Analysis Report on the Investigation of Tianpu Co., Ltd.'s Information Disclosure Violation: Impact on Investors and Rights Protection Guide

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected information, I will systematically analyze the impact of the investigation into Tianpu Co., Ltd.'s information disclosure violation on investors, as well as the development patterns and stock price impacts of similar material omission cases.

Tianpu Co., Ltd. (Ningbo Tianpu Rubber Technology Co., Ltd., Stock Code: 605255.SH) completed the industrial and commercial registration of its wholly-owned subsidiary Hangzhou Tianpu Xincai Technology Co., Ltd. on December 26, 2025. The subsidiary’s public business scope includes

Notably, the stock price of Tianpu Co., Ltd. rose by the daily limit for two consecutive trading days on December 29 and 30, 2025. On December 30 and 31, the company successively disclosed the Announcement on Abnormal Fluctuation of Stock Trading and Announcement on Risk Warning of Stock Trading and Suspension for Verification, both claiming:

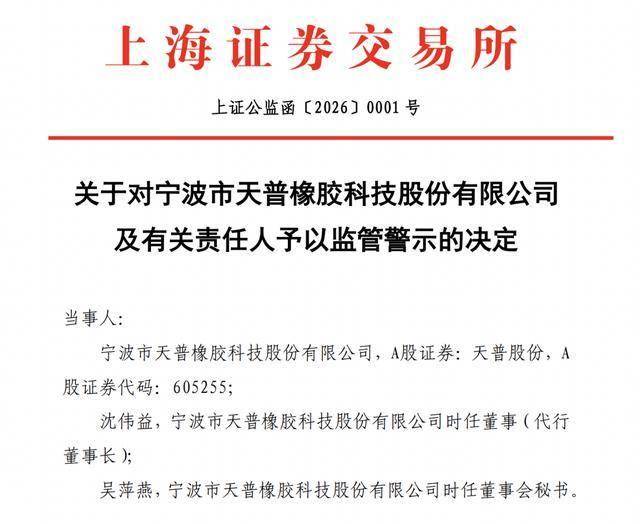

On January 5, 2026, the Shanghai Stock Exchange (SSE) issued the Decision on Giving Regulatory Warnings to Ningbo Tianpu Rubber Technology Co., Ltd. and Relevant Responsible Persons (SSE Public Supervision Letter No. [2026] 0001), which was the first regulatory warning letter for the Shanghai Stock Exchange market in 2026[1]. On January 9, 2026, the CSRC officially placed Tianpu Co., Ltd. under investigation on suspicion of material omissions in its stock trading abnormal fluctuation announcements[3].

The SSE pointed out that after relevant rumors emerged in the market and the stock price fluctuated abnormally, Tianpu Co., Ltd. changed its subsidiary’s business scope within a short period of time.

Information disclosure is the core basis for investors to judge a company’s value. In 2025, Tianpu Co., Ltd. became a “big bull stock” in A-shares with a cumulative increase of over 1600%, but the company’s operating revenue and net profit both declined in the first three quarters, and its stock price was wildly hyped due to rumors of AI cooperation circulating in the market,

According to data from similar cases, information disclosure violations coupled with sharp stock price fluctuations significantly increase investment risks. Taking Pary Co., Ltd., which was placed under investigation during the same period, as an example, its stock price

Although harmed investors may claim compensation in accordance with the law, they need to pay attention to the following key points:

- Preparation of Claim Materials: Investors need to prepare in advance a copy of their ID card, securities account information, and stock transaction statements stamped by the securities company’s business department (including transaction time, price, quantity, profit and loss, and other information)[6]

- Risk of Statute of Limitations: The statute of limitations starts from the date the CSRC’s administrative penalty decision is announced, lasting for three years. Investors need to assert their rights in a timely manner within the limitation period[6]

- Cost Issues: Currently, most securities rights protection lawyers adopt a “contingency fee” model, charging no fees in the early stage and only collecting attorney fees at an agreed proportion after compensation is actually obtained[6]

| Case | Development Trajectory | Outcome |

|---|---|---|

BLT |

Received a regulatory warning letter on July 8, 2025 → Placed under investigation on December 31, 2025 | The issue escalated, with only 5 months between the warning and the investigation |

Zedayi Sheng |

Fraudulent issuance, consecutive years of financial fraud → Special representative litigation | 7,195 investors received compensation totaling RMB 285 million |

