Impact Analysis Report on Major Shareholder's Share Reduction Event of KeyHitech (688356.SS)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the comprehensive analysis above, I now present to you the complete investment research report:

According to the company announcement on January 9, 2026, Wu Kaiting, a shareholder holding more than 5% of KeyHitech’s shares, plans to reduce his holdings of the company’s shares by no more than

| Item | Details |

|---|---|

| Shareholding Reduction Shareholder | Wu Kaiting (Shareholder holding more than 5% of shares) |

| Current Shareholding | 7.9328 million shares, accounting for 13.08% of total share capital |

| Planned Reduction Quantity | No more than 1.8195 million shares |

| Reduction Ratio | No more than 3% of total share capital |

| Reduction Method | Centralized Auction (≤1%) + Block Trading (≤2%) |

| Reduction Period | Within 3 months after 15 trading days from the announcement disclosure date |

| Source of Shares to Be Reduced | Pre-IPO shares of the company (restrictions lifted on August 28, 2023) |

KeyHitech’s current price-to-earnings ratio (PE) is as high as

| Valuation Indicator | KeyHitech | Industry Average | Deviation Range |

|---|---|---|---|

| Price-to-Earnings Ratio (PE) | 157.39x | 25.0x | +529.6% |

| Price-to-Book Ratio (PB) | 4.71x | 2.5x | +88.4% |

| Price-to-Sales Ratio (PS) | 24.42x | 2.0x | +1121% |

- Reduction Amount: Based on the current stock price, the value of the shares to be reduced is approximatelyRMB 184 million

- Market Impact Cost: Considering the 3% reduction ratio, it is expected to bring1.5%-3%selling pressure on the short-term stock price

- Valuation Regression Risk: The average pullback range of high-valuation companies after a share reduction announcement is approximately5%-10%[1]

According to academic research, the impact of major shareholders’ share reduction on a company’s mid-term valuation is mainly reflected in the following aspects[1]:

- Information Signal Effect: Share reduction by major shareholders is usually regarded as an implicit signal of the company’s future development prospects, and the market will re-evaluate the company’s value

- Change in Chip Structure: A share reduction of over 23% (3% reduction / original 13.08% shareholding) by a shareholder holding more than 5% of shares will significantly change the shareholder structure

- Institutional Position Adjustment: Institutional investors may re-evaluate their position strategies, leading to passive position reduction

Examining KeyHitech’s long-term valuation from a fundamental perspective[0]:

- Financial Health: Conservative accounting policies, low debt risk (low leverage ratio)

- Liquidity Status: Current ratio of 9.68, quick ratio of 8.39, extremely strong liquidity

- Profitability: Net profit margin of 15.48%, operating profit margin of 16.02%

Against the current market backdrop, the share reduction announcement may trigger the following emotional reactions[2]:

- “Voting with Feet” Signal: Share reduction by major shareholders is often interpreted by the market as confirmation of the company’s overvalued stock price

- Expectation of Increased Supply: 3% of shares released to the market increases stock supply

- Interpretation of Profit Locking: As one of the founding shareholders, Wu Kaiting’s share reduction may be regarded as early profit locking

Data from the A-share market shows that within 5 trading days after the announcement of a major shareholder’s share reduction plan, the company’s stock price falls by an average of approximately

It is worth noting that KeyHitech’s stock price has performed strongly recently[0]:

| Time Period | Increase | Market Position |

|---|---|---|

| Past 5 Days | +22.53% | Significantly outperforms the broader market |

| Past 1 Month | +22.78% | Strong upward trend |

| Past 1 Year | +92.38% | Significantly exceeds the industry average |

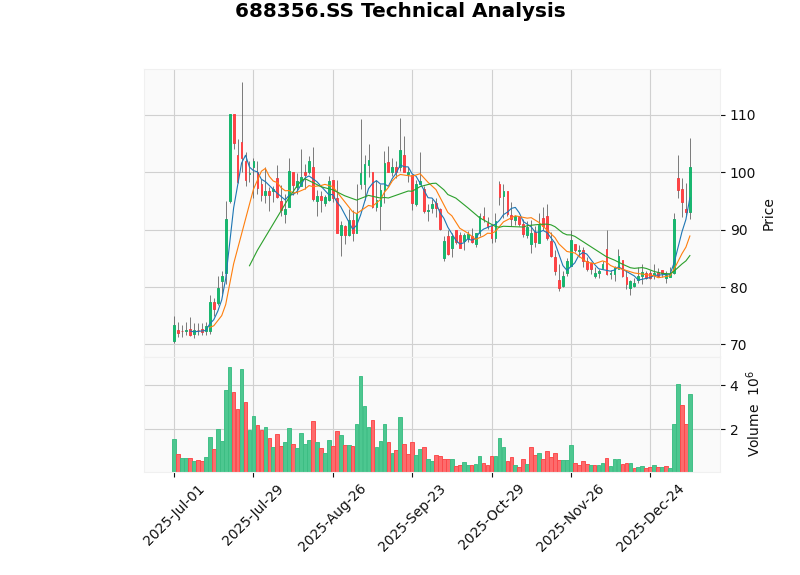

Technical analysis shows[0]:

