Impact Analysis: December 2024 Jobs Data on Fed Policy and US Equity Valuations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on comprehensive analysis of the December 2024 U.S. nonfarm payrolls data and its implications for Federal Reserve policy and equity valuations, here is my detailed assessment:

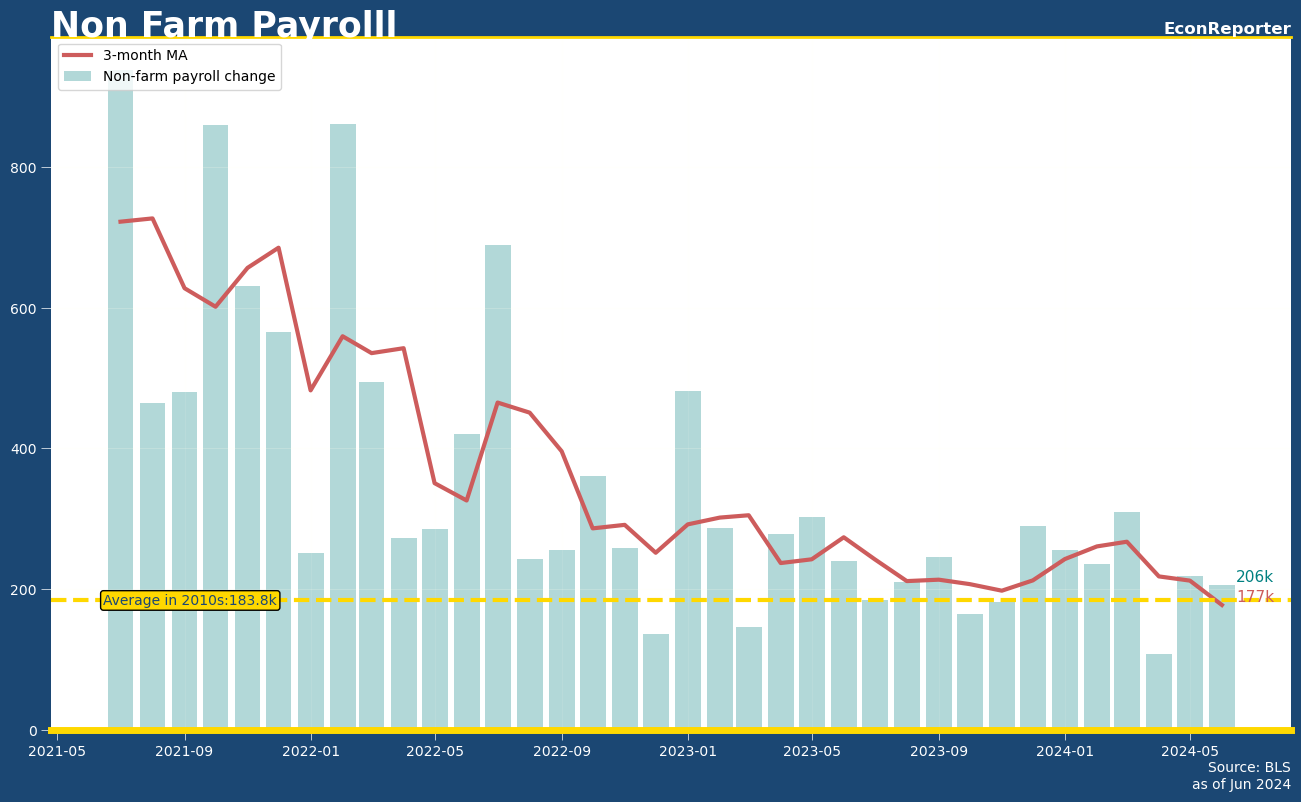

The December 2024 U.S. employment report presented a mixed picture that significantly reshaped market expectations for Federal Reserve monetary policy while exerting modest pressure on equity valuations. With nonfarm payrolls rising by only 50,000 jobs—below the consensus forecast of 55,000—the labor market continued to show signs of softening. However, the unexpected decline in the unemployment rate to 4.4% from November’s revised 4.5% created a complex narrative that complicated the case for near-term Fed accommodation [1][2].

| Metric | Actual | Consensus | Prior Period | Assessment |

|---|---|---|---|---|

| Nonfarm Payrolls | +50,000 | +55,000 | +56,000 (revised) | Below expectations |

| Unemployment Rate | 4.4% | 4.5% | 4.5% (revised) | Better than expected |

| Hourly Earnings Growth | +0.3% MoM | 0.3% MoM | +0.4% MoM | In line |

| Annual Wage Growth | 3.8% | 3.6% | 3.5% | Higher than expected |

The data revealed continued weakness in private-sector hiring, with the three-month moving average of job creation falling into negative territory. More concerning for the economic outlook, revisions to prior months were significantly negative: October’s payrolls were revised down by 68,000 (from a loss of 105,000 to a loss of 173,000 jobs), and November’s figures were revised down by 8,000. Collectively, employment in October and November was 76,000 jobs lower than initially reported [1][3].

The December jobs report triggered a substantial repricing of near-term Fed rate cut expectations:

- January FOMC Meeting: Probability of a rate cut fell to approximately5%, down from roughly22%one month prior and14%immediately before the data release [2][4]

- 2025 Outlook: Despite the near-term setback, the market continued to price intwo rate cuts for 2025, with the first expected by mid-year [4]

- Federal Funds Rate: The target range remained at3.50% to 3.75%following the December FOMC meeting, where officials had cut rates by 25 basis points

Principal Asset Management’s Chief Global Strategist Seema Shah stated: “The prospect of a January Fed rate cut has all but vanished following the unexpected drop in the unemployment rate. It is now difficult to argue that the labor market is collapsing and in urgent need of monetary support. However, the picture remains far from clear: payroll growth undershot expectations and downward revisions to prior months have pushed the three-month moving average into negative territory” [1].

