In-Depth Analysis of Watts Water Technologies (WTS) Investment Value

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now collected sufficient data, let me prepare a comprehensive analysis report for you.

Watts Water Technologies’ stock price hit an all-time high on January 9, 2026, closing at

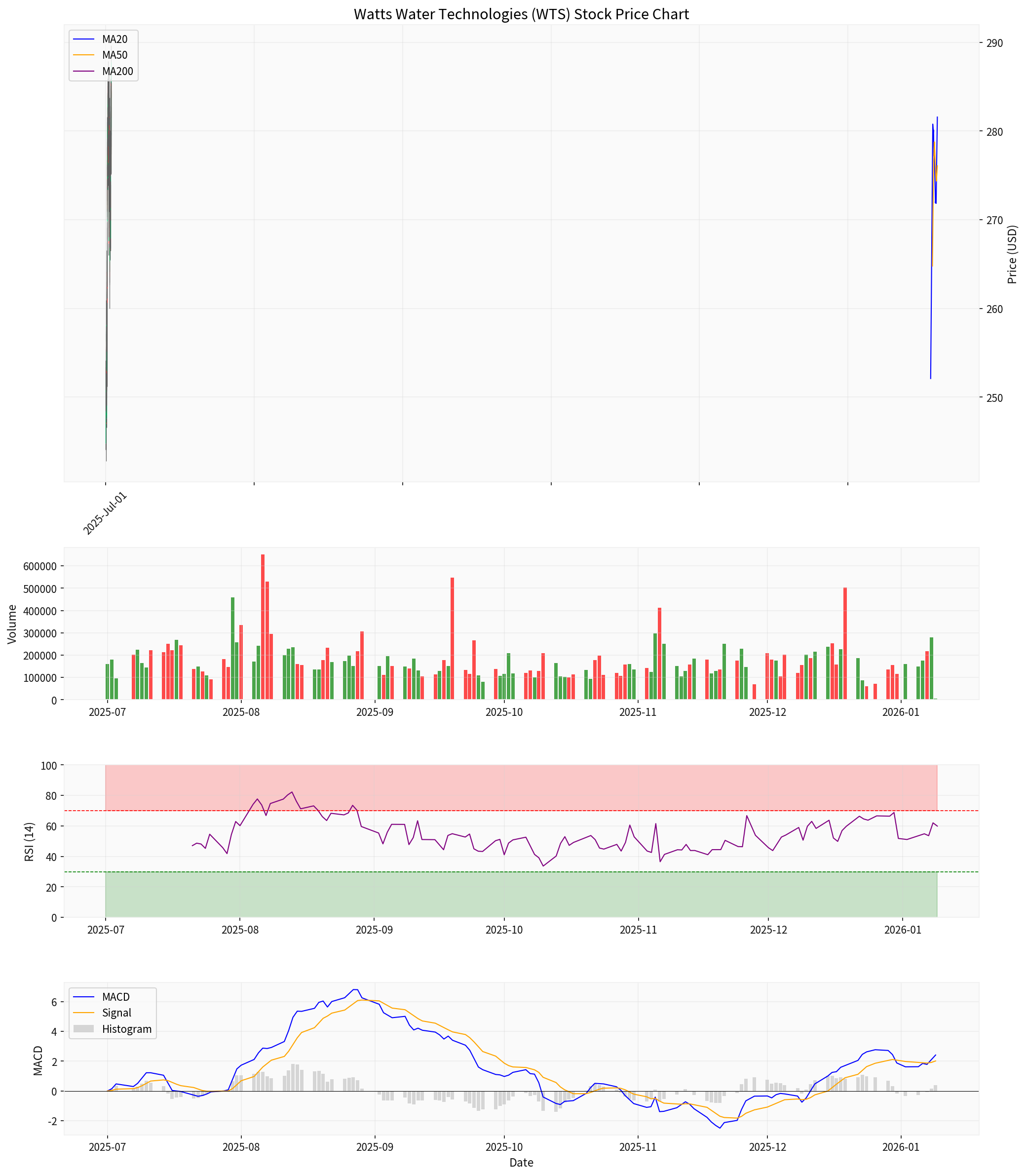

| Technical Indicator | Value | Signal Interpretation |

|---|---|---|

| Latest Closing Price | $289.19 | All-time high |

| 20-Day Moving Average | $281.58 | Stock price above moving average |

| 50-Day Moving Average | $276.08 | Clear upward trend |

| RSI (14-Day) | 59.90 | Neutral to bullish range |

| MACD | 2.42 | Above zero line, bullish signal |

| Beta Coefficient | 1.23 | Slightly higher than market volatility |

- Support Level: $282.32

- Resistance Level: $289.63 (broken)

- Next Target Level: $295.86

According to the latest quarterly report [0][4], Watts Water Technologies has delivered earnings beats for multiple consecutive quarters:

- Q3 FY2025 EPS: $2.50 (consensus estimate $2.23, +10.62% beat)

- Q3 FY2025 Revenue: $612M (consensus estimate $576M, +6.14% beat)

- Average Earnings Surprise Over Past Four Quarters: +10.9%

The company has achieved earnings beats for five consecutive years, demonstrating strong execution and business resilience.

Watts Water has achieved rapid growth through strategic acquisitions [1][2][3][4]:

| Acquisition Project | Time | Strategic Significance |

|---|---|---|

I-CON |

2025 | Digital Platform Integration |

EasyWater |

2025 | Water Treatment Technology Enhancement |

Haws Corporation |

2025 | Emergency Safety and Hydration Solutions |

Saudi Cast |

December 2025 | Middle East Market Expansion (Saudi Arabia) |

During Q3 FY2025, the acquisitions of I-CON and EasyWater contributed approximately

Watts Water Technologies has top-tier profitability metrics in the industry [0][3]:

