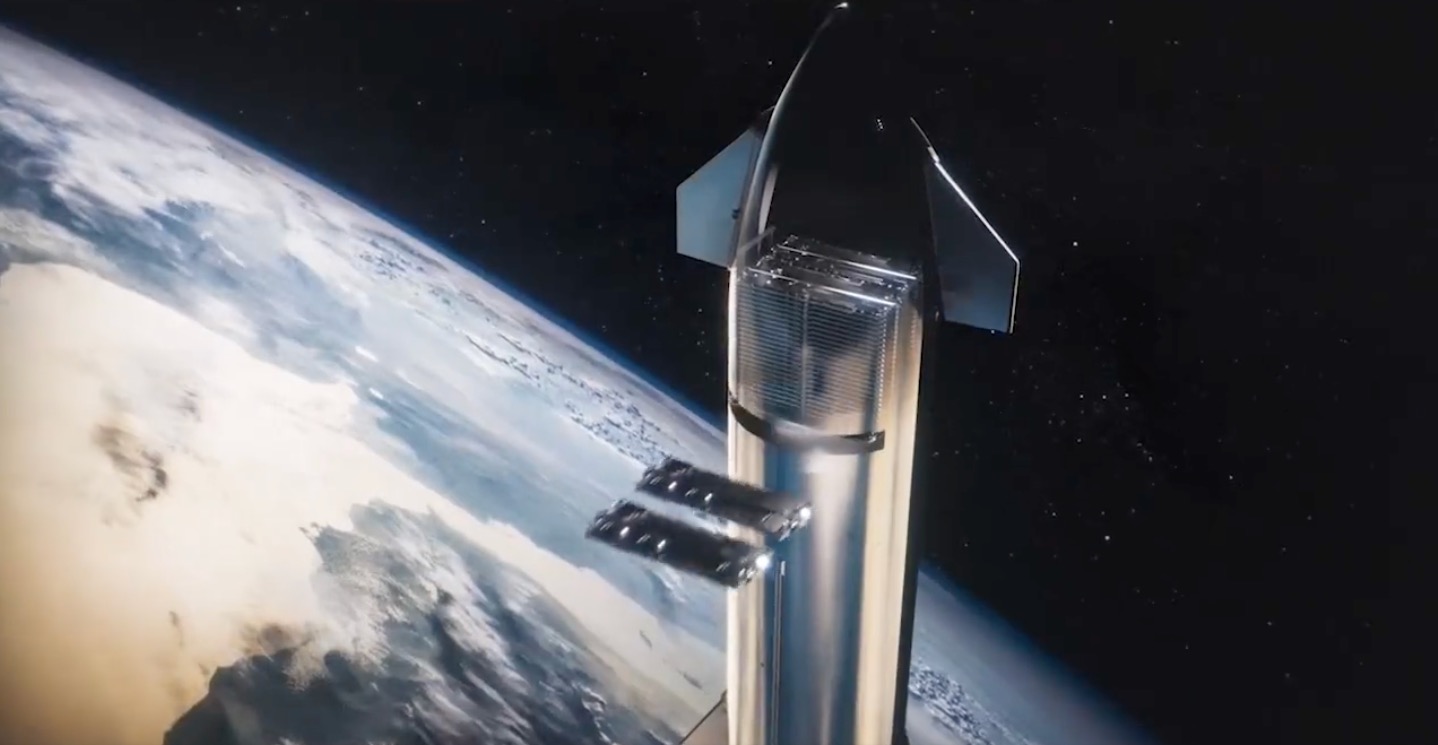

Impact Analysis of FCC's Approval for SpaceX to Deploy 7,500 Starlink Satellites

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I will present a systematic and comprehensive analysis report for you.