Zijing Storage |

Fraudulent issuance, illegal information disclosure → Advance compensation | Compensation amount of approximately RMB 1.086 billion, with 16,986 claimants |

ST Erya |

Undisclosed fund occupation → Pre-notification of administrative penalty | Total fine of RMB 9.7 million |

-

Regulatory Upgrade Model: The transition from a regulatory warning letter to an investigation usually means that the regulatory authorities have discovered more serious problems, or the company’s rectification has not met expectations, and it cannot be ruled out that there are circumstances such as intentional omissions or false records[6]

-

Early Warning of Abnormal Stock Price Fluctuations: In similar cases, sharp stock price fluctuations often occur on the trading day before the investigation announcement. In the BLT case, the stock price opened lower and moved lower on December 30 (the trading day before the investigation announcement), with a drop of 6.22% on the day, and the transaction volume increased to RMB 2.114 billion, which “may reflect that some market funds knew about the relevant regulatory information in advance”[6]

-

Multiple Penalties: Relevant entities may face three types of legal liabilities: administrative penalties (fines of RMB 500,000 to RMB 10 million), civil compensation (investor claims), and criminal liability (for serious cases)[7]

| Time Node | Stock Performance | Transaction Changes |

|---|---|---|

| Trading day before the investigation announcement | Drop of 6%-15% possible | Transaction volume increases significantly |

| Day of the investigation announcement | Opens lower then rises, or continues to fall, with intraday amplitude exceeding 10% | Transaction volume climbs further |

According to historical data statistics:

- Average Decline: Within 1 month of being placed under investigation for information disclosure violations, the average stock price decline can reach15%-30%

- Market Value Evaporation: The amount of market value evaporated due to information disclosure violations hit a record high in 2023

- Recovery Period: It usually takes 6-12 months or even longer to repair the damaged reputation

Based on relevant judicial interpretations and analyses by professional lawyers, the rights protection conditions for Tianpu Co., Ltd. investors are as follows[4]:

- Sina Investor Rights Protection Platform (http://wq.finance.sina.com.cn/)

- Law firms such as Shanghai Xinben Law Firm have launched investor rights protection prompts

According to Article 197 of the new Securities Law[7]:

| Violation Type | Fine for Information Disclosure Obligor | Fine for Direct Responsible Persons |

|---|---|---|

| Failure to submit/disclose as required | RMB 500,000 - RMB 5 million | RMB 200,000 - RMB 2 million |

| False records/misleading statements/material omissions | RMB 1 million - RMB 10 million |

RMB 500,000 - RMB 5 million |

In addition,

Continue to follow the progress of the CSRC’s investigation into Tianpu Co., Ltd., and wait for the specific investigation conclusion before deciding whether to proceed with litigation based on the illegal facts[5]

Investors who meet the preliminary claim conditions may voluntarily register claim information through formal channels and keep complete transaction records and investment vouchers

During the investigation period, the stock price may fluctuate sharply. Investors should

[1] Economic Information Daily - Tianpu Co., Ltd. Warned for Information Disclosure Violation (http://jjckb.xinhuanet.com/20260107/59e86e2b498849ef92282b81dfce379a/c.html)

[2] Securities Times Network - Tianpu Co., Ltd. Disciplined for Inaccurate Information Disclosure (https://www.stcn.com/article/detail/3572276.html)

[3] Sina Finance - CSRC Launches Investigation into Tianpu Co., Ltd. for Suspected Material Omissions in Abnormal Stock Trading Fluctuation Announcements (https://finance.sina.com.cn/jjxw/2026-01-09/doc-inhftipm5761170.shtml)

[4] Sina Finance - The 16-fold Surge Myth Comes to an Abrupt Halt! Tianpu Co., Ltd. Faces Regulatory Storm, Investors May Claim Compensation (https://finance.sina.cn/stock/ssgs/2026-01-05/detail-inhfffrv2226604.d.html)

[5] National Business Daily - Two Shaanxi Enterprises Placed under CSRC Investigation for Information Disclosure Violations (https://www.nbd.com.cn/articles/2026-01-04/4205967.html)

[6] 21st Century Business Herald - BLT, a Leading Company in a RMB 100 Billion Track, Placed under Investigation for Information Disclosure Violations: Investors Should Pay Attention to These Claim Details (https://www.21jingji.com/article/20260104/herald/6d58fcb88546e41f47e61d3e5648f4c7.html)

[7] Zhong Lun Law Firm - The New Securities Law Restructures the Information Disclosure System (https://www.zhonglun.com/research/articles/7602.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.