Analysis of Meinian Health's Suspended M&A Event: Exposed Familial Governance Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the data I collected and in-depth analysis, below is a detailed interpretation of Meinian Health’s suspended M&A event and the governance risks it exposed.

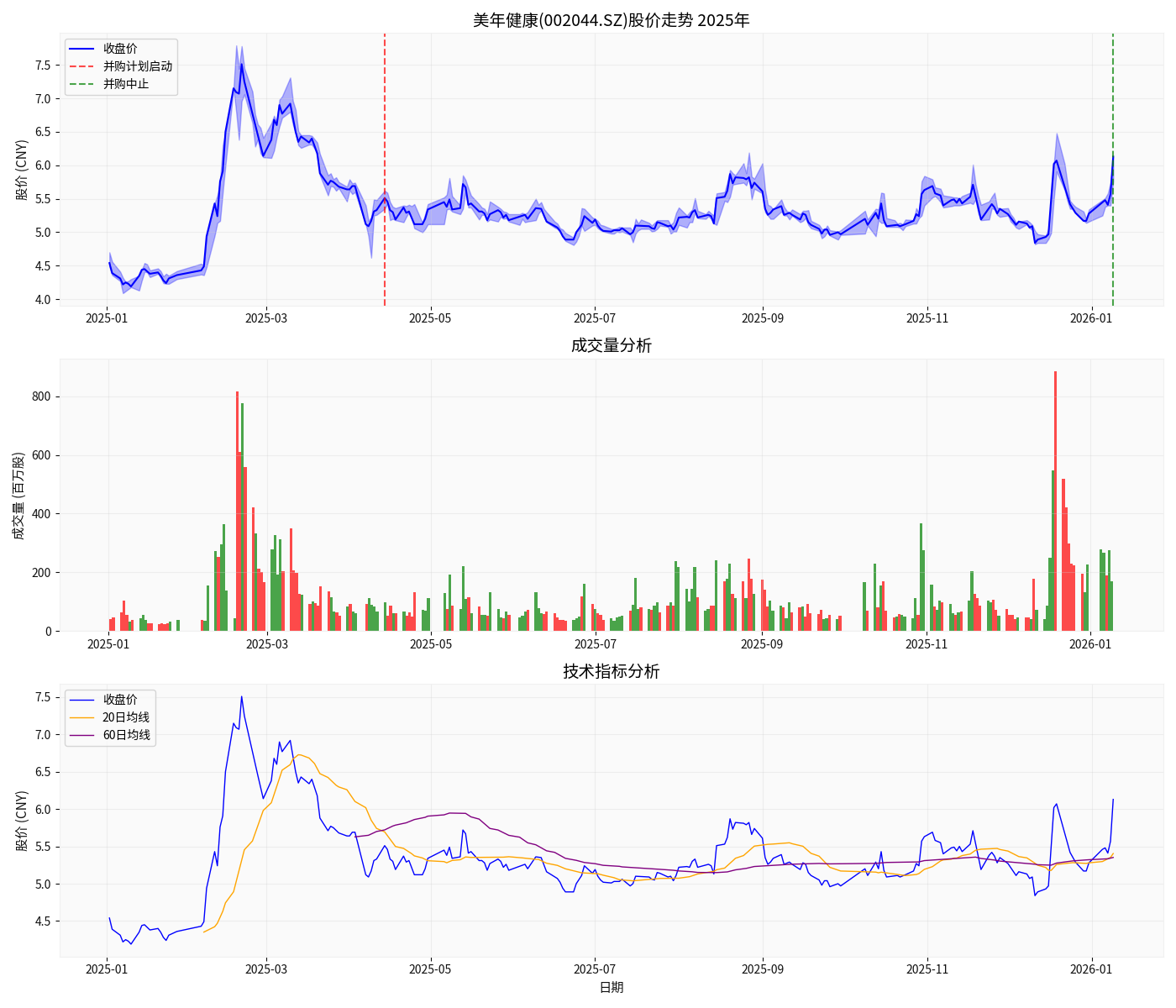

In April 2025, Meinian Health (SZ: 002044) launched a major asset acquisition plan, intending to acquire partial equity in 11 joint-stock companies and 5 holding companies by issuing shares. The total transaction value is approximately RMB 428 million, with approximately 90.439 million shares issued at RMB 4.73 per share[1][2]. In January 2026, the transaction was suspended by the Shenzhen Stock Exchange (SZSE) due to expired financial data in the application materials[1].

