Analysis of the Impact of SpaceX Crew-11 Mission Uncertainty on Investment Sentiment in the Commercial Aerospace Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest reports, NASA announced on January 9, 2026 that due to a medical condition affecting one astronaut on the Crew-11 mission, it would cut short the mission’s space station stay plan, and all four astronauts would return to Earth [1]. This marks the first early mission termination due to an astronaut’s health issue in the 25-year operational history of the International Space Station (ISS), a milestone event [2].

NASA Administrator Jared Isaacman stated at a press conference that an astronaut on the station developed a medical condition on January 7, and is currently in stable condition. NASA decided to take a cautious approach and return all Crew-11 astronauts to Earth early, with the expected return date set for January 14 [1]. Nevertheless, NASA emphasized that this early return will not affect the scheduled launch of the Artemis 2 lunar mission [3].

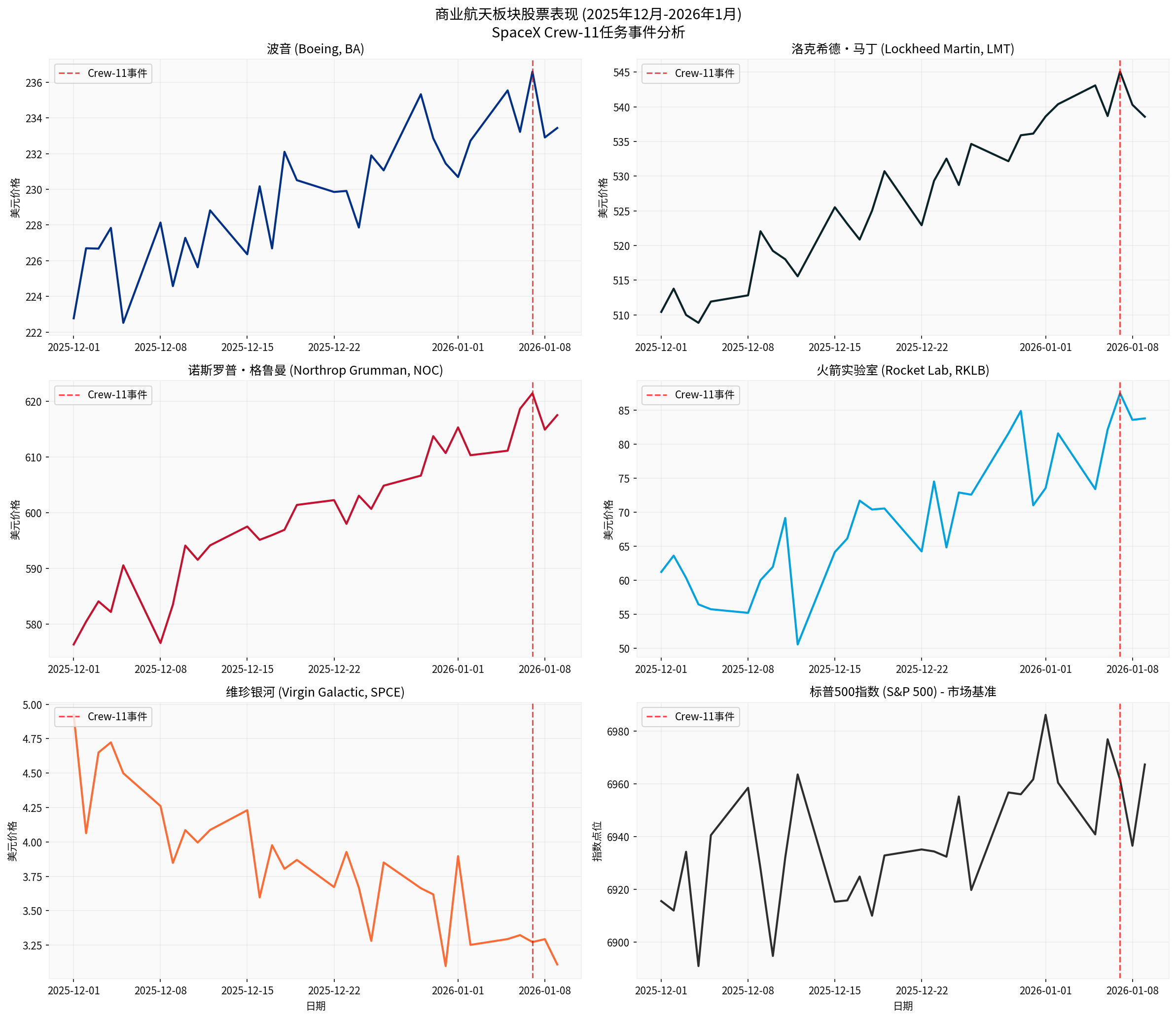

According to market data, recent performance of commercial aerospace-related stocks has shown a divergent trend:

| Ticker Symbol | Company Name | Year-to-Date Performance | 20-Day Moving Average | 200-Day Moving Average | Technical Pattern |

|---|---|---|---|---|---|

RKLB |

Rocket Lab | +1309.47% |

$71.27 | $43.28 | Strong Uptrend |

NOC |

Northrop Grumman | +20.03% |

$580.38 | $547.75 | Steady Uptrend |

BA |

Boeing | +36.12% |

$217.14 | $206.90 | Breakout Pattern |

LMT |

Lockheed Martin | -3.43% |

$491.00 | $467.76 | Range-bound |

SPCE |

Virgin Galactic | -52.89% |

$3.28 | $3.39 | Downtrend |

From a sector perspective, the Industrial sector (+1.32%) outperformed the broader market, while the Communication Services sector (-0.06%) edged lower [0]. Overall, the commercial aerospace sector did not see significant spread of negative sentiment due to the Crew-11 incident.