The data presents a paradox for Fed policymakers: weak hiring suggests economic cooling, yet the unemployment rate remains at historically low levels. This dichotomy complicates the policy calculus, as Chair Powell has emphasized that the central bank faces “no risk-free path” in balancing its dual mandates of price stability and maximum employment [5].

| Index | Start | End | Change | Assessment |

|---|---|---|---|---|

S&P 500 (^GSPC) |

6,063.79 | 5,949.92 | -1.88% | Moderate decline |

NASDAQ Composite (^IXIC) |

20,016.12 | 19,511.23 | -2.52% | Under pressure |

Dow Jones Industrial (^DJI) |

43,825.76 | 43,221.56 | -1.38% | Relatively resilient |

Russell 2000 (^RUT) |

2,344.87 | 2,263.29 | -3.48% | Worst performer |

The market reaction revealed several important dynamics:

-

Rate-Sensitive Sectors: Small-cap stocks (Russell 2000) experienced the most significant decline, reflecting diminished expectations for near-term monetary accommodation. The small-cap index’s 3.48% decline compared to the S&P 500’s 1.88% drop underscores the sector’s sensitivity to funding conditions [0].

-

Bond Market Response: Short-maturity Treasury yields rose approximately 5 basis points, with the two-year note reaching its highest level of the year. This yield increase reflected the reduced probability of near-term rate cuts [4].

-

Equity Valuation Context: The S&P 500 maintained historically elevated valuations throughout 2025, with the trailing dividend yield reaching its lowest level since 2000 at 1.20%. Despite soft labor data, strong earnings growth allowed the market to “grow into” these valuations rather than experiencing significant multiple compression [5].

- Job creation averages 30,000-50,000 per month

- Unemployment stabilizes in the 4.3%-4.5% range

- Fed maintains rates through Q1 2025, cuts beginning in Q2

- Equity markets experience modest upside supported by earnings growth

- Monthly job creation turns negative

- Unemployment rises above 5%

- Fed initiates rate cuts in Q1 2025

- Equity valuations face pressure as earnings expectations decline

- Bond yields fall, supporting fixed-income returns

- Job growth rebounds above 100,000 monthly

- Unemployment remains below 4%

- Fed holds rates steady through 2025

- Equity markets rally on strong growth but face multiple compression risk

The December jobs data suggests a environment of

- Quality Over Growth: Favor companies with strong balance sheets and sustainable earnings over high-multiple growth stocks

- Sector Selection: Healthcare and consumer staples offer defensive characteristics, while technology remains attractive for its productivity-enhancing role

- Valuation Discipline: With the S&P 500 trading near record valuations, selective entry points become increasingly important

The bond market’s reaction indicates expectations for

- Duration Strategy: The two-year Treasury yield’s rise suggests the market has adjusted to a later start for rate cuts

- Credit Opportunities: Investment-grade corporate bonds offer attractive yields relative to historical levels

- TIPS Consideration: If inflation proves more persistent than expected, Treasury Inflation-Protected Securities provide protection

- Trump Administration Policies: Potential tariff implementations could introduce inflation pressures and economic uncertainty

- AI Investment Sustainability: Record market concentration in AI-related stocks poses risks if returns fail to materialize

- Labor Market Trajectory: The three-month moving average of job creation turning negative warrants close monitoring

The December 2024 nonfarm payrolls data represents a pivotal moment in the Fed’s policy normalization cycle. While the headline numbers—50,000 new jobs and a 4.4% unemployment rate—do not individually signal economic distress, the cumulative evidence of downward revisions and persistent hiring weakness suggests the labor market is in the process of a gradual deceleration.

For equity valuations, the immediate impact has been modest downside pressure, with rate-sensitive segments (small caps) bearing the brunt of reduced near-term rate cut expectations. However, the fundamental backdrop remains constructive: inflation is trending downward, corporate earnings continue to grow, and the Fed has demonstrated willingness to support the economy should conditions deteriorate significantly.

The market’s pricing of approximately two rate cuts for 2025—with the first expected by mid-year—appears reasonable given the current data trajectory. Equity investors should maintain a

[1] Fox Business - “US economy added just 50,000 jobs last month” (https://www.foxbusiness.com/economy/us-jobs-report-december-2025)

[2] CNN Business - “The US economy added just 50,000 jobs last month” (https://www.cnn.com/business/live-news/us-jobs-report-december-01-09-2026)

[3] CNBC - “U.S. payrolls rose 50,000 in December, less than expected; unemployment rate falls to 4.4%” (https://www.cnbc.com/2026/01/09/jobs-report-december-2025.html)

[4] Bloomberg - “Fed Rate Cut Bets Fade for January After US Jobs Data” (https://www.bloomberg.com/news/articles/2026-01-09/traders-see-almost-no-shot-of-fed-rate-cut-this-month-after-data)

[5] South State Bank - “Stock Market Sees Double-Digit Gains in December 2025” (https://www.southstatebank.com/wealth/on-point-market-commentary/2026-01-major-stock-market-indices-delivered-doubl)

[0] 金灵AI市场数据 - 主要指数表现数据 (2024-12-15至2025-01-15)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.