| Profitability Metric | Value | Industry Position |

|---|---|---|

Gross Margin |

~45.9% (5-year average) | Top-tier in the industry |

Operating Margin |

17.99% | Significantly above industry average |

Net Profit Margin |

13.79% | Robust and sustainable |

ROE (Return on Equity) |

17.72% | Excellent performance |

5-Year EPS CAGR |

21.8% | Significantly outpaces revenue growth |

This means that for every $100 in revenue generated, the company retains approximately $45.86 of discretionary funds after covering sales, marketing, R&D, and general administrative expenses.

According to SEC 10-Q filings [4][5]:

- Operating Cash Flow (YTD 2025): $247.3M, up 11.6% year-over-year

- Free Cash Flow: $216M

- Cash and Cash Equivalents: $457.7M

- Current Ratio: 2.83 (sound financial position)

- Long-Term Debt: $197.5M (controllable level)

The company has completed multiple acquisitions totaling $85.8M while maintaining a healthy balance sheet and sufficient liquidity.

The company raised its full-year 2025 performance guidance in November 2025 [4]:

| Metric | Previous Guidance | Updated Guidance |

|---|---|---|

Revenue Growth |

7% | 7-8% |

Organic Sales Growth |

- | 4-5% |

Operating Margin |

- | 18.1-18.2% |

Adjusted Operating Margin |

- | 19.1-19.2% |

This represents an increase of 80-150 basis points compared to 2024.

Watts Water Technologies has delivered exceptional long-term investment returns [1][3]:

| Time Period | WTS Return | S&P 500 Return |

|---|---|---|

| Past 5 Years | +128.03% |

~100% |

| Past 3 Years | +93.08% |

~50% |

| Past 25 Years | +2,400% |

~420% |

| Total Return Including Dividends (25 Years) | +3,250% |

- |

When considering dividend reinvestment, the total return over 25 years reaches as high as 3,250%, significantly outperforming the market benchmark.

