In-Depth Analysis Report on Strategic Transformation of Everwin Precision (300115.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above data, I will conduct a systematic and comprehensive analysis.

Everwin Precision (Shenzhen Everwin Precision Technology Co., Ltd.) is a high-tech enterprise focusing on precision component manufacturing. In recent years, the company has actively promoted business strategic transformation, shifting its development focus from the traditional consumer electronics field to precision components for humanoid robots [0].

| Indicator | Value | Industry Positioning |

|---|---|---|

| Market Capitalization | $60.532 billion | Leading enterprise in the precision manufacturing sector |

| Stock Price | $44.48 | Still has room to rise from the historical high |

| P/E Ratio (TTM) | 93.81x | Significantly higher than the average of traditional manufacturing industry |

| P/B Ratio | 7.31x | Reflects the market’s growth expectations for the company |

| ROE | 7.94% | Profitability needs improvement |

| Net Profit Margin | 3.52% | At the medium level in the industry |

| Current Ratio | 1.00 | Liquidity is in a tight balance state |

- 1-Year Increase: 156.52%

- 6-Month Increase: 116.87%

- 3-Month Increase: 18.93%

Judging from the stock price trend, the company has experienced a significant revaluation process in the past year, which is closely related to the breakthrough progress in its humanoid robot business [0].

Based on in-depth analysis of the company’s five-year financial data by financial analysis tools [0]:

- Category: Conservative

- The company exhibits a conservative accounting treatment style, and the high depreciation/capital expenditure ratio indicates that the management is prudent in asset measurement

- As previous investments gradually generate returns, there is room for improvement in earnings quality

- Latest Free Cash Flow: $411 million (positive)

- FCF Margin: Maintained at a healthy level

- The company’s operating cash flow can cover capital expenditure needs

- Risk Level: Medium

- A quick ratio of 0.65 indicates the existence of short-term debt repayment pressure

- It is recommended to pay attention to the company’s subsequent progress in optimizing its asset-liability structure

Everwin Precision has a significant first-mover advantage in its layout in the humanoid robot field. Starting from 2015, the company began its robot business layout through its wholly-owned subsidiary Guangdong Tianji Industrial Intelligent System Co., Ltd. After nearly a decade of technical accumulation and industrial precipitation, it has laid a solid foundation for the company’s expansion into the field of embodied intelligent robots [1].

- 2024: Established a wholly-owned subsidiary Shenzhen Everwin Robot Co., Ltd. as the core carrier for robot industry layout

- April 2024: Began cooperation with Figure AI, providing key components such as fingertip sensors, joint gears, and upper body assemblies for its 01/02 series robots

- August 2025: Signed an order for 20,000 sets of dexterous hand joint assemblies with Figure AI, with a unit value of approximately RMB 6,000, locking in full-year production capacity

- 2025: Reached cooperation with Tesla in the humanoid robot business, providing key components such as joints, bearings, and sensors for its Optimus project

The company’s humanoid robot business has formed a customer structure of “Overseas High-End + Domestic Mainstream” [1]:

| Client | Cooperation Content | Unit Value |

|---|---|---|

Tesla |

Joint gears and bearings for the Optimus project | Approximately RMB 40,000 |

Figure AI |

Dexterous hand joint assemblies, joint gears, sensors | Over RMB 100,000 |

NVIDIA |

Full set of structural components for Project DIGITS dual-arm robot | Approximately RMB 30,000 |

- Cumulative Deliveries from Jan-Aug: Exceeded RMB 80 million (RMB 10.11 million for the full year of 2024, a year-on-year increase of over 700%) [1]

- Contribution from Overseas Brands in H1: Approximately RMB 35 million

- Tesla Optimus Project: According to the 10,000-unit production plan in 2025, the company is expected to obtain a 70% share corresponding to an order of approximately RMB 21 million

- Figure AI Order: The order for 20,000 sets of dexterous hand joint assemblies signed in August locks in full-year production capacity

- Has established connections with more than 30 domestic humanoid robot clients

- Key clients include: UBTECH, DeepBrain Robotics, Unitree Robotics, Agile Dynamics, etc.

