Analysis of the Impact of Surge in Hainan Off-Island Duty-Free Shopping Revenue on the Performance and Investment Value of Operators like China Duty Free Group

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have collected comprehensive data, and below is the complete investment analysis report for you.

According to data from Haikou Customs, in the first week of 2024, Hainan off-island duty-free shopping revenue reached RMB 1.21 billion, a year-on-year increase of 88%, with the number of shoppers rising by 38.3%, marking a strong start [1]. However, this robust opening failed to sustain growth for the full year:

| Indicator | 2024 Data | YoY Change |

|---|---|---|

| Annual Shopping Revenue | RMB 30.94 billion | -29.3% |

| Number of Shoppers | 5.683 million person-times | -15.9% |

| Number of Items Purchased | 33.082 million items | -35.5% |

The annual pressure on data was mainly affected by the following factors:

- Natural disasters such as Typhoon Yagi impacted Hainan’s tourism retail sector [2]

- Sustained diversion effect from outbound consumption

- Domestic brands squeezing duty-free market share

- Consumers increasingly prioritizing cost-effectiveness [2]

Entering 2025, the Hainan off-island duty-free market has shown a clear stabilization and recovery trend:

| Time Period | YoY Growth Rate | Drivers |

|---|---|---|

| October 2025 | +13% | Implementation of new duty-free policies |

| November 2025 | +27% | Double 11 promotion activities |

| December 18-24, 2025 | +55% | Christmas consumption peak season |

| First week of 2026 | +88% | Combination of New Year and policy dividends [3] |

The latest research report from Citigroup points out that Hainan’s strong sales trend is expected to continue during the winter peak season, with Hainan’s duty-free sales expected to grow by over 20% year-on-year in 2026 [3]. This positive expectation is mainly based on:

- Consumption potential unleashed by new duty-free policies

- Wealth effect driving recovery in high-end consumption

- Customer diversion effects from promotions and cultural entertainment activities (e.g., concerts)

As the absolute leader in the Hainan off-island duty-free market (with an 82% market share), the performance of China Duty Free Group (601888.SS) directly reflects industry sentiment [4]:

| Financial Indicator | 2024 | YoY Change | H1 2025 | YoY Change |

|---|---|---|---|---|

| Operating Revenue | RMB 56.474 billion | -16.4% | RMB 28.151 billion | -9.96% |

| Net Profit Attributable to Parent Company | RMB 4.267 billion | -36.5% | RMB 2.6 billion | -20.81% |

| Gross Profit Margin | 32.4% | -1.4 ppts | 32.77% | -0.77 ppts |

- Since Q1 2024, China Duty Free’s operating revenue, gross profit, and net profit have declined for six consecutive quarters [4]

- H1 2025 net profit shrank by over 51% compared to the peak in the same period in 2021

- Net profit in Q2 fell 32.21% year-on-year, increasing quarterly operating pressure [4]

Based on an in-depth analysis of the past four years’ data using financial analysis tools [0]:

- The company maintains balanced accounting treatment principles, with no extremely aggressive or conservative financial policies

- Current ratio of 5.82, quick ratio of 4.03, with ample liquidity

- Asset-liability ratio is at a reasonable level for the industry

- Although operating cash flow fell 39.5% year-on-year, it remains positive

| Indicator | Value | Industry Comparison |

|---|---|---|

| Net Profit Margin | 6.38% | Below historical average |

| ROE | 6.10% | Under pressure |

| Gross Profit Margin of Duty-Free Goods | 39.5% | Significantly higher than general retail |