Watts Water Technologies is a 150-year-old manufacturer of water treatment and water management products [5], serving residential, commercial, and industrial markets. Its main product lines include:

| Product Category | Revenue Share | Key Applications |

|---|---|---|

Residential and Commercial Fluid Control |

51.8% | Check valves, pressure reducing valves, safety valves, leak detection |

HVAC and Gas Products |

31.6% | High-efficiency boilers, water heaters, radiant heating systems |

Drainage and Water Reuse Products |

10.4% | Drainage systems, rainwater harvesting solutions |

Water Treatment Products |

6.3% | Water purification, water softening, scale inhibition systems |

The

The Infrastructure Investment and Jobs Act (IIJA) provides

| Year | IIJA-Related Water Infrastructure Expenditure |

|---|---|

| 2022 | ~$1B |

| 2023 | ~$2B |

| 2024 | ~$4B |

| 2025 | ~$6B |

2027 (Projected Peak) |

~$11B |

| 2028-2031 | Gradual decline |

Funds will be disbursed gradually through the State Revolving Funds system, meaning the next 2-3 years will be a peak period for water infrastructure spending.

According to the EPA 2024-2025 budget [6]:

| Project | FY2025 IIJA Appropriation |

|---|---|

Clean Water State Revolving Fund (CWSRF) |

$2.603B |

Drinking Water State Revolving Fund (DWSRF) |

$2.603B |

Lead Pipe Replacement Program |

$3B |

Emerging Contaminants Program |

$1B |

WIFIA Financing Innovation Act |

$72.3M |

The U.S. water system faces severe infrastructure challenges [6][7]:

- Annual Investment Demand: ~$129B

- Current Annual Expenditure: ~$48B

- Annual Investment Gap: ~$81B

- Cumulative Investment Gap (by 2029): projected to reach$434B

- Water Supply Pipes Needing Replacement: millions of miles

- Existing Wastewater Treatment Plants: ~16,000

Watts Water’s

- Real-time leak detection and alerts

- Remote monitoring and control

- Integration with Building Management Systems (BMS)

- Mobile alert push notifications

- Remote valve shut-off to prevent water damage losses

As demand for intelligent water management in commercial and residential buildings increases, the Nexa platform will become an important growth engine for the company.

The company’s product lines focused on

- Rainwater harvesting systems

- Greywater recycling solutions

- High-efficiency drainage systems

- Water-saving water treatment products

Against the backdrop of the growing popularity of ESG investment concepts, these products meet the green transformation needs of builders and property owners.

Watts Water has a strong distribution network [5]:

- Wholesale distributors: $402.4M (65.8% of Q3 revenue)

- Specialty product distributors: $126.8M

- DIY/Retail channels: $17.9M

- OEM customers: $64.6M

Extensive channel coverage ensures products can reach various end users, particularly with continued penetration growth in commercial and industrial markets.

The recent acquisition of

Based on the above analysis, we expect the water treatment business to benefit from the following long-term trends:

| Growth Driver | Impact Level |

|---|---|

| IIJA Infrastructure Fund Implementation | High (significant incremental growth in the next 2-3 years) |

| Increasing Demand for Smart Water Management | High (digital transformation trend) |

| Water Crisis Caused by Worsening Climate Change | Medium-High (long-term structural demand) |

| Building Modernization Upgrade Cycle | Medium (commercial and residential renovation demand) |

| Global Water Infrastructure Investment | Medium-High (international expansion opportunities) |

According to the latest financial analysis [0][5]:

| Dimension | Assessment | Details |

|---|---|---|

Financial Stance |

Aggressive | Low depreciation/capital expenditure ratio, potential constraints on earnings growth |

Revenue Growth |

Robust | 5-year revenue CAGR of 9.3%, outperforming industry average |

Cash Flow |

Strong | FCF conversion rate >100%, sufficient cash reserves |

Debt Risk |

Low | Controllable debt ratio, good liquidity |

Profitability |

Excellent | Gross margin of ~46%, far exceeding industry levels |

| Risk Type | Specific Description | Mitigation Measures |

|---|---|---|

Macroeconomic Risk |

Rising interest rates suppress construction activity | Diversify customers and regions to reduce cyclical sensitivity |