- In September 2025, UBTECH won the world’s largest humanoid robot order worth RMB 250 million, and Everwin Precision is one of its core component suppliers

The company has built a comprehensive product system and technical barriers in the humanoid robot field [1]:

- Core Components: Dexterous hand joint gears, bearings, fingertip sensors, transmission lead screws

- Structural Components: Structural components made of metal materials such as aluminum alloy, magnesium alloy, and titanium alloy

- Actuators and Sensors: High-precision actuators, multi-dimensional force sensors

- Others: Supporting components such as variable speed gears, wiring harnesses, and motors

- Materials: Metal materials such as aluminum alloy, magnesium alloy, and titanium alloy; engineering plastics such as PEEK and IGUS; various materials such as rubber, silica gel, nylon, and fiber cloth

- Processes: Various forming processes such as CNC, 3D printing, die casting, injection molding, gear hobbing, and hot pressing

- Ultra-precision processing capability: 2-micron level precision

- Titanium alloy processing yield: 92%

- Planetary roller screw technology: Cost is only 1/10 of that of international manufacturers

As of now, the number of part numbers supplied by the company to clients in the humanoid robot business exceeds 400, which not only reflects the richness of the product line and customization capabilities, but also demonstrates the company’s technical accumulation in diversified material applications and complex process integration [1].

The company is accelerating the construction of humanoid robot-related production capacity [1]:

| Base | Capacity Plan | Expected Production Launch Time |

|---|---|---|

Shenzhen Robot Industrial Park |

Approximately 60,000 sqm factory building with a monthly production capacity of 10,000 robot structural components | Q4 2025 |

Dongguan Songshan Lake Phase I |

50,000 joint modules/year, 100,000 precision structural components/year | Q1 2026 |

Dongguan Phase III + Shanghai Lingang |

Equipped with 3,000 CNC machines to support Figure AI’s capacity ramp-up | Under construction |

Dongguan Reducer Base |

Annual production of 500,000 harmonic reducers | Full production capacity in 2026 |

- 2025: Target for humanoid robot-related orders reaches RMB 100 million

- 2026: Production volume for core client Figure AI increases from 1,000 units to 10,000 units

- 2030: Humanoid robot-related revenue exceeds RMB 1 billion

It is worth noting that the company’s robot production lines are highly reusable with its consumer electronics business, requiring no large-scale new equipment investment, and the reuse rate of precision manufacturing capabilities exceeds 80%, enabling rapid response to market demand [1]. This capacity reuse strategy not only improves asset utilization efficiency, but also reduces initial expansion costs and investment risks.

The humanoid robot industry is at a critical juncture of scaling from “1-10” to “10-100” [2]. 2025 is regarded as the “first year of mass production” by the industry, and 2026 will officially start the path of large-scale commercialization.

| Time Node | Chinese Market Size | Global Market |

|---|---|---|

| 2024 | RMB 12.54 billion | - |

| 2025 | RMB 8.239 billion (accounting for 50% of the global market) | Approximately $16.8 billion |

| 2030 | RMB 254.04 billion | Over $230 billion (CAGR 64%) |

- GGII (High-Tech Robot Industry Research Institute): It is predicted that domestic shipments will reach 18,000 units in 2025 (YoY +650%), and are expected to reach 62,500 units in 2026

- Industry experts are more optimistic: Domestic production will exceed the 100,000-200,000 unit level in 2026

According to industry research reports, the humanoid robot industry will present three core trends in 2026 [2]:

-

Cost Reduction Drives Volume Expansion

- The cost of UBTECH’s Walker series robots has decreased by 25% compared to 2024

- The localization rate of core components such as planetary roller screws, servo drivers, and harmonic reducers continues to rise

- Xiasia Precision has reduced the cost of reverse planetary roller screws to the thousand-yuan level through the “one factory, dual use” model

-

Scenario Expansion Accelerates Commercialization

- “Hard Scenarios”: Industrial scenarios such as logistics handling, sorting, and loading/unloading have begun to substantially take over workstations

- “Soft Scenarios”: Significant progress has been made in fields such as companionship, commercial guidance, education, and performance

- Galaxy General and Baida Precision have cooperated to deploy over 1,000 embodied intelligent robots

-

Technological Breakthroughs Solve Industry Bottlenecks

- Continuous progress in full-body coordinated mobile operations and human-robot interaction technology