On January 9, 2026, the U.S. Federal Communications Commission (FCC) granted a major authorization to SpaceX, approving its additional deployment of 7,500 second-generation Starlink satellites [1]. This “partial grant” brings the total number of operable satellites of SpaceX to approximately 19,400 (7,500 second-gen Starlink satellites + 7,500 second-gen Starlink satellites approved in 2022 + first-gen Starlink satellites) [2]. The core significance of this FCC approval lies in: allowing SpaceX to operate satellites in lower orbits, use a wider range of radio frequencies, and increase power limits, thereby achieving

SpaceX originally planned to apply for more than 22,000 satellites, but the FCC adopted a more prudent approach. Nevertheless, this approval still marks a major turning point in the global satellite internet competition landscape.

The FCC’s approval will

| Competitor | Planned Number of Satellites to Deploy | Current In-orbit Satellites | Development Stage |

|---|---|---|---|

| SpaceX Starlink | ~42,000 | 9,400+ | Large-scale Operation |

| Amazon Kuiper | 3,236 | Testing Phase | Mass Deployment to Start in 2025 |

| OneWeb (Eutelsat) | 648 | 634 | Focused on Enterprise/Government Clients |

| China Satellite Network GW Constellation | 12,992 | 136 | Initial Network Deployment Stage |

| Telesat Lightspeed | 198 | Testing Phase | Focused on Enterprise Users |

SpaceX’s

- Scale Advantage: The number of satellites far exceeds that of competitors, enabling broader global coverage and higher network capacity

- Technological Iteration: The second-generation satellites (V2 Mini) have larger bandwidth and more advanced communication capabilities

- Commercial Maturity: Starlink has over 9 million users, forming a sustainable business model [4]

The FCC’s approval of SpaceX’s large-scale deployment poses

| Constellation | Planned Number of Satellites | ITU Deadline | Current Progress |

|---|---|---|---|

| GW Constellation (China Satellite Network) | 12,992 | Deploy 1,300 satellites by September 2029 | 136 satellites |

| Qianfan Constellation (Shanghai Yuanxin) | 12,000+ | Deploy 1,500 satellites by August 2032 | 108 satellites |

| Honghu-3 Constellation (LandSpace) | ~1,000 | Deploy 1,000 satellites by May 2033 | Testing Phase |

The two national-level constellations have currently completed less than 1% of their planned launches, and the

The “Action Plan for the China National Space Administration to Promote the High-Quality and Safe Development of Commercial Aerospace (2025-2027)” released by the China National Space Administration in November 2025 provides a top-level design for industrial development [8]. Dongxing Securities pointed out that commercial aerospace will become an important engine driving new-quality productive forces during the 15th Five-Year Plan period, and the number of satellite launches for Chinese constellations is expected to grow at an accelerated pace in 2026 [8].

| Time Node | Market Size | Segmented Sectors |

|---|---|---|

| 2025 | Exceeding RMB 45 billion | Entire Industry Chain |

| 2030 | Manufacturing Segment: RMB 25-46 billion | Satellite Platforms, Communication Payloads |

| 2030 | Ground Equipment Segment: RMB 26.7 billion | Phased Array Antennas, Gateways |

| 2030 | Services Segment: RMB 22.7 billion | Satellite Broadband, Application Services |

| Company | Ticker | Core Business | Competitive Advantage |

|---|---|---|---|

| Jiayuan Technology | 301117.SZ | Radiation-Hardened Chips | Only Domestic Player |

| Aerospace Hongtu | 688066.SH | Inter-satellite Laser Communication | Holds Core Patents |

| Aerospace Huanyu | 688523.SH | On-board Antennas/Ground Gateways | Core Supplier for GW Constellation |

| Company | Ticker | Core Business | Bound Clients |

|---|---|---|---|

| Shanghai Hanxun | 300762.SZ | Military Communication Equipment | GW Constellation/G60 Starlink |

| China Star Map | 688568.SH | Satellite Remote Sensing Applications | National Satellite Projects |

| China Satellite | 600118.SH | Satellite Manufacturing | Supporting the National Team |