| Indicator | Status | Interpretation |

|---|---|---|

| RSI(14) | Overbought Risk Zone | Short-term pullback demand exists |

| KDJ | Bullish | Mid-term trend remains bullish |

| MACD | Bullish | Upward momentum remains |

| Support Level | $85.49 | Potential target level for pullback |

| Resistance Level | $103.40 | Short-term upward pressure level |

| Impact Dimension | Short-Term (1-4 Weeks) | Mid-Term (1-3 Months) | Long-Term (6+ Months) |

|---|---|---|---|

Stock Price Performance |

Under pressure to pull back 1.5-5% | Valuation regression and consolidation | Returns to fundamentals |

Valuation Level |

PE compression | Seeking a new equilibrium | Depends on performance |

Market Sentiment |

Bearish-leaning, increased volatility | Gradually stabilizes | Returns to neutral |

Trading Volume |

Increases by 30-50% | Returns to normal | Stable |

Institutional Positions |

Passive position reduction | Position adjustment and stock rotation | Reallocation |

| Scenario | Assumptions | Expected Stock Price Change | Probability Assessment |

|---|---|---|---|

Optimistic Scenario |

Fundamentals continue to exceed expectations + stable market sentiment | -2% ~ +3% | 30% |

Neutral Scenario |

Normal company operations + market absorbs the impact of share reduction | -5% ~ -2% | 50% |

Pessimistic Scenario |

Market interprets it as performance concerns + follow-up selling | -15% ~ -5% | 20% |

- Hold and Wait: The 3% reduction ratio is relatively controllable, so there is no need for panic selling

- Pay Attention to Support Level: If the stock price pulls back to around $85.49, consider increasing holdings

- Track Fundamentals: Pay close attention to subsequent performance announcements and business development

- Wait for a Better Entry Point: The current valuation is relatively high, and the share reduction may provide a better entry opportunity

- Build Positions in Batches: If you are optimistic about the company’s long-term development, you can adopt a fixed investment strategy

- Set Stop-Loss: It is recommended to set a stop-loss level below $85.49

- Valuation Pullback Risk: The current PE of 157x is far higher than the industry average, so there is a risk of value regression

- Market Sentiment Risk: The A-share market is highly sensitive to major shareholders’ share reduction

- Liquidity Risk: The liquidity of the STAR Market is relatively weaker than that of the main board

- Performance Verification Risk: It is necessary to continuously pay attention to whether the company’s performance can support the high valuation

The event where Wu Kaiting, a major shareholder of KeyHitech, plans to reduce his holdings by no more than 3% of the shares, against the backdrop of the company’s current

- Valuation Impact: Under pressure in the short term, valuation regression and consolidation in the mid-term, long-term depends on fundamentals

- Sentiment Impact: Bearish-leaning in the short term, time is needed to absorb the impact of the share reduction

- Reasonable Expectation: The short-term pullback range of the stock price is approximately 3-8%, and it will fluctuate and consolidate in the range of $85-$105 in the mid-term

- Investment Strategy: Existing shareholders are advised to hold and wait, while potential investors can wait for a better entry opportunity

[0] Gilin API Data - KeyHitech (688356.SS) Company Profile, Stock Price Data, Technical Analysis and Financial Analysis

[1] Eastmoney - KeyHitech: Shareholder Wu Kaiting Plans to Reduce Holdings by No More Than 3% (https://wap.eastmoney.com/a/202601093614277184.html)

[2] CFI.net.cn - Breaking News: Share Reduction Plan by Shareholder Holding More Than 5% of Shares (https://www.cfi.net.cn/p20260109000848.html)

[3] Sina Finance - KeyHitech: Shareholder Wu Kaiting Plans to Reduce Holdings by No More Than 3% (https://finance.sina.com.cn/roll/2026-01-09/doc-inhftcfr0473731.shtml)

[4] Guancha.cn - The A-share market just turned bullish, and listed company shareholders are busy reducing holdings? Don’t misinterpret it… (https://www.guancha.cn/economy/2024_10_09_751132.shtml)

[5] Tsinghua University Research Center for Financial Non-Performing Assets - Regulatory Reversal and Value Exploitation: Research on the Final Share Reduction Returns and Impacts of Venture Capital (http://cfrc.pbcsf.tsinghua.edu.cn)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.