Based on analysis using professional valuation models, China Duty Free’s current share price of RMB 95.78 is higher than the base scenario valuation [0]:

| Valuation Scenario | Intrinsic Value | Deviation from Current Price |

|---|---|---|

| Bear Scenario | RMB 66.97 | -30.1% |

| Base Scenario | RMB 78.67 | -17.9% |

| Bull Scenario | RMB 271.94 | +183.9% |

| Weighted Average | RMB 139.19 | +45.3% upside potential |

| Assumption Parameter | Bear Scenario | Base Scenario | Bull Scenario |

|---|---|---|---|

| Revenue Growth Rate | 0% | 1.8% | 40.5% |

| EBITDA margin | 14.1% | 14.9% | 15.6% |

| WACC | 11.2% | 9.7% | 8.2% |

| Terminal Growth Rate | 2.0% | 2.5% | 3.0% |

| Institution | Rating | Target Price (HKD) | Latest Adjustment |

|---|---|---|---|

| Citigroup | Buy | 100 | Upgraded (+38.9%) [3] |

| Soochow Securities | Buy | 85 | Maintained |

| Guotai Junan Securities | Buy | 82 | Maintained |

| Haitong Securities | Overweight | 78 | Maintained |

| Shenwan Hongyuan Securities | Buy | 88 | Maintained |

| CITIC Securities | Hold | 76 | Maintained |

| CICC | Overweight | 92 | Maintained |

- 2025 net profit forecast: RMB 4.33 billion (neutral)

- 2026 net profit forecast: RMB 5.0 billion

- 2027 net profit forecast: RMB 5.52 billion

- Corresponding PE ratios: 34x/30x/27x (based on current share price)

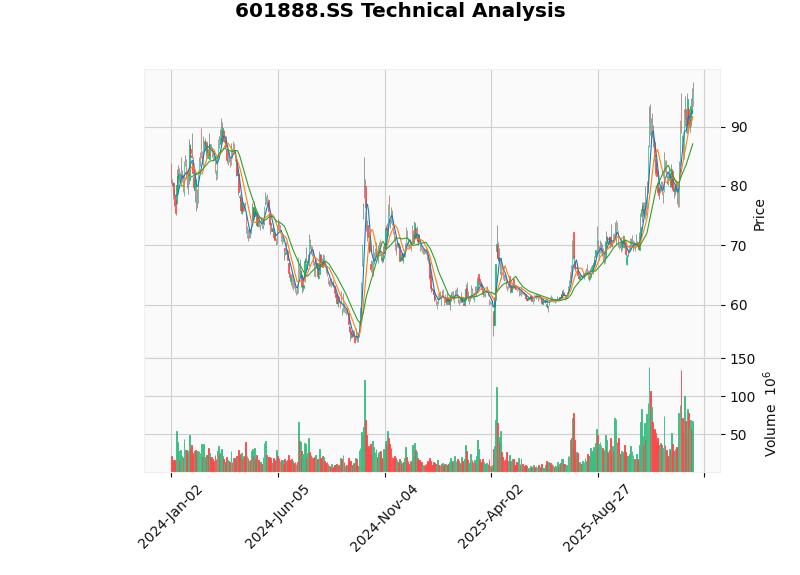

Based on technical analysis indicators [0]:

| Indicator | Value | Signal Interpretation |

|---|---|---|

| Share Price (2026-01-09) | RMB 95.78 | - |

| 20-Day Moving Average | RMB 87.09 | Medium-term trend upward |

| 50-Day Moving Average | RMB 83.80 | Medium-term trend upward |

| 200-Day Moving Average | RMB 69.69 | Long-term trend upward |

| KDJ | K:75.9, D:71.6 | Near the overbought zone |

| MACD | Golden cross pattern formed | Bullish signal |

| Beta (vs. SSE Composite Index) | 0.75 | Low volatility characteristics |

| Current Trend | Range-bound | Reference range: [87.09, 97.86] |

- 82% market share in Hainan’s off-island duty-free market, up nearly 1 percentage point year-on-year in H1 2025 [4]

- Owns 6 core stores in Hainan, including Sanya International Duty-Free City and Haikou International Duty-Free City

- Continues to expand port duty-free store operations, successfully winning bids for terminals such as Guangzhou Baiyun International Airport T3

- Policy benefits from the customs clearance operation of Hainan Free Trade Port on December 18, 2025 [4]

- Expansion of downtown duty-free store policies: 13 foreign exchange commodity duty-free stores in Beijing, Shanghai, etc. have been transformed, and downtown duty-free stores have been added in 8 cities including Guangzhou and Chengdu [2]