- Robot large models gradually participate in strategy adjustment and motion generation

- Substantial breakthroughs have been achieved in tactile perception capabilities and multi-dimensional force touch

The core components market of humanoid robots presents a competition pattern of “dominated by international giants + rise of domestic forces” [1]. In terms of industrial chain layout:

| Segment | Representative Enterprises |

|---|---|

| Software | iFLYTEK, Qunhe Technology |

| Chips | Rockchip |

| Structural Components | Everwin Precision , Changsheng Bearing |

| 3D Visual Sensors | ORBBEC |

| Reducers | Shuanglin Co., Ltd., Xiasia Precision |

| Batteries/Motors | Leaders in various sub-segments |

Everwin Precision has successfully secured positions in the core supply chains of the world’s two top humanoid robot enterprises (Tesla and Figure AI), and has established a leading position in the structural components field [1].

Based on in-depth DCF analysis by professional valuation tools [0]:

| Scenario | Intrinsic Value | Comparison with Current Price |

|---|---|---|

Conservative Scenario |

$36.39 | -18.2% |

Base Scenario |

$41.41 | -6.9% |

Optimistic Scenario |

$55.92 | +25.7% |

Probability-Weighted |

$44.57 | +0.2% |

| Assumption Parameter | Conservative Scenario | Base Scenario | Optimistic Scenario |

|---|---|---|---|

| Revenue Growth Rate | 0.0% | 14.7% | 17.7% |

| EBITDA Margin | 8.9% | 9.3% | 9.8% |

| Terminal Growth Rate | 2.0% | 2.5% | 3.0% |

| Cost of Equity | 14.6% | 13.1% | 11.6% |

| WACC | - | 12.4% | - |

- Beta Coefficient: 1.22 (relative to S&P 500)

- Risk-Free Rate: +4.5%

- Market Risk Premium: +7.0%

- The current stock price ($44.48) is basically in line with the probability-weighted DCF valuation ($44.57), which means that the market has incorporated the growth of existing businesses and foreseeable humanoid robot businesses into pricing

- The 93.81x TTM P/E ratio is significantly higher than the valuation level of the traditional manufacturing industry, reflecting the market’s high expectations for the company’s growth

- High Growth Expectations Support High P/E: Analysts predict that EPS will reach $1.89 in 2029, with significant room for improvement compared to the current level

- Business Transformation Premium: The humanoid robot business is in a period of explosive growth, and it is reasonable for the market to give a growth premium

- Order Certainty: Orders from leading clients such as Tesla and Figure AI have been locked in, and revenue predictability is relatively strong

- Expectations Are Already Fully Reflected: The current valuation is close to the upper limit of DCF valuation, with limited upside space

- Performance Delivery Pressure: The 2025 target order of RMB 100 million needs to be released quarter by quarter, and if it fails to meet expectations, it may trigger a valuation correction

- Intensified Industry Competition: As more enterprises enter the humanoid robot component track, the competition pattern may deteriorate

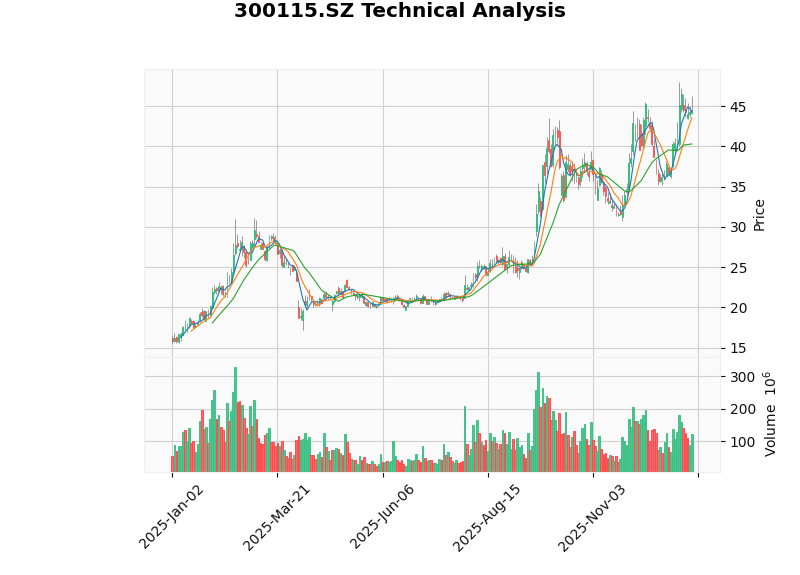

According to technical analysis tools [0]:

| Indicator | Value | Signal |

|---|---|---|

| MACD | No Crossover | Bullish Bias |

| KDJ | K:66.2, D:68.1, J:62.2 | Bearish Bias |

| RSI(14) | Normal Range | Neutral |

| Beta | 1.22 | High Volatility |

- Current Trend: Sideways consolidation (no obvious trend)

- Price Range: $40.30 (support) - $45.75 (resistance)

- Operation Suggestion: No clear buy or sell signal for the time being

-

Track Switching Premium

- Transformation from traditional consumer electronics precision manufacturing to the high-growth humanoid robot track

- The compound annual growth rate of the humanoid robot industry is expected to exceed 60% from 2026 to 2030

- The market is willing to give a valuation premium for track switching

-

Customer Structure Optimization

- Access to the supply chains of global top technology enterprises such as Tesla and Figure AI

- The improvement of customer level brings higher profitability and more stable revenue expectations

- The increase in the proportion of overseas customers reduces dependence on a single market

-

Technical Barrier Consolidation

- 2-micron level ultra-precision processing capability forms a technical moat

- The product matrix with over 400 part numbers enhances customer stickiness

- Joint R&D with leading clients ensures technological leadership

-

Performance Delivery Risk

- Deliveries of RMB 80 million have been achieved from January to August 2025, and efforts are still needed to reach the annual target of RMB 100 million

- The humanoid robot industry is in the early stage of commercialization as a whole, with relatively large order volatility

- The speed of capacity ramp-up may be limited by factors such as equipment debugging and yield improvement

-

Valuation Correction Risk

- The current P/E ratio (93.81x) is already at a historical high

- If growth fails to meet expectations, it may face the risk of “valuation compression”

- The market has overly high expectations for the company, leaving little room for error

-

Competition Pattern Risk

- Competitors such as Changsheng Bearing, Shuanglin Co., Ltd., and Xiasia Precision are accelerating their layout

- Price competition may erode gross profit margin

- Diversified customer needs may disperse the company’s orders

- The revenue of the humanoid robot business will achieve high-speed growth, and its proportion is expected to increase from the current low single digits to 5-10%

- The main growth comes from the mass production ramp-up of Tesla Optimus and Figure AI

- Capacity release will support order delivery capability

- The domestic humanoid robot market is expected to replicate the development path of new energy vehicles

- The company is expected to become a core supplier of core components for global humanoid robots

- Scale effect will emerge, and gross profit margin and net profit margin are expected to improve

- The target for humanoid robot-related revenue exceeds RMB 1 billion

- It is expected to become a new growth engine for the company, with its revenue proportion possibly reaching over 20%

- After industry standards are improved, the company, as a leading supplier, will benefit from the increase in market concentration

Everwin Precision’s strategic transformation direction is correct, and its humanoid robot business has the potential to become a new growth engine. The company has successfully secured positions in the supply chains of global leading clients and established dual barriers in technology and clients. However, the current valuation has fully reflected market expectations, and the stock price is close to the upper limit of DCF valuation.

- Risk-Taking Investors: Can accumulate positions on dips to share the growth dividends of the humanoid robot industry

- Risk-Averse Investors: It is recommended to wait for a better buying opportunity or a valuation restructuring opportunity after performance is delivered

- Key Observation Indicators: Q4 2025 order delivery status, 2026 capacity ramp-up progress, changes in customer structure

- The commercialization progress of humanoid robots is slower than expected

- Order fluctuation risk caused by high customer concentration

- Gross profit margin decline due to intensified industry competition

- Valuation correction risk

[0] Jinling AI Financial Database - Everwin Precision (300115.SZ) Company Overview, Financial Analysis, DCF Valuation and Technical Analysis Data

[1] “The Story Behind the RMB 80 Million Humanoid Robot Component Order”, Leaderobot, November 20, 2025 (https://www.leaderobot.com/news

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.