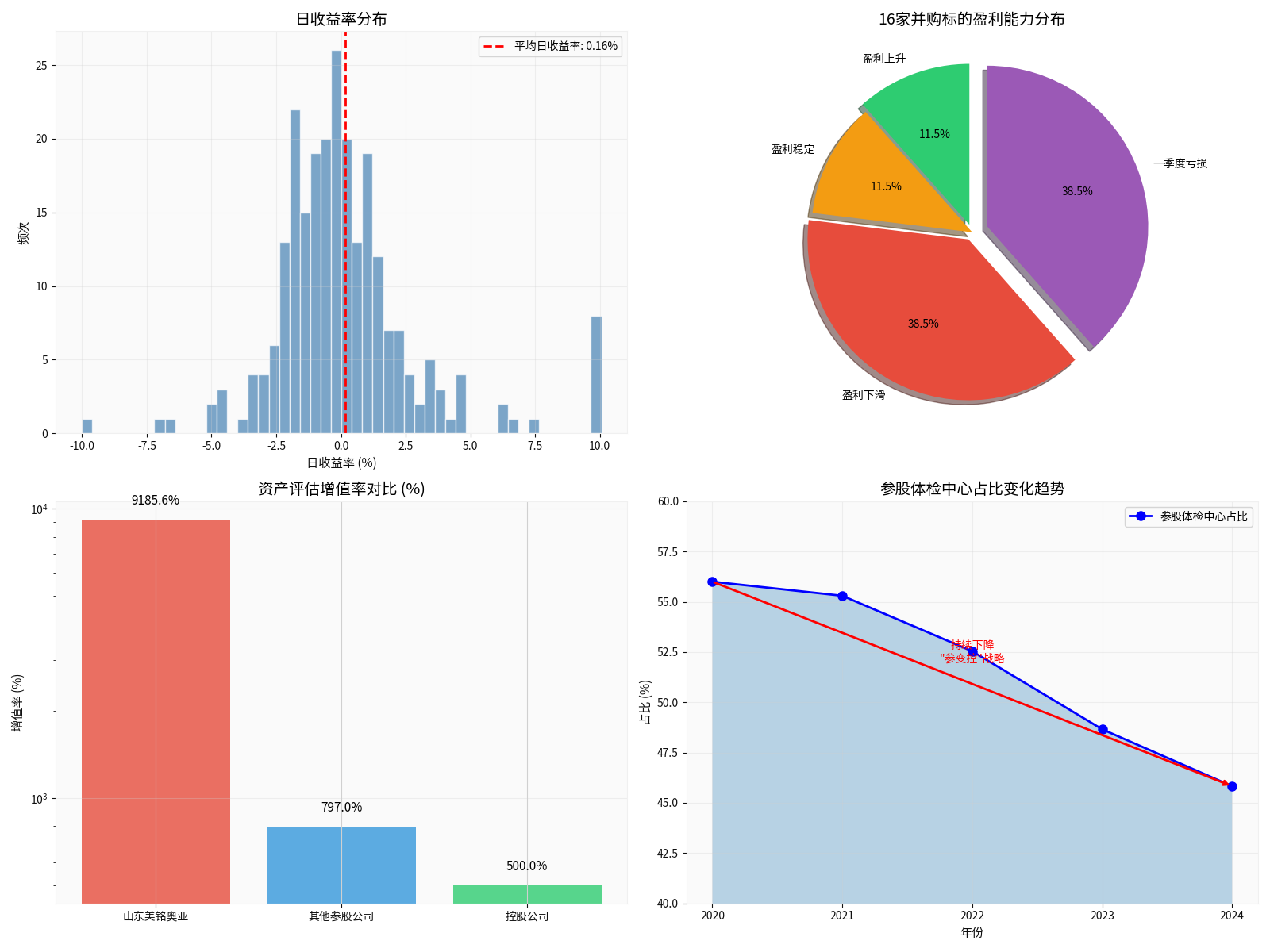

| Target Assets | Evaluation Appreciation Rate | Issue Analysis |

|---|---|---|

| Shandong Meiming Aoya | 9185.6% |

Extremely abnormal |

| Other joint-stock companies | 797% | Obviously too high |

| Holding companies | ~500% | Premium acquisition |

These target assets were established between 2015 and 2018, during the most intense oligopolistic competition period in the private physical examination industry[1].