Crew-11 mission’s early termination did not cause a significant negative impact on the commercial aerospace sector, mainly due to the following reasons:

- NASA’s Rapid Response and Transparency: NASA Administrator Jared Isaacman clearly stated that this was a cautious decision based on astronaut safety considerations, and official communications were clear and effective, reducing market uncertainty [1][2].

- Mission Continuity Assurance: NASA also announced that it will accelerate the launch schedule of the Crew-12 mission to fill the station stay vacancy left by Crew-11’s early return, demonstrating sufficient operational resilience [3].

- Decoupling from the Artemis Program: NASA clearly stated that this incident will not affect preparations for the Artemis 2 lunar mission (scheduled for launch in February 2026), a high-profile project closely watched by the market [3].

From a longer-term perspective, the fundamentals of the commercial aerospace sector remain solid:

- 2026 is regarded as the first year of commercialization for China’s commercial aerospace sector, with milestone events such as the first recoverable rocket landing and annual launch volume exceeding 100 expected to be achieved [4].

- Continuous Inflow of Social Capital: Social capital and state-owned funds are accelerating their inflow into the commercial aerospace sector, with significantly increased activity in secondary market equity transfers [4].

- Growing Global Demand for Commercial Aerospace: Institutions such as UBS have listed the aerospace and defense sector as one of the key investment directions for 2026 [5].

- Stable Confidence Among Institutional Investors: Judging from the positions of the 20-day and 200-day moving averages of major aerospace stocks, BA, NOC, and RKLB all show a bullish alignment pattern, indicating strong short-term momentum.

- High-Beta Targets Remain Favored: Rocket Lab (RKLB) has surged over 1300% year-to-date, demonstrating the market’s high recognition of the commercial aerospace track.

- Support from Defensive Demand: Share prices of traditional aerospace and defense companies such as Boeing and Northrop Grumman have remained stable, reflecting rigid demand for defense budgets amid geopolitical tensions.

- Dilemma of Virgin Galactic: SPCE has dropped over 52% year-to-date, showing that not all commercial aerospace companies can share in the industry’s growth dividends, with significant divergence among individual stocks.

- Technical Risk Premium: The Crew-11 incident may prompt investors to re-evaluate the technical risks of manned space missions, especially against the backdrop of increasingly active commercial manned spaceflight.

- Potential Strengthening of Regulatory Scrutiny: The first ISS medical evacuation incident may trigger stricter scrutiny of commercial aerospace safety standards.

- NASA’s decision reflects a high priority on astronaut safety, alleviating market concerns about safety risks;

- The early termination of the mission does not affect the scheduled progress of subsequent key missions (such as Artemis 2);

- The fundamentals of the commercial aerospace sector remain solid, and the logic of structural growth remains intact.

- Focus on Targets with Core Technological Advantages: Companies such as Rocket Lab (RKLB) and Northrop Grumman (NOC) have high technical barriers and strong growth certainty;

- Exercise Caution with High-Volatility Targets: Companies such as Virgin Galactic (SPCE) are under fundamental pressure, and valuation risks should be watched closely;

- Watch for Incremental Defense Contracts: Boeing (BA) and Lockheed Martin (LMT) are expected to benefit from growth in defense budgets.

The chart above shows the price trends of major commercial aerospace-related stocks from December 2025 to January 2026, with a red dashed line marking the time of the Crew-11 medical incident on January 7.

[1] Spaceflight Now - “Crew-11 to cut mission short and return to Earth due to medical issue” (https://spaceflightnow.com/2026/01/09/crew-11-to-cut-mission-short-and-return-to-earth-due-to-medical-issue/)

[2] Space.com - “ISS astronaut medical evacuation latest news” (https://www.space.com/news/live/astronaut-medical-evacuation-on-iss-jan-9-2026)

[3] NPR - “NASA to bring back Crew-11 early from space station” (https://www.npr.org/2026/01/08/nx-s1-5671060/nasa-crew-11-crew-member-earth-return)

[4] Futunn News - “Looking Ahead to Commercial Aerospace 2026” (https://news.futunn.com/en/post/66882816/looking-ahead-to-commercial-aerospace-2026-existing-shares-may-be)

[5] Investing.com - “8 Best US Aerospace & Defense Stocks for 2026: UBS Picks” (https://www.investing.com/news/stock-market-news/8-best-us-aerospace--defense-stocks-for-2026-ubs-picks-93CH-4437631)

[0] Gilin AI Market Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.