Supply Chain Risk |

Raw material price fluctuations, tariff impacts | Strong cost pass-through capability, stable gross margin |

Competition Risk |

Industry consolidation, price competition | Differentiated products, Nexa platform provides a moat |

Exchange Rate Risk |

International business exposure | Foreign exchange hedging strategies |

Valuation Risk |

Current P/E ~29.85x, slightly above historical average | Growth expectations partially reflected in stock price |

| Source | Rating | Target Price |

|---|---|---|

Zacks |

Strong Buy (Rating 1) |

$325.00 |

Barclays |

Equal Weight | $287.00 |

Stifel |

Buy | - |

RBC Capital |

Sector Perform | - |

Consensus Target Price |

- | $288.00 |

Zacks’

- Consistent earnings beats: 5 consecutive years of earnings exceeding estimates, Q3 FY2025 EPS +10.62%

- Strong external growth: multiple strategic acquisitions contributing significant incremental sales

- Excellent profitability: ~46% gross margin, top-tier in the industry

- Abundant cash flow: FCF conversion rate >100%, supporting expansion and shareholder returns

- Beneficiary of infrastructure investment: IIJA fund disbursement will continue to drive demand for water treatment products

- Leading digital transformation: Nexa smart water management platform provides long-term growth momentum

- Continuous fund disbursement ahead of the IIJA water infrastructure investment peak (2027)

- Synergies from acquisitions such as Haws and Saudi Cast becoming evident

- Commercialization of the Nexa platform

- International market expansion (Middle East, APMEA regions)

- Product upgrade demand driven by smart buildings and ESG

The current stock price corresponds to:

- P/E (TTM): 29.85x

- Forward P/E: ~27x

- P/B: 4.95x

Considering the company’s high growth, high profit margins, and strong cash flow, the valuation is reasonable despite a premium. Zacks’ $325 target price provides some upside potential.

- Short-term valuation is relatively high, potential profit-taking pressure

- Need to pay attention to the Q4 FY2025 earnings guidance released on January 9

- Beware of the negative impact of macroeconomic slowdown on construction activity

- Risks of tariff policy and supply chain cost fluctuations

[0] Jinling API - Watts Water Technologies Real-Time Quotes, Company Profile and Technical Analysis

[1] Zacks Equity Research - “Watts Water Up 40% in a Year: How to Approach the Stock Now?” (https://www.nasdaq.com/articles/watts-water-40-year-how-approach-stock-now)

[2] Nasdaq - “Bull of the Day: Watts Water Technologies, Inc. (WTS)” (https://www.nasdaq.com/articles/bull-day-watts-water-technologies-inc-wts)

[3] Yahoo Finance - “Watts Water’s Margin Strength And Nexa Platform Might Change The Case For Investing In WTS” (https://finance.yahoo.com/news/watts-water-margin-strength-nexa-151035595.html)

[4] Watts Water Technologies Q3 FY2025 10-Q Filing (https://www.sec.gov/Archives/edgar/data/795403/000110465925107489/wts-20250928x10q.htm)

[5] Seeking Alpha - “Watts Water Technologies raises 2025 sales growth outlook to 7–8%” (https://seekingalpha.com/news/4518406-watts-water-technologies-raises-2025-sales-growth-outlook-to-7-8-percent-with-haws)

[6] U.S. EPA - Water Infrastructure Appropriations FY2024-FY2025 (https://www.congress.gov/crs-product/IF12950)

[7] L.E.K. Consulting - “IIJA’s Limited Impact on the Water and Wastewater Industry” (https://www.lek.com/sites/default/files/PDFs/IIJA-water.pdf)

[8] Business Wire - “Watts Water Technologies Reports Strong Third Quarter 2025 Results” (https://www.businesswire.com/news/home/20251105236713/en/Watts-Water-Technologies-Reports-Strong-Third-Quarter-2025-Results)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.