- Reusable Rockets: LandSpace’s “Zhuque-3” aims to reduce launch costs to below RMB 20,000 per kilogram, which will significantly reduce network deployment costs [7]

- Satellite Manufacturing: GalaxySpace has reduced the cost per satellite to RMB 8 million, forming scale effects

- Launch Services: China’s aerospace launch count reached 92 in 2025, a record high [8]

From the release of the policy in late November 2025 to January 5, 2026:

- The Satellite Internet Index surged 33.9%

- Aerospace Huanyu saw a stage increase of 108.9%

- China Satellite saw a stage increase of 136.11%

- Rayco Defense saw a stage increase of 116.8%

- Aerospace Electronics saw a stage increase of 99.54% [8]

- Risk of Intensified Competition: After SpaceX’s approval, the market pattern will further concentrate, and latecomers may face order fluctuations and price pressure [4]

- Risk of Technological Route: Satellite technology iterates rapidly, and investment needs to focus on the direction of technological evolution

- Risk of Regulatory Policies: Countries are tightening supervision over spectrum and orbital resources, which may affect overseas market expansion

- Risk of Performance Realization: Some companies have a divergence between current performance and valuation (e.g., Aerospace Huanyu’s net profit fell 24.42% year-on-year in 2024)

- Risk of Connected Transactions: Some companies have a high degree of dependence on a single customer

- Risk of Market Volatility: Concept stocks have seen large short-term increases, with potential pullback risks

- Space debris and collision risks may trigger regulatory tightening

- The risk of Kessler Syndrome may affect long-term orbital use [4]

- Geopolitical tensions may impact commercial constellation operations

The FCC’s approval for SpaceX to deploy 7,500 Starlink satellites

- Focus on targets with technological barriers (Jiayuan Technology, Aerospace Hongtu)

- Pay attention to enterprises deeply bound to the supply chain (Shanghai Hanxun, China Star Map)

- Lay out leading enterprises in the launch and manufacturing segments (China Satellite, Aerospace Huanyu)

- Track the progress of reusable rocket technology (industry chain related to LandSpace)

[1] PCMag - “Big Win for SpaceX as FCC Clears It to Upgrade Starlink With Gigabit Speeds” (https://www.pcmag.com/news/big-win-for-spacex-as-fcc-clears-it-to-upgrade-starlink-with-gigabit-speeds)

[2] Reuters - “FCC approves SpaceX plan to deploy an additional 7,500 Starlink satellites” (https://www.reuters.com/business/media-telecom/fcc-approves-spacex-plan-deploy-additional-7500-starlink-satellites-2026-01-09/)

[3] Spaceflight Now - “Live coverage: SpaceX to launch its Falcon 9 rocket on midday Starlink mission” (https://spaceflightnow.com/2026/01/08/live-coverage-spacex-to-launch-its-falcon-9-rocket-on-midday-starlink-mission-from-cape-canaveral/)

[4] Founder Securities/Dongxing Securities - Satellite Internet Industry Research Report (2025-2026)

[5] TechTimes - “Top Satellite Internet Providers for 2026: Fastest Speeds” (https://www.techtimes.com/articles/313912/20260109/top-satellite-internet-providers-2026-fastest-speeds-best-nationwide-coverage.htm)

[6] PESTEL Analysis - “Competitive Landscape of SpaceX Company” (https://pestel-analysis.com/blogs/competitors/spacex)

[7] 21st Century Business Herald - “Satellite Internet Market Space to Exceed RMB 45 Billion: Which Segment Leaders Are Worth Paying Attention to?” (https://www.21jingji.com/article/20251212/herald/24c2ab3d19334d95b3eadd10b62ac0f2.html)

[8] Sina Finance - “The Next Trillion RMB Track? Satellite Internet Enters a Golden Development Period” (https://finance.sina.com.cn/stock/wbstock/2026-01-08/doc-inhfqpsv1373278.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.