According to data from the asset evaluation statement[1]:

- The net profit of 13target companies shows an overalldownward trend

- The net profit of 10target companies was inlossin Q1 2025

- Only a small number of physical examination centers saw an increase in profits

- Meihong Investment (co-founded by former shareholders and senior executives of Meinian Health) acquired approximately 92.35% equity of Shandong Meiming Aoya from Shanghai Tianyi Industrial, which is controlled by Yu Rong, in February 2025[1]

- Just a few months later, this asset was acquired by Meinian Health, with an evaluation appreciation rate of approximately 797%

- Acquired from Yu Rong and then resold to another company controlled by Yu Rong, achieving an astonishing rate of return

- The major shareholders of Xiamen Yincheng Meinian, Anxi Meinian, and Nanning Meinian are all private equity funds managed by Meihong Investment

- This fund was established in August 2024 with a registered capital of RMB 1.185 billion, and has acquired 51 companies within less than 1.5 years of its establishment[1]

- Actual Controller: Yu Rong controls the listed company through Shanghai Tianyi Industrial

- Horizontal Competition Issue: The historically retained joint-stock physical examination centers form horizontal competition with the listed company

- Commitment Extension: In November 2024, Yu Rong extended the deadline for resolving the horizontal competition to November 8, 2027[3]

| Risk Type | Specific Performance |

|---|---|

Frequent Related-Party Transactions |

A large number of contracting/outsourcing businesses, consulting service fees, and asset transactions with related parties of Yu Rong |

Information Asymmetry |

Minority shareholders find it difficult to learn the real commercial purpose of the transaction |

Suspicion of Interest Transfer |

Extremely abnormal evaluation appreciation rate, the “left hand to right hand” model |

Suspicious Performance Commitments |

Widespread losses of target companies, with doubts about the fulfillment of performance commitments |

Meinian Health’s proportion of joint-stock physical examination centers has been continuously declining[1]:

- 2020: 56%

- 2021: 55.3%

- 2022: 52.54%

- 2023: 48.66%

- 2024: 45.83%

This trend reflects that the company is gradually acquiring historically retained joint-stock companies as holding companies, but the

- Rose from RMB 4.54 to RMB 6.13 in 2025, with an increase of 35.02%

- Closed at the daily price limit (up)after the announcement of the M&A suspension (January 9, 2026)[1]

- Dilution of Shareholders’ Equity: The share issuance for the acquisition will dilute approximately 2.26% of the equity

- Goodwill Risk: The new goodwill is RMB 275 million, and the company’s total goodwill has reached RMB 5.141 billion, accounting for 26.75% of total assets[3]

- Performance Commitment Risk: Widespread losses of target companies, with doubts about the fulfillment of performance commitments

- Doubts About the Fairness of Related-Party Transaction Pricing: The maximum evaluation appreciation rate reaches 9185.6%, which is obviously beyond a reasonable range

- Clear Interest Transfer Chain: As a related entity of Yu Rong, Meihong Investment first acquired assets at a low price and then resold them to the listed company at a high price

- Inadequate Protection of Minority Shareholders’ Interests: Promoted the M&A despite doubts about performance commitments and widespread losses of target companies

- Delay in Resolving Horizontal Competition: The commitment was extended to 2027, indicating slow improvement in governance

[1] Sina Finance - “Meinian Health with Suspended M&A: Is Its Situation More Dangerous Than AiKang Guobin?” (https://finance.sina.com.cn/roll/2026-01-09/doc-inhftcfr0488111.shtml)

[2] Phoenix Net Finance - “Meinian Health Plans to Issue Shares to Acquire Equity in 16 Physical Examination Institutions; Transaction Progresses Orderly” (https://finance.ifeng.com/c/8jUgaIeXsQQ)

[3] SZSE Announcement - “Reply of Meinian Health Industry Holding Co., Ltd. to the Inquiry Letter from Shenzhen Stock Exchange” (http://file.finance.sina.com.cn/211.154.219.97:9494/MRGG/CNSESZ_STOCK/2025/2025-9/2025-09-20/11470849.PDF)

[4] 36Kr - “Meinian Health with Suspended M&A: Is Its Situation More Dangerous Than AiKang Guobin?” (https://m.36kr.com/p/3632030592496134)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.