrels announced its plan to acquire Ai Lingshi for no more than RMB 200 million and Ai Zhekou for RMB 60 million, but the acquisition plan was terminated in June 2025 [1][3]. This reflects the company’s shortcomings in integrating offline resources, which may indicate that the expansion of the lifestyle store model will also face similar challenges.

From the latest financial data, Three Squirrels’ profit foundation is not stable [0]:

| Financial Indicator | Value | Comparison with Industry Level |

|---|---|---|

| Net Profit Margin | 2.03% | Low |

| ROE | 7.69% | Medium |

| Gross Profit Margin | Approximately 24.25% | Continuous Decline |

| P/E | 42.08x | High |

In the first three quarters of 2025, Three Squirrels’ sales expenses reached as high as RMB 1.605 billion, a year-on-year increase of 24.03%, of which promotion fees and platform service fees were RMB 761 million [1]. High traffic costs continue to squeeze profit margins.

Against this background, the lifestyle store model requires a large amount of upfront investment (store decoration, inventory stocking, staff training, etc.), which will create phased pressure on the company’s cash flow and income statement.

| Assessment Dimension | Score (out of 5) | Explanation |

|---|---|---|

| Strategic Innovation | 4 | Full-category positioning has differentiated advantages |

| Execution Feasibility | 2 | Doubts about supply chain and operation capabilities |

| Financial Support | 2.5 | Weak profitability, high cost pressure |

| Competitive Barrier | 3 | The model is easy to imitate, lacking a moat |

Comprehensive Score |

2.7 |

Neutral to Cautious |

- The full-category positioning has indeed opened up a differentiated competition path

- High-frequency consumption scenarios help to increase repurchase rate and average transaction value

- The pilot data of the first store in Wuhu is acceptable

- Long-term weakness in offline channels, with far fewer stores than competitors

- Insufficient supply chain capabilities and refined operation experience

- The company’s overall profitability is under pressure, and cost-side pressure continues to increase

- Failed acquisitions reflect the lack of offline integration capabilities

- The quality control risk under the OEM model may be amplified with category expansion

Investors should pay close attention to the following indicators:

- Single-store profit modelof lifestyle stores (sales per square meter, net profit margin, etc.)

- Capital expenditurefor supply chain construction and the improvement ofself-production ratio

- Changes in inventory turnover rateandloss rateof full-category operations

- The time point when the proportion of offline channel revenue stops falling and rebounds

If the above indicators show substantial improvement in 2026, the lifestyle store model is expected to gradually verify its commercial feasibility; otherwise, this model may just be another case of the company’s diversification attempts, and it will be difficult to fundamentally reverse the decline of offline channels.

[1] 21st Century Business Herald - “Three Squirrels Trapped Online” (https://www.21jingji.com/article/20260106/herald/3f4336defa1c57a94d8277595ffe66d5.html)

[2] Rui Finance - “In-Depth: Three Squirrels: Embracing Omnichannel, Supply Chain Dividends on the Way” (https://m.rccaijing.com/news-7389496567772411810.html)

[3] Jiemian News - “Three Squirrels’ Transformation Dilemma” (https://www.jiemian.com/article/12990799.html)

[0] Gilin API Data - Company Financial and Market Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.