- Expansion of duty-free product categories: increased from 45 to 47 categories starting November 2025, adding pet supplies, portable musical instruments, etc. [2]

- Gross profit margin of duty-free goods sales is as high as 39.5%, far exceeding general retail formats (about 24%) [2]

- The high gross profit mainly comes from price competitive advantages brought by tax dividends

- Successfully entered markets such as Hong Kong, Macau, and Vietnam

- Duty-free stores at Hanoi Noi Bai International Airport and Phu Quoc International Airport have opened

- Promotes the “Guochao” (Chinese Chic) going global strategy, partnering with brands like Tongrentang and Bloomage Biotech

- Current P/E (TTM) of 58.28x is significantly higher than the industry average (about 35x)

- The share price is about 18% higher than the DCF base scenario valuation, limiting upside potential

- The overall high-end consumption market is weak, and international luxury giants have poor performance

- The recovery of residents’ consumption willingness may fall short of expectations

- Sustained diversion from the South Korean duty-free market

- Changes in the competitive landscape of downtown duty-free stores

- Domestic brands squeezing duty-free market share

- Progress of customs clearance operation policies

- Implementation effect of downtown duty-free store policies

- Uncertainty in adjustments to duty-free quotas

The 88% surge in Hainan off-island duty-free shopping revenue sends a positive signal of consumption recovery. As the industry leader, China Duty Free will directly benefit from the market recovery. However, the current valuation has fully reflected recovery expectations, so investors are advised to adopt a phased position-building strategy.

| Risk Preference | Recommended Strategy | Target Price Range |

|---|---|---|

| Conservative | Wait-and-see or light position | Wait for pullback to below RMB 85 |

| Moderate | Phased position-building | Range of RMB 87-92 |

| Aggressive | Appropriate participation | Chase upward after breaking RMB 100 |

- Monthly sales data of Hainan off-island duty-free

- Quarterly earnings guidance from the company

- Opening progress of downtown duty-free stores

- Rhythm of policy benefit releases

| Scenario | 6-Month Target Price | Expected Return | Trigger Condition |

|---|---|---|---|

| Bull | RMB 110 | +14.8% | Hainan sales growth exceeds 25%, policy benefits are realized |

| Base | RMB 98 | +2.3% | Sales growth of 15-20%, performance meets expectations |

| Bear | RMB 78 | -18.6% | Sustained weak consumption, performance falls short of expectations |

The chart shows: (1) Annual sales trend of Hainan off-island duty-free; (2) Changes in YoY growth rate; (3) Quarterly revenue trend of China Duty Free; (4) Comparison of DCF valuation and current price

The chart shows: (1) Comparison of analyst target prices and current price; (2) Comparison of valuation indicators and industry averages; (3) Consensus earnings forecasts; (4) Investment value scoring matrix

The chart shows the share price trend and technical indicator analysis of China Duty Free from 2024 to present

[0] Jinling AI Financial Database - Real-time quotes, financial analysis, DCF valuation and technical indicator data of China Duty Free Group (601888.SS)

[1] Haikou Customs - Shopping data of Hainan off-island duty-free in the first week of the 2024 New Year

[2] 2024 Annual Report Summary of China Tourism Group Duty Free Corporation Limited - https://www.ctg.cn/2025-05-28/f1b1e712-75cc-41cf-a3bd-310b6f28e5ee1748426222323.pdf

[3] Citigroup Research Report - More Positive Outlook on Hainan Duty-Free Sales Growth, Upgrades Target Price of China Duty Free H-shares to HKD 100 (https://www.163.com/dy/article/KIR2EIVF05198ETO.html)

[4] Securities Times - China Duty Free’s H1 Net Profit Falls 20.81%, Duty-Free Leader Seeks Breakthrough with Diversified Layout (https://www.stcn.com/article/detail/3291014.html)

[5] Soochow Securities - China Duty Free (601888) H1 2025 Report Comment: Revenue Decline Narrows, Customer Flow Stabilizes (https://pdf.dfcfw.com/pdf/H3_AP202508271735306256_1.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.